albert Chan

Livestreaming refers to online video content that is simultaneously recorded and broadcast in real time—a concept that is not unusual for television but is still new in online marketing and e-commerce. Livestreaming has become an important channel for brands to establish trust with consumers and allow them to buy products or services directly from the videomaker.

Livestreaming E-Commerce: China and the US

China has a relatively mature livestreaming e-commerce market in which influencers are product advisors and consumers can buy products through videos with one click. In the West, the market is somewhat less established, but we are beginning to see momentum as brands and retailers explore the use of social media platforms such as Instagram and TikTok to engage with customers. Furthermore, innovative platforms are launching in-video check-out functions.The livestreaming e-commerce market in China was worth an estimated ¥440 billion (around $63 billion) in 2019, according to financial services firm Everbright—the equivalent of just over 5% of total online sales of goods in China that year, as reported by the National Bureau of Statistics of China. The US market, on the other hand, is still developing and is several years behind China. Assuming that livestreaming can capture 2.5% of online retail sales in the US by 2023 (half the ratio seen in China), we estimate the potential market size for US livestreaming e-commerce to reach $25 billion in 2023.

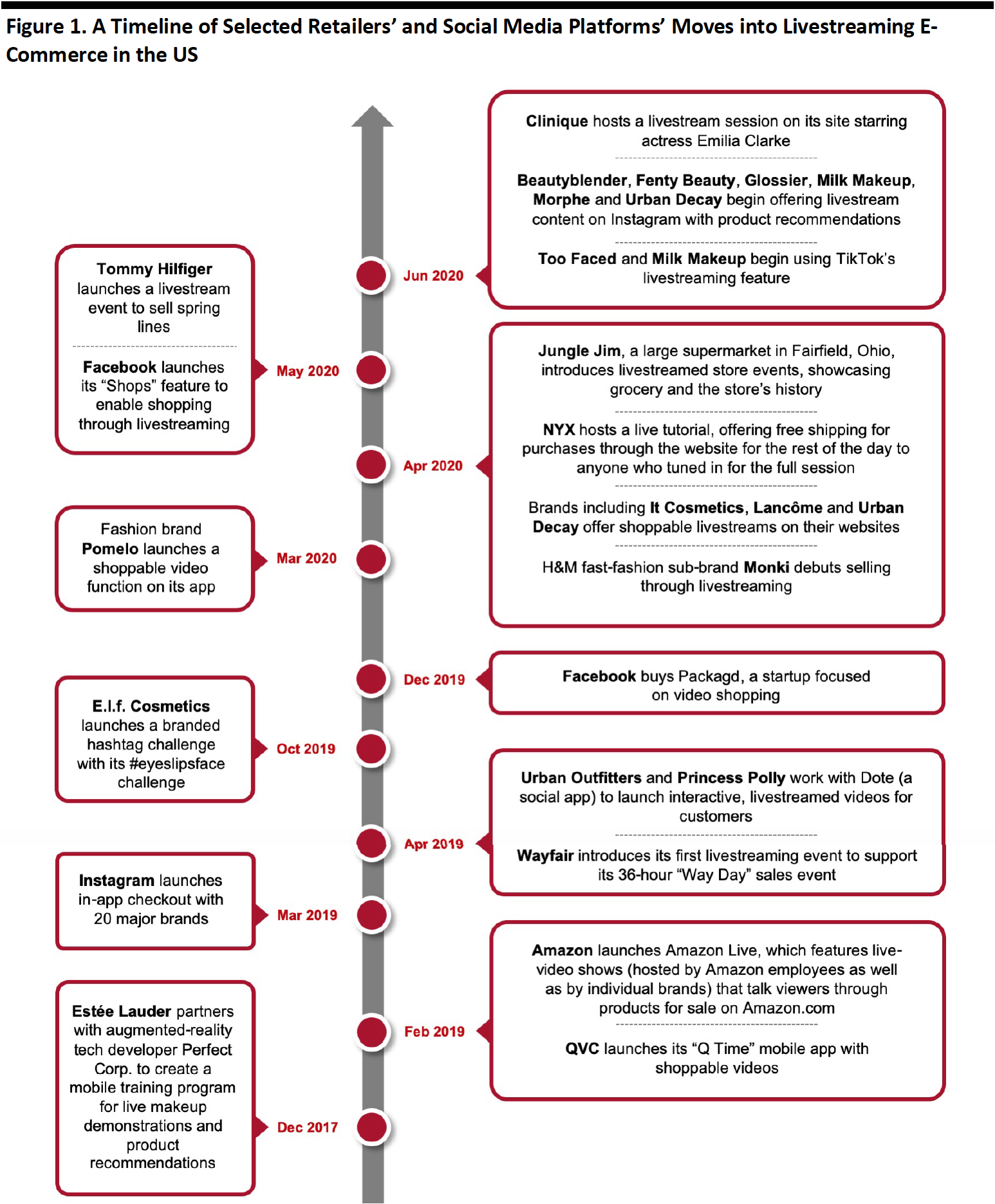

Although livestreaming e-commerce is just taking off in the US, we have seen retailers and social media platforms making tactical moves into this space over the past few years (see Figure 1), including by launching livestreamed sales events, adding checkout features to live videos and partnering with third-party platforms such as Amazon Live.

[caption id="attachment_113241" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Livestreaming Platforms in the US

Company websites: Wayfair launched a livestreaming event to support its 36-hour “Way Day” sales event in April 2019, and it also debuted a “Share and Save” feature through which customers could save an additional 40% on selected products by sharing the deals on social media.

Also in April 2019, Princess Polly and Urban Outfitters launched interactive livestreaming on their websites, and NYX hosted a live tutorial on its website, offering free shipping for viewers that tuned in for the full session.

