Web Developers

Lowe’s held an upbeat investor meeting on December 7, two years after its last investor meeting in 2014. The major themes of the meeting were steady evolution to adapt to customers’ needs and investment in future growth opportunities. Lowe’s strategy seems to be an evolutionary approach at this stage, working to listen to its customers and develop, based on their needs. The company is an avid adopter of the omnichannel model and digital technology, empowering its associates with mobile devices and using analytics and data to drive better business decisions. At the same time, management has pledged to deliver solid revenue and earnings growth, as well as substantial cash generation, for its shareholders.

Strategic Priorities and Financial Guidance

Before the meeting, Lowe’s disseminated a press release outlining its strategic priorities and long-term financial targets to be discussed at the meeting. Lowe’s strategic priorities include the following:- Expand home improvement reach to drive profitable share gains.

- Further adapt to the customer, developing capabilities to anticipate and support his or her needs.

- Generate long-term profitable growth and substantial returns for shareholders.

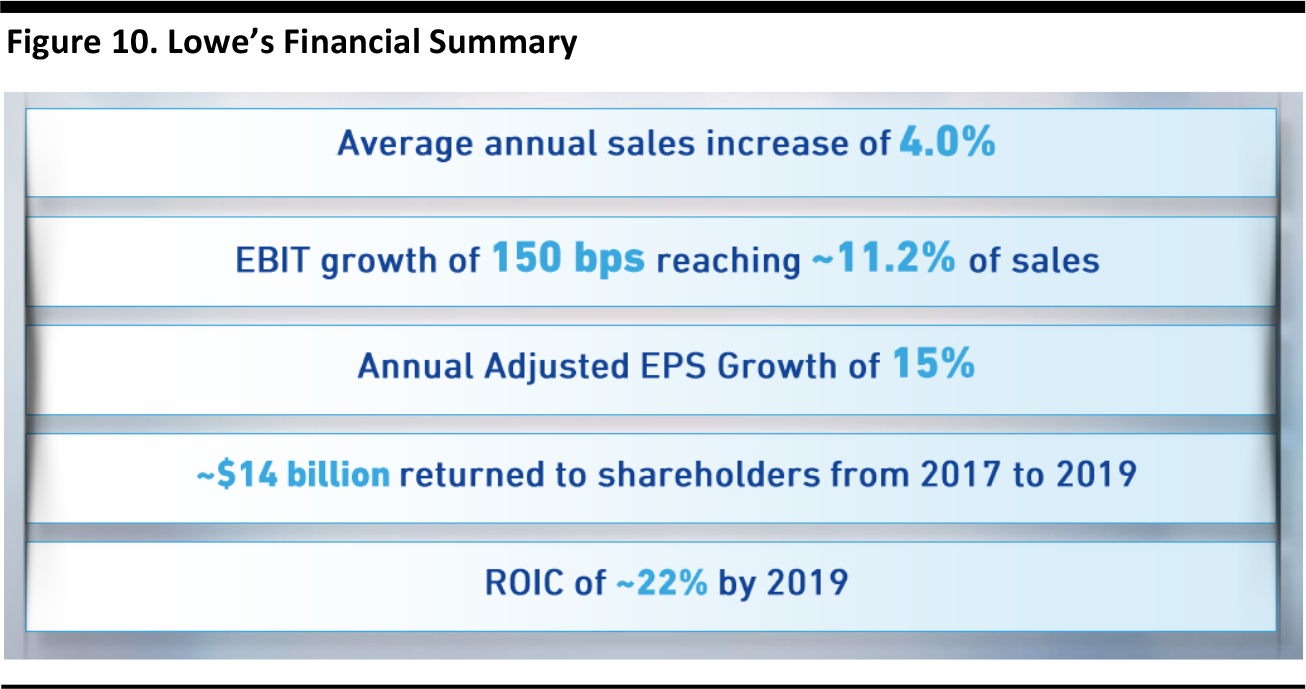

- Return on invested capital is expected to exceed 22% by 2019, an increase of more than 500 basis points over the next three years.

- The company also reiterated its prior sales and earnings guidance for 2016.

- Finally, management commented that it is pleased with the company’s performance quarter to date, including the holiday season, and remains confident in its business outlook.

- Total sales are expected to increase 9%–10%, including the 53rd week, i.e., to $64.3–$65.0 billion. (The current consensus estimate is $64.5 billion.)

- The 53rd week is expected add about 1.5 percentage points to sales growth.

- Comparable sales are expected to increase 3%–4%.

- Lowe’s expects to open approximately 40 new home-improvement and hardware stores.

- Earnings before interest and taxes (EBIT) as a percentage of sales (i.e., the operating margin) are expected to increase approximately 65 basis points.

- The effective income tax rate is expected to be approximately 40.1%.

- Diluted GAAP earnings per share of $3.52 are expected. (The current consensus estimate is for adjusted EPS of $3.92, compared to adjusted EPS of $3.29 in 2015.)

Robert Niblock, Chairman, President and CEO

- Lowe’s is evolving as customers’ expectations change, establishing itself as the project authority and building on past experiences to meet evolving customer needs, as depicted in the following figure.

Source: Company

- The company aims to serve more customers, more effectively (whether in-store, online, in-home, at the job site or via a contact center) and provide differentiated customer experiences.

