1Q17 Results

Like most European companies, L’Oréal reports sales performance quarterly and provides updates on profits only at the half-year and full-year points.

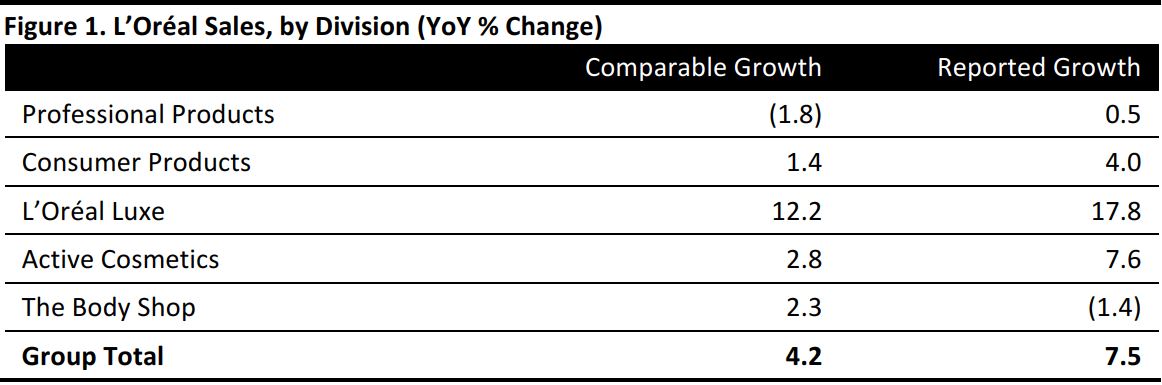

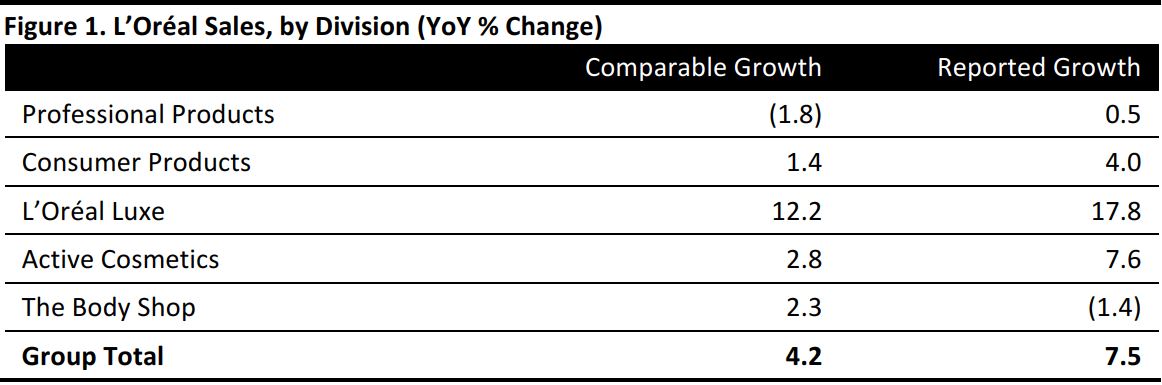

In 1Q17, ended March 31, L’Oréal grew group revenues by 7.5%, to €7,045 million. This was ahead of consensus of €7,023 million. Comparable sales growth of 4.2% was ahead of the 3.8% consensus.

Comparable sales growth nevertheless slowed sequentially, from 4.8% in the prior quarter.