See Figure 1 for other notable brands that have launched livestreaming content through their own websites over the past few years. We expect that more retailers and brands will implement this strategy in future, to stay competitive and win customers. However, there are a number of social media platforms that offer livestreaming functionality in the US, as we outline below and in Figure 2.

Amazon Live: Amazon launched Amazon Live in February 2019, which features live videos that walk customers through products for sale on Amazon.com. Brands that work with Amazon Live include JOLY Cosmetics, Levi’s, Manuka Health and Amazon’s private labels.

On July 15, 2020, Amazon began offering its Interactive Video Service, which enables users to easily set up live, interactive video streams for web or mobile applications. The company also announced its new Amazon Influencer Program on July 16, which offers livestreamers a new way to earn sales commission on the products showcased in their videos (previously, influencers earned money by directing fans to their favorite Amazon products through posts on Facebook, Twitter, Instagram and YouTube).

Facebook: Facebook’s strategic acquisition of Packagd (which had been focused on enabling users to make direct purchases of products via livestreamed, unboxing-type videos) in December 2019 demonstrates that this popular social media platform is entering the livestreaming e-commerce marketplace and is building shopping capabilities to let users make purchases directly from live video broadcasts.

In May 2020, Facebook launched Shops, a platform for businesses to set up free storefronts on Facebook and Instagram. The online stores—which will be powered by third-party services including BigCommerce, Shopify and Woo—are designed to turn the social network into a top-tier shopping destination, laying the groundwork for Facebook to offer livestreaming. The social media platform plans to enable livestreaming e-commerce by allowing brands and creators to tag items from their Facebook catalogs to appear at the bottom of live videos.

Instagram: Beauty brands including Beautyblender, Clinique, Fenty Beauty, Glossier, Milk Makeup, Morphe and Urban Decay livestream content through Instagram, offering product recommendations.

TikTok: In October 2019, E.l.f. Cosmetics launched a hashtag challenge with its #eyeslipsface challenge. The brand partnered with agency Movers+Shakers to turn its eponymous abbreviation, “eyes, lips, face,” into a song, attracting over 5.3 billion views and over 3.5 million user-generated singing videos. The song generated over 16 million streams outside of TikTok and a number-four spot on Spotify's Global Viral 50 list.

