Nitheesh NH

Brexit is fast approaching: March 29 is the date the U.K. should leave the European Union (EU). But, there is little clarity on the future relationships between the U.K. and the EU. This uncertainty could threaten London’s startup ecosystem, but data suggest that Brexit has not negatively impacted the country’s startup ecosystem and that London’s leadership is likely to remain unchallenged, keeping the city ahead of Berlin and Paris.

[caption id="attachment_75857" align="aligncenter" width="620"] Largest tech communities in Europe in terms of indicators including capital invested, number of professional developers, the capability of attracting foreign talents, number of early-stage tech companies and number of tech-related Meetups.

Largest tech communities in Europe in terms of indicators including capital invested, number of professional developers, the capability of attracting foreign talents, number of early-stage tech companies and number of tech-related Meetups.

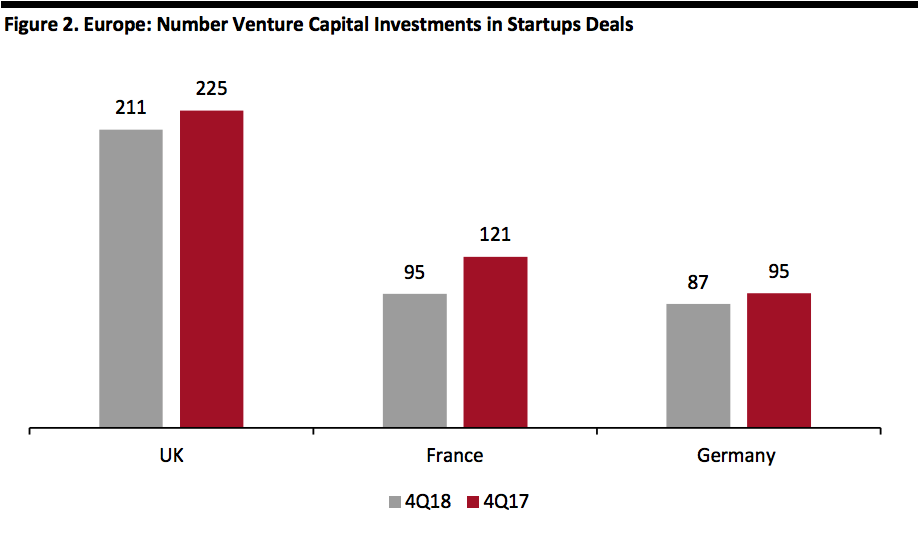

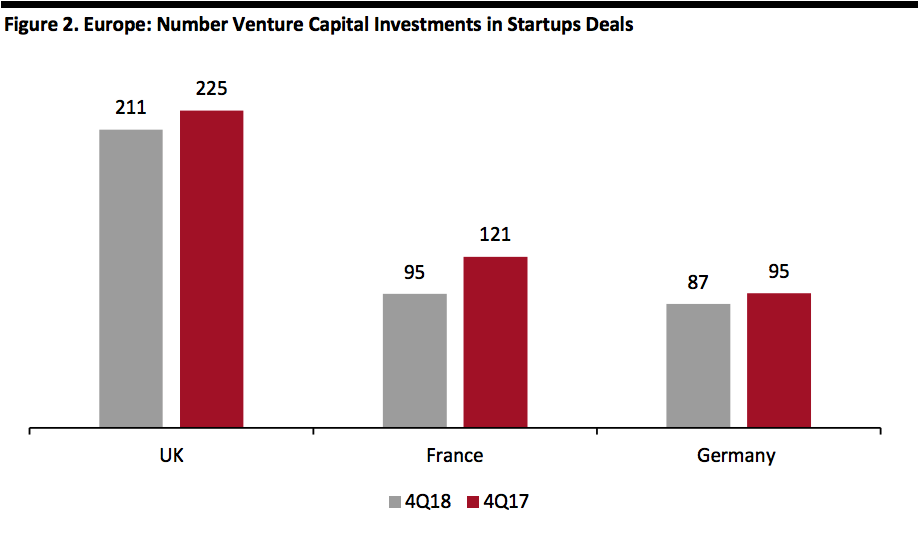

Source: Atomico[/caption] The UK Sees More than Double the Deals Versus the Other Leading European Startup Hubs In the fourth quarter of 2018 the U.K. continued to lead in Europe in number of startup deals (the number of VC investments), capturing 29% of all deals in Europe, according to global VC database Dow Jones VentureSource. France and Germany came second and third during the quarter, with 13% and 12% of the total number of deals in Europe respectively. Figure 2 shows how these three European countries fared during the fourth quarter of 2018 (4Q18) in number of deals versus the same period in 2017. In both periods, the number of deals in the U.K. was about double those in France and Germany. Deals in the U.K. slowed year over year, but this was a Europe-wide trend and the decline in the U.K. was just 6% versus a 22% fall in France and an 8% decline in Germany, according to our analysis of Dow Jones VentureSource data. [caption id="attachment_75858" align="aligncenter" width="620"] Source: Dow Jones VentureSource/Coresight Research[/caption]