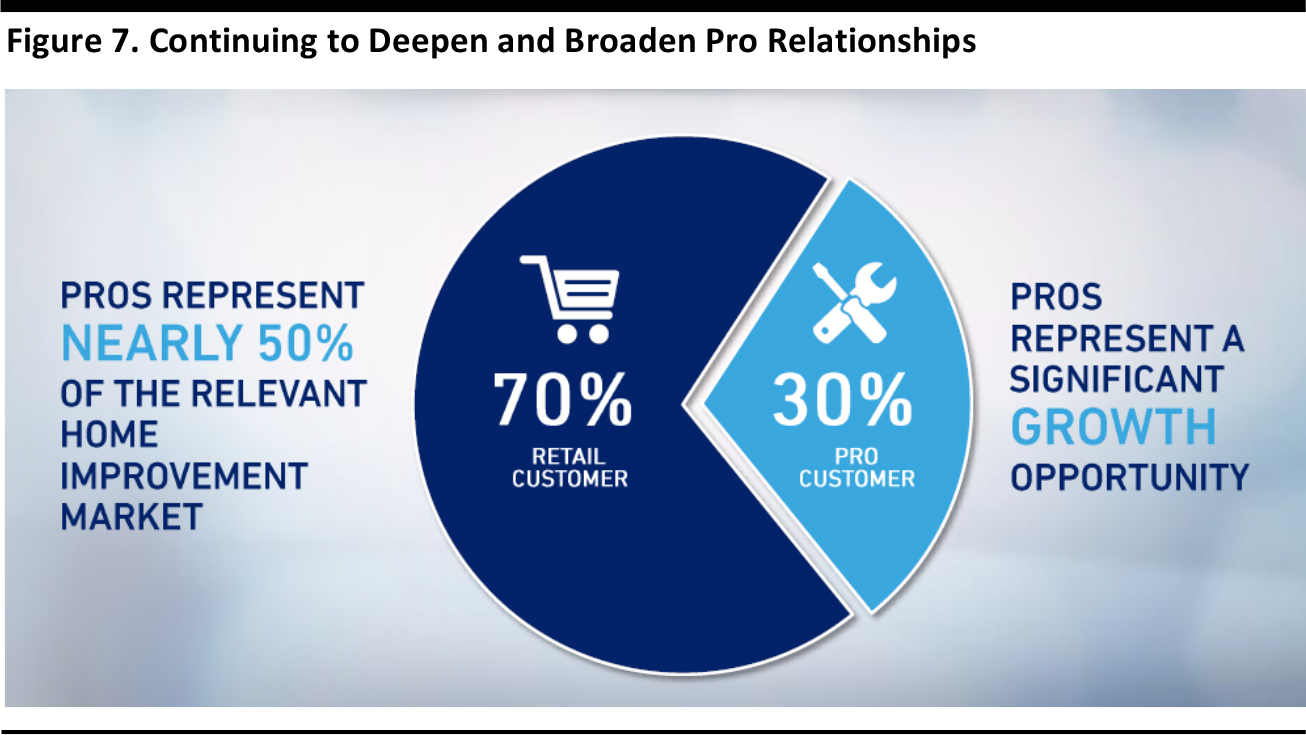

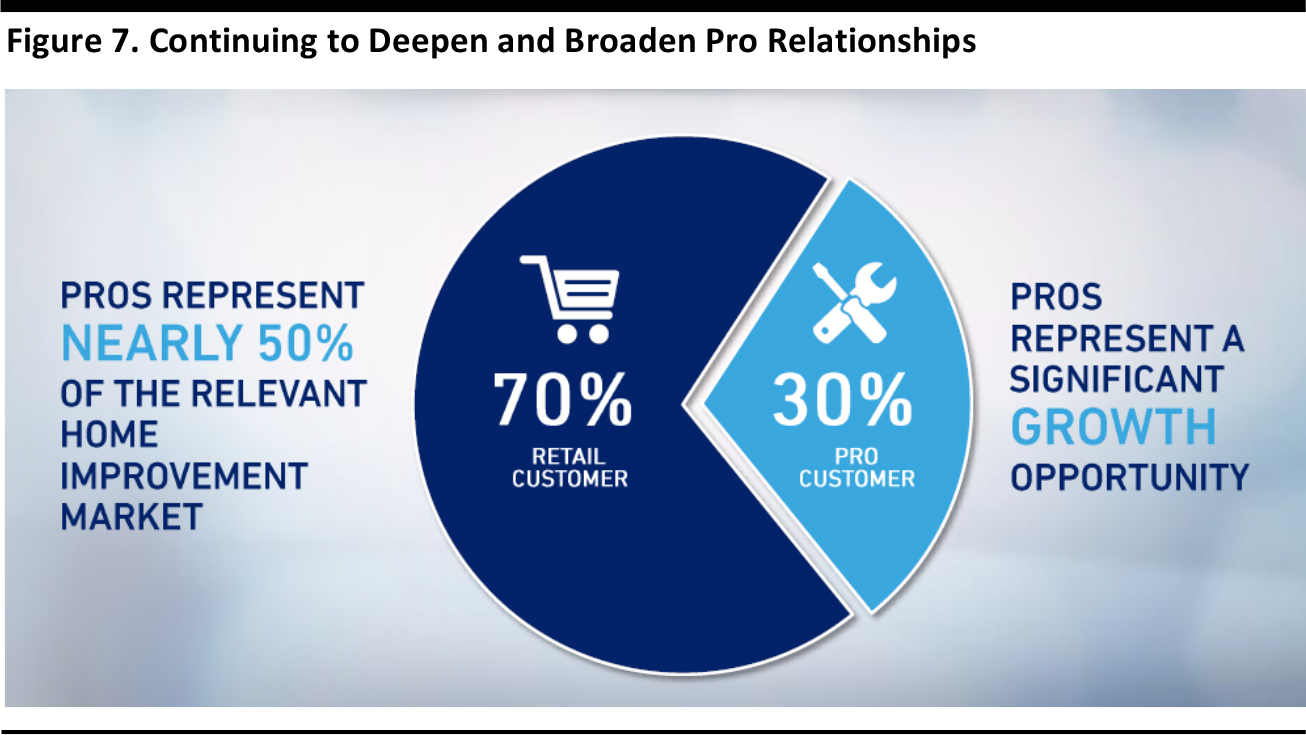

- Lowe’s is expanding its capabilities to serve project demand and is building on a strong foundation for the pro:

- Examples include: improved inventory depth, a strong brand portfolio, enhanced service offerings, LowesForPros.com and Alacrity Restoration Services.

- The company aims to enhance operating discipline and make productivity a core strength.

Source: Company

- Niblock characterized the current macro environment as “fundamentally solid.”

- GDP growth is healthy.

- Consumer balance sheets are strong.

- Home improvement spending is benefiting from employment gains, rising incomes, home-price appreciation and housing turnover.

- Lowe’s capital-allocation priorities remain consistent: 1) strategic investments; 2) dividends; and 3) share repurchases.

Mike McDermott, Chief Customer Officer

- McDermott commented that customer expectations are evolving and the Lowe’s plans to expand its home-improvement reach and further adapt to the customer to differentiate itself as the project authority.

- Lowe’s is empowering customers throughout their project journeys:

- These journeys include inspiration, planning, getting supplies, execution and enjoyment.

- Moreover, the company is investing to deliver a differentiated experience, positioning Lowe’s as the project authority, and deepening and broadening its pro relationships.