Too Faced and Milk Makeup have also begun using TikTok’s livestreaming feature to promote cosmetics products.

Figure 2. Selected Livestreaming Platforms in North America

[wpdatatable id=332]Source: Coresight Research

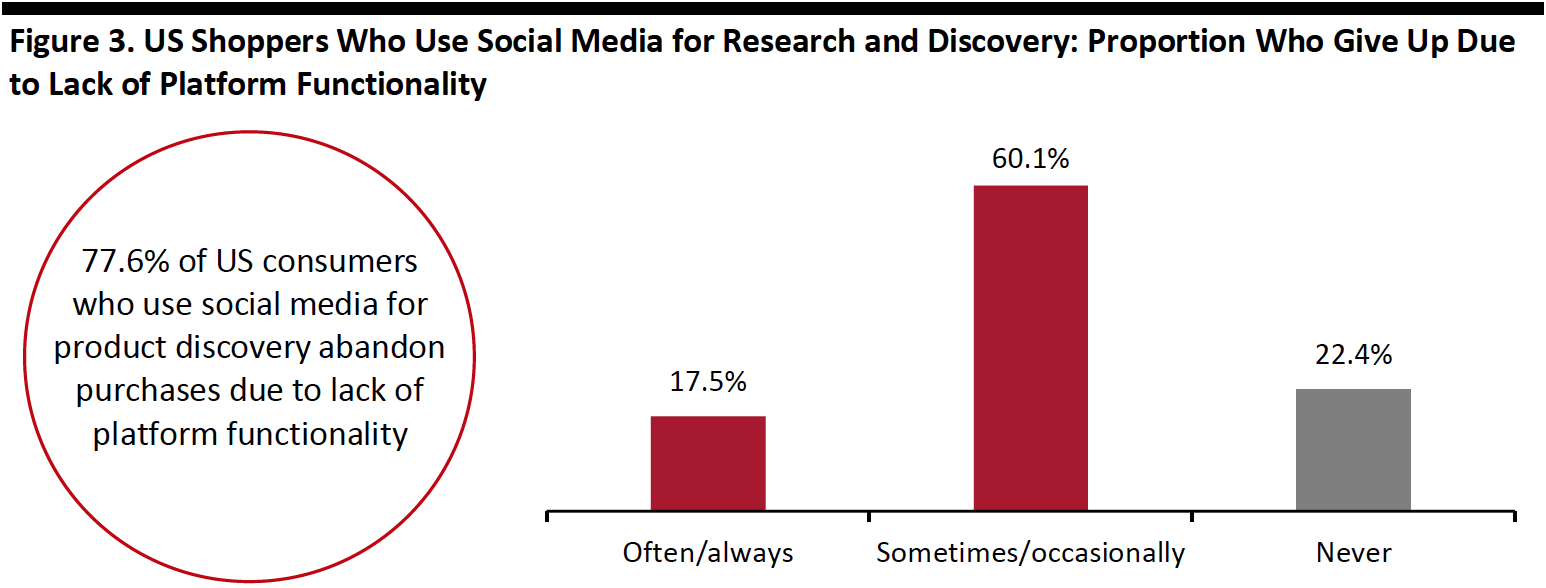

The Missing Link: In-Video Checkout Most livestreaming videos, posts or advertisements on social media platforms include tags or links to third-party websites rather than having in-built purchasing functionality, meaning that the shopping experience is not seamless. This can lead to consumers abandoning purchases. According to a Coresight Research 2019 survey that explored the use of social media by US shoppers, 77.6% of US consumers who use social media for product research said they would occasionally or often give up making a purchase due to a lack of in-built functionality (see Figure 3). [caption id="attachment_113242" align="aligncenter" width="700"] Base: 851 US Internet respondents aged 18+ who use social media to discover products or research purchases as part of the shopping process, surveyed in November 2019

Base: 851 US Internet respondents aged 18+ who use social media to discover products or research purchases as part of the shopping process, surveyed in November 2019Source: Coresight Research[/caption]

In March 2019, Instagram launched checkout options on its platform to facilitate in-app shopping. Consumers can select the “Checkout on Instagram” option to make an immediate purchase without being redirected to a third-party site.

