albert Chan

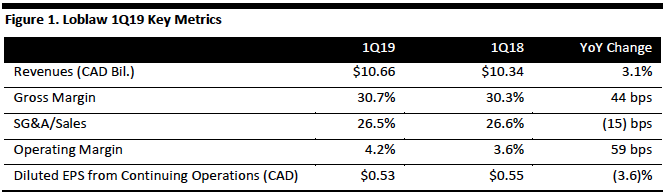

[caption id="attachment_85910" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Loblaw reported 1Q19 same-store sales growth of 2.0% in food retail and 2.2% in drug retail, with growth in both segments accelerating from the prior quarter. Revenue of C$10.66 billion came in slightly ahead of the consensus estimate of C$10.60 billion recorded by StreetAccount.

Operating income was up 19.9%, or C$75 million, year over year. Operating income included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equaled approximately C$75 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$22 million. Normalized for these impacts, Loblaw said its operating income increased by C$22 million year over year.

Adjusted EBITDA of C$1.04 billion was up 41.9%, or C$313 million, and comfortably exceeded expectations of C$825 million. This included a favorable year-over-year impact from IFRS 16 of approximately C$282 million and a favorable impact from the consolidation of franchises of C$20 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased by C$31 million, driven by an increase in adjusted gross profit, but partially offset by an increase in selling, general and administrative expenses.

The company noted that food retail traffic was relatively flat and basket size increased in 1Q19. Pharmacy same-store sales increased 1.2% and front store same-store sales grew 3.1%. Drug retail was negatively impacted by incremental healthcare reform. The timing of Easter, which fell entirely outside 1Q19 this year, had a nominal impact on same-store sales growth for retail segments in the quarter.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

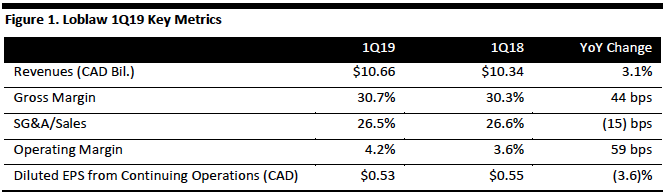

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Loblaw reported 1Q19 same-store sales growth of 2.0% in food retail and 2.2% in drug retail, with growth in both segments accelerating from the prior quarter. Revenue of C$10.66 billion came in slightly ahead of the consensus estimate of C$10.60 billion recorded by StreetAccount.

Operating income was up 19.9%, or C$75 million, year over year. Operating income included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equaled approximately C$75 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$22 million. Normalized for these impacts, Loblaw said its operating income increased by C$22 million year over year.

Adjusted EBITDA of C$1.04 billion was up 41.9%, or C$313 million, and comfortably exceeded expectations of C$825 million. This included a favorable year-over-year impact from IFRS 16 of approximately C$282 million and a favorable impact from the consolidation of franchises of C$20 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased by C$31 million, driven by an increase in adjusted gross profit, but partially offset by an increase in selling, general and administrative expenses.

The company noted that food retail traffic was relatively flat and basket size increased in 1Q19. Pharmacy same-store sales increased 1.2% and front store same-store sales grew 3.1%. Drug retail was negatively impacted by incremental healthcare reform. The timing of Easter, which fell entirely outside 1Q19 this year, had a nominal impact on same-store sales growth for retail segments in the quarter.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Loblaw reported 1Q19 same-store sales growth of 2.0% in food retail and 2.2% in drug retail, with growth in both segments accelerating from the prior quarter. Revenue of C$10.66 billion came in slightly ahead of the consensus estimate of C$10.60 billion recorded by StreetAccount.

Operating income was up 19.9%, or C$75 million, year over year. Operating income included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equaled approximately C$75 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$22 million. Normalized for these impacts, Loblaw said its operating income increased by C$22 million year over year.

Adjusted EBITDA of C$1.04 billion was up 41.9%, or C$313 million, and comfortably exceeded expectations of C$825 million. This included a favorable year-over-year impact from IFRS 16 of approximately C$282 million and a favorable impact from the consolidation of franchises of C$20 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased by C$31 million, driven by an increase in adjusted gross profit, but partially offset by an increase in selling, general and administrative expenses.

The company noted that food retail traffic was relatively flat and basket size increased in 1Q19. Pharmacy same-store sales increased 1.2% and front store same-store sales grew 3.1%. Drug retail was negatively impacted by incremental healthcare reform. The timing of Easter, which fell entirely outside 1Q19 this year, had a nominal impact on same-store sales growth for retail segments in the quarter.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Loblaw reported 1Q19 same-store sales growth of 2.0% in food retail and 2.2% in drug retail, with growth in both segments accelerating from the prior quarter. Revenue of C$10.66 billion came in slightly ahead of the consensus estimate of C$10.60 billion recorded by StreetAccount.

Operating income was up 19.9%, or C$75 million, year over year. Operating income included a favorable year-over-year impact from the implementation of IFRS 16 accounting, which equaled approximately C$75 million, and an unfavorable impact from spin-out-related incremental depreciation of approximately C$22 million. Normalized for these impacts, Loblaw said its operating income increased by C$22 million year over year.

Adjusted EBITDA of C$1.04 billion was up 41.9%, or C$313 million, and comfortably exceeded expectations of C$825 million. This included a favorable year-over-year impact from IFRS 16 of approximately C$282 million and a favorable impact from the consolidation of franchises of C$20 million. Normalized for the impact of IFRS 16, adjusted EBITDA increased by C$31 million, driven by an increase in adjusted gross profit, but partially offset by an increase in selling, general and administrative expenses.

The company noted that food retail traffic was relatively flat and basket size increased in 1Q19. Pharmacy same-store sales increased 1.2% and front store same-store sales grew 3.1%. Drug retail was negatively impacted by incremental healthcare reform. The timing of Easter, which fell entirely outside 1Q19 this year, had a nominal impact on same-store sales growth for retail segments in the quarter.

Management commented that the company continues to execute its multiyear plan, launched in 2018, to improve processes and generate efficiencies across its administrative, store, and distribution network infrastructure.

Outlook

Management maintained FY19 guidance for positive same-store sales and a stable gross margin in the retail segment. In FY19, it also expects to deliver positive adjusted net earnings growth, to invest approximately C$1.1 billion in capital expenditures (net of proceeds from property disposals) and return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.