Nitheesh NH

[caption id="attachment_79236" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

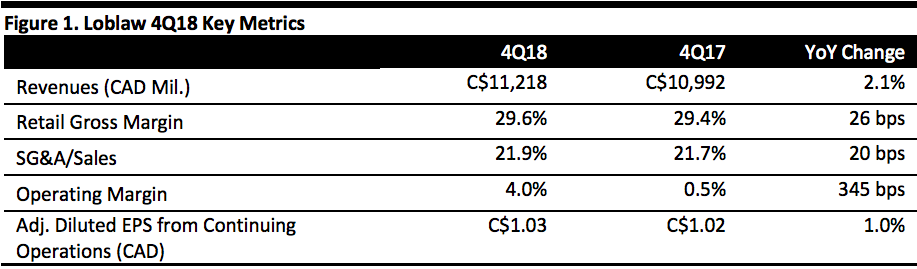

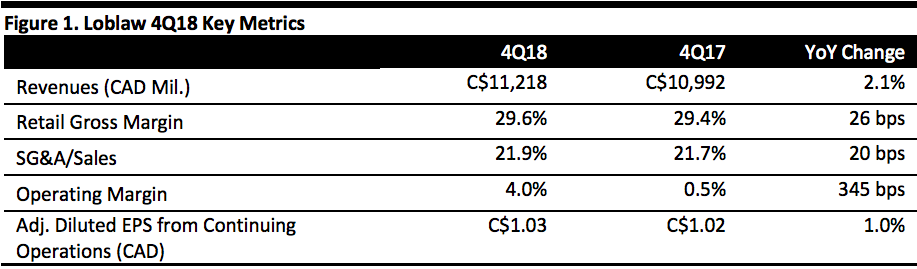

Loblaw reported a slight sequential weakening of revenue growth in 4Q18. Same-store sales in the food retail segment grew 0.8% year over year versus 0.9% growth in the prior quarter. Same-store sales in its drug retail segment grew 1.9% versus 2.5% growth in the prior quarter; comparable sales in this segment continued to be driven by over-the-counter sales. However, total revenues of C$11.22 billion came in below the consensus estimate of C$11.27 billion recorded by StreetAccount.

Within the food retail segment, management noted sales growth in food categories was “moderate” and sales in pharmacies “declined significantly.” Its internal food-price index, which reflects the company’s sales mix, was lower than one year earlier.

Within the drug retail segment, pharmacy same-store sales growth came in at just 0.6%, despite a 3.3% rise in the number of prescriptions dispensed. “Front store” (i.e., retail) sales grew 2.8% year over year.

The year-over-year jump in the operating margin, shown in the table above, was driven by impacts in the corresponding quarter of the prior year, when the company recorded charges related to the relaunch of its PC Optimum loyalty program, restructuring costs and other costs related to the Loblaw Card Program.

In 4Q18, diluted EPS from continuing operations came in at C$0.61 versus a loss per share of C$0.06 in the same period one year earlier. Adjusted diluted EPS from continuing operations came in at C$1.03 versus C$1.02 one year earlier; this measure strips out amortization of intangible assets acquired with Shoppers Drug Mart (totaling C$120 million), fixed asset and other impairments (totaling C$83 million) and a number of smaller cost items. Continuing operations excludes Choice Properties Real Estate Investment Trust, in which Loblaw distributed its 61.6% interest to its parent company George Weston Ltd.; Loblaw said this transaction “simplifies the company as a pure-play retailer.” According to StreetAccount, analysts had penciled in EPS of C$1.04 per share, though it is not immediately clear which of Loblaw’s several EPS metrics all constituent estimates referred to.

FY18 Results

In FY18, Loblaw reported total revenues up 0.2% to C$46.69 billion. and adjusted diluted EPS from continuing operations of C$4.06 versus C$3.99 one year earlier. Management remarked that, “through 2018, the company experienced food price inflation while drug retail prices were negatively impacted by the effects of incremental healthcare reform.”

Outlook

For FY19, excluding the impact of the spin-out of Choice Properties Real Estate Investment Trust, management offered the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Loblaw reported a slight sequential weakening of revenue growth in 4Q18. Same-store sales in the food retail segment grew 0.8% year over year versus 0.9% growth in the prior quarter. Same-store sales in its drug retail segment grew 1.9% versus 2.5% growth in the prior quarter; comparable sales in this segment continued to be driven by over-the-counter sales. However, total revenues of C$11.22 billion came in below the consensus estimate of C$11.27 billion recorded by StreetAccount.

Within the food retail segment, management noted sales growth in food categories was “moderate” and sales in pharmacies “declined significantly.” Its internal food-price index, which reflects the company’s sales mix, was lower than one year earlier.

Within the drug retail segment, pharmacy same-store sales growth came in at just 0.6%, despite a 3.3% rise in the number of prescriptions dispensed. “Front store” (i.e., retail) sales grew 2.8% year over year.

The year-over-year jump in the operating margin, shown in the table above, was driven by impacts in the corresponding quarter of the prior year, when the company recorded charges related to the relaunch of its PC Optimum loyalty program, restructuring costs and other costs related to the Loblaw Card Program.

In 4Q18, diluted EPS from continuing operations came in at C$0.61 versus a loss per share of C$0.06 in the same period one year earlier. Adjusted diluted EPS from continuing operations came in at C$1.03 versus C$1.02 one year earlier; this measure strips out amortization of intangible assets acquired with Shoppers Drug Mart (totaling C$120 million), fixed asset and other impairments (totaling C$83 million) and a number of smaller cost items. Continuing operations excludes Choice Properties Real Estate Investment Trust, in which Loblaw distributed its 61.6% interest to its parent company George Weston Ltd.; Loblaw said this transaction “simplifies the company as a pure-play retailer.” According to StreetAccount, analysts had penciled in EPS of C$1.04 per share, though it is not immediately clear which of Loblaw’s several EPS metrics all constituent estimates referred to.

