albert Chan

Introduction

What’s the Story? Started in 2005 as a sneaker blog by streetwear enthusiast Kevin Ma, Hypebeast is an online destination for men’s contemporary fashion and streetwear that has evolved to become a one-stop source for content, culture and commerce at the intersection of today’s hottest trends, encompassing the varied interests and lifestyles of global youth culture. Today, the company is a multimedia platform with e-commerce (its HBX business) and creative agency services that provide solutions to brands in the fashion, automotive, tech and lifestyle categories (its Hypemaker business) added to its original core media business. With a full-service ecosystem, Hypebeast has developed a new model for youth culture media that puts the consumer at the center of an evolving cultural zeitgeist. The company characterizes this as creating value as part of a virtuous cycle: the trends piquing the interest of the consumer are validated via e-commerce sales, which in turn are driven by editorial content that reflects the lifestyles and issues most important to young people today. However, Hypebeast’s ambitions extend far beyond fashion (as we see through its flywheel model, discussed in this report), which are designed to enable new lines of revenue based on the data gleaned from its editorial-based platform and growing list of clients from the fashion, tech and automotive worlds. By virtue of Hypebeast’s position as the vanguard of youth- and culture-focused commerce, it could take advantage of opportunities in the recommerce space and compete with companies such as GOAT and StockX (each with valuations of over $3.5 billion as of 2021). While those companies are primarily focused on the commerce side of the equation, Hypebeast’s full-scale consumer ecosystem draws attention to its e-commerce platform from all aspects of its lifestyle-focused editorial content. Hypebeast is positioned to capitalize on the emerging opportunities presented by the Web 3.0 technological revolution through venturing into NFTs (non-fungible tokens) and the metaverse. In this report, sponsored by Hypebeast, we explore how the company is positioning itself to play a major role in defining the culture of the Web 3.0 generation through its new media business model. We identify three key areas of opportunity for the digital media platform. Why It Matters The convergence of content, culture and commerce is only set to accelerate as more people discover and live their virtual lives in the metaverse. This represents a powerful opportunity for brands to engage with trendsetters and influencers—as well as mass consumers—as trends are being launched. Data from Hypebeast’s community of trendsetters and influencers can help drive a more curated and relevant inventory position for brands while leveraging existing relationships for exclusive and hard-to-find items. This data will extend in scope as the company transitions to Web 3.0.Living Up to the Hype: Coresight Research Analysis

