Source: Company reports/Coresight Research

1H18 Results

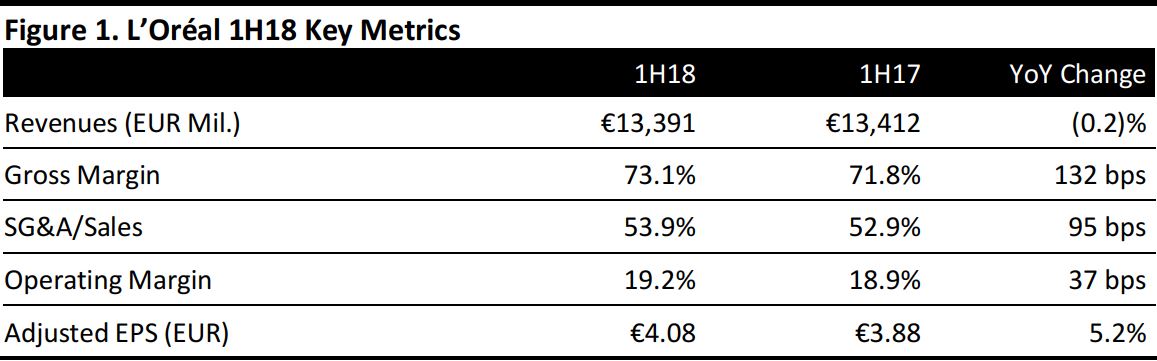

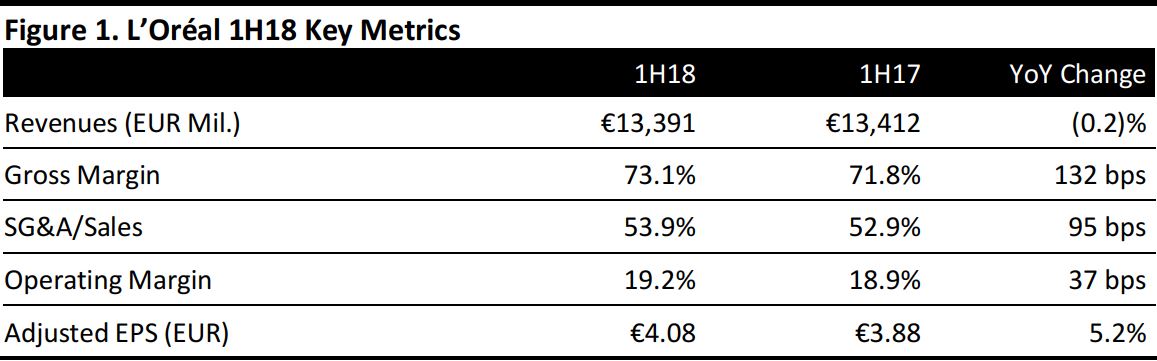

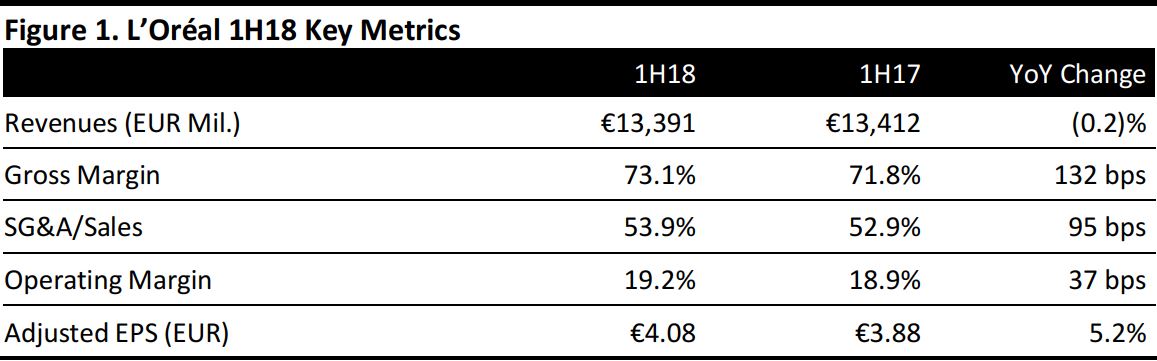

L'Oreal reported a strong 1H18, though currency effects hit reported numbers. At constant currency, total sales were up by a strong 7.0% and comparable sales were up by a solid 6.6%. As reported, total net sales of €13.4 billion were broadly flat year over year and fractionally below the consensus estimate. As reported, EBIT was up by a respectable 1.8% versus consensus expectations of a 1.7% rise and yielding a small uplift in the operating margin.

L’Oréal Luxe was again the strongest performer, with comparable sales up fully 13.5%; the company noted strong demand in China for the line. Active Cosmetics sales climbed 11.4% on a comparable basis. By the same measure, the Consumer Products segment grew sales by 2.5% and Professional Products nudged turnover up by 1.6%.

By region, Asia-Pacific reported remarkable comparable sales growth of 22.0%, putting it within a whisker of overtaking North America as L’Oréal’s second-biggest region by sales, behind Western Europe. For context, L’Oréal grew Asia-Pacific comparable sales by 12.3% in FY17. In 1H18, North America sales were up 3.0% on a comparable basis, while Western Europe sales were down 0.8% on a comparable basis.

Following

LVMH’s strong first-half performance reported on July 24, L’Oréal’s numbers confirm the buoyancy of demand for luxury goods among Chinese shoppers.

Outlook

For FY18, L’Oréal expects to outperform the cosmetics market and achieve significant growth in comparable sales and profitability. For FY18, analysts expect the company to grow revenues by 2.0%, to €26.5 billion. Consensus calls for a 3.3% increase in EBIT and a 7.6% increase in statutory pretax profit in FY18.