DIpil Das

[caption id="attachment_89197" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

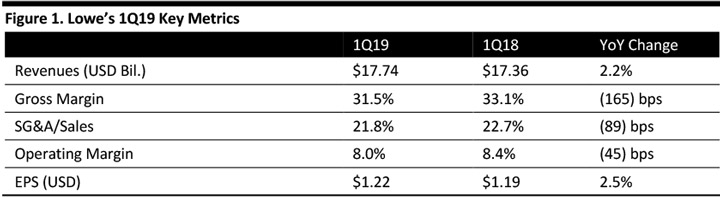

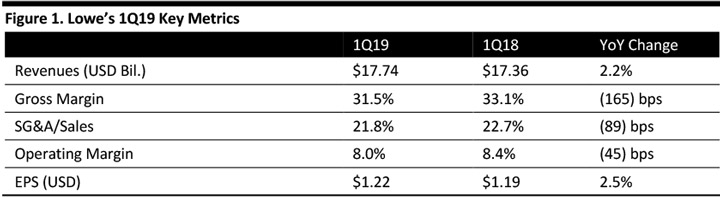

Lowe’s reported 1Q19 net sales of $17.74 billion, up 2.2% year over year, and ahead of the $17.64 billion consensus estimate.

Comps increased 3.5%, beating the 3.0% consensus estimate. Comps for the US home improvement business increased 4.2%.

Gross margin contracted to 31.5% in 1Q19, compared to 33.1% in 1Q18.

Adjusted EPS was $1.22, up 2.5% year over year but missing the consensus estimate by 11 cents. GAAP EPS was $1.31, compared to $1.19 in the year-ago quarter.

Details from the Quarter

Management described its top line results in the first quarter as “solid,” but stated it still needs to improve its gross margins as it continues its transformation. The company added that it has taken short- and long-term steps to improve its gross margin.

Other details:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lowe’s reported 1Q19 net sales of $17.74 billion, up 2.2% year over year, and ahead of the $17.64 billion consensus estimate.

Comps increased 3.5%, beating the 3.0% consensus estimate. Comps for the US home improvement business increased 4.2%.

Gross margin contracted to 31.5% in 1Q19, compared to 33.1% in 1Q18.

Adjusted EPS was $1.22, up 2.5% year over year but missing the consensus estimate by 11 cents. GAAP EPS was $1.31, compared to $1.19 in the year-ago quarter.

Details from the Quarter

Management described its top line results in the first quarter as “solid,” but stated it still needs to improve its gross margins as it continues its transformation. The company added that it has taken short- and long-term steps to improve its gross margin.

Other details:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lowe’s reported 1Q19 net sales of $17.74 billion, up 2.2% year over year, and ahead of the $17.64 billion consensus estimate.

Comps increased 3.5%, beating the 3.0% consensus estimate. Comps for the US home improvement business increased 4.2%.

Gross margin contracted to 31.5% in 1Q19, compared to 33.1% in 1Q18.

Adjusted EPS was $1.22, up 2.5% year over year but missing the consensus estimate by 11 cents. GAAP EPS was $1.31, compared to $1.19 in the year-ago quarter.

Details from the Quarter

Management described its top line results in the first quarter as “solid,” but stated it still needs to improve its gross margins as it continues its transformation. The company added that it has taken short- and long-term steps to improve its gross margin.

Other details:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lowe’s reported 1Q19 net sales of $17.74 billion, up 2.2% year over year, and ahead of the $17.64 billion consensus estimate.

Comps increased 3.5%, beating the 3.0% consensus estimate. Comps for the US home improvement business increased 4.2%.

Gross margin contracted to 31.5% in 1Q19, compared to 33.1% in 1Q18.

Adjusted EPS was $1.22, up 2.5% year over year but missing the consensus estimate by 11 cents. GAAP EPS was $1.31, compared to $1.19 in the year-ago quarter.

Details from the Quarter

Management described its top line results in the first quarter as “solid,” but stated it still needs to improve its gross margins as it continues its transformation. The company added that it has taken short- and long-term steps to improve its gross margin.

Other details:

- Lowe’s followed through with its plan to exit its Mexico operations during the quarter and following an extensive assessment, decided to sell the assets of its Mexico retail operations, in what was a departure from its previously announced intent to sell the operating business. The sale generated an $82 million tax benefit in the quarter which offset pre-tax costs of $12 million to fund Mexico operations.

- The company repurchased $818 million of stock and paid out $385 million in dividends during the quarter.

- The company adopted a new accounting standard for leases during the quarter, which increased lease-related assets by $3.6 billion and lease-related liabilities by $3.9 billion. The differential was recorded as an adjustment to opening retained earnings in fiscal 2019.

- Comps from pro customers notably outperformed DIY comps in the quarter and management stated this is significant for the company and that strategic initiatives in this area are gaining traction.

- Comps were positive in 12 of 14 regions, with the only exceptions being Tampa and Houston, both of which faced tough prior year comparisons owing to hurricanes Irma and Harvey. Atlanta, Charlotte, Los Angeles, Nashville, New York Metro, Pittsburgh, Philadelphia and Richmond were among the best performing geographic regions.

- Comps were positive in 10 of 13 product categories, with the seasonal and outdoor living segment recording double-digit comps growth while the lawn and garden segment registered high-single-digit comps growth.

- Lowe’s website recorded positive comps growth of 16% and management said they will continue to focus on driving growth in e-commerce and on expanding online assortments.

- Comps in Canada were negative on the back of a weaker Canadian housing market.

- Gross margin contracted considerably in the quarter resulting in EPS that was short of consensus estimates.

- As of May 3, 2019, the company operated 2,002 home improvement and hardware stores in the US, Canada and Mexico, representing 208.8 million square feet of retail selling space.

- Total sales to grow by 2.0%.

- Comps growth to be around 3.0%.

- Adjusted EPS in the range of $5.45-5.65.