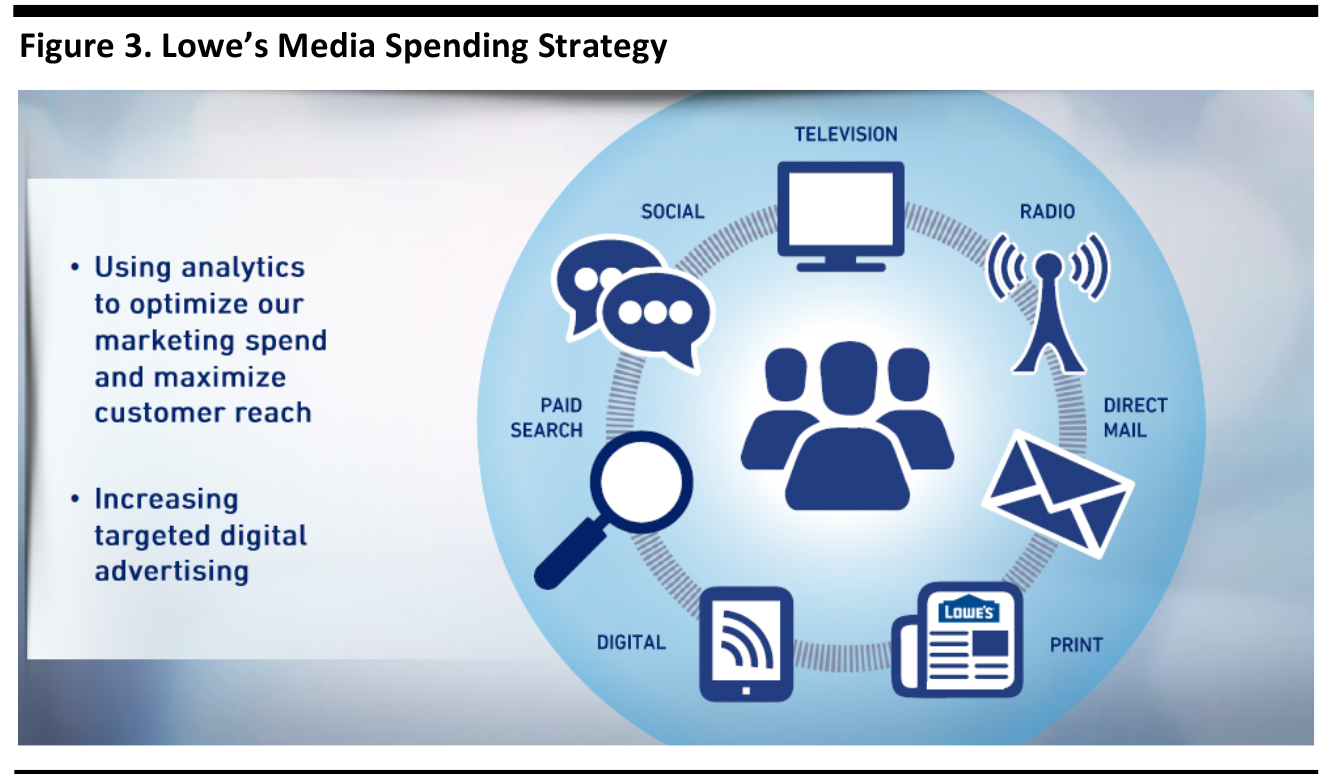

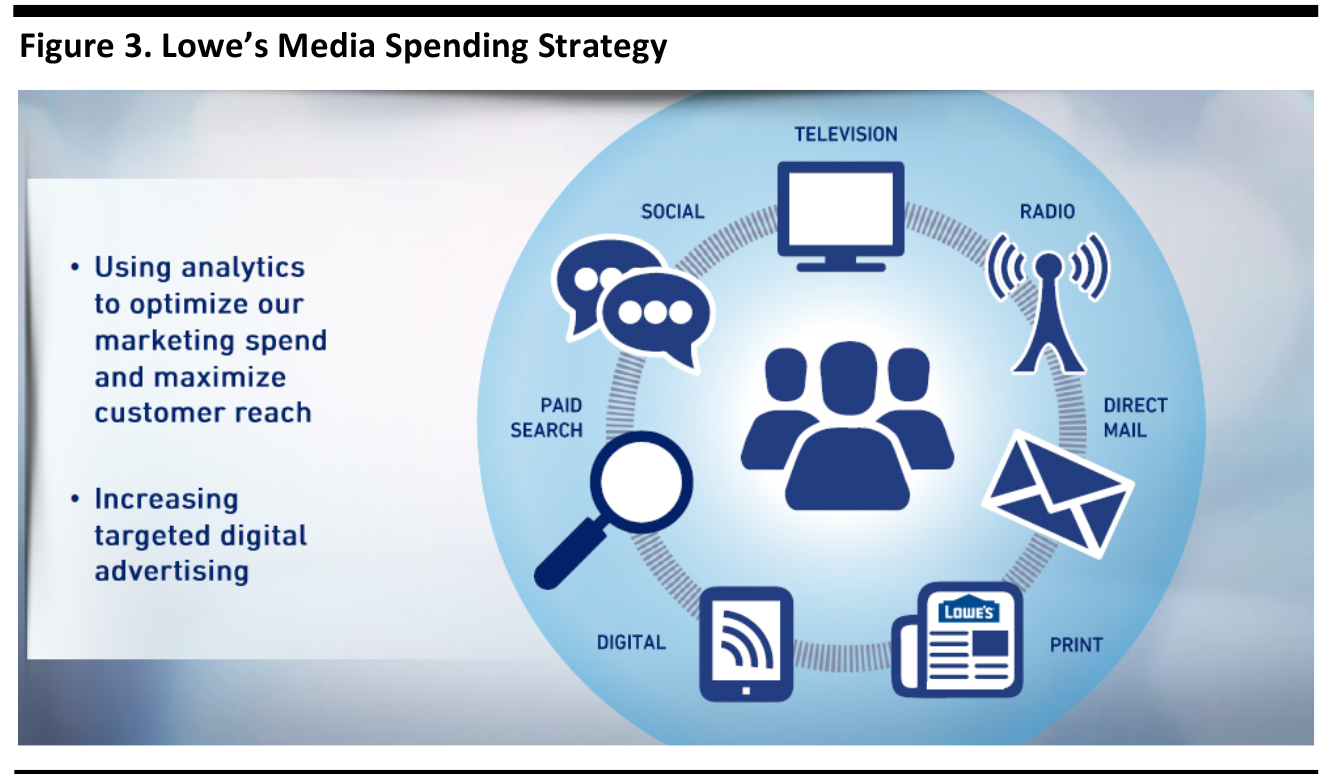

- Lowe’s is also leveraging advanced analytics to study the customer’s project journey and using data-driven insights to relieve project pain points, as well as influencing project decisions with digital marketing and optimizing its media mix to drive efficiency in marketing spending.

