Web Developers

This report provides an update on what we know so far about Lidl’s entry into the US market. It provides some answers to major questions about the discount grocer’s prospects and impact. We begin by providing some key facts on Lidl’s US and worldwide operations.

Lidl US: Key Facts

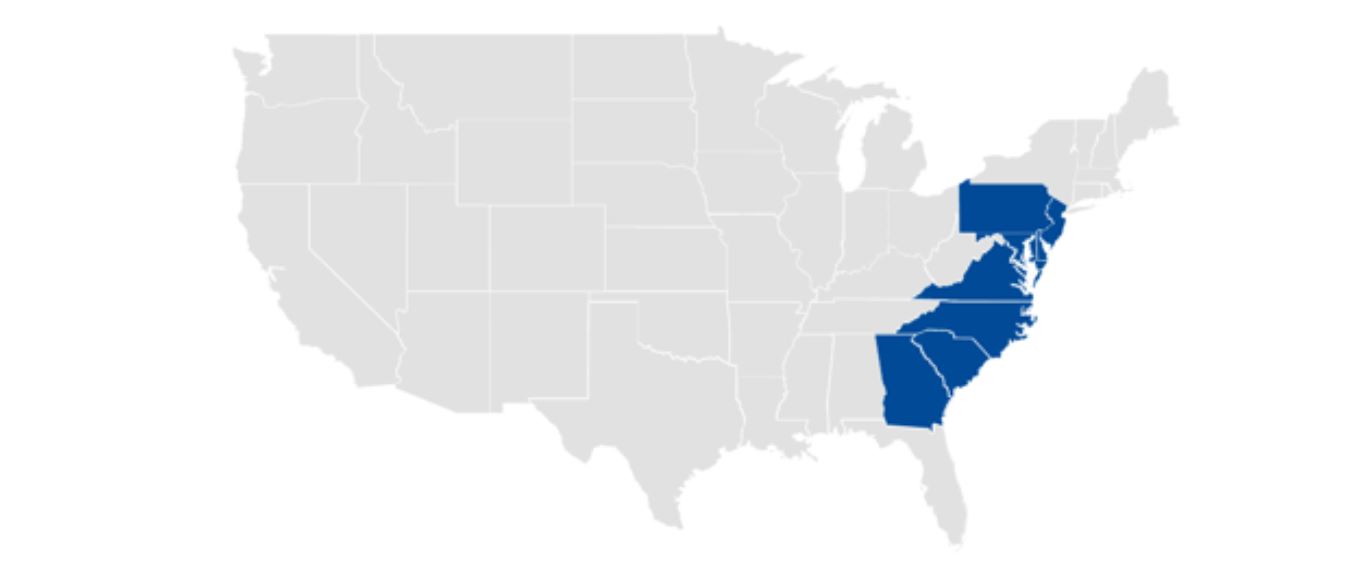

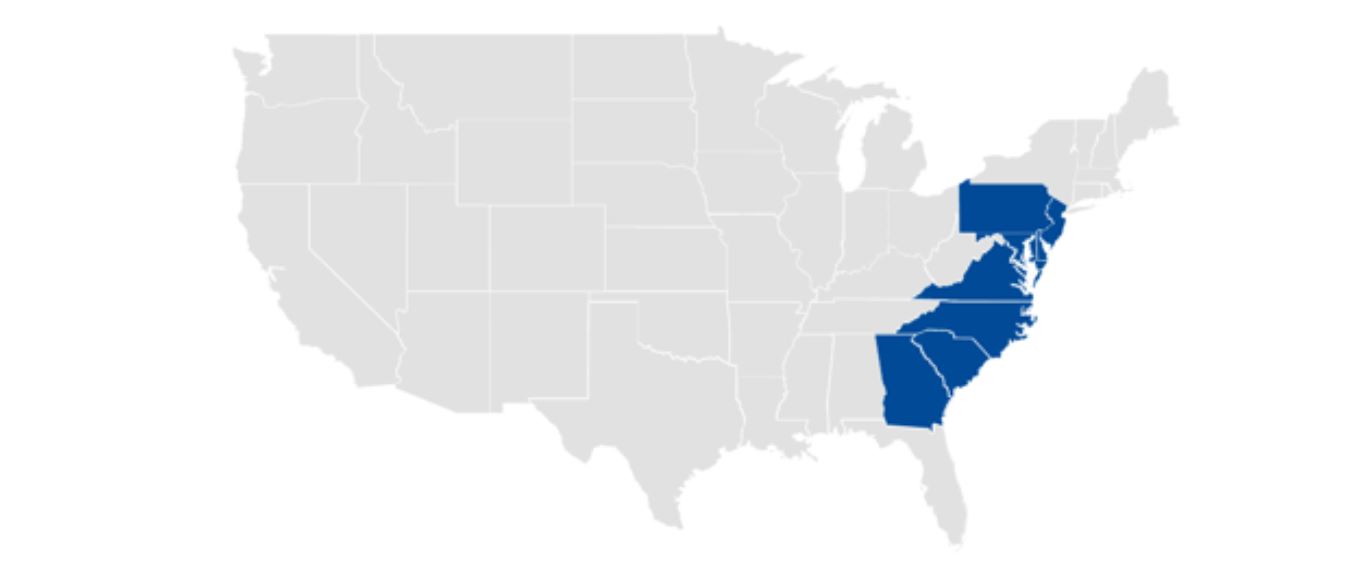

- Lidl will open its first 20 US stores in the summer of 2017 across three eastern states: North Carolina, South Carolina and Virginia.

- When we checked Lidl’s website on March 22, the company was hiring for store-based roles in a total of 38 towns in eight eastern states: Delaware, Georgia, Maryland, New Jersey and Pennsylvania, as well as North Carolina, South Carolina and Virginia.

