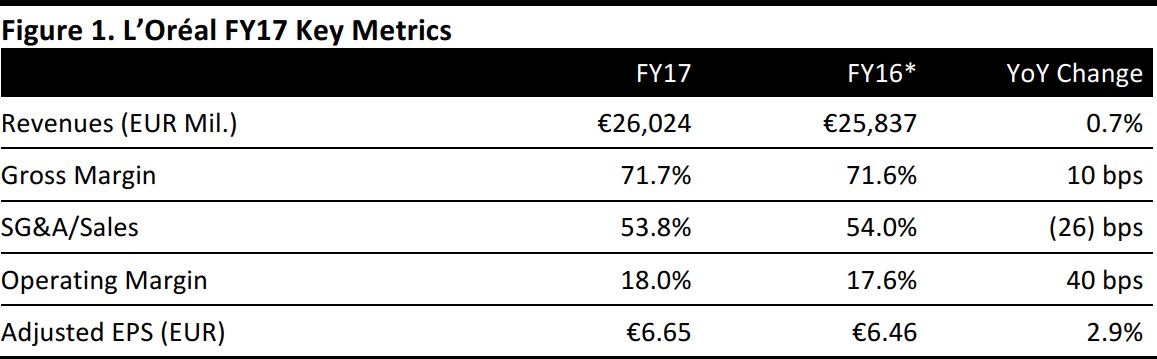

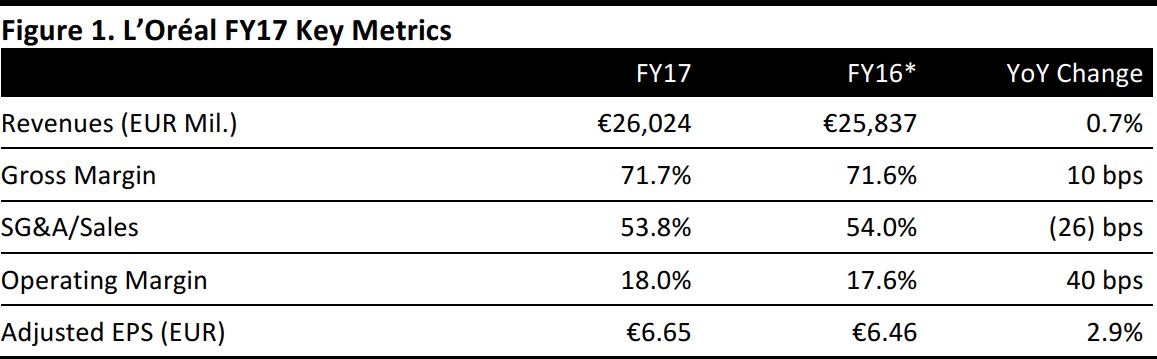

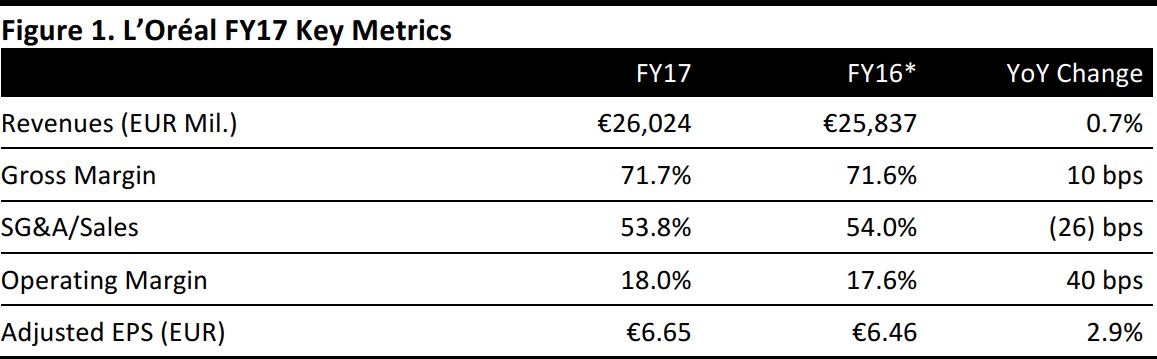

*In FY16, reported group sales included The Body Shop’ssales, which totaled€920.8 million.

Source: Company reports/FGRT

FY17 Results

L’Oréal reported FY17 net sales of €26,024 million, up 0.7% as reported but below the consensus estimate of €26,153 million. The sale of The Body Shop—which was finalized on September 7, 2017—had a negative impact of 3.7% on revenue. Comparable sales, which exclude the impact of sales and acquisitions and are expressed at constant exchange rates, grew by 4.8%. Operating profit for FY17 was €4,676 million, below the consensus estimate of €4,716 million.

The best-performing division in FY17 was L’Oréal Luxe, which reported comparable sales growth of 10.5%. The company noted that the division saw “particularly good” figures in China and in Travel Retail and that Luxe sales in the Asia-Pacific region were up by double digits. Consumer Products, the largest division by revenue, reported comparable sales growth of 2.2% during the year. The company said that the segment is winning market share in Europe and that China is driving an acceleration in the segment’s Asia-Pacific sales.

Geographically, the Asia-Pacific region performed best, with comparable sales growth of 12.3% in FY17. Western Europe, the largest geography by revenue, posted comparable sales growth of 2.6% during the period.

4Q17 Update

In 4Q17, the group posted sales of €6,514 million, a year-over-year decline of 4.1% in reporting currency and below the consensus estimate of €6,607 million. Comparable sales for the period grew by 5.5%, above analysts’ estimate of 5.0%.

Outlook

For FY18, L’Oréal expects to outperform the market and to achieve significant growth in comparable sales and profitability. For FY18, analysts expect the company to achieve revenue of €26,731 million and EBIT of €4,876 million, according to S&P Capital IQ.