Source: Company

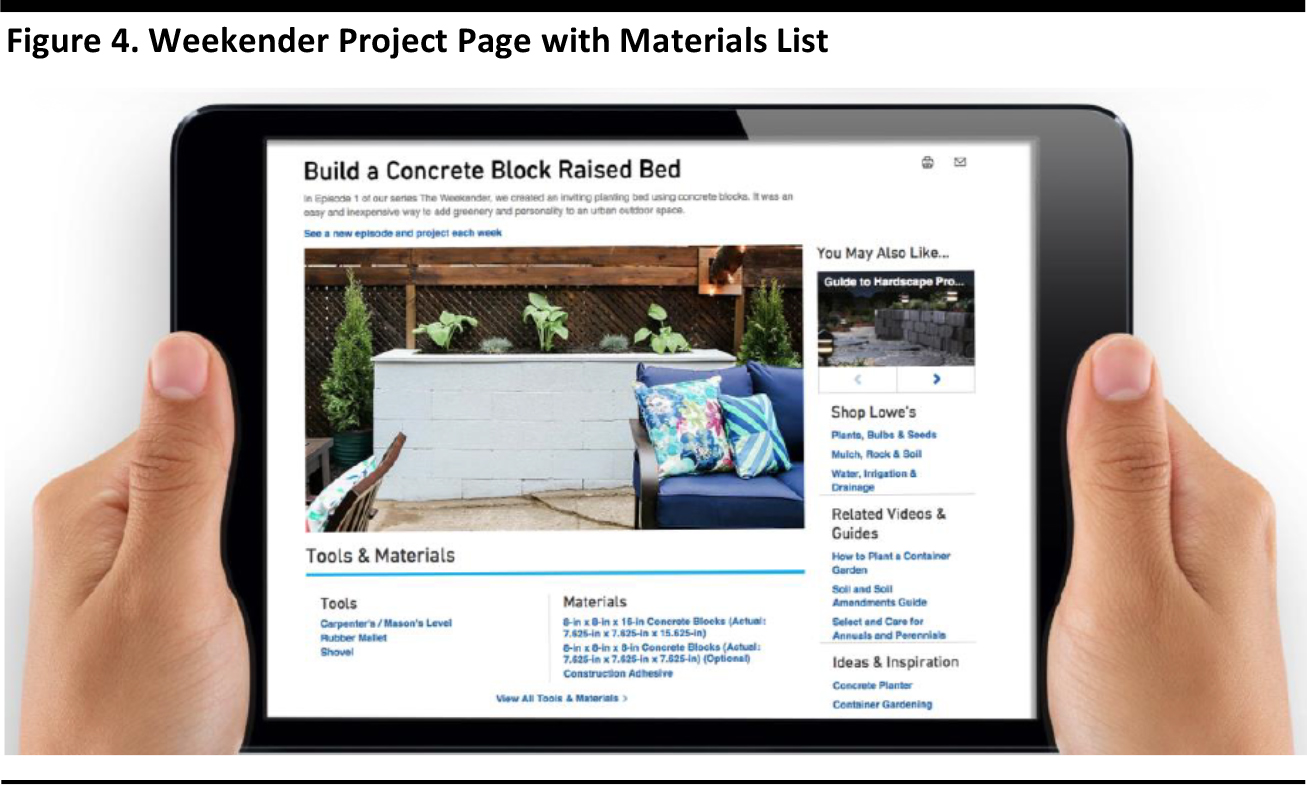

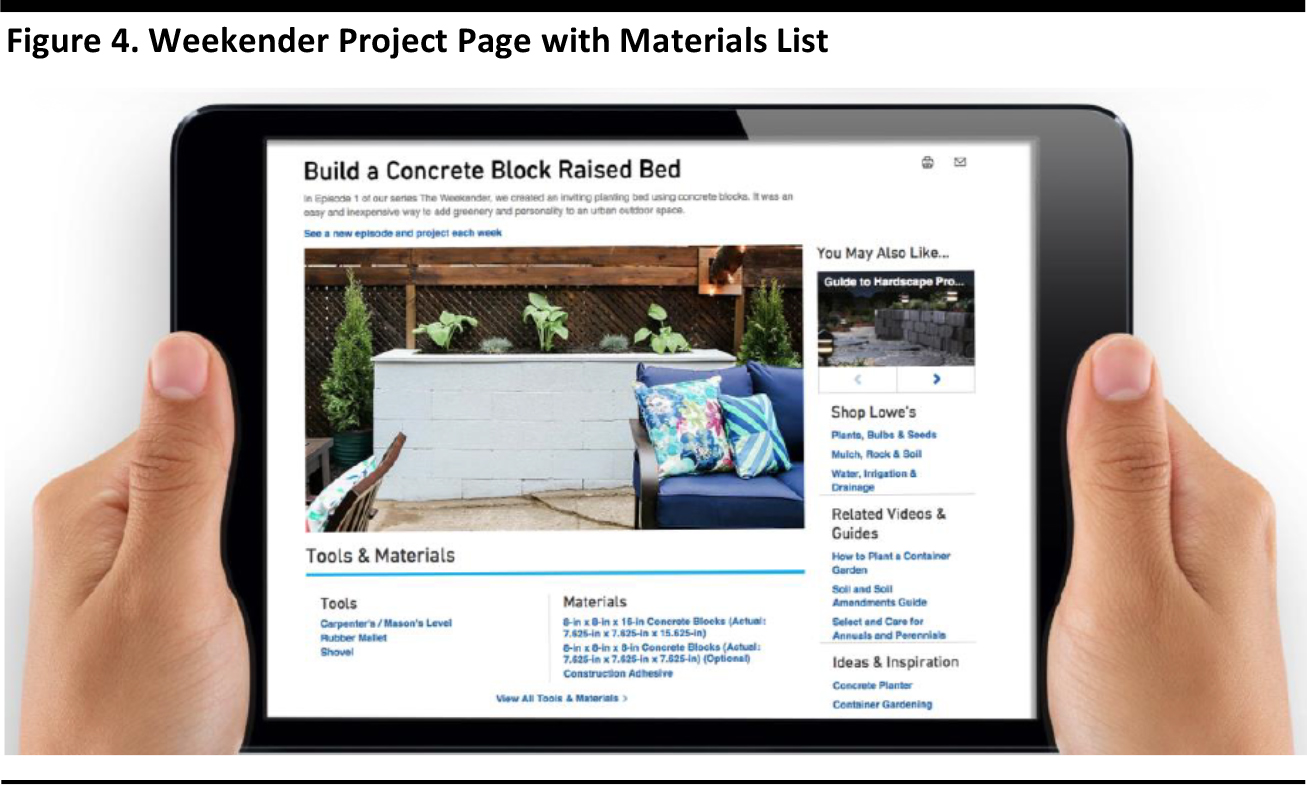

- McDermott highlighted The Weekender blog on the company’s website, which offers one-weekend rescues of problem spaces as well as new DIY projects and home décor ideas, project how-tos and shopping guides for the furniture and accessories for each makeover.

