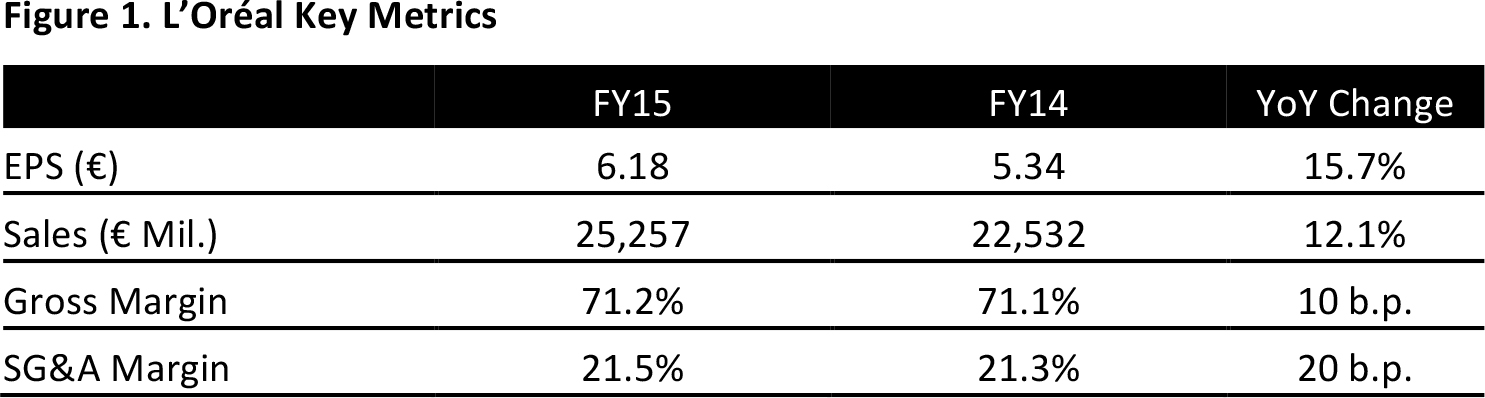

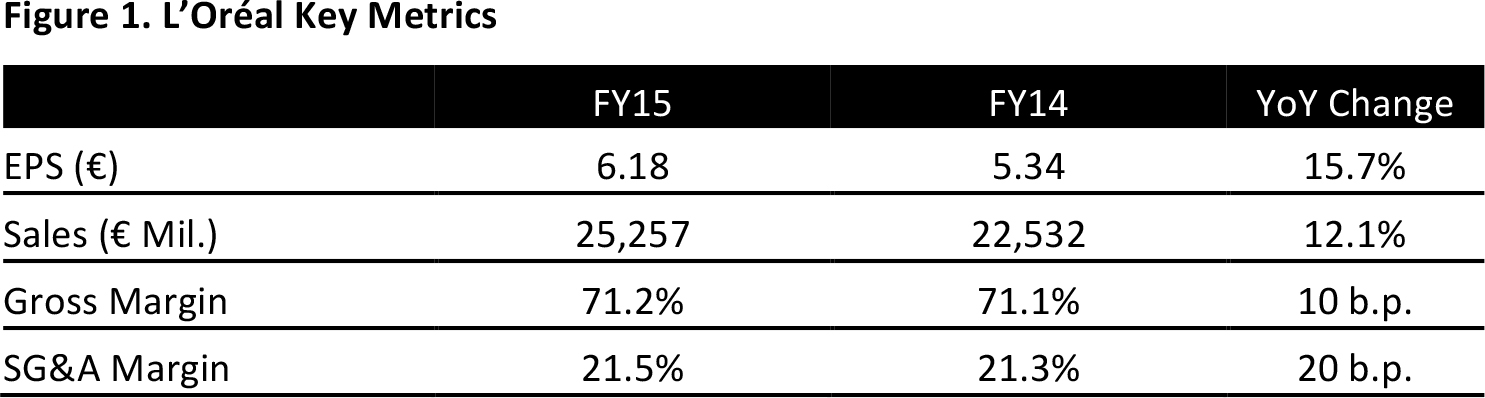

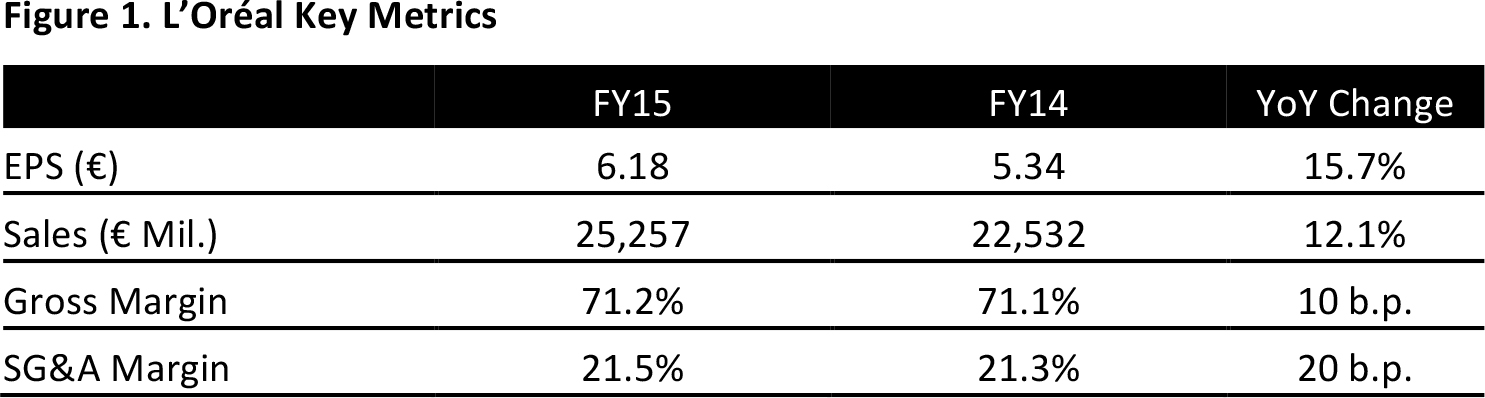

Source: Company reports

France-based cosmetics brand owner and retailer L’Oréal reported that FY15 revenue increased by 12.1%, to €25.3 billion, beating the consensus estimate of €25.1 billion recorded by S&P Capital IQ.

L’Oréal achieved strong growth in 2015, despite a challenging and volatile economic environment. The company benefited from positive currency effects and outperformed the market in three of its four divisions, according to Chairman and CEO Jean-Paul Agon. With revenue growth at constant exchange rates up 4.9%, currency fluctuations had a positive impact of 7.2% on reported revenue. Comps were up 3.9%.

The company reported an increase of 12.8% in EBIT for the year, to €4,388 million, slightly below the consensus estimate of €4,398 million, according to S&P Capital IQ. Reported EPS was €6.18, an increase of 15.7% over the previous fiscal year and in line with the consensus estimate.

E-commerce sales grew rapidly during the period, to €1.3 billion, accounting for more than 5% of the group’s total sales. The company says this figure represents total sales through its brands’ own websites and estimated sales of its brands “through our retailers’ websites.”

BY DIVISION

Revenues for the company’s cosmetics divisions were up 12.2% based on reported figures, driven by the performance of L’Oréal Luxe, which grew by 16.7% thanks to the dynamism of makeup and fragrances, including Yves Saint Laurent Black Opium and Giorgio Armani Sì and Acqua di Gio.

Also within the cosmetics divisions, professional products revenues rose by 12.1%, while consumer products revenues rose by 10.0% and active cosmetics revenues by 9.4%.

The Body Shop, the company’s retailing division, recorded a 10.7% increase in revenue, to €967 million, in FY15, but comps were down 0.9%. The company said its focus on skincare paid off in all markets, and good momentum was recorded in Africa, the Middle East, Europe and the UK, while results were negatively affected by a challenging economic environment in Asia—notably in Hong Kong—and in North America, where sales in the year-end holiday period were “below expectations.”

The company expects to achieve further revenue and profit growth in FY16 thanks to its balanced exposure in terms of beauty categories, distribution channels and geographical areas. Despite the global economic environment, Agon said, “We are entering 2016 with the ambition to outperform the cosmetics market and achieve another year of sales and profit growth.”