Facebook is also looking to provide a seamless shopping experience for its users, such as through its acquisition of Packagd last year. The platform has also reported that it is exploring ways to enable buyers to easily ask questions and place orders within live video broadcasts. Its newly launched Shops platform will likely incorporate these functions.

Innovators such CommentSold allow consumers to shop products without leaving the livestream platform. Customers can watch content, interact with other customers, add products to a digital cart and place orders instantly. CommentSold also allows merchants to broadcast to a Facebook page, Facebook group and mobile app simultaneously, as well as track inventory updates in real time. The platform offers gamification features to increase shopper engagement, such as gaming experiences, five-minute flash sales and rewards for returning customers and top fans.

[caption id="attachment_113243" align="aligncenter" width="700"] CommentSold facilitates selling through live video content and engages with customers via push notifications and gamification features

CommentSold facilitates selling through live video content and engages with customers via push notifications and gamification featuresSource: CommentSold[/caption]

The Impact of Social Media Influencers on Consumer Shopping Behavior

Our social commerce survey found that social media influencers have an impact on the purchasing decisions of US shoppers—and Instagram is outperforming other platforms in this respect: Some 23.6% of Instagram shoppers who follow influencers on the platform stated that their shopping is “often or always” affected by influencers or celebrities on Instagram, compared to the 19.7% of general social media shoppers who follow influencers.

The greater impact of influencers on Instagram is very likely due to its focus on visual content—images and videos—which users may find more engaging and personable than the text-based nature of other social media platforms. Fully 80% of US consumers would rather watch a live video from a brand than read a blog, according to Livestream, a Vimeo-owned event-sharing platform—indicating consumers’ preference for live video and its importance as a marketing and distribution tool.

[caption id="attachment_113244" align="aligncenter" width="550"] In this live video by celebrity Kim Kardashian, model Bella Hadid was invited to share her makeup methods and products

In this live video by celebrity Kim Kardashian, model Bella Hadid was invited to share her makeup methods and productsSource: Instagram[/caption]

Recognizing the power of key opinion leaders (KOLs) and celebrities in influencing consumer behavior, brands and retailers in the US have started to leverage influencers in their marketing strategies:

- Birchbox partnered with four YouTube influencers to create sponsored holiday-themed videos in 2019 that featured the Birchbox holiday box.

- Clinique hosted a livestream on its site starring actress Emilia Clarke in June 2020.

- Walmart began adding influencer-generated content to its website in July 2018, including photos with bloggers, recipes and other information on product pages.

The influencer marketing industry is estimated to reach $15 billion by 2022, according to Business Insider Intelligence.

MCNs Are Driving Livestreaming E-Commerce Momentum in China; Opportunity in the US