Source: Lidl

- Lidl is aiming for stores of about 36,000 gross square feet, per its property advertisements. Stores will typically have 21,000 square feet of net selling space, according to a February 2017 Washington Post interview with Brendan Proctor, Lidl’s US CEO.

- That means Lidl is seeking US stores that are approximately 40% bigger than its largest European stores (which are 15,000 square feet) and roughly double the size of its typical store worldwide. By comparison, Aldi’s average US store is 10,000 square feet.

- Lidl’s US headquarters is in Arlington, Virginia, and it has established three distribution centers: Spotsylvania County, Virginia; Alamance County, North Carolina; and Cecil County, Maryland.

Lidl Worldwide: Key Facts

- Lidl is part of the privately owned Schwarz Group, which also owns the Kaufland discount hypermarket chain. Lidl’s worldwide net sales were €64.4 billion (US$71 billion) in the year ended February 2016, up 9% year over year. Schwarz Group reported total net revenues of €85.7 billion (US$94.4 billion) in the year ended February 2016, up 8% year over year.

- According to a December 2016 interview in Germany’s Manager Magazin, Schwarz Group CEO Klaus Gehrig expects Lidl to report revenue of more than €70 billion (US$77.1 billion) for the year ended February 2017.

- Lidl operated approximately 10,000 stores worldwide as of February 2016. The average store size was approximately 9,208 square feet in 2016, according to our analysis of Euromonitor International data.

- Lidl is a limited-line discounter that focuses heavily on its own-brand products in grocery and offers a no-frills experience. However, the number of products offered has crept up in recent years. In its stores in Italy, Lidl reportedly now offers 1,700 products. In the UK, its last stated SKU count (in 2013) was 1,600, and the company said that it aimed to increase that number to 1,700 in 2014.

- By number of stores, Lidl’s biggest markets are, in descending order, Germany, France, Poland, the UK, Italy, Spain, the Netherlands, the Czech Republic, Belgium, Portugal, Greece and Austria.

