Source: Company reports

1Q16 RESULTS

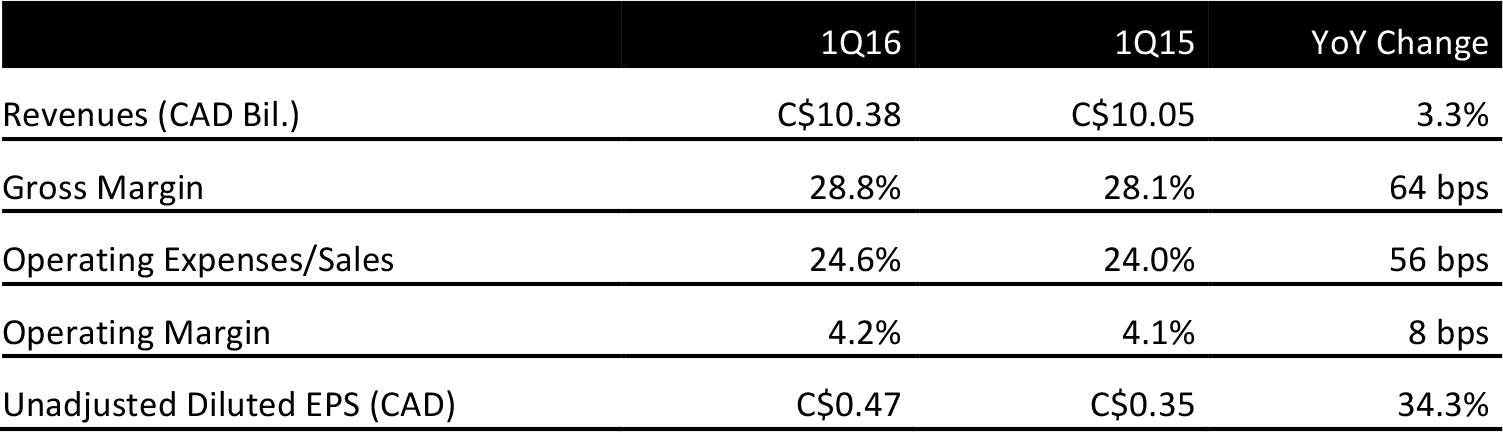

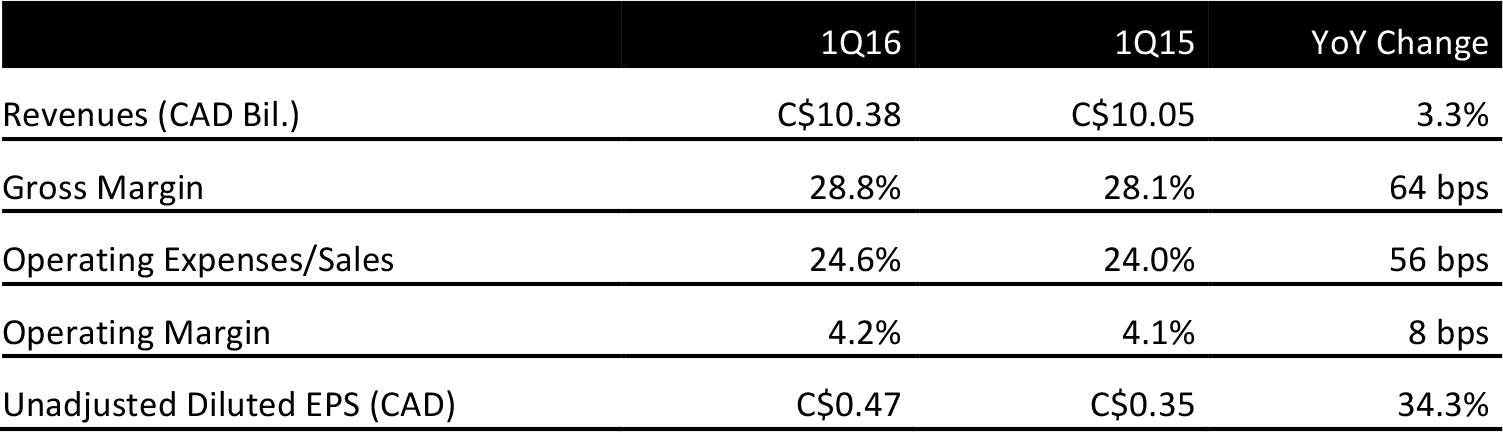

Loblaw Companies, Canada’s largest grocery and pharmacy retailer, reported a 3.3% increase in revenues in 1Q16, in line with the consensus estimate recorded by S&P Capital IQ. Net income was C$193 million, falling short of the C$236 million that had been expected.

At the end of 1Q16, the company had consolidated 115 franchise stores, including 85 stores that were consolidated in 2015 and 30 additional franchises. Adjusted to include these consolidations:

- Net earnings were C$338 million in 1Q16, up 12.3% year over year and versus consensus of C$334 million.

- Diluted EPS was 82 cents, up 13.9% year over year and in line with consensus.

The company said that net earnings gained from positive same-store sales and a stable gross margin in its retail segment. This was coupled with a C$28 million contribution from “incremental net synergies” related to acquisitions, which took total net synergies in the quarter to C$72 million. The selling, general and administrative expenses ratio improved once the impact of consolidated franchises was excluded.

REVENUE PERFORMANCE BY SEGMENT

Retail segment revenues were up 3.3% in 1Q16. Financial services revenues increased by 4.0% and Choice Properties revenues rose by 5.5%.

Within the retail segment:

- Food retail comps were up 2.0%, or 2.6% excluding gasoline. The timing of Easter boosted food retail comps by 1.0%, the company said.

- Drug retail comps were up 6.3% in total, with pharmacy up 4.2% and front store (non-pharmacy) comps up 8.2%. The timing of Easter boosted front store comps by 1.9%, the company said.

GUIDANCE

The company offered no update on guidance. For FY16, analysts expect revenues to grow by 2.7%, GAAP net earnings to jump 91% and GAAP EPS to rise by 111%. Analysts expect net earnings to rise by 7.5% and EPS to rise by 12.1% on an adjusted basis.