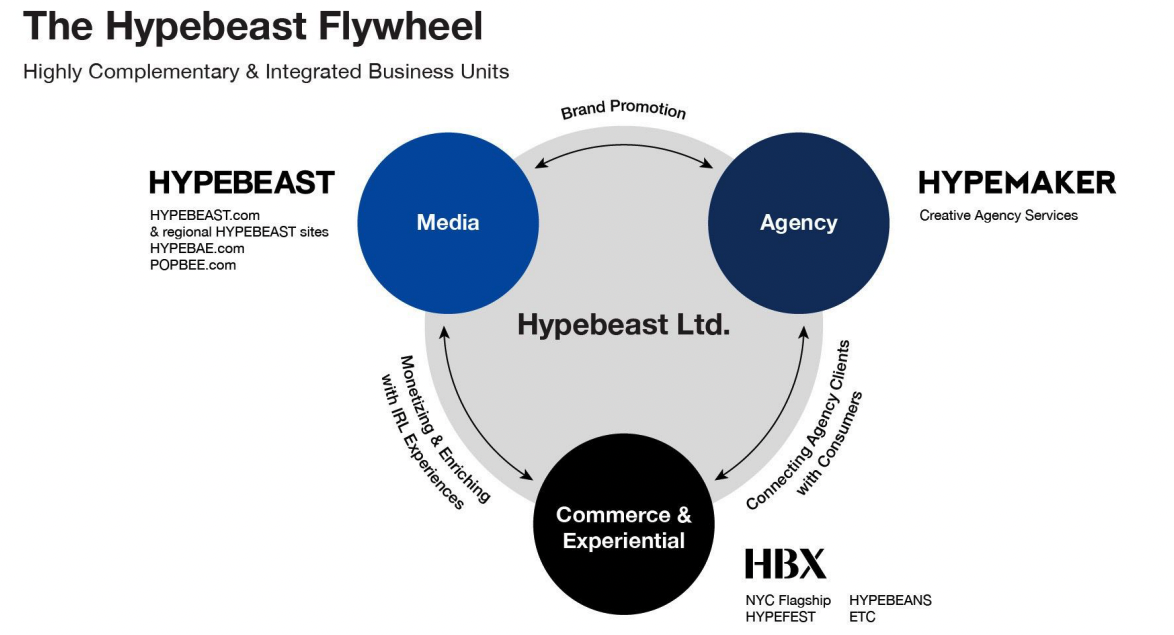

Hypebeast’s Interconnected Ecosystem Hypebeast’s digital media agency services extend the company’s reach beyond fashion to technology, art and entertainment, encompassing the full spectrum of global youth culture. The company claims that this interconnected ecosystem allows it to move quickly and react to consumer trends in close-to-real time, and that this positions Hypebeast in an advantageous place to drive the transition from Web 2.0 to Web 3.0. The company has established an active presence in the metaverse and an extension of its e-commerce initiatives to new revenue lines based around virtual assets such as NFTs. Hypebeast’s new media business model is set up to leverage the power of engaging content to grow its business across several verticals compared to more established media brands such as Details, which had difficulties flexing beyond traditional editorial content and advertising sales. As a result, Details was shut down by its parent company, Condé Nast, in 2016, and Condé Nast only returned to profitability in 2021 after several years of losing money. The competitive landscape on media side has changed; Hypebeast now sees itself as competing against companies such as The Athletic, which provides subscription-based sports content that allows subscribers to engage in live Q&A sessions with authors, and Vice Media, which describes itself as a platform for third-party creators and is targeted at tastes and trends among millennials. That said, both The Athletic and Vice Media do not have e-commerce capabilities. Meanwhile, Hypebeast has been on a steady growth trajectory amid the global pandemic and supply chain issues of the last two years. The proposed SPAC transaction with Iron Spark I shows how the tailwinds surrounding Hypebeast’s model should only accelerate the company’s reach in the years to come. In its most recent financial statement, Hypebeast reported 33% revenue growth in fiscal 2022 (ended March 31, 2022), achieving HK$896 million (US$114 million) in revenue. Hypebeast also proved itself to be a global business, with the US taking a 31% share of revenue, followed by China at 18% and Hong Kong at 9%—with multiple other countries together accounting for the remaining 41%. Moreover, as the revenue from the company’s higher-margin media business grew 46.1%, net profits grew 42% to HK$100 million (US$13 million), demonstrating profitability through the company’s interconnected ecosystem. Hypebeast attributes its revenue growth to brands’ increased appetite for physical activations and retail opportunities. The Hypebeast model is designed to spin up adjacent businesses that could potentially accelerate growth. Other product verticals that are currently in development include Hypemoon (a Web 3.0-focused community and platform), Hypebeans (a food and beverage destination now open in Hong Kong, South Korea and New York), Hypegolf (a sports community created to democratize golf and get more young people involved in the sport), Hypebae (women’s lifestyle focused content), Hypeart and Hypefoods—all of which aim to capture additional attention around other crucial aspects of youth culture. These illustrate Hypebeast’s efforts in growing revenues and increasing profitability through entering new businesses. The company is also investing in infrastructures such as IT, warehousing and logistics capabilities and is growing its regional offerings. The image below depicts the Hypebeast “flywheel”—the company’s ecosystem of interconnected business units. [caption id="attachment_151757" align="aligncenter" width="700"] The Hypebeast Flywheel

The Hypebeast FlywheelSource: Hypebeast[/caption] Three Areas of Opportunity Coresight Research has identified three areas of opportunity for Hypebeast, which we present in Figure 1 and explore in detail below.

