Source: Company reports/Fung Global Retail & Technology

1Q17 Results

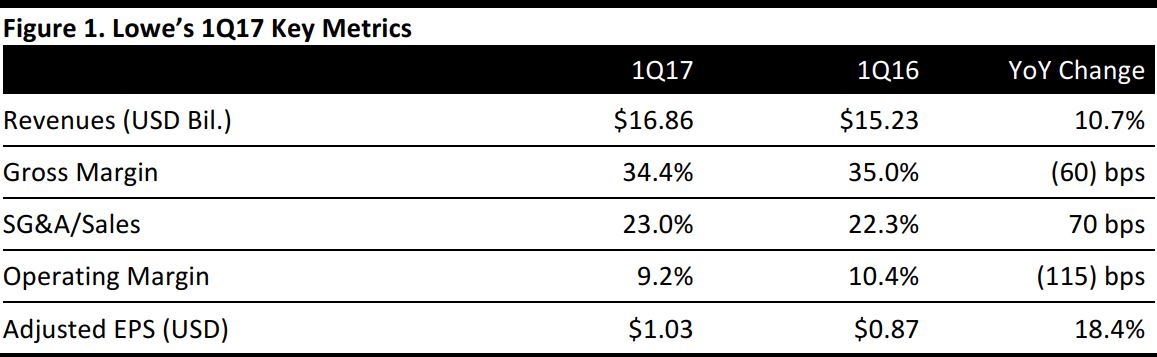

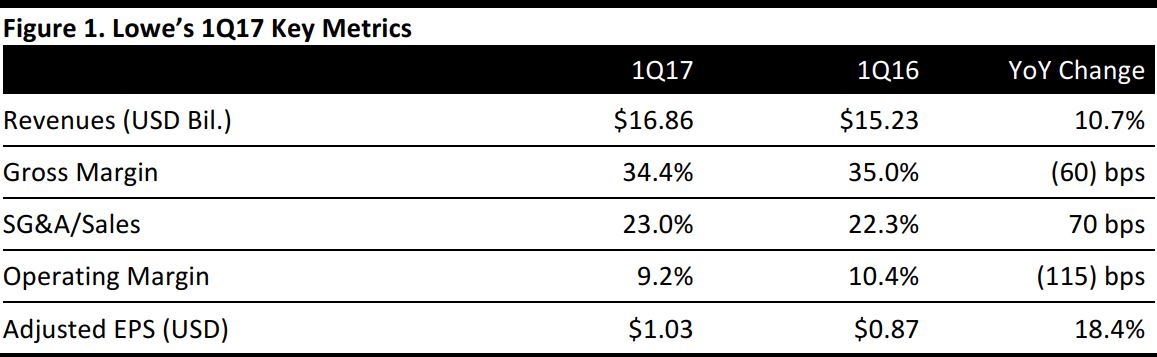

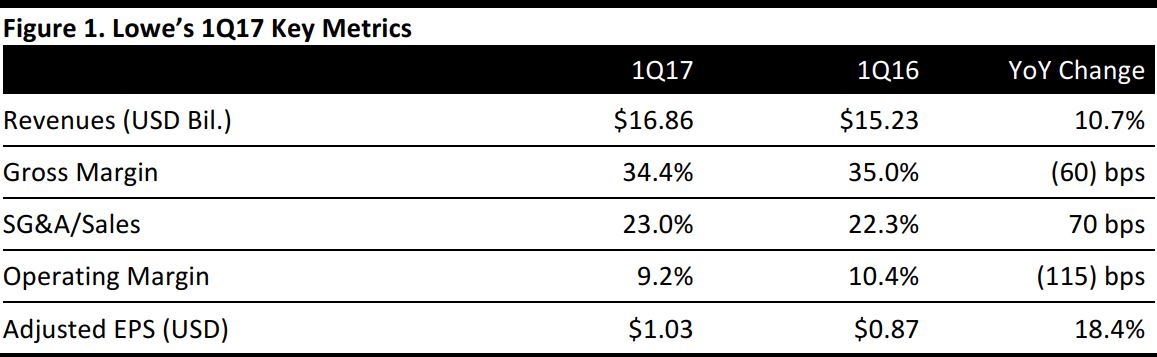

Lowe’s reported 1Q17 adjusted EPS of $1.03, up 18.4% from the year-ago quarter, but below the $1.06 consensus estimate. The company reported revenue of $16.86 billion, below the $16.95 billion consensus estimate, but up 10.7% from the year-ago quarter. Total customer transactions increased by 6.4% in the quarter and average ticket increased by 4%, to $70.79.

Same-store sales rose by 1.9% during the quarter, below the 3.1% consensus estimate. Comps were driven by a 3.5% increase in average ticket, which was partially offset by a 1.5% decline in customer transactions due to weaker performance in outdoor categories. The comp results were in contrast to those of Home Depot, which

reported a 1.5% increase in comp transactions in 1Q17 and a 5.5% increase in total comps compared with the year-ago period.

The 1Q17 earnings announcements from the two leading home improvement retailers show that the category continues to be a bright spot on the US retail landscape; however, Lowe’s is still playing catch-up with Home Depot when it comes to taking full advantage of the tailwinds.

Details from the Quarter

Lowe’s reported positive comps in 8 of 11 product categories, and flat growth in one category. Indoor project categories across appliances, kitchens and foreign categories all posted comps that were above the company’s average. Pro customer comp sales also outperformed, driving category sales in plumbing and electrical, lumber and building materials, and tools and hardware. Lowes.com comps increased by 27% from the year-ago quarter.

Comps for the US were up 2%, and comps were positive in 12 of 14 regions of the country. Internationally, Mexico posted double-digit comp growth, while Canada was flat in local currency.

Inventory was $12.3 billion at the end of the quarter, an increase of 10.8% from the year-ago period; roughly 60% of the increase was related to the addition of Canadian home-improvement chain Rona. Inventory turnover was 3.95, an increase of 12 basis points year over year.

Management commented that Lowe’s continues to benefit from a strong housing market in which home values are appreciating, as well as from job gains and rising consumer sentiment, all of which are encouraging more consumer spending on home projects.

As of May 5, Lowe’s operated 2,137 stores, up 14.9% from 2016. The store-number increase was largely driven by the purchase of the Rona chain.

FY17 Outlook

The company reaffirmed its FY17 revenue guidance of a 5% increase, implying $68.27 billion in full-year revenue, slightly below the $68.36 billion consensus estimate. The Rona acquisition, along with a plan to open 35 stores, is expected to add 1% to sales growth. Lowe’s expects full-year comp growth of 3.5% versus the 3.6% consensus estimate.

The company lowered its FY17 EPS guidance and now expects EPS of $4.30 versus prior guidance of $4.64 and compared with the $4.65 consensus estimate. Guidance for FY17 EPS was adjusted for debt charge and the resulting lower interest expense.