Four Key Questions

1. What Do We Estimate Lidl’s US Sales Will Be?

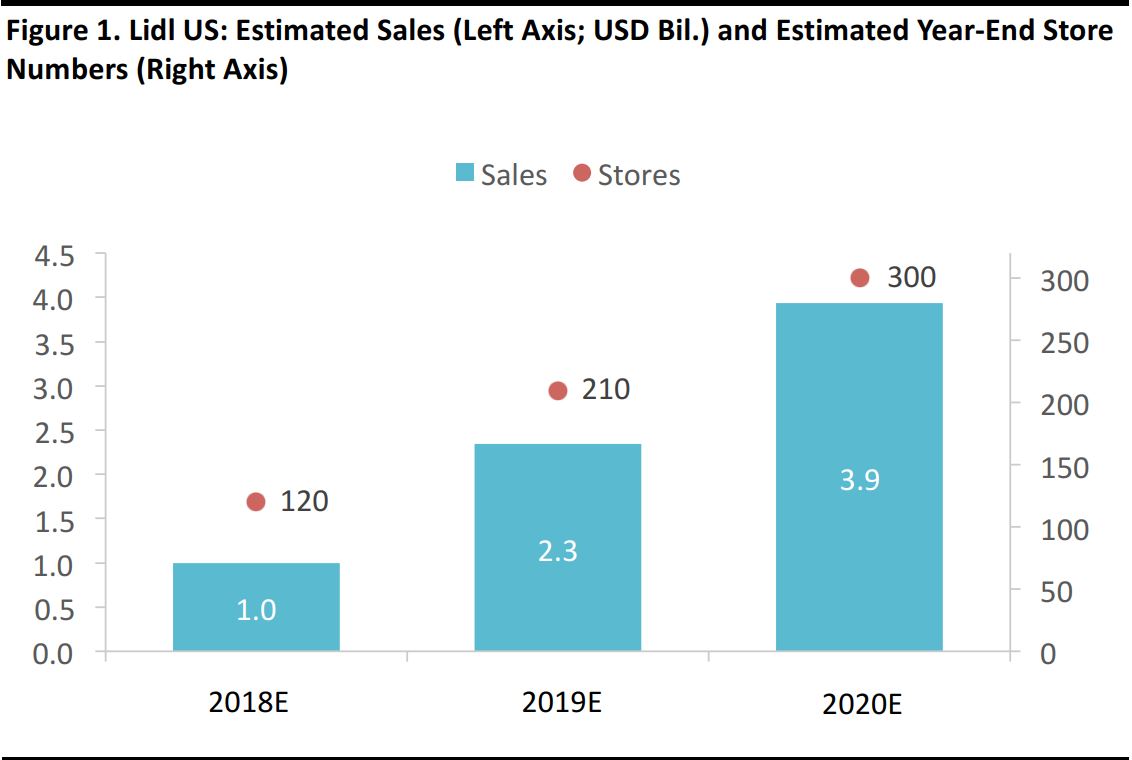

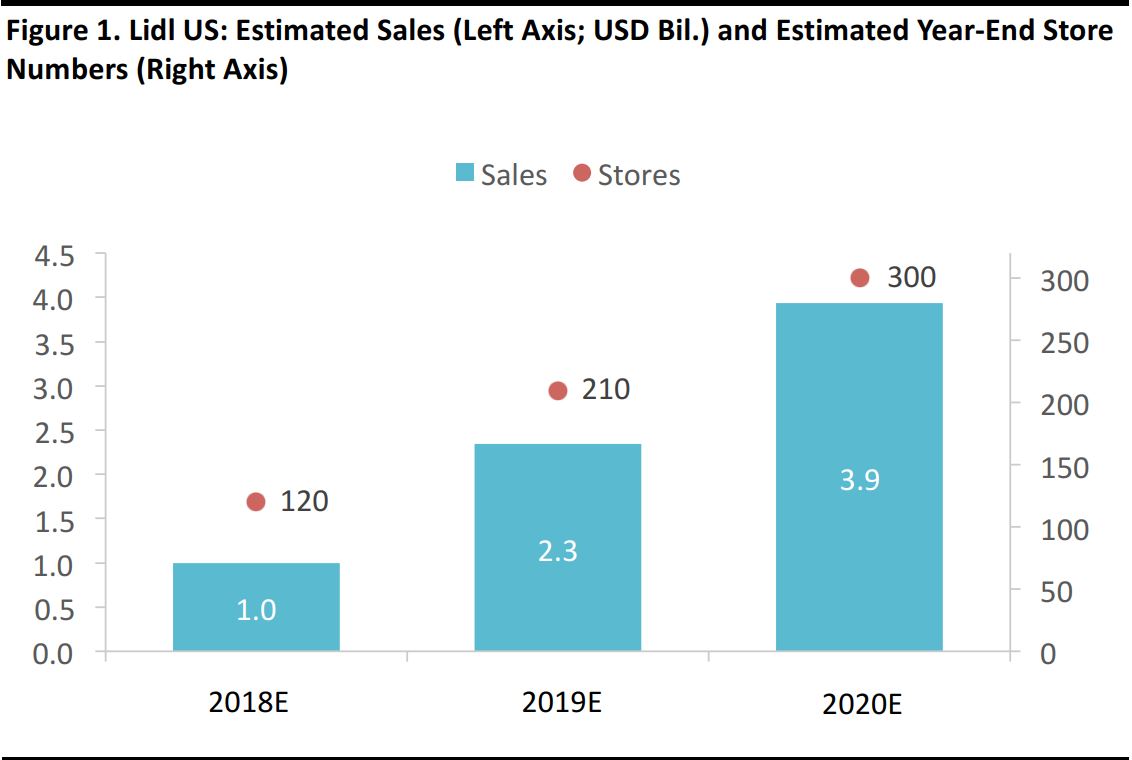

We see an approximate 1-2-4 structure to Lidl’s US sales: we estimate that the company will generate roughly $1 billion in US sales in 2018, $2 billion in 2019 and $4 billion in 2020. To put this in context, Kroger generated revenues of $115 billion in the year ended January 2017. However, revenues in the low single billions would place Lidl in the same ballpark as Ingles Market, which had $3.2 billion in sales in 2016; Sprouts Farmers Market, which had $4.3 billion in sales in 2016; and SuperValu, which had $4.8 billion in sales in 2016 (all figures are from Euromonitor). Our estimates assume that Lidl will open just under 100 new stores per year. According to The Washington Post, Lidl is planning to open 100 US stores by mid-2018. Estimates published by various research firms between autumn 2016 and spring 2017 placed the number of sites under development between 80 and 225.

Source: Fung Global Retail & Technology

Our sales estimates are based on a number of metrics, including sales densities at Aldi US, other competing US retailers and Lidl (both globally and in selected mature markets). Our estimates assume a gradual increase in average sales densities and are based on average annual store numbers.2. What Headwinds and Tailwinds Could Lidl Face?

Potential Headwinds

Lidl is not so much dipping its toes in the water as diving straight in—and it is doing so with a store format that differs from what it uses elsewhere in the world. We see the following risks associated with these decisions:- A race for space: Given the proposed pace of store openings, there is a risk that Lidl will pursue quantity of physical space over quality of location in terms of shopper access and visibility.

- Limited time to adjust: Similarly, by building out a network of stores before the first store has even opened, Lidl is limiting its ability to adjust its store formats and overall offering as it expands in the US.

- Moving into unfamiliar formats: The US stores are a departure from Lidl’s operating model in terms of size. While the size of new stores has been creeping up in discount retail in Europe, Lidl’s aim of opening stores of 36,000 gross square feet in the US is a leap into a different format for the retailer.

Potential Tailwinds

Meanwhile, we see three possible tailwinds that could drive Lidl’s growth: Consumer interest in healthy living: Grocery retailers and analysts widely recognize that there is a trend toward healthier living, including increased demand for more natural products and fresh produce. But this does not mean shoppers have limitless budgets to spend on these kinds of products. Reflecting this, Whole Foods Market has underperformed, while Walmart has bolstered its organic ranges. If Lidl uses its additional store space to offer substantial fresh food ranges, as we expect it will, the retailer could be well placed to pick up shoppers looking for fresh and natural foods on a budget.

Source: Walmart.com

The frugality of millennial shoppers: Millennials—typically characterized as those born between 1980 and 2000—are entering their peak earning and spending years. And this generation shows significant price sensitivity in grocery, which we noted in a previous report, How Millennials Disrupt Industries: Millennials and Grocery. If Lidl gets its marketing right, it may be able to mop up some of these shoppers. Incremental shifts away from superstore shopping: As more and more nongrocery purchases shift online, and as consumers’ expectations of convenience and immediacy in food shopping increase, there appear to be fewer reasons for shoppers to visit large superstores for grocery purchases. Lidl could benefit from any ongoing shift to smaller store formats that allow consumers to shop more quickly.3. Which Incumbent Retailers Look to Be Most at Risk?

To answer this question, we looked at two sets of data:- First, we analyzed our own data on Lidl’s likely regional overlap with incumbent retailers.

- Second, we looked at consumer survey data from Prosper Insights & Analytics on who shops at Aldi in the US, as understanding who shops at Aldi is one way to understand who is likely to shop at Lidl, given the similarity of formats.