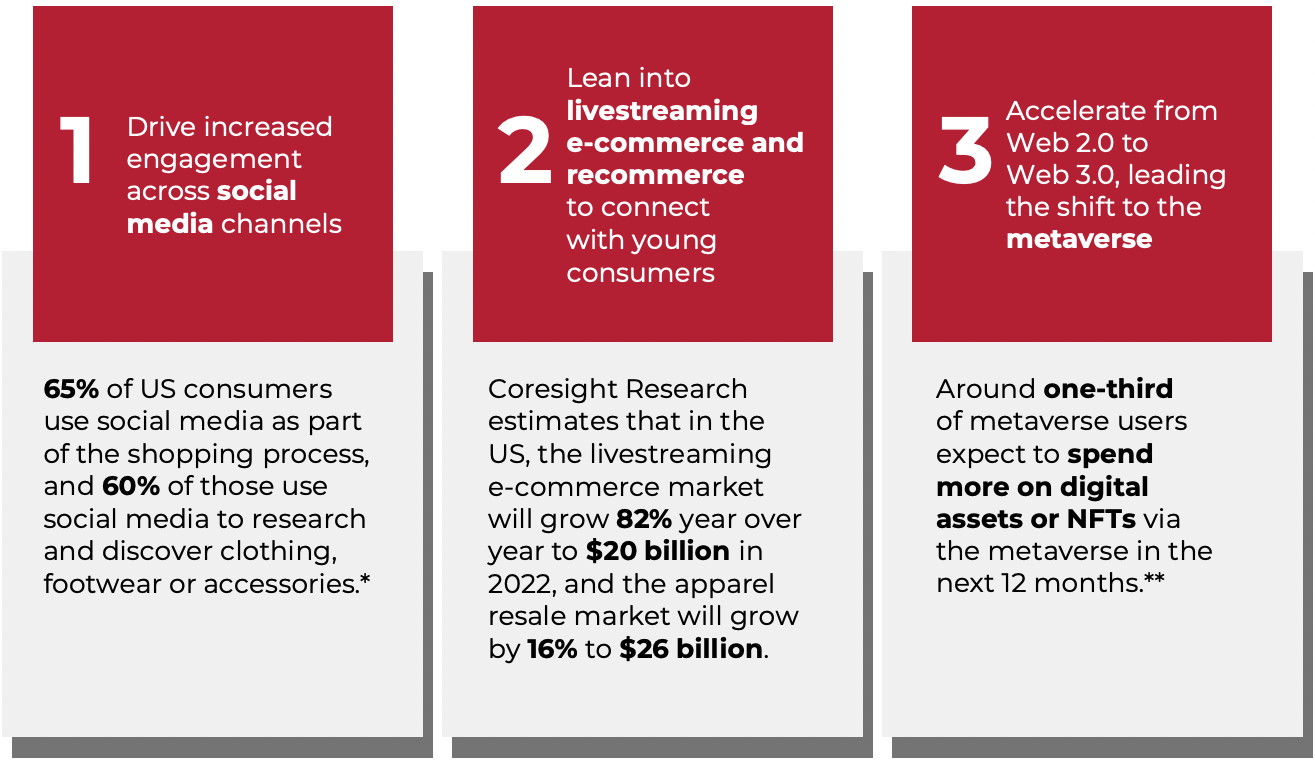

Figure 1. Three Areas of Opportunity for Hypebeast [caption id="attachment_151758" align="aligncenter" width="700"]

*Base: US respondents aged 18+, surveyed in March 2022

*Base: US respondents aged 18+, surveyed in March 2022**Base: US metaverse users aged 13+, surveyed in March 2022

