1Q18 Update

L’Oréal reported that 1Q18 revenues grew by 6.8% on a comparable basis at constant exchange rates. The figure represented a sequential improvement from 5.5% growth in the final quarter of 2017 and was comfortably ahead of the consensus expectation of 5.6% growth.

Unfavorable currency impacts caused total revenues to fall by 1.0% in 1Q18. This figure strips out the effect of the sale of The Body Shop in September 2017; including The Body Shop, total revenues fell by 3.8%.

Total revenues of €6.78 billion were in line with analysts’ expectations.

L’Oréal noted the strength of Chinese demand for high-end products. The company’s comments follow LVMH’s report of very strong organic revenue growth for top-tier luxury brands

earlier this week, when LVMH management noted “good growth” in Asia.

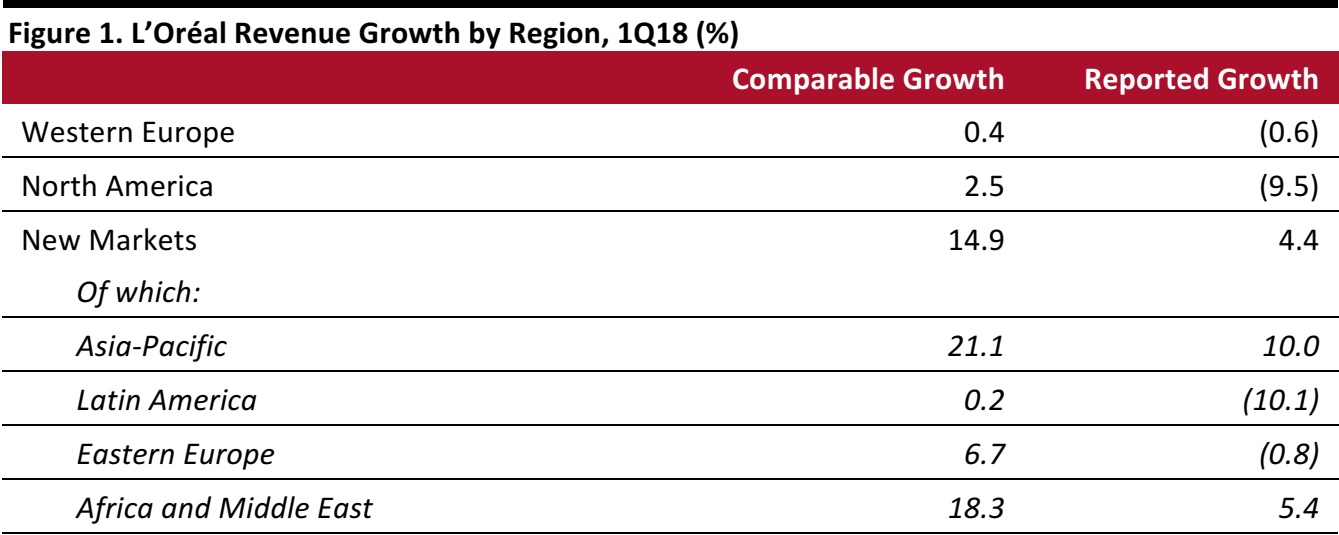

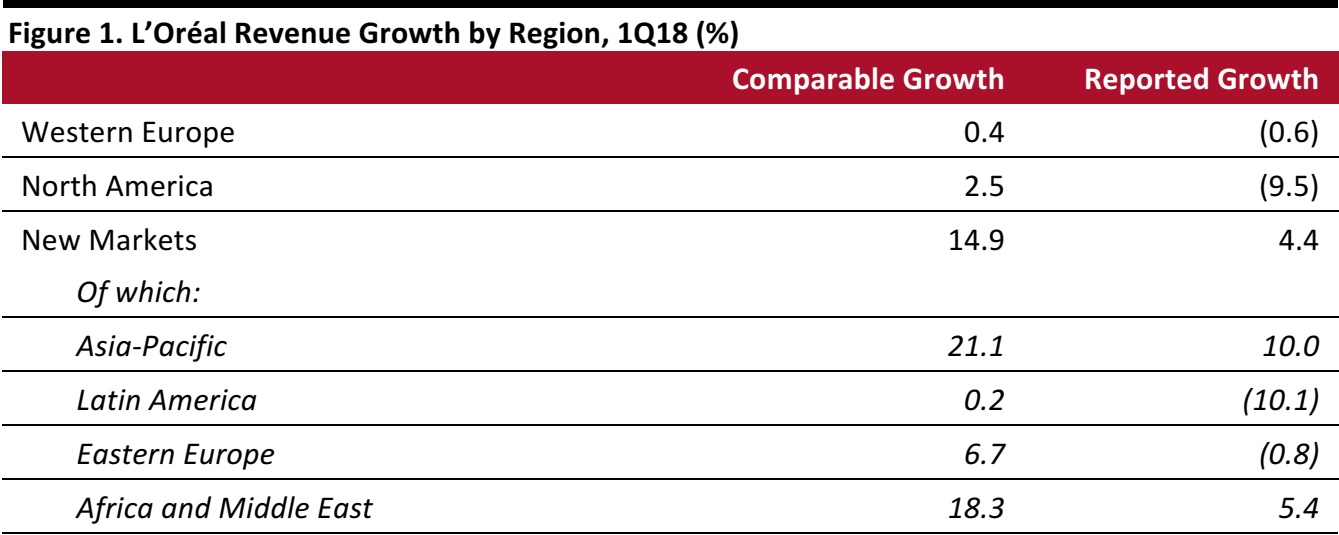

Performance by Region

L’Oréal noted that France is still a difficult market. Management said that the Consumer Products and Active Cosmetics divisions have won market share in North America. In the Asia-Pacific region, management pointed to “strong dynamism” in China and Hong Kong.

