DIpil Das

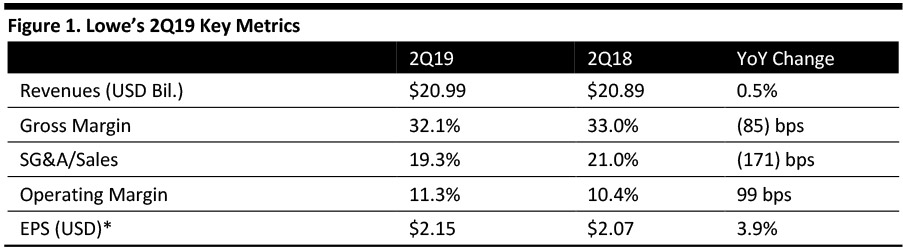

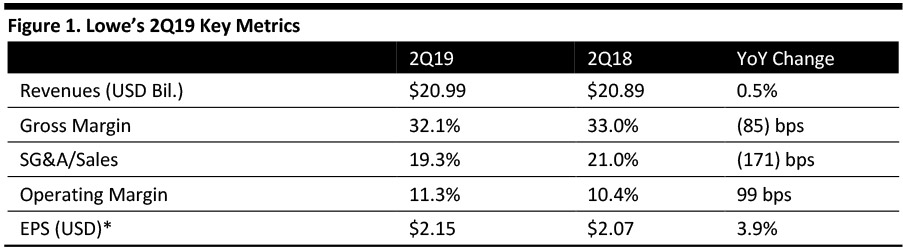

[caption id="attachment_95132" align="aligncenter" width="700"] *EPS is adjusted for pre-tax operating losses pertaining to the wind-down of Lowe’s Mexico retail operations.

*EPS is adjusted for pre-tax operating losses pertaining to the wind-down of Lowe’s Mexico retail operations.

Source: Company reports/Coresight Research[/caption] 2Q19 Results Lowe’s reported 2Q19 net sales of $20.99 billion, up 0.5% year over year, and ahead of the $20.93 billion consensus estimate. Comps increased 2.3%, beating the 1.7% consensus estimate. Comps for the US home improvement business increased 3.2%. Gross margin contracted to 32.1% in 2Q19, compared to 33.0% in 2Q18. Adjusted EPS was $2.15, up 3.9% year over year and comfortably beating the $2.00 consensus estimate. GAAP EPS was $2.14, compared to $1.86 in the year-ago quarter. Details from the Quarter Management described top-line results in the second quarter as “strong,” driven by spring demand, strong holiday event execution and growth in its paint and pro business. The company added that a solid macroeconomic backdrop and ongoing momentum in executing its retail fundamentals framework helped it deliver positive comps across all geographic regions. Other details:

*EPS is adjusted for pre-tax operating losses pertaining to the wind-down of Lowe’s Mexico retail operations.

*EPS is adjusted for pre-tax operating losses pertaining to the wind-down of Lowe’s Mexico retail operations. Source: Company reports/Coresight Research[/caption] 2Q19 Results Lowe’s reported 2Q19 net sales of $20.99 billion, up 0.5% year over year, and ahead of the $20.93 billion consensus estimate. Comps increased 2.3%, beating the 1.7% consensus estimate. Comps for the US home improvement business increased 3.2%. Gross margin contracted to 32.1% in 2Q19, compared to 33.0% in 2Q18. Adjusted EPS was $2.15, up 3.9% year over year and comfortably beating the $2.00 consensus estimate. GAAP EPS was $2.14, compared to $1.86 in the year-ago quarter. Details from the Quarter Management described top-line results in the second quarter as “strong,” driven by spring demand, strong holiday event execution and growth in its paint and pro business. The company added that a solid macroeconomic backdrop and ongoing momentum in executing its retail fundamentals framework helped it deliver positive comps across all geographic regions. Other details:

- Comps grew 2.3%, including a 2% increase in average ticket and a 0.3% increase in comparable transactions.

- Professional comp growth considerably outpaced DIY in the quarter and the company attributed this to investments in job-lot quantities, along with its improved service model. The company opened more than 35,000 new professional accounts in the quarter.

- Comps were positive in all 15 regions, with three of the top four performing regions belonging to the western division. Other regions that performed better than the company average during the quarter included Atlanta, Boston, Charlotte and Tampa.

- Comps in Canada were negative and the company attributed this to the ongoing integration of Canadian home improvement and construction products retailer RONA, which it acquired in 2016.

- Gross margin contracted 85 basis points (bps) against the year-ago quarter but improved 65 bps over the previous quarter. Management said the improvement against the first quarter was driven by retail price adjustments, a shift to strategic and targeted promotions and better vendor support for key promotional efforts.

- The company recorded $14 million in pre-tax operating costs attributed to the ongoing wind-down of its Mexico retail operations, offset by a $3 million tax benefit.

- The company repurchased $1.96 billion of stock and paid out $382 million in dividends during the quarter.

- The company said it has been actively hiring full- and part-time staff at its corporate locations, stores and distribution centers and since July 1, has filled over 14,000 positions.

- As of August 2, 2019, the company operated 2,003 home improvement and hardware stores in the US and Canada, with 208.8 million square feet of retail selling space.

- Total sales to grow by 2.0%, in line with the 1.7% consensus estimate.

- Comps growth to be around 3.0%.

- Adjusted EPS in the range of $5.45-5.65, in line with consensus of $5.61.