UK Startups Raise Nearly Double the Funds Compared to their European Counterparts

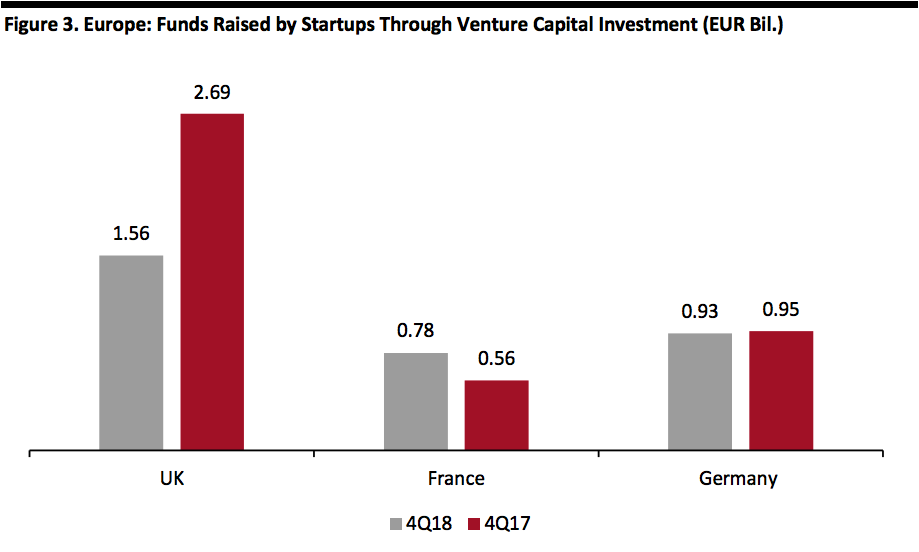

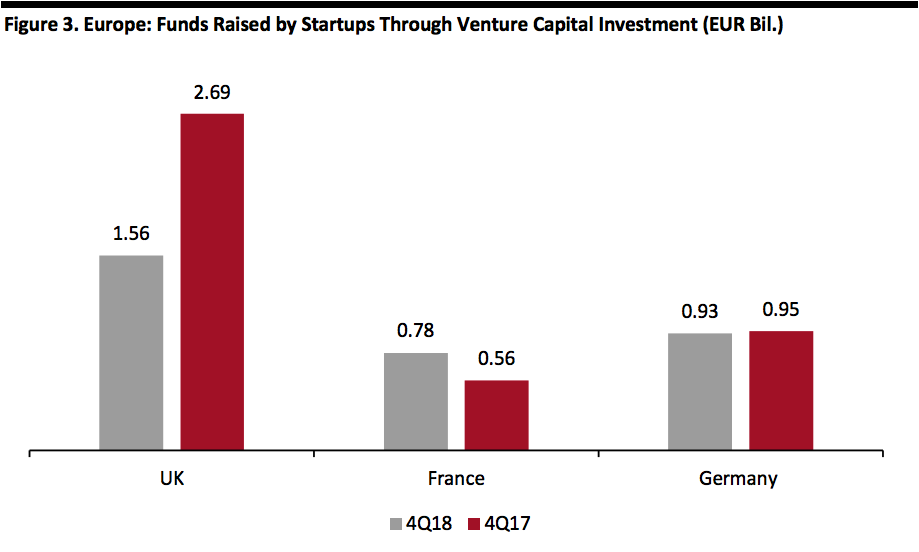

The U.K. also leads in terms of amount of VC investment raised. The U.K. accounted for 30% of all VC capital invested in startups in Europe in 4Q18, compared to 18% and 15% of Germany and France respectively, according to Dow Jones VentureSource. Startup in the U.K. raised €1.56 billion in 4Q18, compared to the €930 million raised by startups in Germany, the second largest market for VC capital investment in 4Q18, according to our analysis of Dow Jones VentureSource data.