Regional Overlap

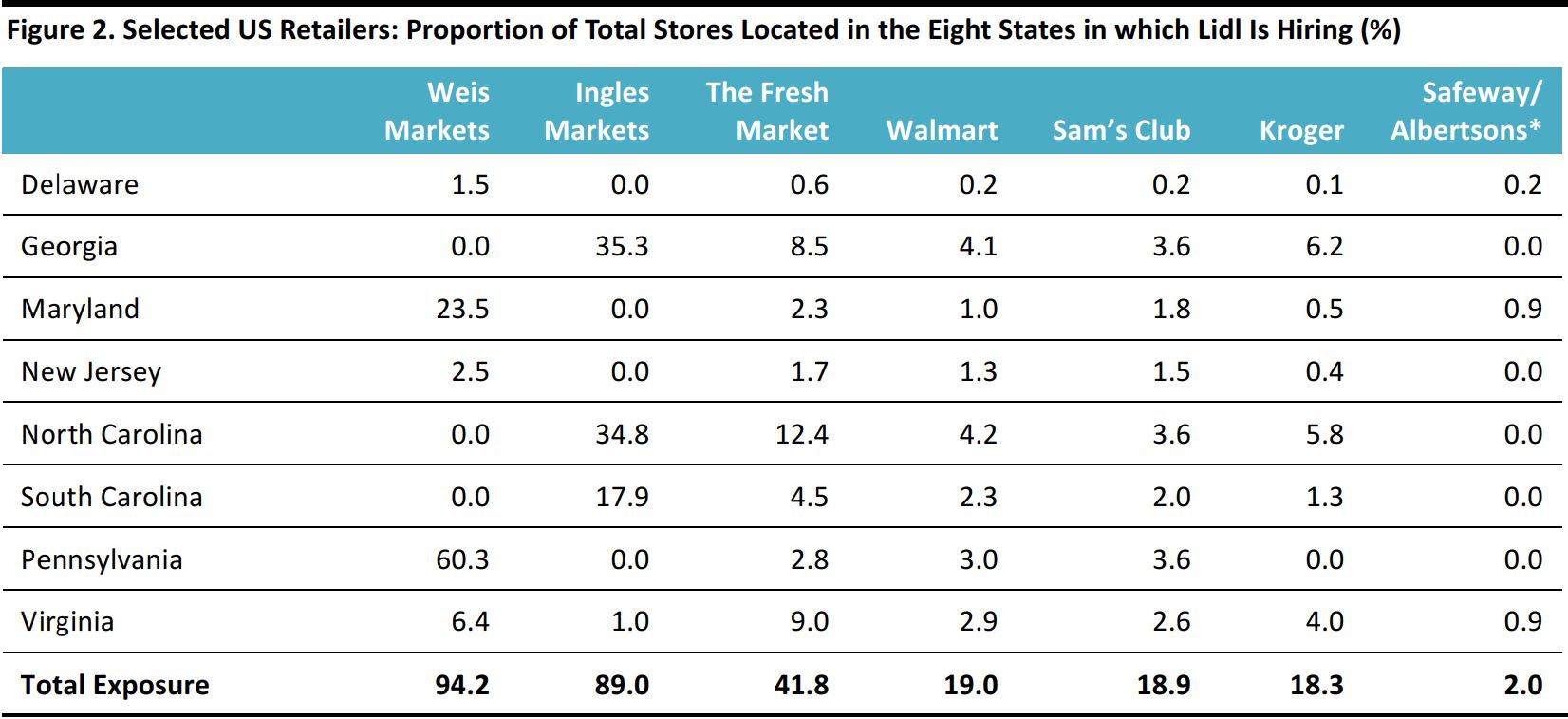

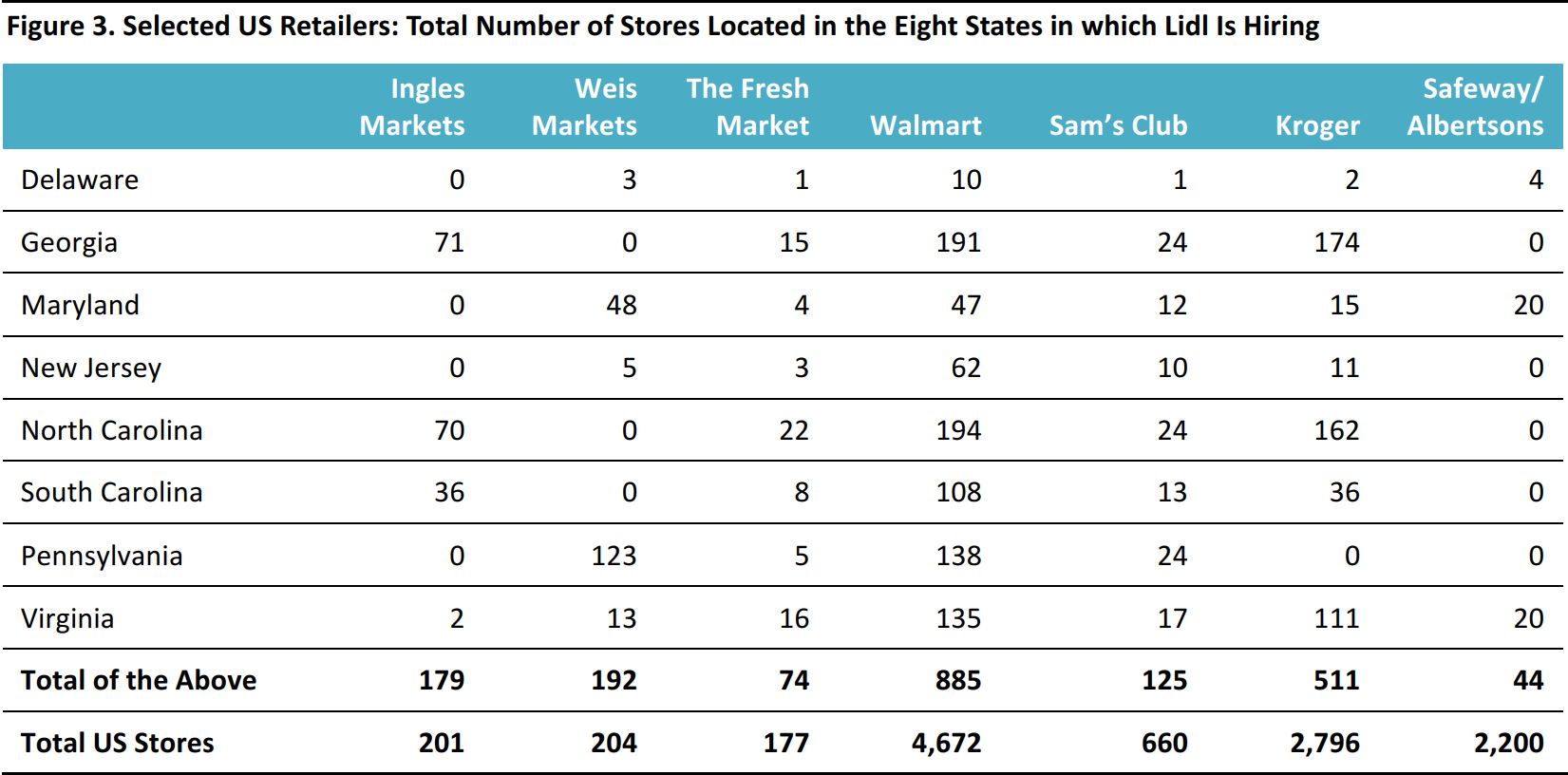

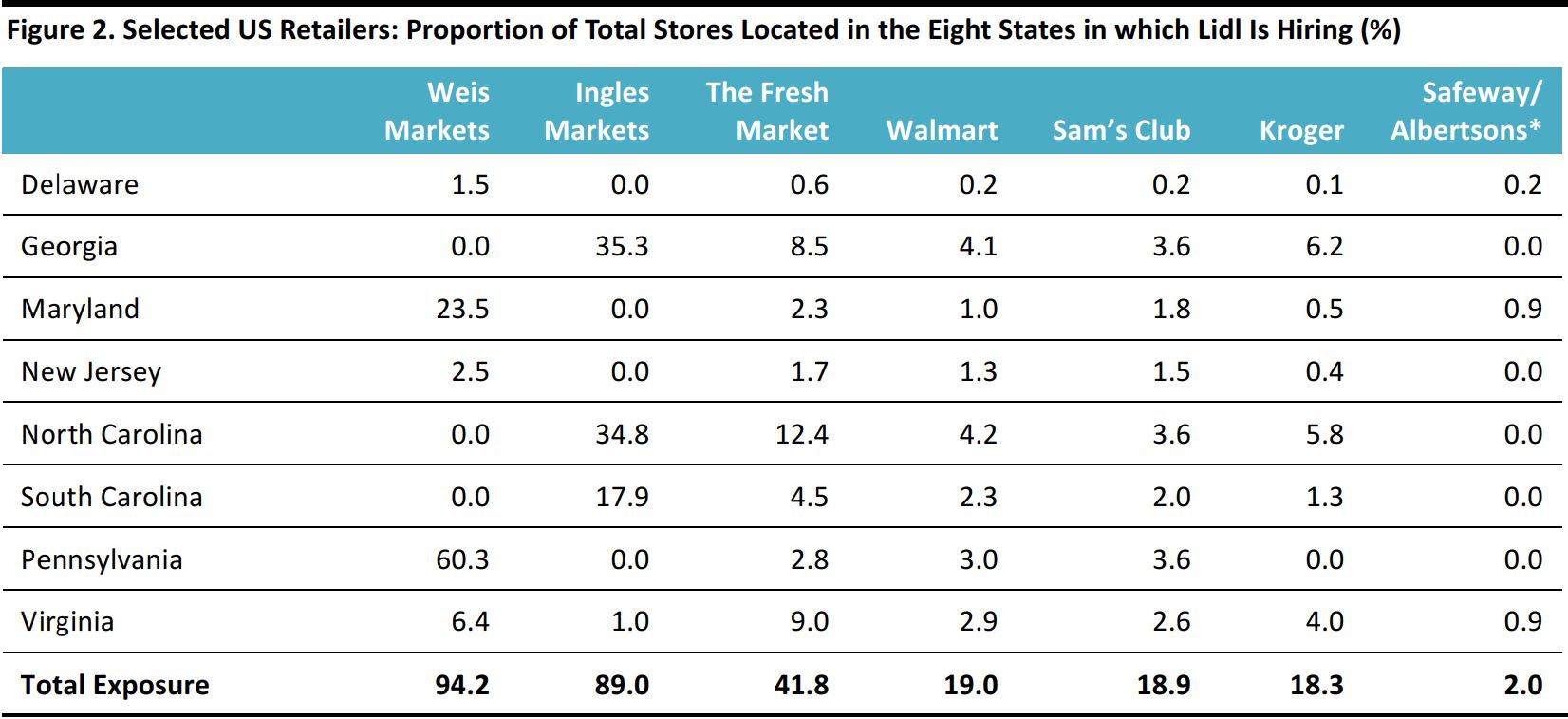

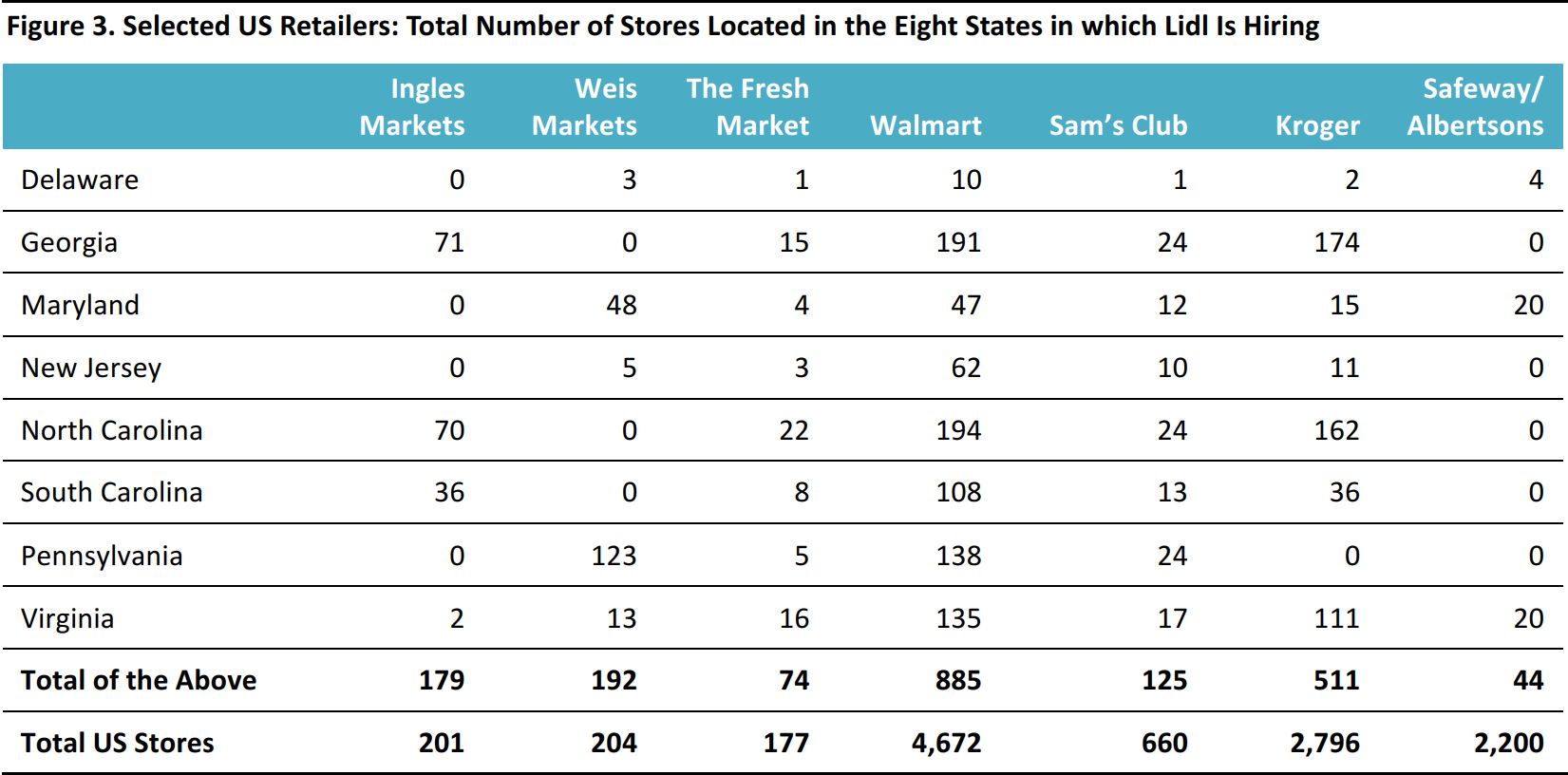

Below, we present two tables that look at selected grocery retailers’ overlap within the eight states in which Lidl apparently plans to open stores. The first table shows the percentage of selected retailers’ stores that fall within the eight states. This gives an indication of the exposure each retailer may have to new competition from Lidl, although the degree of exposure will depend on the proximity of stores within each state. The second table provides store numbers in absolute terms for the same eight states. This shows the extent of potential overlap in terms of absolute scale. The data show that Weis Markets and Ingles Markets have, by far, the greatest relative exposure to the eight states in which Lidl is hiring.

Data are as of April 2017, except for Ingles Markets, which are as of September 2016; Kroger, which are as of January 2017; and Walmart and Sam’s Club, which are as of February 2017. * Based on total Albertsons stores Source: Company reports/Fung Global Retail & Technology

In absolute terms, Walmart and Kroger have the greatest number of stores in these eight states.

Source: Company reports/Fung Global Retail & Technology

We do not have robust state-level data for Ahold Delhaize banners. These include Food Lion, Giant Carlisle, Giant Landover and Martin’s Food Markets, which are variously present in the eight states, with the exception of New Jersey, and Stop & Shop, which is present in only one of the eight listed states, New Jersey.Understanding Aldi Shoppers to Understand Lidl Shoppers