Source: Company

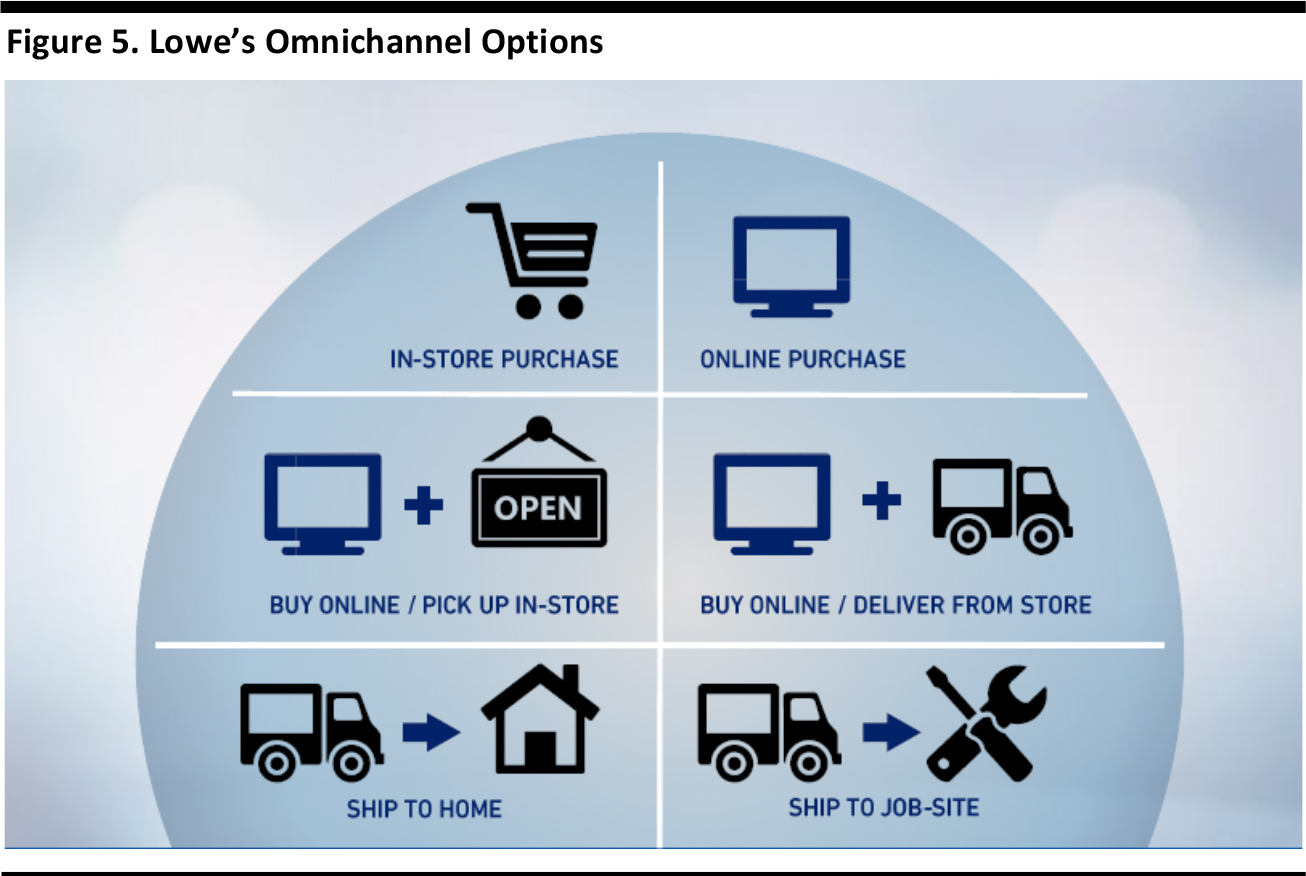

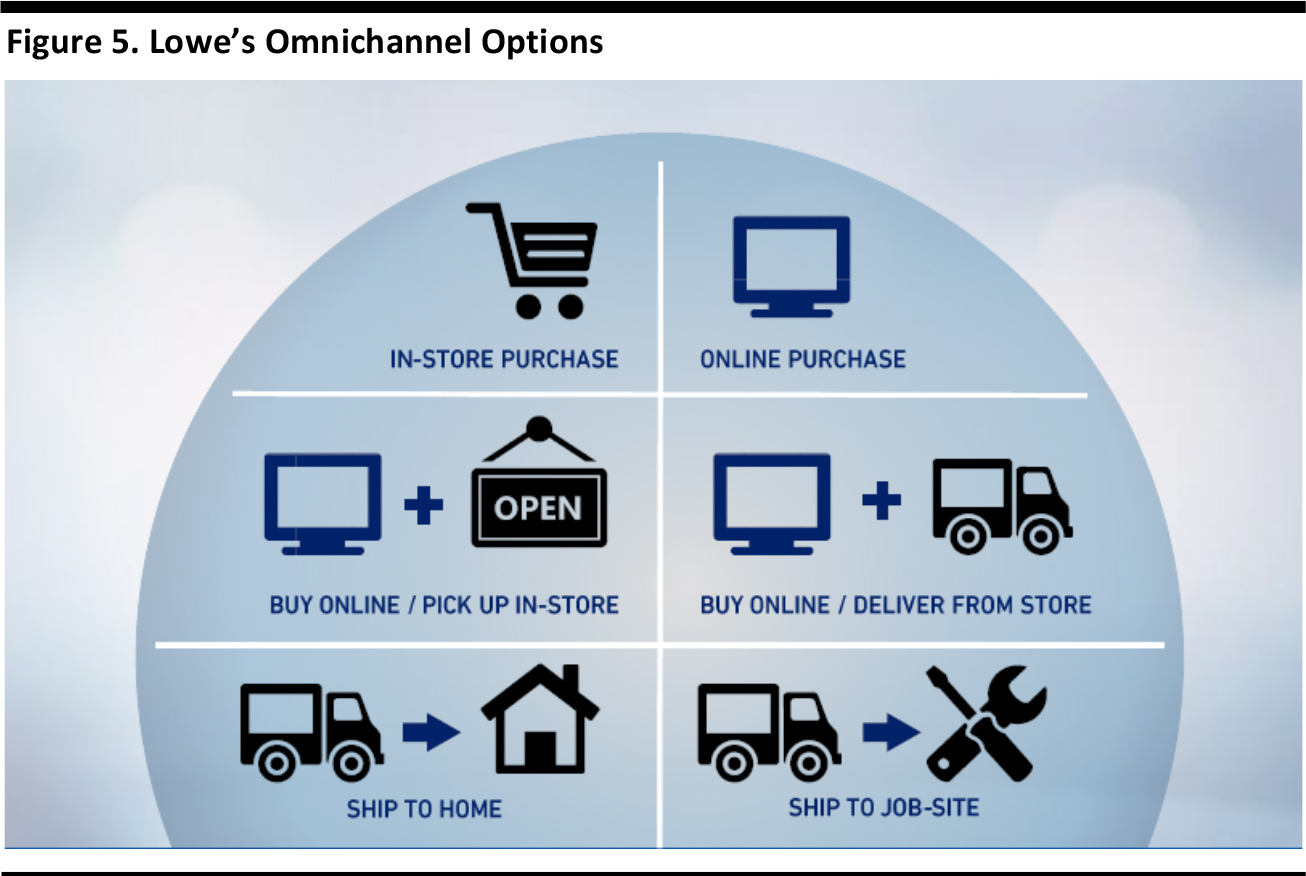

- Lowe’s also aims to provide “omnichannel inspiration,” and its omnichannel options are depicted in the figure below.