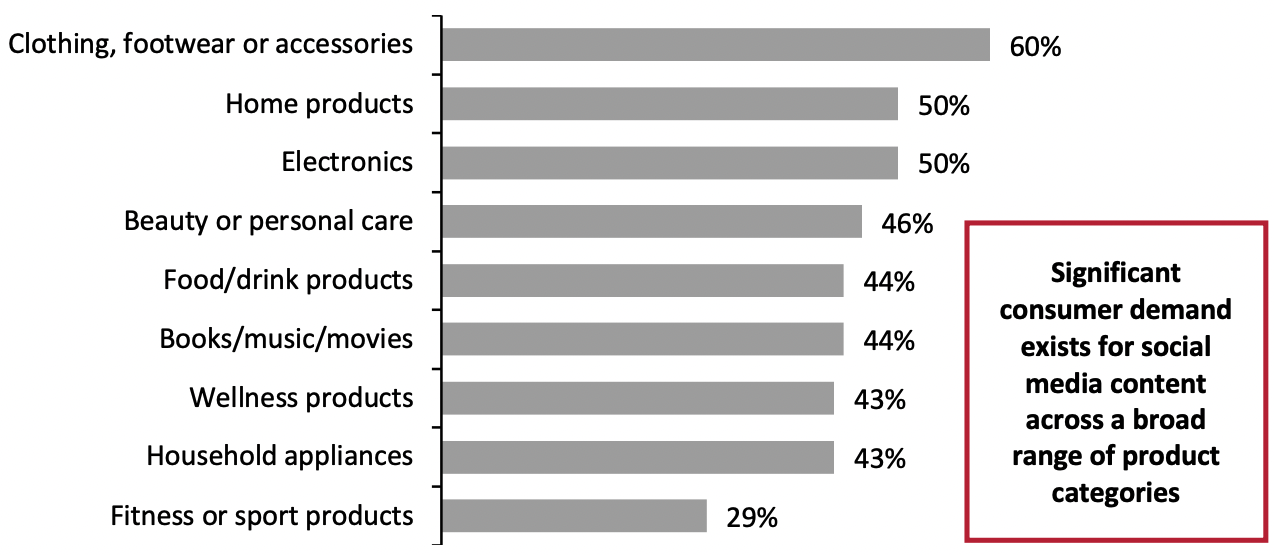

Source: Coresight Research[/caption] 1. Hypebeast’s Social Media Presence Puts the Company at the Center of the Cultural Conversation Hypebeast is a central gathering place on the Internet for emerging and established artists, designers and brands. Its community of creators and consumers covers over 80 countries with a focus on millennial and Gen Z audiences. On social media, Hypebeast has 32 million followers worldwide as of fiscal 2022—representing a 24% year-over-year increase, the company reported. However, the key to the company’s success depends less on the sheer size of its following and more through how Hypebeast drives engagement on its platform through relevant content curation. The company reported that it had 16.4 million active monthly users in fiscal 2022, the equivalent of 51% of the company’s social media following. According to Coresight Research’s 2022 US social commerce survey, 65% of US consumers use social media as part of the shopping process, and 60% of those use social media to research and discover products in the clothing, footwear and accessories category—the highest proportion among all categories. However, significant consumer demand exists for social media content covering electronics and home products, with half of all social media shoppers using social media to discover/research these categories—and other product categories do not fall far behind (see Figure 2). Hypebeast plans to capitalize on this interest by recommitting to its strategy of increasing its social media following by expanding into new topics such as home products, toys, technology, food, Web 3.0 and more.

Figure 2. Respondents Who Use Social Media as Part of the Shopping Process: Product Categories They Discover/Research on Social Media (% of Respondents) [caption id="attachment_151759" align="aligncenter" width="700"]

Base: 899 US respondents aged 18+ who use social media as part of the shopping process, surveyed in March 2022

