Nitheesh NH

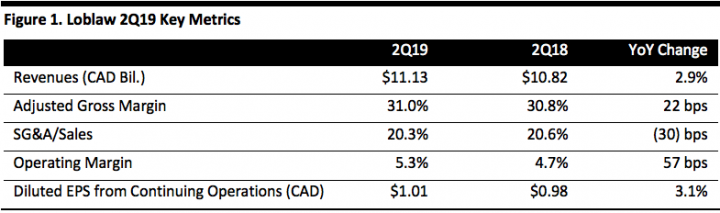

[caption id="attachment_93480" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Loblaw reported 2Q19 comparable sales growth of 0.6% in food retail and 4.0% in drug retail; this compared to comparable sales growth of 2.0% in food retail and 2.2% in drug retail in the prior quarter. 2Q19 revenue of C$11.13 billion came in slightly shy of the consensus estimate of C$11.14 billion recorded by StreetAccount. Total retail segment sales were C$10.9 billion, up 2.9% year over year. After excluding the consolidation of franchises, retail segment sales increased 2.5% year over year.

The company’s quarterly internal food price index was in line with the national 3.6% CPI for food — well above Loblaw’s food retail comp growth and implying the company saw meaningful volume declines in its food retail segment.

Retail gross margins were negatively impacted by drug retail while food retail gross margins improved slightly.

Operating income was up 15.3%, or C$78 million, year over year. This included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equated to approximately C$82 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$20 million. Normalized for these impacts, Loblaw said its operating income increased C$16 million, or 3.1%, year over year.

Adjusted EBITDA of C$1.18 billion was up 39.9%, or C$335 million, and exceeded expectations of C$1.10 billion. This included a favorable year-over-year impact from IFRS 16 of approximately C$290 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased C$45 million, or 5.4%.

Adjusted diluted EPS from continuing operations came in at C$1.01 versus the $1.02 consensus.

Management noted that food retail traffic decreased and basket size increased in 2Q19. Pharmacy same-store sales increased 4.8% and front store same-store sales grew 3.3%.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure. In 2Q19, the company recorded approximately C$16 million of restructuring and related charges.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases. In 2Q19, the company repurchased 3.6 million common shares at a cost of C$250 million.

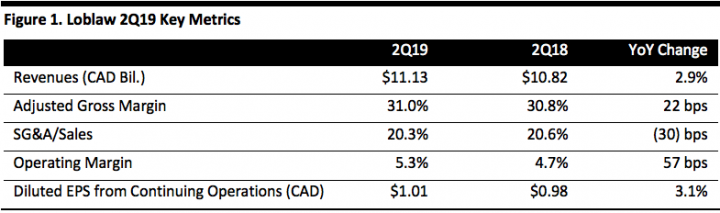

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Loblaw reported 2Q19 comparable sales growth of 0.6% in food retail and 4.0% in drug retail; this compared to comparable sales growth of 2.0% in food retail and 2.2% in drug retail in the prior quarter. 2Q19 revenue of C$11.13 billion came in slightly shy of the consensus estimate of C$11.14 billion recorded by StreetAccount. Total retail segment sales were C$10.9 billion, up 2.9% year over year. After excluding the consolidation of franchises, retail segment sales increased 2.5% year over year.

The company’s quarterly internal food price index was in line with the national 3.6% CPI for food — well above Loblaw’s food retail comp growth and implying the company saw meaningful volume declines in its food retail segment.

Retail gross margins were negatively impacted by drug retail while food retail gross margins improved slightly.

Operating income was up 15.3%, or C$78 million, year over year. This included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equated to approximately C$82 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$20 million. Normalized for these impacts, Loblaw said its operating income increased C$16 million, or 3.1%, year over year.

Adjusted EBITDA of C$1.18 billion was up 39.9%, or C$335 million, and exceeded expectations of C$1.10 billion. This included a favorable year-over-year impact from IFRS 16 of approximately C$290 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased C$45 million, or 5.4%.

Adjusted diluted EPS from continuing operations came in at C$1.01 versus the $1.02 consensus.

Management noted that food retail traffic decreased and basket size increased in 2Q19. Pharmacy same-store sales increased 4.8% and front store same-store sales grew 3.3%.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure. In 2Q19, the company recorded approximately C$16 million of restructuring and related charges.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases. In 2Q19, the company repurchased 3.6 million common shares at a cost of C$250 million.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Loblaw reported 2Q19 comparable sales growth of 0.6% in food retail and 4.0% in drug retail; this compared to comparable sales growth of 2.0% in food retail and 2.2% in drug retail in the prior quarter. 2Q19 revenue of C$11.13 billion came in slightly shy of the consensus estimate of C$11.14 billion recorded by StreetAccount. Total retail segment sales were C$10.9 billion, up 2.9% year over year. After excluding the consolidation of franchises, retail segment sales increased 2.5% year over year.

The company’s quarterly internal food price index was in line with the national 3.6% CPI for food — well above Loblaw’s food retail comp growth and implying the company saw meaningful volume declines in its food retail segment.

Retail gross margins were negatively impacted by drug retail while food retail gross margins improved slightly.

Operating income was up 15.3%, or C$78 million, year over year. This included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equated to approximately C$82 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$20 million. Normalized for these impacts, Loblaw said its operating income increased C$16 million, or 3.1%, year over year.

Adjusted EBITDA of C$1.18 billion was up 39.9%, or C$335 million, and exceeded expectations of C$1.10 billion. This included a favorable year-over-year impact from IFRS 16 of approximately C$290 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased C$45 million, or 5.4%.

Adjusted diluted EPS from continuing operations came in at C$1.01 versus the $1.02 consensus.

Management noted that food retail traffic decreased and basket size increased in 2Q19. Pharmacy same-store sales increased 4.8% and front store same-store sales grew 3.3%.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure. In 2Q19, the company recorded approximately C$16 million of restructuring and related charges.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases. In 2Q19, the company repurchased 3.6 million common shares at a cost of C$250 million.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Loblaw reported 2Q19 comparable sales growth of 0.6% in food retail and 4.0% in drug retail; this compared to comparable sales growth of 2.0% in food retail and 2.2% in drug retail in the prior quarter. 2Q19 revenue of C$11.13 billion came in slightly shy of the consensus estimate of C$11.14 billion recorded by StreetAccount. Total retail segment sales were C$10.9 billion, up 2.9% year over year. After excluding the consolidation of franchises, retail segment sales increased 2.5% year over year.

The company’s quarterly internal food price index was in line with the national 3.6% CPI for food — well above Loblaw’s food retail comp growth and implying the company saw meaningful volume declines in its food retail segment.

Retail gross margins were negatively impacted by drug retail while food retail gross margins improved slightly.

Operating income was up 15.3%, or C$78 million, year over year. This included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equated to approximately C$82 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$20 million. Normalized for these impacts, Loblaw said its operating income increased C$16 million, or 3.1%, year over year.

Adjusted EBITDA of C$1.18 billion was up 39.9%, or C$335 million, and exceeded expectations of C$1.10 billion. This included a favorable year-over-year impact from IFRS 16 of approximately C$290 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased C$45 million, or 5.4%.

Adjusted diluted EPS from continuing operations came in at C$1.01 versus the $1.02 consensus.

Management noted that food retail traffic decreased and basket size increased in 2Q19. Pharmacy same-store sales increased 4.8% and front store same-store sales grew 3.3%.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure. In 2Q19, the company recorded approximately C$16 million of restructuring and related charges.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases. In 2Q19, the company repurchased 3.6 million common shares at a cost of C$250 million.