Source: Company

- Finally, Lowe’s plans to offer a strong foundation for the pro, including: maintenance, repair and operations (MRO), builders, repair/remodelers and specialty tradespeople.

Rick Damron, Chief Operating Officer

- Damron began his remarks by revisiting Lowe’s multiple avenues of delivering omnichannel, and reiterated that the company continues to evolve as customer expectations change.

- Lowe’s physical stores still play an important role in omnichannel retailing, and the company continues to invest to deliver an outstanding experience as well as superior customer service.

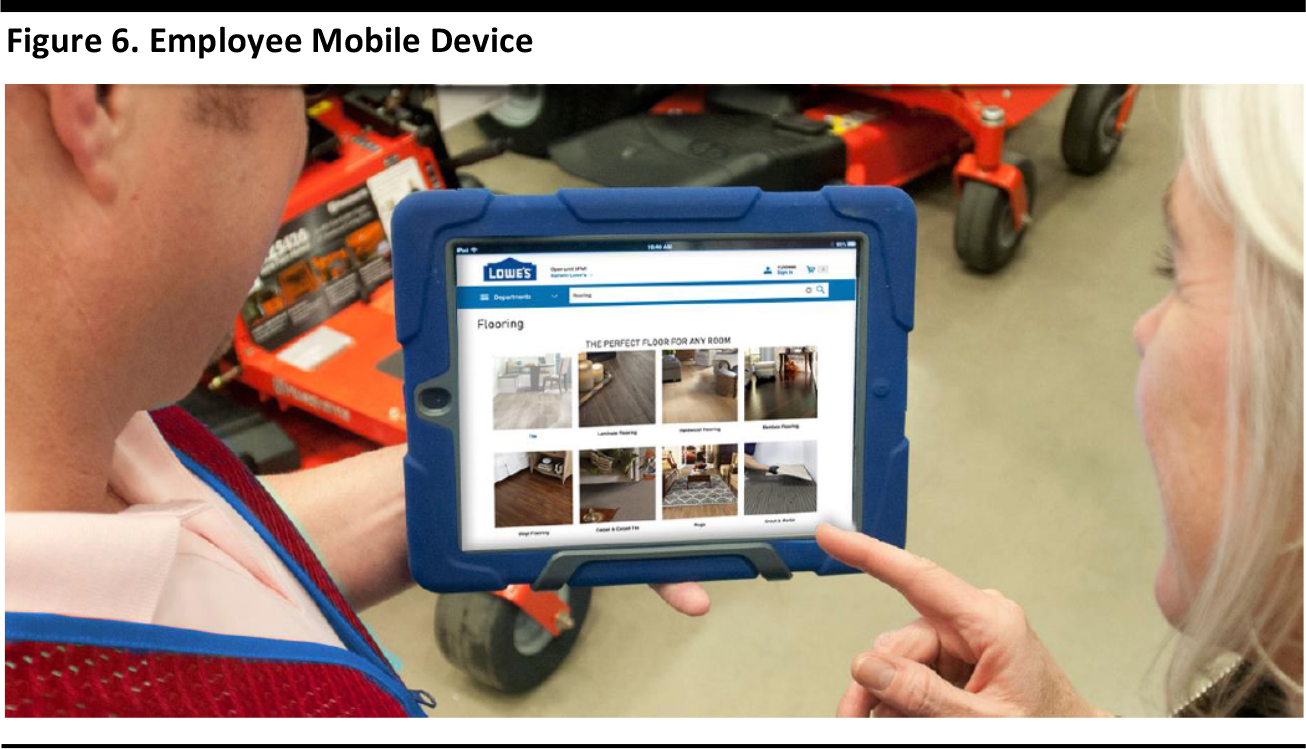

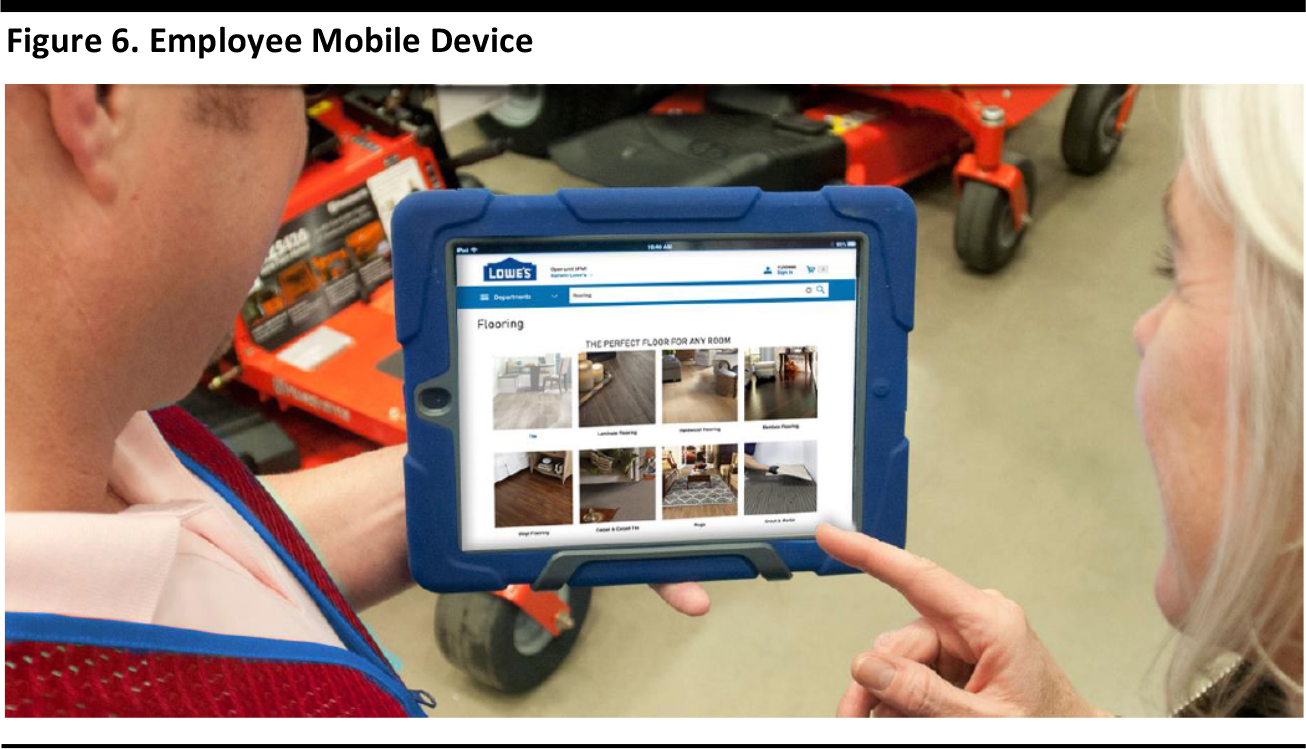

- To improve service, Lowe’s is empowering associates with digital assets.