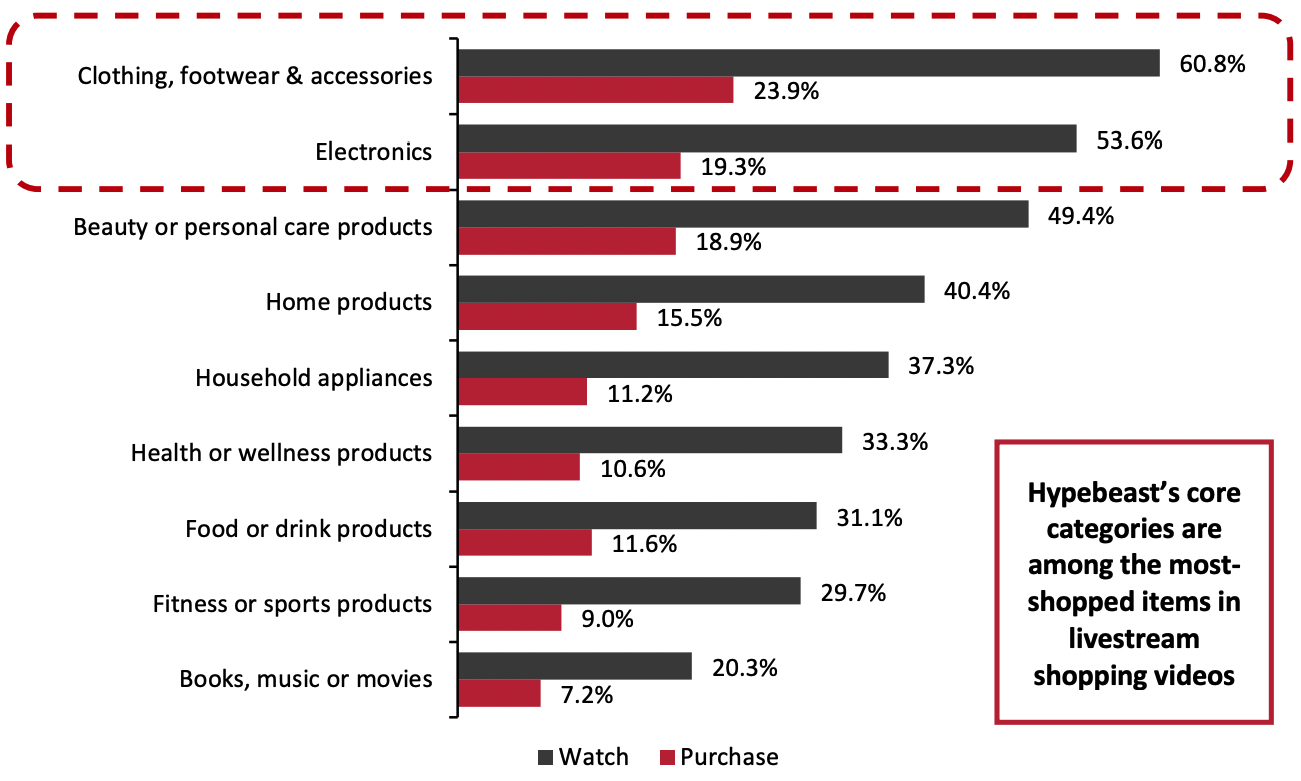

Base: 899 US respondents aged 18+ who use social media as part of the shopping process, surveyed in March 2022Source: Coresight Research[/caption] 2. Recommerce and Livestreaming Will Enable Brands To Be a Part of Hypebeast’s Authentic Community of Youth Influencers Hypebeast’s e-commerce growth is likely to be supported by the company’s ability to tap into two quickly emerging global trends: recommerce and livestreaming commerce. Recommerce involves the resale of previously owned goods that are either unused or very lightly used. The US fashion resale market grew from a single-billion-dollar market in 2008 to a $22.3 billion market in 2021, Coresight Research estimates, and we expect it to grow by a further 16.0% and 15.0% in 2022 and 2023, respectively. Hypebeast, along with StockX and GOAT, has leaned into resale in recent years. With these companies’ core product offerings centered around the collectible sneaker market, the issues surrounding wear and tear are less relevant to these brands than other recommerce platforms such as ThredUP. Video content is also becoming increasingly critical to any organization’s e-commerce strategy. Hypebeast’s community sits at the nexus of art, commerce and fashion, enabling the entertainment aspect of livestreaming to complement Hypebeast’s model. Many Hypebeast followers will be looking for exclusive product releases and making authentic connections with the influencers and trend spotters that are core to the Hypebeast community, and livestream video looks to be a promising platform to drive these engagements. With its community already actively engaged on its digital and social media platforms, Hypebeast has the opportunity to capitalize on bridging e-commerce demand to its audience through livestreaming. The livestreaming e-commerce market has exploded over the last 12–24 months, and we expect its growth to continue: Coresight Research estimates that in the US, the market will grow 82% year over year to $20 billion in 2022 (and in China, we expect the livestreaming e-commerce market to total $497 billion in 2022, growing 52% from 2021). Coresight Research’s 2022 US livestreaming e-commerce survey found that 52.2% of US livestream viewers have bought products while watching events, with Hypebeast’s core product categories of clothing and electronics among the most-shopped categories (see Figure 3).