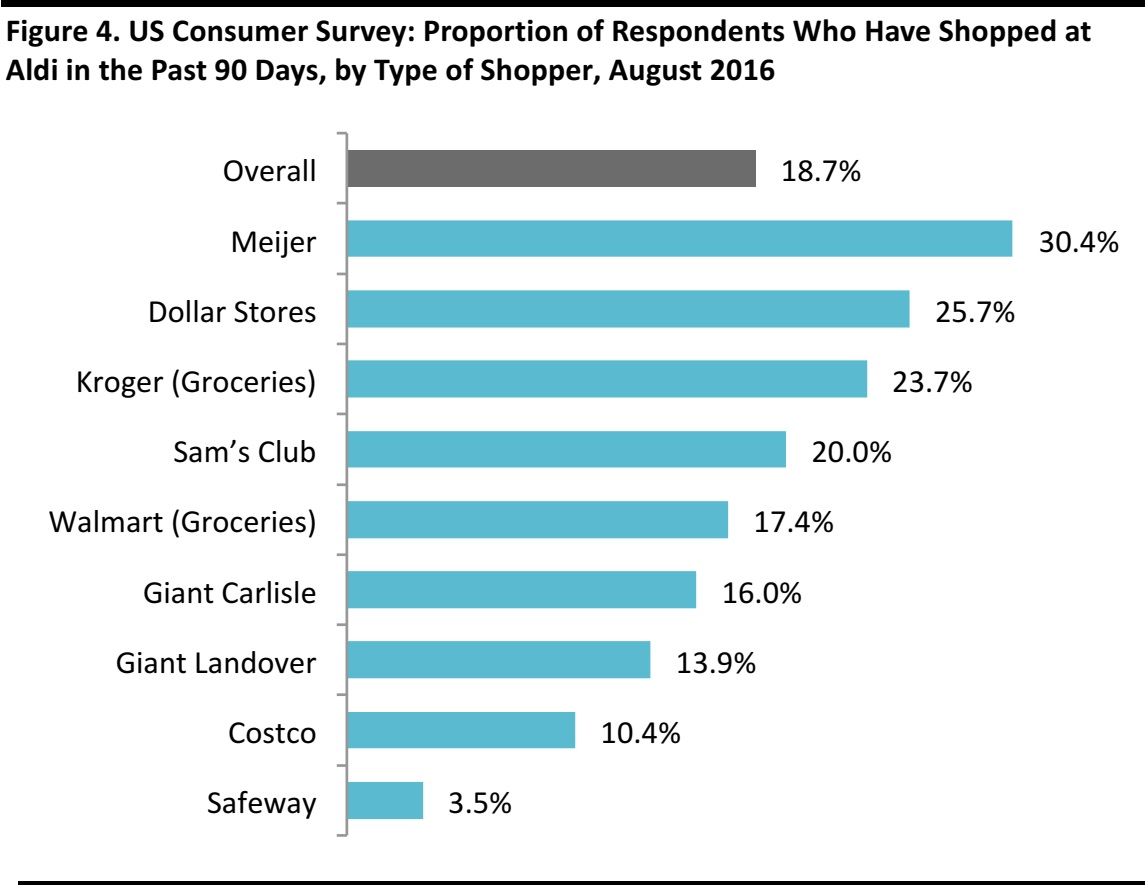

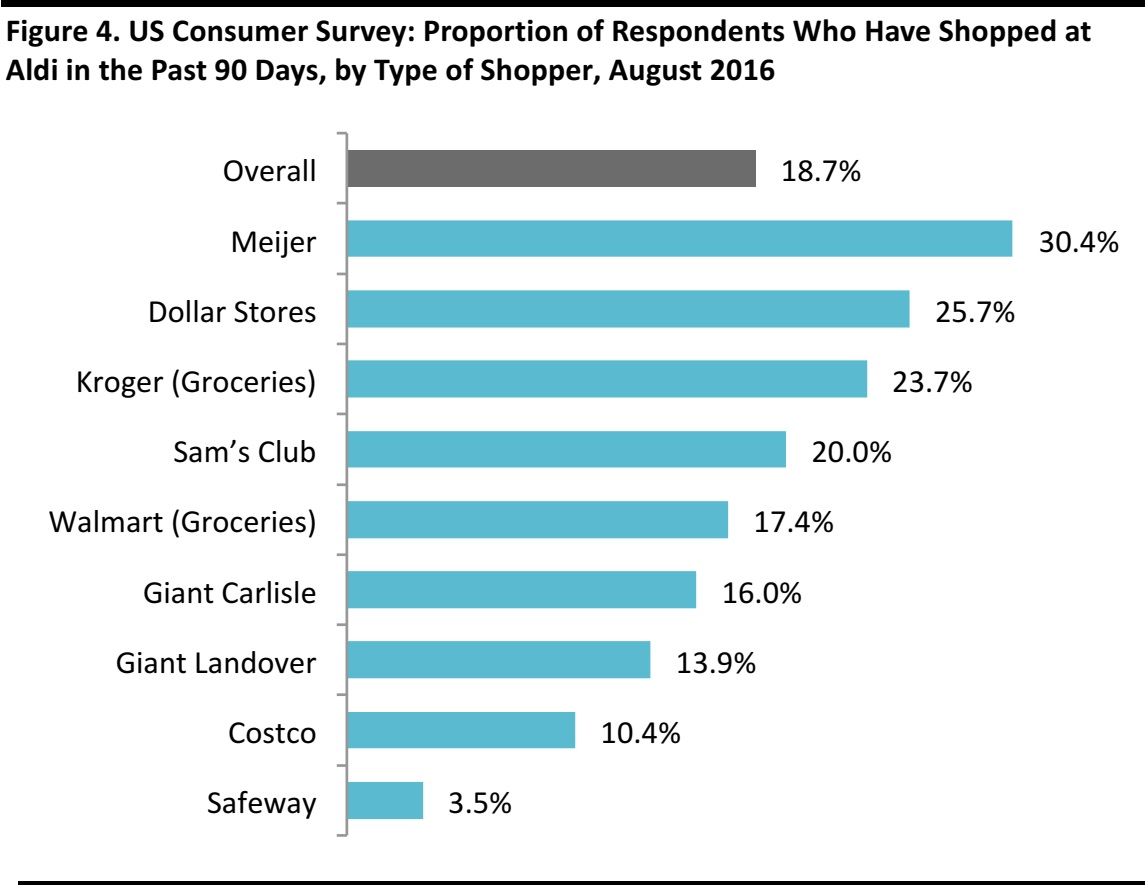

We think one way to understand who will shop at Lidl is to look at who shops at Aldi in the US, given the similarity of the companies and their comparable focus on eastern states. For this, we turn to consumer survey data from our research partner, Prosper Insights & Analytics. Prosper’s survey asked consumers where they had shopped in the past 90 days, and the data enable us to isolate at which other stores those who identify as loyal shoppers at a particular retailer also shop. One caveat to these data is that if a shopper has switched to shopping only at Aldi, they will no longer register as a shopper of the rival stores listed below. Of the grocery stores tracked by Prosper, Meijer sees the greatest overlap in customer base with Aldi, with 30% of Meijer shoppers having also shopped at Aldi in the 90 days prior to being surveyed. However, Meijer is present in Illinois, Indiana, Kentucky, Michigan, Ohio and Wisconsin—and Lidl does not currently appear to be recruiting staff in those states. After dollar stores, Kroger sees the next-biggest customer overlap with Aldi. As we noted above, Kroger sees significant geographical overlap in those states where Lidl looks to be opening stores.