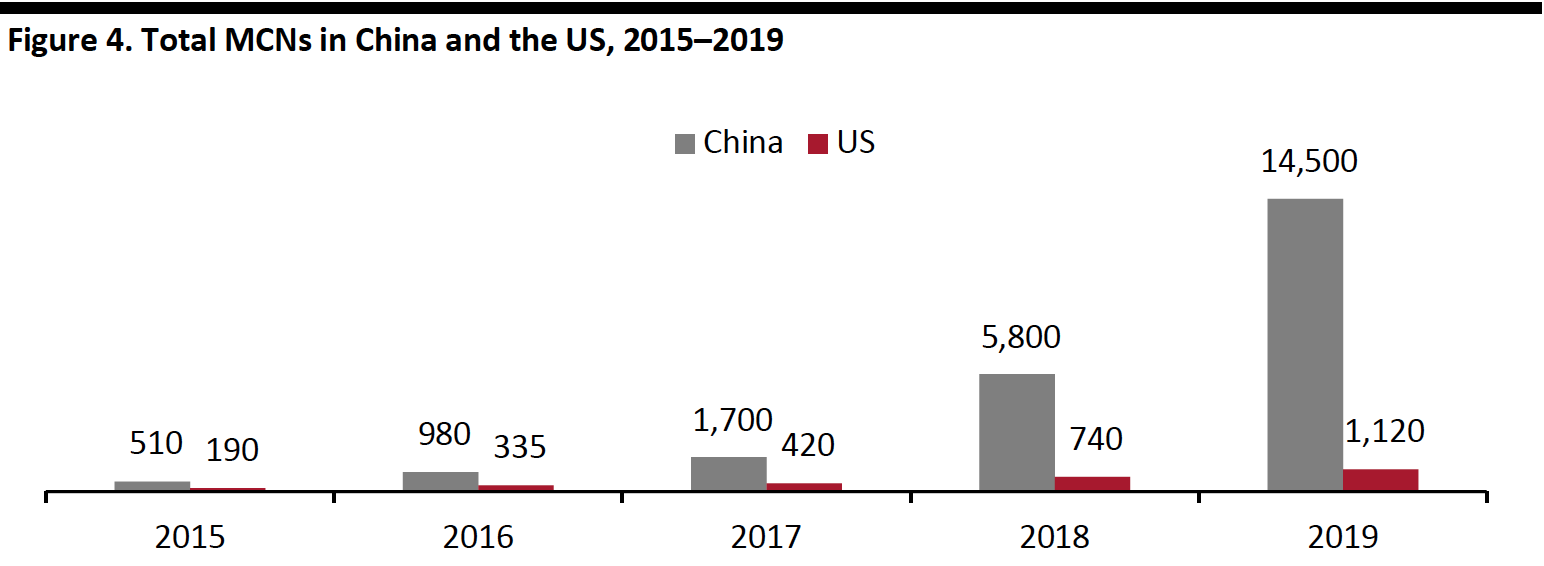

The boom in China’s livestreaming e-commerce industry was driven not only by consumers’ growing interests in online shopping and live videos, but also by MCNs, which provide livestreaming services for brands, connect brands with appropriate influencers, design content and shoot videos.

We have seen similar players emerging in the US, such as influencer marketing agencies, digital communications and campaign design companies, and branding firms. For example, brands such as M.GEMI, Equinox and Tommy John have partnered with Village Studio, an influencer marketing agency, to design campaigns and launch online promotional activities in connection with powerful influencers. The number of MCNs in the US grew to 1,120 in 2019 from just 190 in 2015—but there is growing opportunity in this field, as it is still just a fraction of the market in China (see Figure 4).

[caption id="attachment_113245" align="aligncenter" width="700"] Source: Influencermarketinghub/iimedia[/caption]

Source: Influencermarketinghub/iimedia[/caption]

Key Insights

- Livestreaming e-commerce is just taking off in the US, and we have seen retailers and social media platforms making tactical moves into this space. As more retailers and brands turn to this channel to stay competitive and win customers, the market will see significant growth: We estimate that it will be worth around $25 billion in 2023.

- The integration of in-app checkout functionality on social media platforms will increase the seamlessness of the purchasing experience for consumers, meaning that fewer shoppers will abandon purchases. This concept extends to livestreaming, with opportunities for brands to boost sales through direct in-video checkout options.

- Social media influencers impact consumer purchasing decisions. Recognizing this, retailers and industry players in the US have started to incorporate influencers into their marketing strategies to appeal to shoppers and drive conversion.

- With the boom in China’s livestreaming e-commerce industry having been driven by MCNs—in addition to changing consumer behavior—similar players are emerging in the US. We believe that there is growing opportunity in this field.