Figure 3 shows that U.K. startups raised less capital in 4Q18 than during the same period in 2017. But 4Q17 was exceptional as there were several substantial deals involving London-based tech companies, including Thruphone, Acorn OakNorth, Orchard Therapeutics, TransferWise and Monzo Bank, which skewed the results. U.K. firms raised 48% of all funds raised in Europe in 4Q17, well above the 32.5% average over the 18 year-period to 2018, according to Dow Jones VentureSource.

The biggest single startup deal in 4Q18 was Bristol-based information technology firm Graphcore, which raised $200 million (€176 million) in December 2018, according to company database Crunchbase.

[caption id="attachment_75859" align="aligncenter" width="620"]

Source: Dow Jones VentureSource/Coresight Research[/caption]

UK Startups Raise Nearly Double the Funds Compared to their European Counterparts

The U.K. also leads in terms of amount of VC investment raised. The U.K. accounted for 30% of all VC capital invested in startups in Europe in 4Q18, compared to 18% and 15% of Germany and France respectively, according to Dow Jones VentureSource. Startup in the U.K. raised €1.56 billion in 4Q18, compared to the €930 million raised by startups in Germany, the second largest market for VC capital investment in 4Q18, according to our analysis of Dow Jones VentureSource data.

Figure 3 shows that U.K. startups raised less capital in 4Q18 than during the same period in 2017. But 4Q17 was exceptional as there were several substantial deals involving London-based tech companies, including Thruphone, Acorn OakNorth, Orchard Therapeutics, TransferWise and Monzo Bank, which skewed the results. U.K. firms raised 48% of all funds raised in Europe in 4Q17, well above the 32.5% average over the 18 year-period to 2018, according to Dow Jones VentureSource.

The biggest single startup deal in 4Q18 was Bristol-based information technology firm Graphcore, which raised $200 million (€176 million) in December 2018, according to company database Crunchbase.

[caption id="attachment_75859" align="aligncenter" width="620"] Source: Dow Jones VentureSource/Coresight Research[/caption]