Source: Company

- Lowe’s is also improving operational efficiencies:

- These efficiencies include better alignment of staffing with customer traffic, optimizing freight flow, expanding central production offices and testing alternative delivery options.

- Other actions include delivering a superior product selection, partnering with vendors to drive innovation, enhancing extended-aisle capabilities and delivering a better digital experience.

- For pro customers, Lowe’s has added several new brands to the product lineup, and is pursuing a multilevel pro engagement strategy:

- Steps include creating a national sales team, offering market-level account executive services and a dedicated in-store team for pro customers.

- Growing share in restoration services extends Lowe’s customer reach and capabilities, and creates a synergistic relationship with Lowe’s core pro-services offerings.

Source: Company

Richard Maltsbarger, Chief Development Officer and President, International

- Maltsbarger launched his remarks with a discussion of the use of omnichannel to build a dynamic, adaptable ecosystem.

- Lowe’s expanded its geographic and customer reach with the acquisition of Orchard Supply Hardware in 2013, which complements Lowe’s strength in big-box retail, and the stores are located in high-density prime locations with a merchandise mix tailored to local neighborhoods.

- Results have improved in Mexico, including improved brand penetration, optimized operations, strengthened supply-chain capabilities and strong comp sales growth.

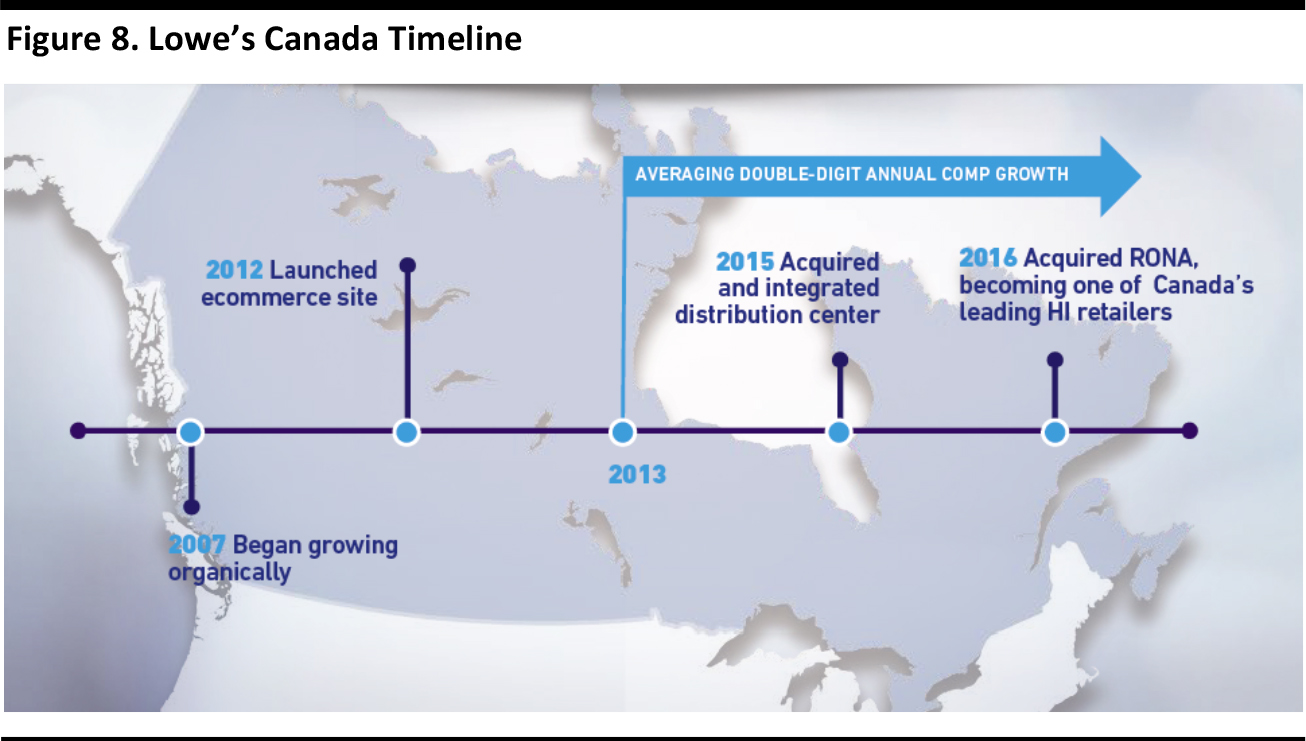

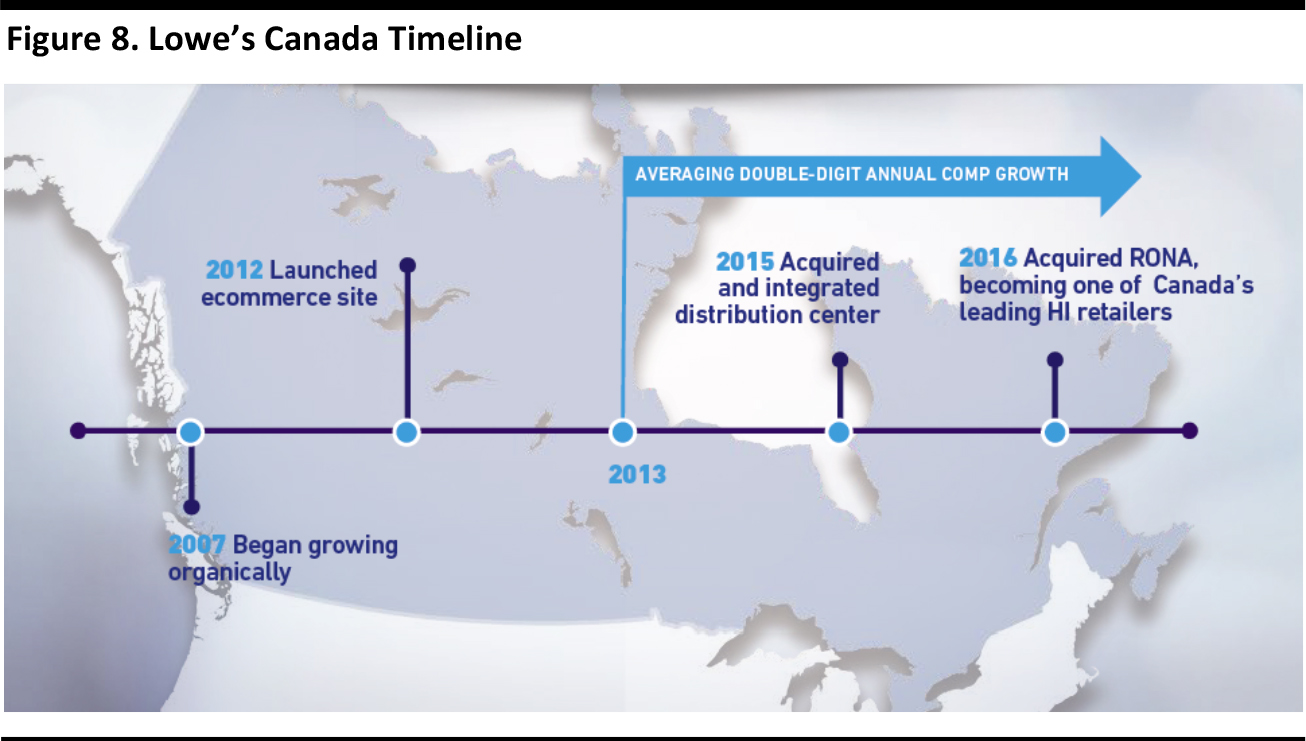

- Lowe’s continues to expand its customer reach and capabilities in Canada, enhancing customer relevance, expanding customer reach and driving increased profitability.

Source: Company

- The company has identified C$1 billion in revenue and cost synergies from the RONA acquisition. Early integration wins include the rollout of appliances, shared supplier negotiations and confirmation of synergy cases.

Bob Hull, Chief Financial Officer

