Source: Company reports

1Q16 RESULTS

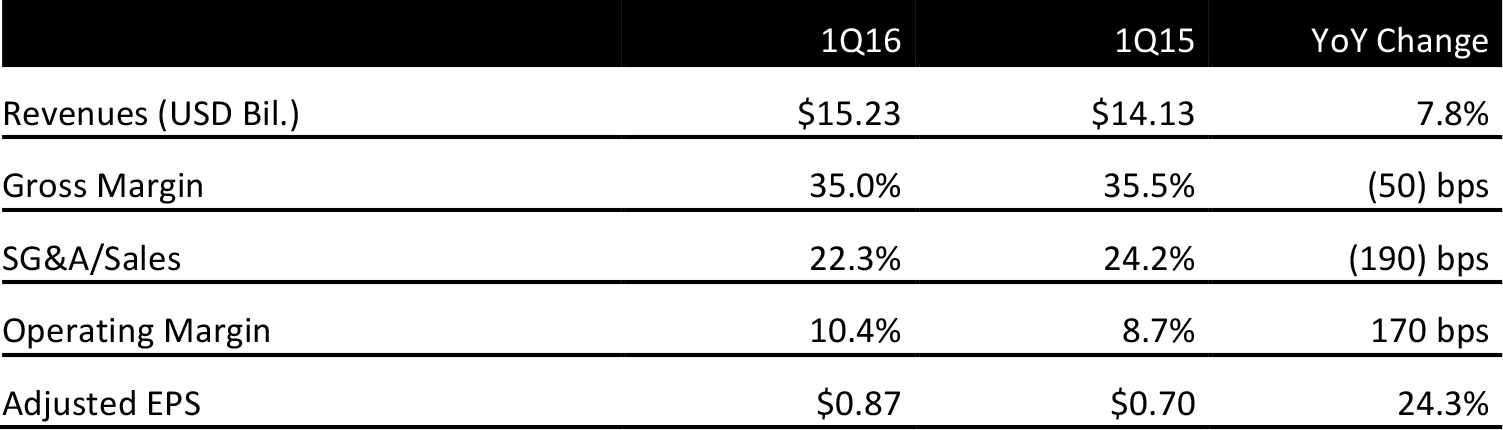

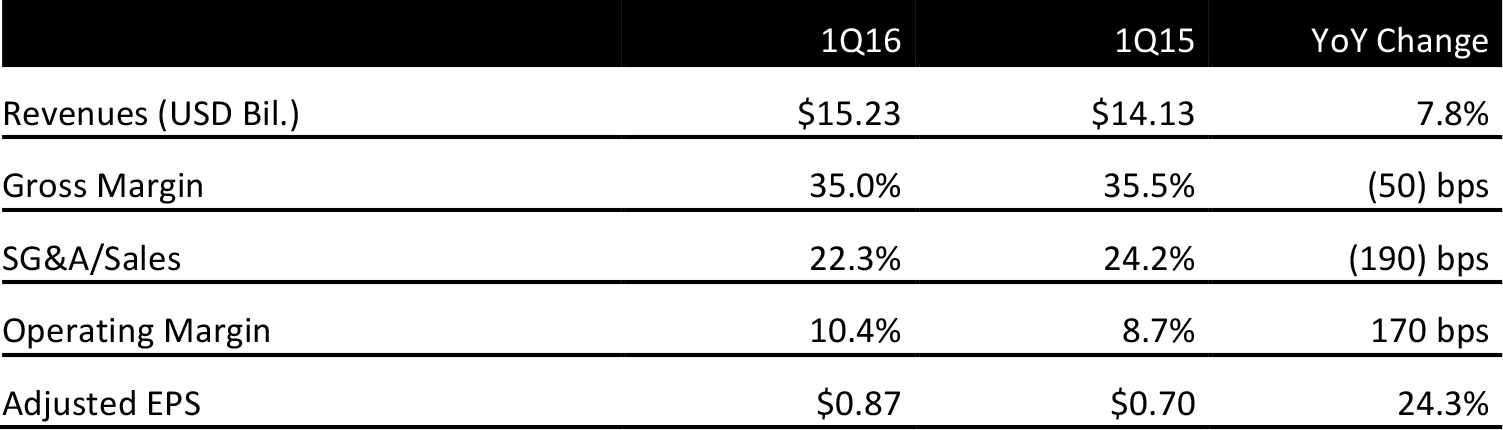

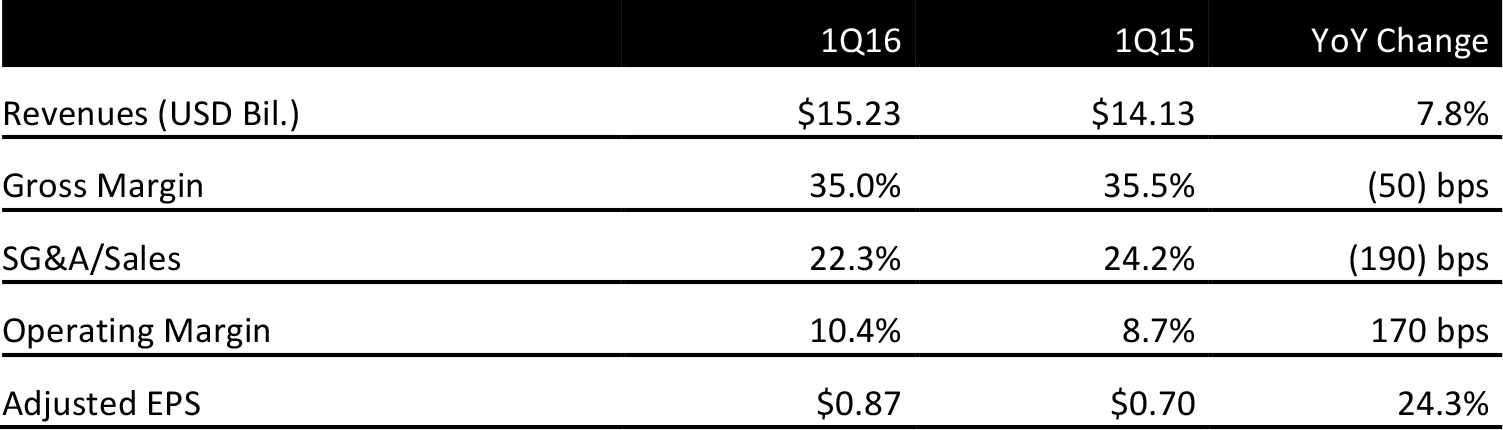

Lowe’s reported adjusted 1Q16 EPS of $0.87, excluding an $0.11 benefit related to an unrealized gain on a foreign currency hedge, versus the consensus estimate of $0.85.

Total revenues were $15.23 billion versus consensus of $14.87 billion. Comps were up 7.3% versus consensus of 4.7%. Comps for the US home improvement business increased by 7.5%. Both transactions and average ticket increased in the period (by 5.1% and 2.2%, respectively), driving higher-than-planned sales.

Comps were positive in all categories, with lumber and building materials, millwork, paint, lawn and garden, and tools and hardware showing particular strength.

Comps were up 8.3% in February, up 9.1% in March and up 4.9% in April. Comps were stronger earlier in the quarter due to favorable weather. April sales were consistent with management’s plan.

The company’s most recent consumer sentiment survey found that consumers’ favorable views regarding personal finances and home improvement spending are holding steady. Rising home prices are motivating homeowners to invest in their homes, and many believe that this trend will continue, as the survey revealed a significant increase in future-home-value expectations.

Inventories ended the quarter up 4.2% year over year, compared to the 7.8% sales growth during the period.

2016 OUTLOOK

Management reaffirmed its full-year guidance for EPS of $4.00, excluding the $0.11 benefit related to an unrealized gain on a foreign currency hedge. That is based on expected revenue growth of 6%, which implies sales of $62.62 billion versus consensus of $62.73 billion and includes a 1.5% benefit related to the 53rd week. Comps are expected to increase by 4% versus consensus of 4.2%. Operating margins are expected to increase by 80–90 basis points.

Lowe’s expects to open 45 stores over the year.