London Has More than Double the Number of Startups of Paris and Berlin Combined

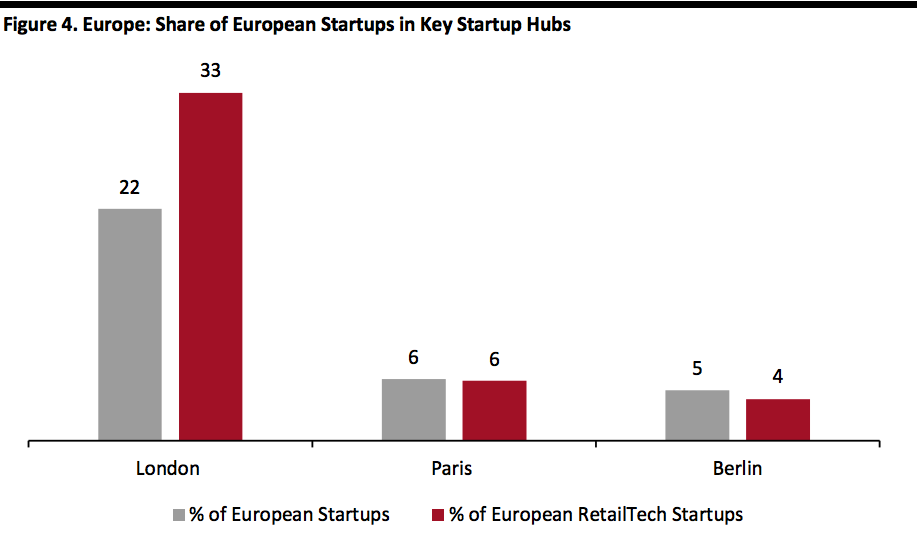

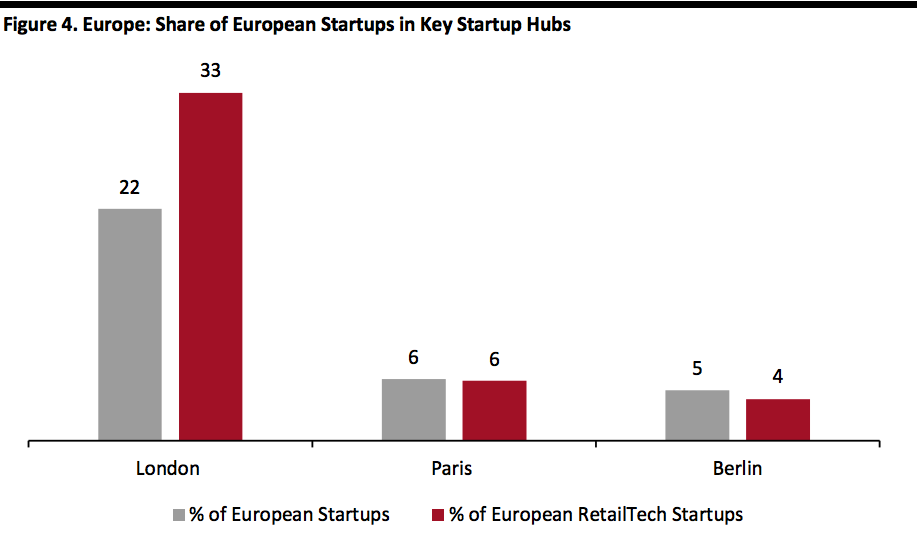

A simple comparative analysis of the number of startups in the three main European hubs confirms the supremacy of London over its continental European counterparts.

London has 15,214 tech startups, according to startup database AngelList (as of February 5, 2019), accounting for 71% of the U.K. total and 22% of the European total. London boasts an even greater concentration of retail-technology startups, with 75% of the U.K. total and 33% of the European total. By comparison, Paris, the second largest European hub in terms of number of companies, has just 6% of European total tech and retail-tech startups, with a similar concentration as London: Paris-based companies account for 67% of all French startups and 77% of all French retail-tech startups, according to our analysis of AngelList data.

[caption id="attachment_75860" align="aligncenter" width="620"]

Source: Dow Jones VentureSource/Coresight Research[/caption]

London Has More than Double the Number of Startups of Paris and Berlin Combined

A simple comparative analysis of the number of startups in the three main European hubs confirms the supremacy of London over its continental European counterparts.

London has 15,214 tech startups, according to startup database AngelList (as of February 5, 2019), accounting for 71% of the U.K. total and 22% of the European total. London boasts an even greater concentration of retail-technology startups, with 75% of the U.K. total and 33% of the European total. By comparison, Paris, the second largest European hub in terms of number of companies, has just 6% of European total tech and retail-tech startups, with a similar concentration as London: Paris-based companies account for 67% of all French startups and 77% of all French retail-tech startups, according to our analysis of AngelList data.

[caption id="attachment_75860" align="aligncenter" width="620"] Number of companies as of February 5, 2019.

Number of companies as of February 5, 2019.

Source: AngelList/Coresight Research[/caption] The London Startup Ecosystem Benefits from Favorable and Hard-to-Replicate Factors London boasts a combination of favorable factors that makes the city a world-class startup ecosystem which cannot be easily replicated. Factors include:

Largest tech communities in Europe in terms of indicators including capital invested, number of professional developers, the capability of attracting foreign talents, number of early-stage tech companies and number of tech-related Meetups.

Largest tech communities in Europe in terms of indicators including capital invested, number of professional developers, the capability of attracting foreign talents, number of early-stage tech companies and number of tech-related Meetups.Source: Atomico[/caption] The UK Sees More than Double the Deals Versus the Other Leading European Startup Hubs In the fourth quarter of 2018 the U.K. continued to lead in Europe in number of startup deals (the number of VC investments), capturing 29% of all deals in Europe, according to global VC database Dow Jones VentureSource. France and Germany came second and third during the quarter, with 13% and 12% of the total number of deals in Europe respectively. Figure 2 shows how these three European countries fared during the fourth quarter of 2018 (4Q18) in number of deals versus the same period in 2017. In both periods, the number of deals in the U.K. was about double those in France and Germany. Deals in the U.K. slowed year over year, but this was a Europe-wide trend and the decline in the U.K. was just 6% versus a 22% fall in France and an 8% decline in Germany, according to our analysis of Dow Jones VentureSource data. [caption id="attachment_75858" align="aligncenter" width="620"]

Source: Dow Jones VentureSource/Coresight Research[/caption]

UK Startups Raise Nearly Double the Funds Compared to their European Counterparts

The U.K. also leads in terms of amount of VC investment raised. The U.K. accounted for 30% of all VC capital invested in startups in Europe in 4Q18, compared to 18% and 15% of Germany and France respectively, according to Dow Jones VentureSource. Startup in the U.K. raised €1.56 billion in 4Q18, compared to the €930 million raised by startups in Germany, the second largest market for VC capital investment in 4Q18, according to our analysis of Dow Jones VentureSource data.

