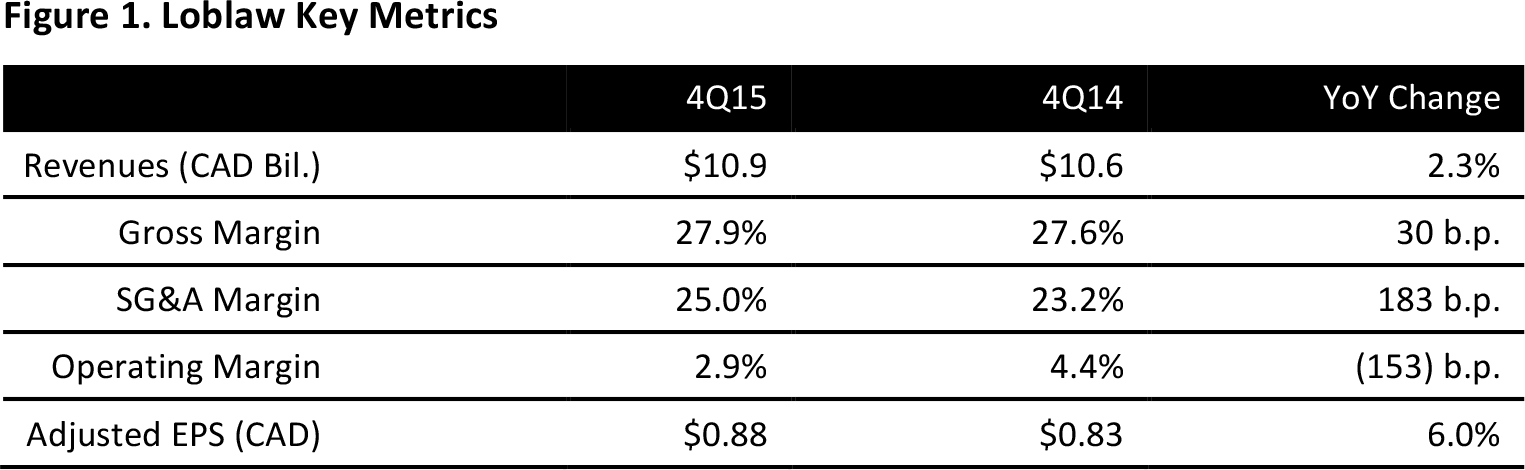

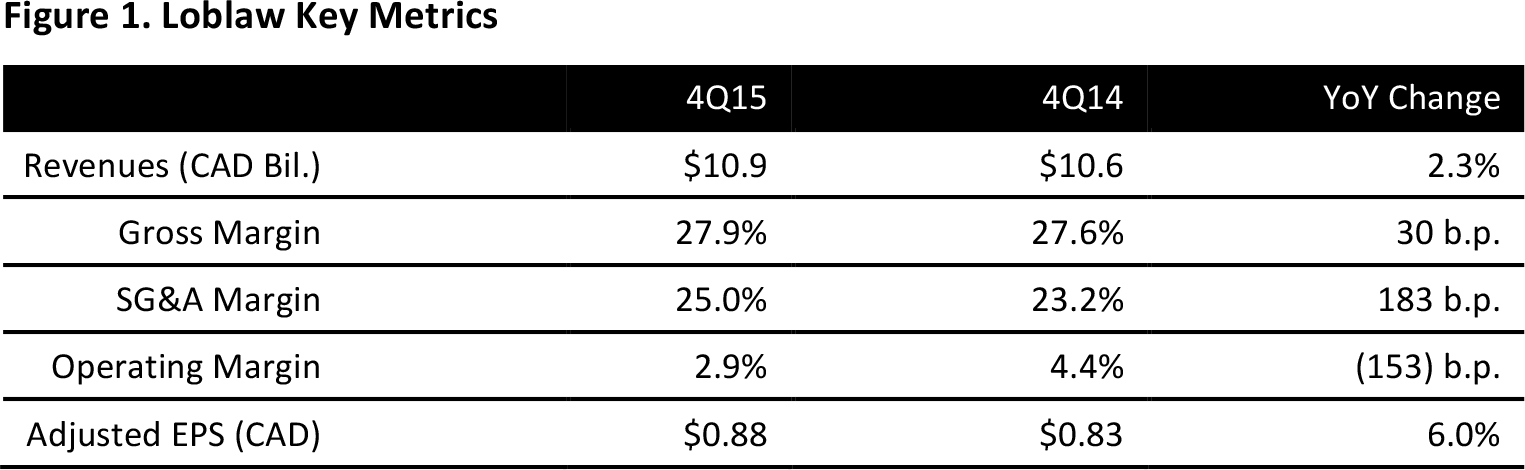

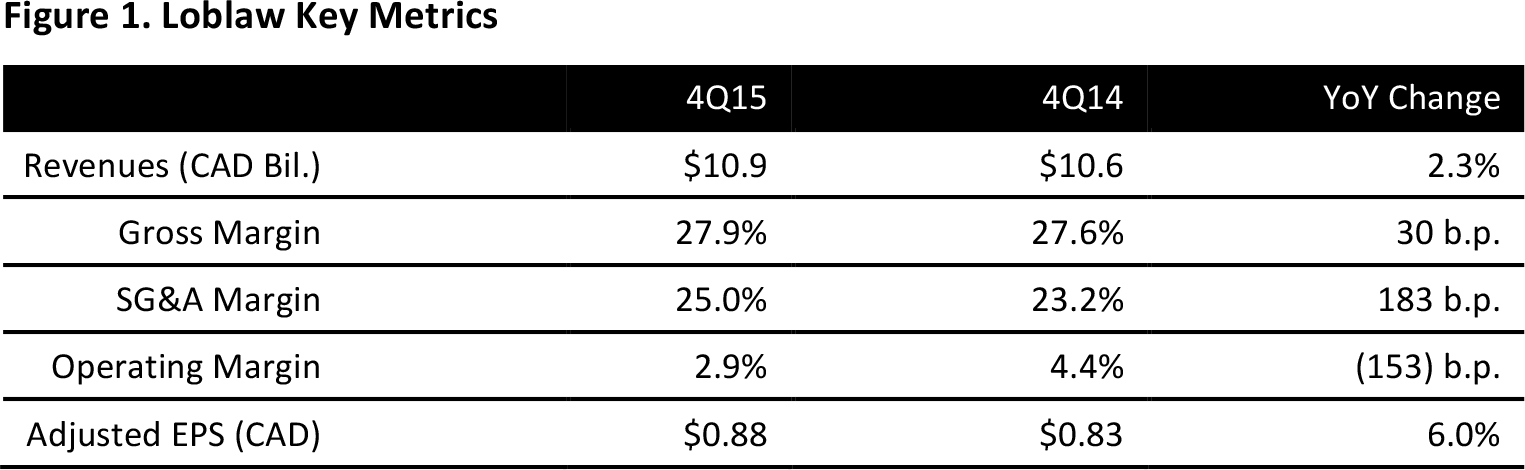

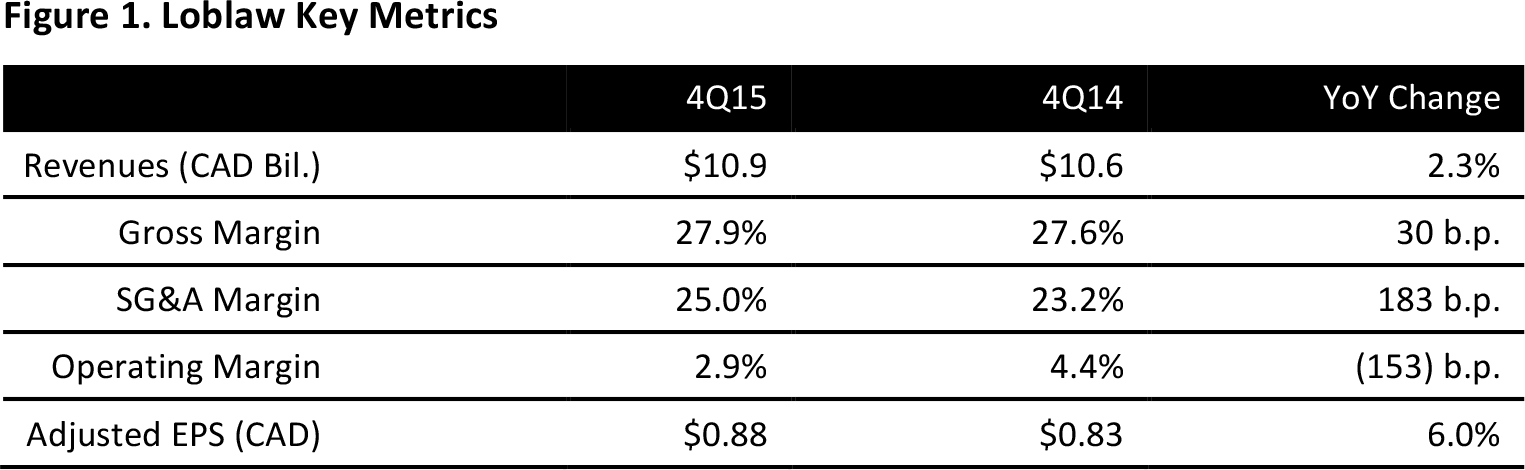

The company’s focus on executing its strategic framework delivered revenue growth. Loblaw aims to deliver positive same-store sales and stable gross margins in FY16.

Source: Company reports

Loblaw, Canada’s largest grocery and pharmacy retailer, reported a 4Q15 adjusted revenue increase of 2.3%, to C$10.9 billion, beating the consensus estimate of C$10.8 billion. The increase in revenue versus 4Q14 excludes the impact of the 53rd trading week of 2014.

The company reported an increase of 0.2% in adjusted EBITDA, excluding the 53rd week, to C$881.0 million, beating the consensus estimate of C$880.0 million.