FY18 Results

In FY18, Loblaw reported total revenues up 0.2% to C$46.69 billion. and adjusted diluted EPS from continuing operations of C$4.06 versus C$3.99 one year earlier. Management remarked that, “through 2018, the company experienced food price inflation while drug retail prices were negatively impacted by the effects of incremental healthcare reform.”

Outlook

For FY19, excluding the impact of the spin-out of Choice Properties Real Estate Investment Trust, management offered the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Loblaw reported a slight sequential weakening of revenue growth in 4Q18. Same-store sales in the food retail segment grew 0.8% year over year versus 0.9% growth in the prior quarter. Same-store sales in its drug retail segment grew 1.9% versus 2.5% growth in the prior quarter; comparable sales in this segment continued to be driven by over-the-counter sales. However, total revenues of C$11.22 billion came in below the consensus estimate of C$11.27 billion recorded by StreetAccount.

Within the food retail segment, management noted sales growth in food categories was “moderate” and sales in pharmacies “declined significantly.” Its internal food-price index, which reflects the company’s sales mix, was lower than one year earlier.

Within the drug retail segment, pharmacy same-store sales growth came in at just 0.6%, despite a 3.3% rise in the number of prescriptions dispensed. “Front store” (i.e., retail) sales grew 2.8% year over year.

The year-over-year jump in the operating margin, shown in the table above, was driven by impacts in the corresponding quarter of the prior year, when the company recorded charges related to the relaunch of its PC Optimum loyalty program, restructuring costs and other costs related to the Loblaw Card Program.

In 4Q18, diluted EPS from continuing operations came in at C$0.61 versus a loss per share of C$0.06 in the same period one year earlier. Adjusted diluted EPS from continuing operations came in at C$1.03 versus C$1.02 one year earlier; this measure strips out amortization of intangible assets acquired with Shoppers Drug Mart (totaling C$120 million), fixed asset and other impairments (totaling C$83 million) and a number of smaller cost items. Continuing operations excludes Choice Properties Real Estate Investment Trust, in which Loblaw distributed its 61.6% interest to its parent company George Weston Ltd.; Loblaw said this transaction “simplifies the company as a pure-play retailer.” According to StreetAccount, analysts had penciled in EPS of C$1.04 per share, though it is not immediately clear which of Loblaw’s several EPS metrics all constituent estimates referred to.

FY18 Results

In FY18, Loblaw reported total revenues up 0.2% to C$46.69 billion. and adjusted diluted EPS from continuing operations of C$4.06 versus C$3.99 one year earlier. Management remarked that, “through 2018, the company experienced food price inflation while drug retail prices were negatively impacted by the effects of incremental healthcare reform.”

Outlook

For FY19, excluding the impact of the spin-out of Choice Properties Real Estate Investment Trust, management offered the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Loblaw reported a slight sequential weakening of revenue growth in 4Q18. Same-store sales in the food retail segment grew 0.8% year over year versus 0.9% growth in the prior quarter. Same-store sales in its drug retail segment grew 1.9% versus 2.5% growth in the prior quarter; comparable sales in this segment continued to be driven by over-the-counter sales. However, total revenues of C$11.22 billion came in below the consensus estimate of C$11.27 billion recorded by StreetAccount.

Within the food retail segment, management noted sales growth in food categories was “moderate” and sales in pharmacies “declined significantly.” Its internal food-price index, which reflects the company’s sales mix, was lower than one year earlier.

Within the drug retail segment, pharmacy same-store sales growth came in at just 0.6%, despite a 3.3% rise in the number of prescriptions dispensed. “Front store” (i.e., retail) sales grew 2.8% year over year.

The year-over-year jump in the operating margin, shown in the table above, was driven by impacts in the corresponding quarter of the prior year, when the company recorded charges related to the relaunch of its PC Optimum loyalty program, restructuring costs and other costs related to the Loblaw Card Program.

In 4Q18, diluted EPS from continuing operations came in at C$0.61 versus a loss per share of C$0.06 in the same period one year earlier. Adjusted diluted EPS from continuing operations came in at C$1.03 versus C$1.02 one year earlier; this measure strips out amortization of intangible assets acquired with Shoppers Drug Mart (totaling C$120 million), fixed asset and other impairments (totaling C$83 million) and a number of smaller cost items. Continuing operations excludes Choice Properties Real Estate Investment Trust, in which Loblaw distributed its 61.6% interest to its parent company George Weston Ltd.; Loblaw said this transaction “simplifies the company as a pure-play retailer.” According to StreetAccount, analysts had penciled in EPS of C$1.04 per share, though it is not immediately clear which of Loblaw’s several EPS metrics all constituent estimates referred to.

FY18 Results

In FY18, Loblaw reported total revenues up 0.2% to C$46.69 billion. and adjusted diluted EPS from continuing operations of C$4.06 versus C$3.99 one year earlier. Management remarked that, “through 2018, the company experienced food price inflation while drug retail prices were negatively impacted by the effects of incremental healthcare reform.”

Outlook

For FY19, excluding the impact of the spin-out of Choice Properties Real Estate Investment Trust, management offered the following guidance for FY19:

- Positive same-store sales and a stable gross margin in its retail segment.

- Positive adjusted net earnings growth.

- Investment of approximately C$1.1 billion in capital expenditures, net of proceeds from property disposals.

- To return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.