Chairman and CEO Jean-Paul Agon remarked that the return to strong growth in the Asia-Pacific region was “the highlight of the first quarter” and that it was driven by Chinese consumers’ “aspirations for iconic brands.”

Source: Company reports

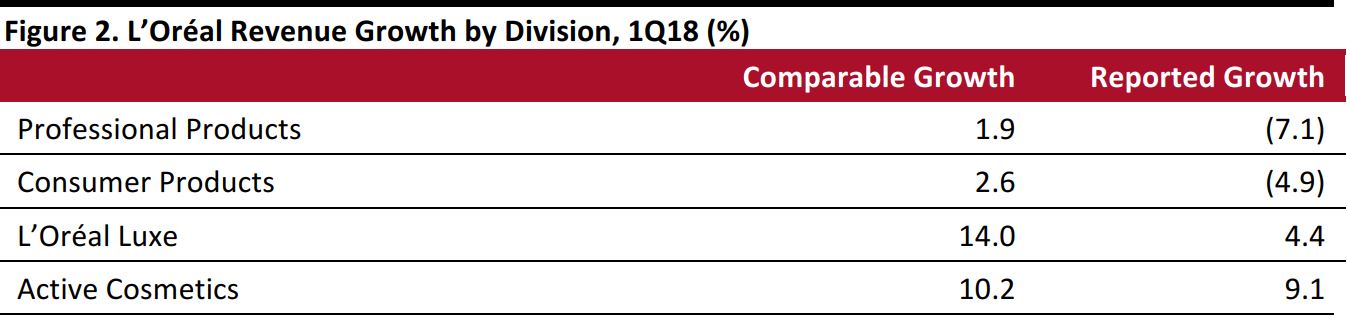

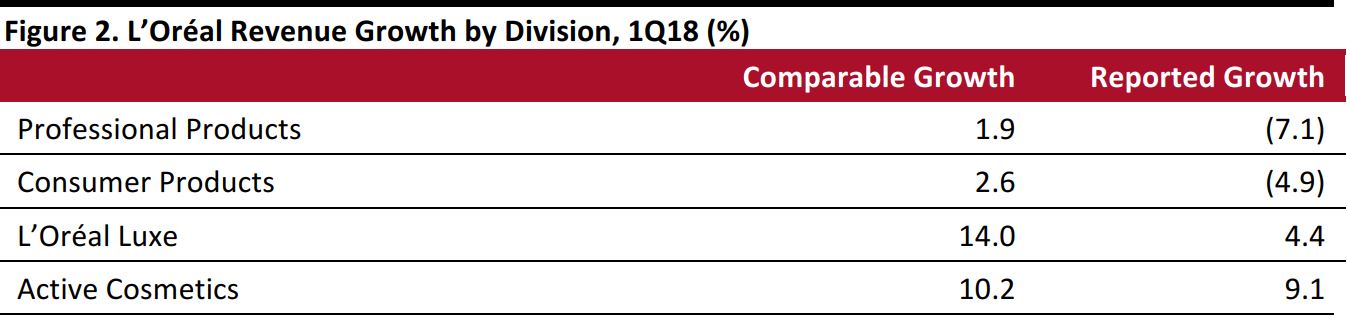

Performance by Division

The company noted that the Consumer Products division saw good sales momentum in China, India, and the Africa and Middle East region. China and Hong Kong drove growth at L’Oréal Luxe and the company remarked that the division’s four major brands—Lancôme, Yves Saint Laurent, Giorgio Armani and Kiehl’s—each grew sales by more than 10% in the quarter.

All regions contributed to growth in the Active Cosmetics business.

Source: Company reports

Outlook

The company issued no specific guidance. For FY18, analysts expect L’Oréal to grow revenues by 1.7%, EBIT by 3.0% and unadjusted net profit by 7.5%.