Figure 3. Livestream Viewers: Product Categories They Watch vs. Purchase via Livestreaming (% of Respondents) [caption id="attachment_151760" align="aligncenter" width="700"]

Base: 502 US respondents aged 18+ who have watched a shoppable livestream, surveyed in February 2022

Base: 502 US respondents aged 18+ who have watched a shoppable livestream, surveyed in February 2022Source: Coresight Research[/caption] 3. The Fundamentals of Hypebeast’s Platform Position the Company To Become One of the Defining Influencer Communities in the Metaverse and Beyond As the metaverse and other Web 3.0 technologies begin to gain popularity, Hypebeast looks well positioned to take advantage of the opportunities this emerging virtual ecosystem presents. Hypebeast is already mirroring many of its current editorial, media, agency and project initiatives on Web 3.0 platforms and the community will live on all Web 3.0 platforms. The company is engaging with its user base in conversations about how to bridge the gap between the virtual and physical worlds, with an ambition to becoming fully Web 3.0 integrated across core media, agency and e-commerce offerings. With Hypebeast so focused on the interests of young people, it makes sense that the company would be leading the shift to the metaverse. Its agency business has been working with clients as Hypebeast positions itself to be “the first Web 3.0-enabled agency in the world.” Global clients have expressed interest in tapping Hypebeast’s expertise in launching Web 3.0 initiatives, creating a seamless experience across Web 2.0 and Web 3.0 in the creation of compelling media campaigns. While Coresight Research estimates the market for metaverse retail sales at around $2.3 billion for 2022, we expect sales to more than double every year for the next five years to $89.2 billion in 2026 and could grow to as much as $780 billion by 2030. More than half (57%) of metaverse users in the US had invested in digital assets or NFTs via the metaverse in the 12 months prior to a Coresight Research survey in March 2022—and around one-third (34%) of metaverse users expect to spend more on digital assets or NFTs via the metaverse in the next 12 months. This should support further growth in Hypebeast’s e-commerce store. The company launched its first NFT art sale in 2021 and is developing an NFT shop for the metaverse that aims to integrate the metaverse shopping experience with goods that can be used both virtually and in the physical world.

- View our infographic for more exclusive insights into how early adopters are using the metaverse.

What We Think

Gen Z’s spending power is just getting started, and as the first digitally native generation, they will spend a greater share of their wallet online than prior generations. We see a sustained, multiyear generational shift to digital channels that will likely include still-emerging channels such as virtual worlds, livestreaming and social commerce. The media landscape has also evolved from pure content provision to subscription offerings, posing stronger competition within the media industry. However, communities of mutual interest go a step further by circling between content, culture and commerce with opportunities to invest in new verticals and infrastructure to remain competitive.About Coresight Research Custom Reports

Coresight Research Custom Reports are produced as part of commercial partnerships with leading firms in the retail, technology and startup ecosystems. These Custom Reports present expert analysis and proprietary data on key topics in the retail, technology and related industries, and enable partner companies to communicate their brand and messaging to a wider audience within the context of brand-relevant research.