Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

4Q18 Results

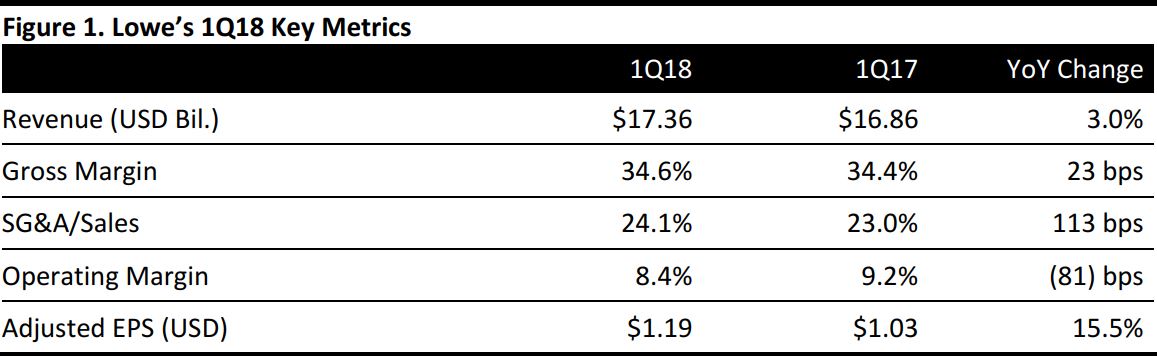

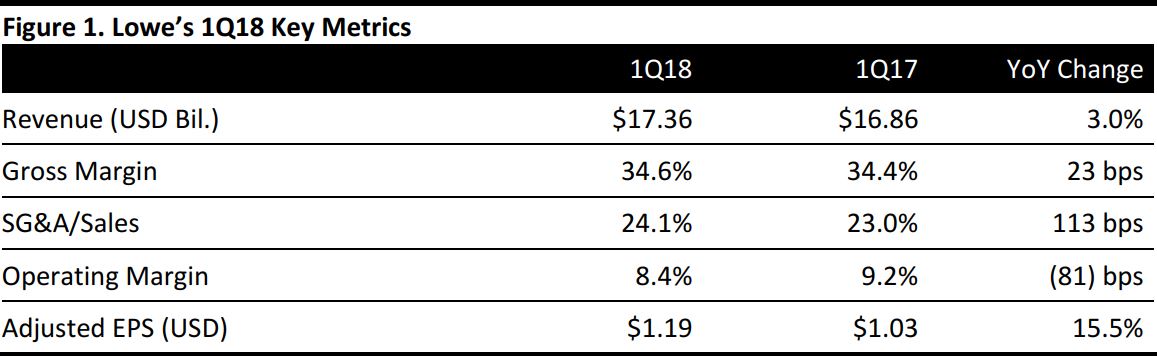

Lowe’s reported 1Q18 net sales of $17.36 billion, up by 3.0% year over year, but below the $17.46 billion consensus estimate.

Comps increased by 0.6%, missing the 3.2% consensus estimate. Comps for the US home improvement business increased by 0.5%. Average ticket size increased by 4.3%.

Adjusted EPS was $1.19, up by 15.5% year over year, but missing the consensus estimate by two cents. GAAP EPS was $1.20, compared with $0.74 in the year-ago quarter.

Details from the Quarter

- Chairman, President and CEO Robert Niblock previously announced plans to retire in March, and the company announced that industry veteran Marvin Ellison will become President and CEO, effective July 2.

- The company adopted a new accounting standard during the quarter, which increased revenues by $130 million.

- Management characterized performance in indoor categories as solid.

- Sales to pro customers grew, yet prolonged unfavorable weather across geographies led to a delayed spring selling season, which hurt results in outdoor categories. The quarter experienced more snow than in the past 12 years and the coldest April since 2007.

- Historically, outdoor categories represent 35% of 1Q sales and 40% of 2Q sales.

- Since the close of the quarter, spring has arrived, and management is encouraged by strong sales in May. Comps in May are in the positive double digits.

- Comps were positive in six of 14 regions, with two regions flat.

- Comps were positive in five of 11 product categories, with one category flat. Appliances led product category growth with another quarter of double-digit comps, supported by the company’s integrated omnichannel experience.

- Lowe’s continues to strengthen its relationships with pro customers, driving outperformance in rough plumbing and electrical, lumber and building materials, tools and hardware, and millwork. Sales to pro customers are driving comps above the industry average. Investments to enhance the online shopping experience drove 20% online comp growth in the quarter.

- Comps grew by double digits in Mexico, and comps in Canada were positive, in local currency. Comps in Canada were pressured by challenging weather conditions similar to those experienced in the US.

- The integration of RONA continues to make progress, and management expects continued growth from the rollout of appliances, a strong digital offering and ongoing store conversions and remodeling.

- Management continues to work to improve conversion, better manage inventory and stabilize gross margin, while investing in the capabilities to deliver simple and seamless customer experiences.

- As of May 4, the company operated 2,154 home improvement and hardware stores in the US, Canada and Mexico, representing 215.1 million square feet of retail selling space.

- Housing is expected to remain a positive driver, as demand exceeding supply drives home price appreciation.

Outlook

For 2018, the company expects the following:

- Total sales to increase by 5%, up from 4% previously. The consensus estimate calls for 3.8% sales growth.

- Comps to increase by 3.5%, ahead of the 3.3% consensus estimate.

- The addition of 10 home improvement and hardware stores.

- Operating margin to decrease by 40 basis points, up from 10 points previously.

- EPS of $5.40–$5.50, unchanged.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research