Figure 3 shows that U.K. startups raised less capital in 4Q18 than during the same period in 2017. But 4Q17 was exceptional as there were several substantial deals involving London-based tech companies, including Thruphone, Acorn OakNorth, Orchard Therapeutics, TransferWise and Monzo Bank, which skewed the results. U.K. firms raised 48% of all funds raised in Europe in 4Q17, well above the 32.5% average over the 18 year-period to 2018, according to Dow Jones VentureSource.

The biggest single startup deal in 4Q18 was Bristol-based information technology firm Graphcore, which raised $200 million (€176 million) in December 2018, according to company database Crunchbase.

[caption id="attachment_75859" align="aligncenter" width="620"]

Source: Dow Jones VentureSource/Coresight Research[/caption]

UK Startups Raise Nearly Double the Funds Compared to their European Counterparts

The U.K. also leads in terms of amount of VC investment raised. The U.K. accounted for 30% of all VC capital invested in startups in Europe in 4Q18, compared to 18% and 15% of Germany and France respectively, according to Dow Jones VentureSource. Startup in the U.K. raised €1.56 billion in 4Q18, compared to the €930 million raised by startups in Germany, the second largest market for VC capital investment in 4Q18, according to our analysis of Dow Jones VentureSource data.

Figure 3 shows that U.K. startups raised less capital in 4Q18 than during the same period in 2017. But 4Q17 was exceptional as there were several substantial deals involving London-based tech companies, including Thruphone, Acorn OakNorth, Orchard Therapeutics, TransferWise and Monzo Bank, which skewed the results. U.K. firms raised 48% of all funds raised in Europe in 4Q17, well above the 32.5% average over the 18 year-period to 2018, according to Dow Jones VentureSource.

The biggest single startup deal in 4Q18 was Bristol-based information technology firm Graphcore, which raised $200 million (€176 million) in December 2018, according to company database Crunchbase.

[caption id="attachment_75859" align="aligncenter" width="620"] Source: Dow Jones VentureSource/Coresight Research[/caption]

London Has More than Double the Number of Startups of Paris and Berlin Combined

A simple comparative analysis of the number of startups in the three main European hubs confirms the supremacy of London over its continental European counterparts.

London has 15,214 tech startups, according to startup database AngelList (as of February 5, 2019), accounting for 71% of the U.K. total and 22% of the European total. London boasts an even greater concentration of retail-technology startups, with 75% of the U.K. total and 33% of the European total. By comparison, Paris, the second largest European hub in terms of number of companies, has just 6% of European total tech and retail-tech startups, with a similar concentration as London: Paris-based companies account for 67% of all French startups and 77% of all French retail-tech startups, according to our analysis of AngelList data.

[caption id="attachment_75860" align="aligncenter" width="620"]

Source: Dow Jones VentureSource/Coresight Research[/caption]

London Has More than Double the Number of Startups of Paris and Berlin Combined

A simple comparative analysis of the number of startups in the three main European hubs confirms the supremacy of London over its continental European counterparts.

London has 15,214 tech startups, according to startup database AngelList (as of February 5, 2019), accounting for 71% of the U.K. total and 22% of the European total. London boasts an even greater concentration of retail-technology startups, with 75% of the U.K. total and 33% of the European total. By comparison, Paris, the second largest European hub in terms of number of companies, has just 6% of European total tech and retail-tech startups, with a similar concentration as London: Paris-based companies account for 67% of all French startups and 77% of all French retail-tech startups, according to our analysis of AngelList data.

[caption id="attachment_75860" align="aligncenter" width="620"] Number of companies as of February 5, 2019.

Number of companies as of February 5, 2019.Source: AngelList/Coresight Research[/caption] The London Startup Ecosystem Benefits from Favorable and Hard-to-Replicate Factors London boasts a combination of favorable factors that makes the city a world-class startup ecosystem which cannot be easily replicated. Factors include:

- The presence of a diverse and global talent pool

- Proximity to top universities

- Favorable business environment (the U.K. ranks ninth globally for ease of doing business according to The World Bank)

- One of the world’s top three financial centers (together with New York and Hong Kong)

- Excellent transport infrastructure with easy global connections