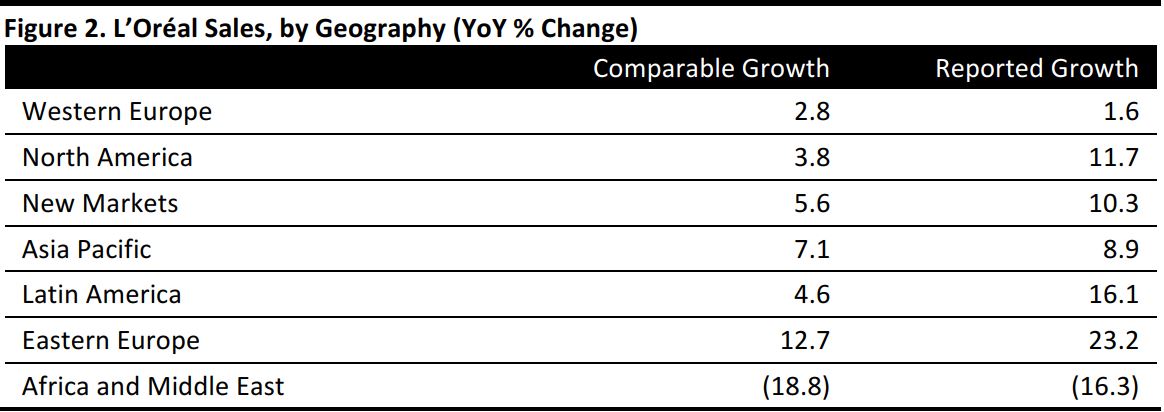

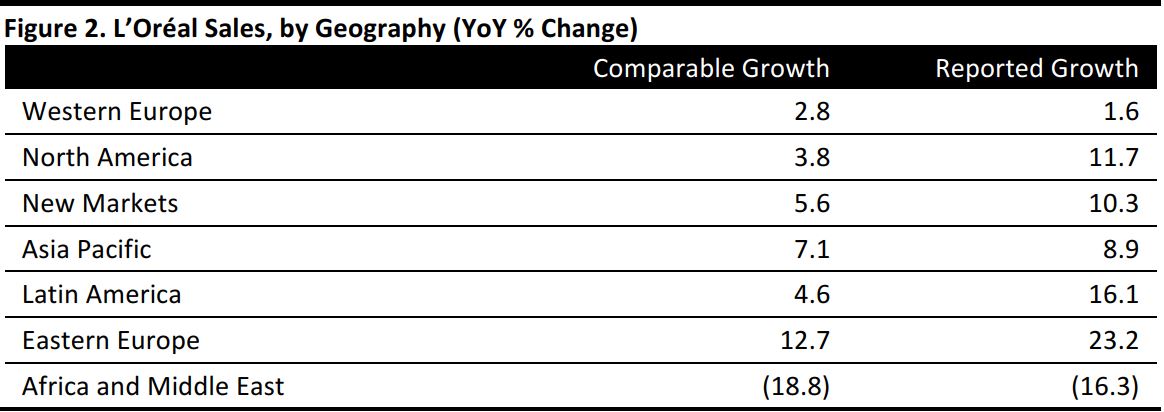

Top-line growth was helped by a significant strengthening of demand in the Asia-Pacific region.

Chairman and CEO Jean-Paul Agon said, “The cosmetics market has unexpectedly proven extremely atypical in the first weeks of the year, with very strong consumption of luxury products, especially in Asia, and, on the contrary, a very slow start for consumption in the mass market and the professional market. The market seems to have become steadier and is returning to a more usual profile.”

Performance by Division

Agon’s comments reflect L’Oréal Luxe knocking it out of the park, with double-digit growth in both comparable and total terms in the quarter. This was an acceleration from comps of 7.1% and total growth of 8.4% in the prior quarter. China, Spain and the UK drove Luxe growth.

The company said that sales of its Professional Products in Western Europe were “severely affected by the difficulties of the French market,” and that the US also remains “difficult” for the division.

Consumer Products sales outperformed the market “in most regions of the world,” the company said.

Source: Company reports

- Within Western Europe, France was weak, but the UK, Spain and Germany were strong.

- L’Oréal said its Consumer Products division is gaining share in North America. However, the division’s North America comps of 3.8% were notably weaker than the 6.3% reported for the prior quarter.

- Comps of 7.1% in the Asia-Pacific region represented a substantial acceleration from 1.3% in the prior quarter. L’Oréal attributed this to a return to “dynamic growth” in Hong Kong, as well as to sustained demand in Australia, Thailand and Indonesia.

- Eastern Europe continued its double-digit run in comps, with the company noting strong growth in Russia, Poland and Turkey.

- Africa and the Middle East nosedived into negative territory. The company noted that the market slowed in Saudi Arabia, which led to destocking by distributors.

Source: Company reports

Outlook

The company offered no guidance. Agon said, “We are confident in our ability to achieve another year of sales and profit growth in 2017.”

Regarding the potential disposal of The Body Shop, the company said that no decision had yet been made. L’Oréal finalized its acquisition of the CeraVe, AcneFree and Ambi brands from Valeant on March 6.

For FY17, analysts expect L’Oréal to grow revenues by 6.5% and EBIT by 8.2%. Consensus calls for FY17 adjusted EPS of €6.93, up 7.3%.