Source: Company reports/FGRT

2Q17 Results

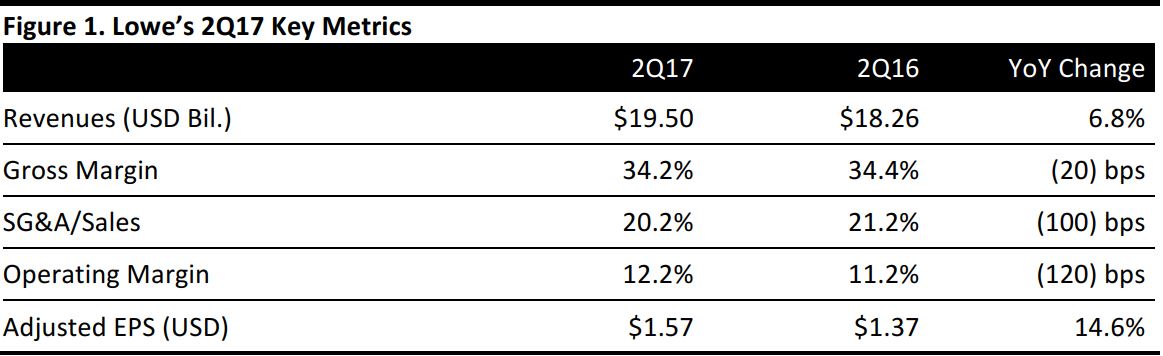

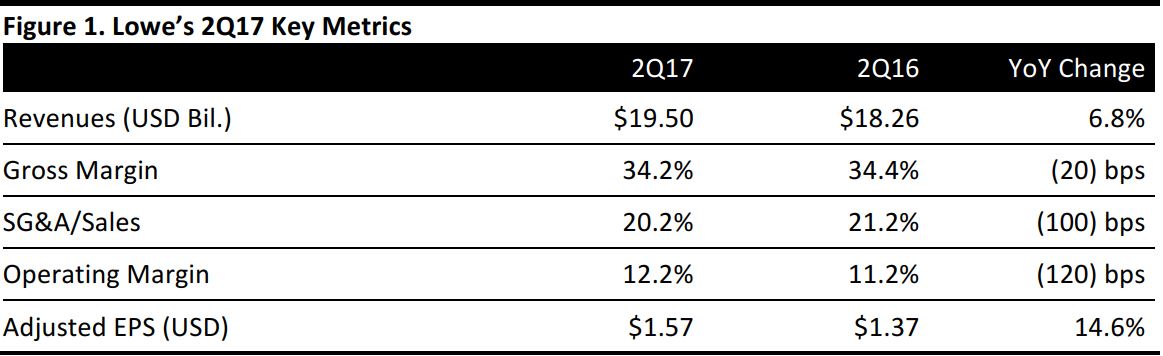

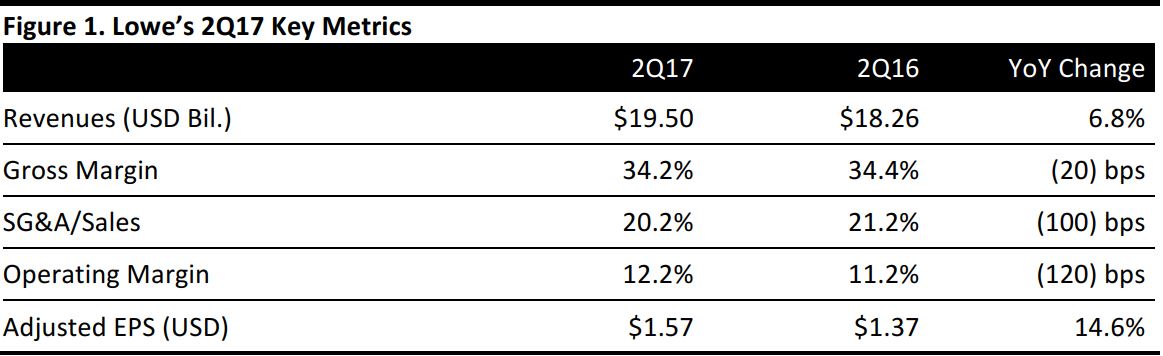

Lowe’s reported 2Q17 adjusted EPS of $1.57, up from $1.37 in the year-ago period and missing the $1.62 consensus estimate. The company reported revenue of $19.50 billion, which was below the $19.55 billion consensus estimate but up 6.8% from the year-ago quarter. The adjusted EPS figure excludes a $96 million gain for the sale of the company’s interest in its Australian joint venture.

Comps were up 4.5% year over year, driven by improved transaction growth of 0.9% and a 3.6% increase in average ticket. The US home improvement business was up 4.6%, with positive comps reported in 13 out of 14 regions in all product categories. Appliances were the top-performing category, posting high-single-digit comps. Lawn and garden also achieved strong comps. In Lowe’s Pro business, plumbing, electrical, lumber and materials were the outperforming categories. Internationally, the company delivered mid-single-digit comps in both Canada and Mexico.

Management was pleased with the improved comp sales performance versus the previous quarter. July comps increased by 7.9%. While the overall results for the first half of the year were below expectations, the company is working on extending store operating hours in order to capitalize on the strong macroeconomic environment for the home improvement market.

Inventory was $11.4 billion at the end of the quarter, an increase of 7.6% from the year-ago period, driven by appliances to support sales growth as well as seasonal factors.

Management commented that Lowe’s continues to benefit from a strong macroeconomic backdrop. The outlook for US household formation has been encouraging and housing prices continue to appreciate. The job market also remains strong.

As of August 4, Lowe’s operated 2,141 stores in the US, Canada and Mexico.

FY17 Outlook

Lowe’s reaffirmed its FY17 revenue guidance of a 5% increase. The company expects full-year comp growth of 3.5% versus the 3.3% consensus estimate.

The company lowered its FY17 EPS guidance again, and now expects EPS of $4.20–$4.30 versus prior guidance of $4.30 and the consensus estimate of $4.62. Guidance for FY17 EPS was adjusted for debt charge and the gain resulting from the sale of the company’s Australian joint venture.