- Hull categorized the economic outlook as favorable.

Source: Company

- Hull further offered specific economic commentary:

- Economic growth is expected to remain steady.

- The consumer sector is expected to moderate but remain favorable.

- The unemployment rate has declined to the full-employment level.

- Home prices have returned to the prior peak.

- Home price appreciation is aligned with trends in job and income growth.

- Home affordability is expected to remain higher than the long-term average (i.e., less affordable).

- Growth in housing turnover is expected to moderate, but remain positive.

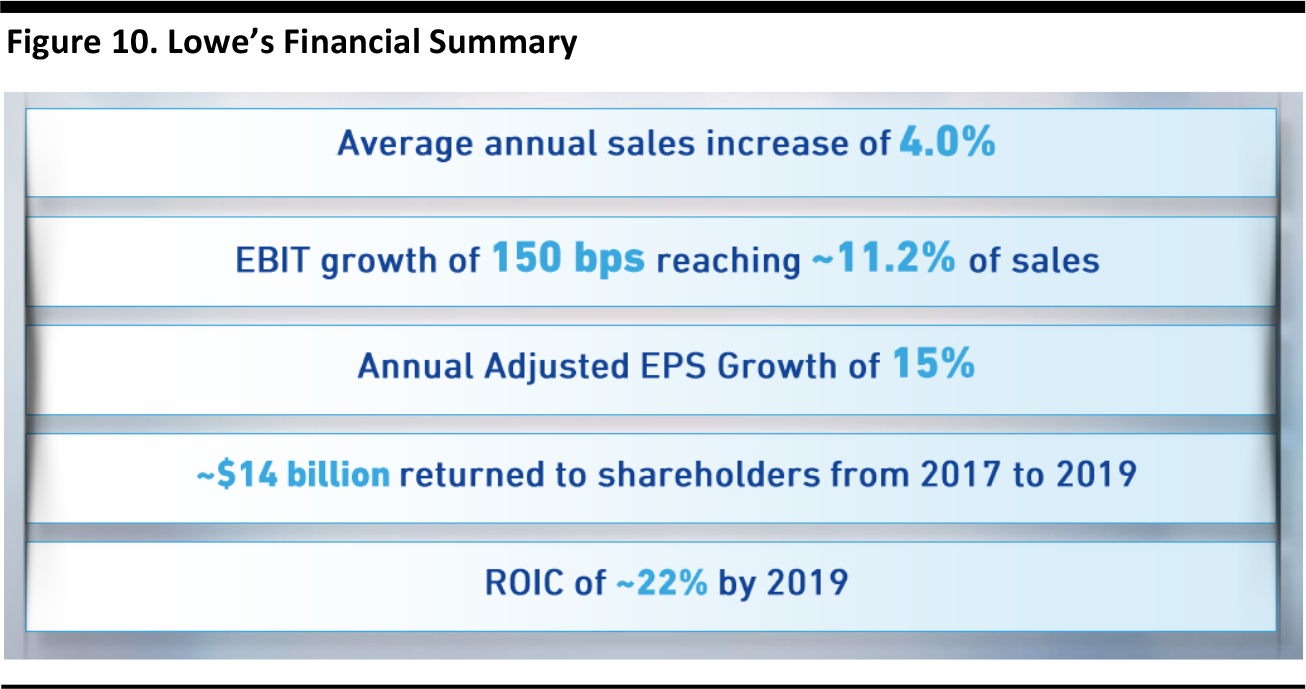

- Hull reiterated three areas of meeting customer needs while driving shareholder value:

- Focusing on the customer.

- Investing to meet the needs of evolving customers.

- Growing customer reach and profits.

- Efficiencies can be found by evaluating labor productivity, centrally managing indirect spending and adapting processes to improve speed-to-market.

- Hull reiterated the guidance from the press release and provided a 2017–2019 outlook:

- Annual comp sales growth of 3.0%–3.5%

- Average sales growth of 4.0%, based on the comp sales expectation, including the sales contribution of RONA and opening 15–20 new stores per year.

- An 11.2% operating margin in 2019, based on optimizing labor, leveraging fixed costs, reducing indirect spending, lower depreciation and improving RONA’s productivity.

- These figures result in three-year cumulative cash from operations of about $18 billion.

- The lease adjusted debt-to-EBITDAR ratio target is expected to hit 2.25x.

- Capital allocation priorities remain: 1) strategic investments, 2) dividends and 3) share repurchases.

- Capital spending is expected to average $1.2 billion, comprised of 45% omnichannel, 45% store infrastructure and 10% corporate/supply-chain infrastructure.

- Putting it all together, Lowe’s expects 4% revenue growth, resulting in 15% annual adjusted EPS growth, driving about $14 billion of cash returned to shareholders during 2017–2019.