Adjusted net income increased by 5.5% (excluding the 53rd week), to C$363 million, beating the consensus of C$359 million. Adjusted EPS was C$0.88, an increase of 6.0% versus 4Q14, and below of consensus of C$0.90.

However, the company reported a decrease in GAAP net income of 34.4%, to C$128 million. The decrease, which excludes the 53rd week, is attributable to the write-down of retail pharmacy assets and other special items.

Management commented that its focus on the execution of its strategic framework and stated purpose of “Live Life Well” consistently delivered operational excellence and growth in comps and operating earnings.

SALES BY RETAIL DIVISION

Retail segment sales, excluding the 53rd week, increased by 2.3%, to C$10.6 billion, in 4Q15. Food retail (Loblaw) sales were C$7.6 billion, up 1.3%, and drug retail (Shoppers Drug Mart) sales were C$3.0 billion, up 4.8%, versus 4Q14.

Comps at Loblaw increased by 3.1%, excluding gas and the negative impact of a change in distribution model by a tobacco supplier. Comps increased by 5.0% at Shoppers Drug Mart, with same-store pharmacy sales up 4.2% and same-store front store sales up 5.7%.

2015 RESULTS

Revenue in FY15 increased by 8.5%, excluding the 53rd week, to C$45.4 billion, in line with the consensus estimate. Adjusted EPS for the full year increased by 13.1%, excluding the 53rd week, to C$3.46.

GUIDANCE

In 2016, Loblaw expects to deliver positive same-store sales and stable gross margins in its retail segment despite a highly competitive grocery market and negative pressure from healthcare reforms. The consensus estimate is for FY16 revenue of C$46.5 billion, an increase of 2.4% over FY15. Analysts expect gross margin to be 27.24% for the year and EPS of C$3.90.