A retailer’s shoppers are defined as respondents who ranked that retailer as the one they shop at most often for any category within the survey. Base: 6,915 respondents aged 18+ Source: Prosper Insights & Analytics

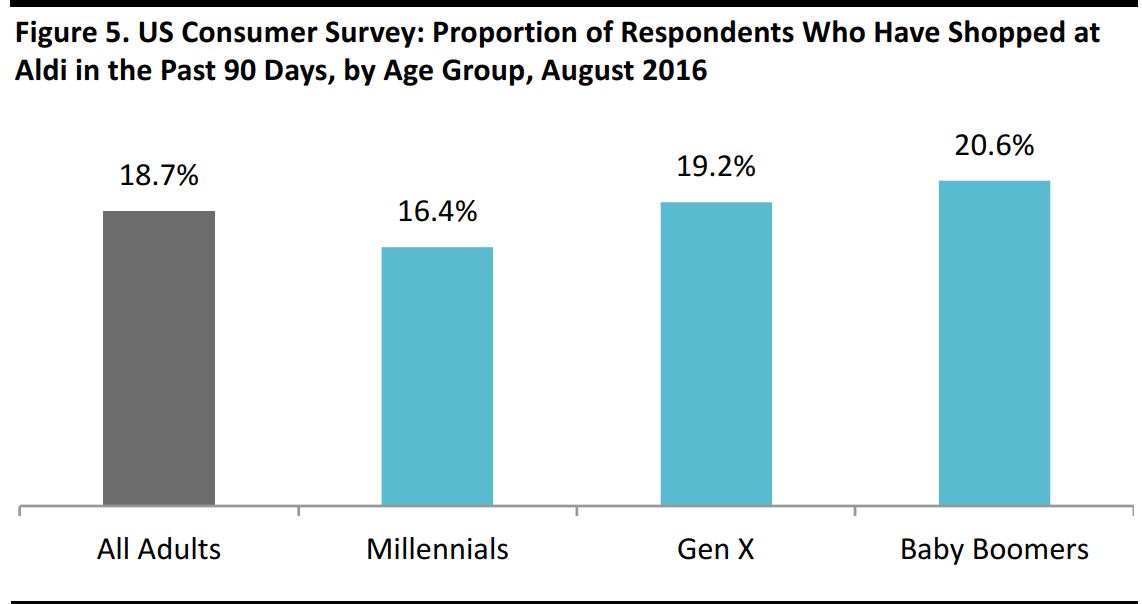

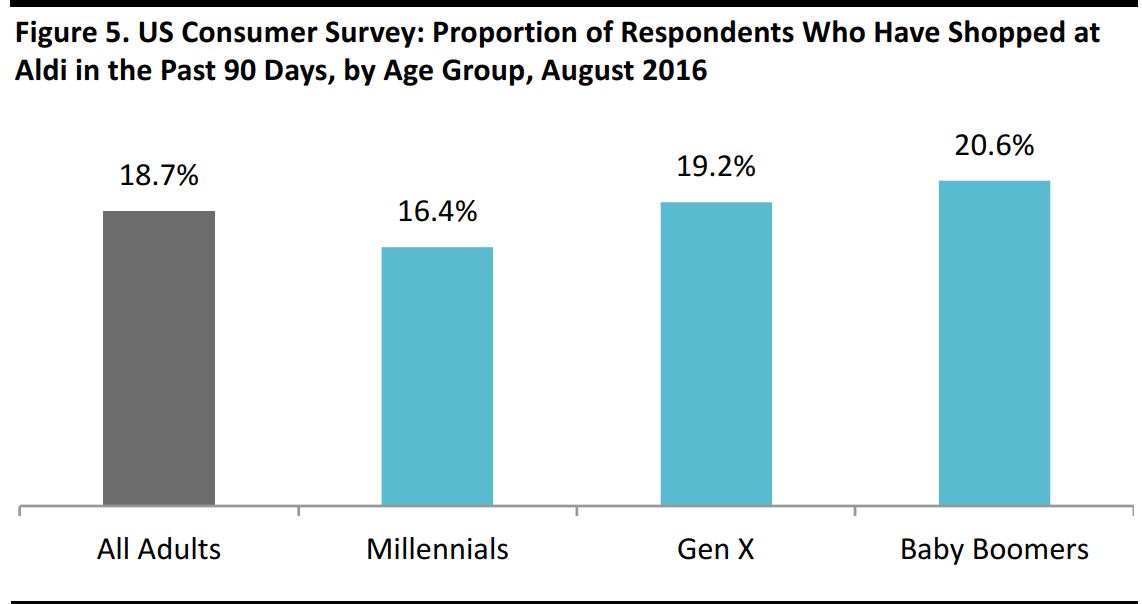

Low prices and smaller store formats may appear to resonate with millennials, but Prosper’s survey data show that this age group so far underindexes in terms of shopping at Aldi: instead, shopping at Aldi tends to increase with age. We think this represents an opportunity for Lidl to market itself to millennials who are price-conscious, but demand quality fresh foods. Figure 5. US Consumer Survey: Proportion of Respondents Who Have Shopped at Aldi in the Past 90 Days, by Age Group, August 2016

Base: 6,915 respondents aged 18+ Source: Prosper Insights & Analytics

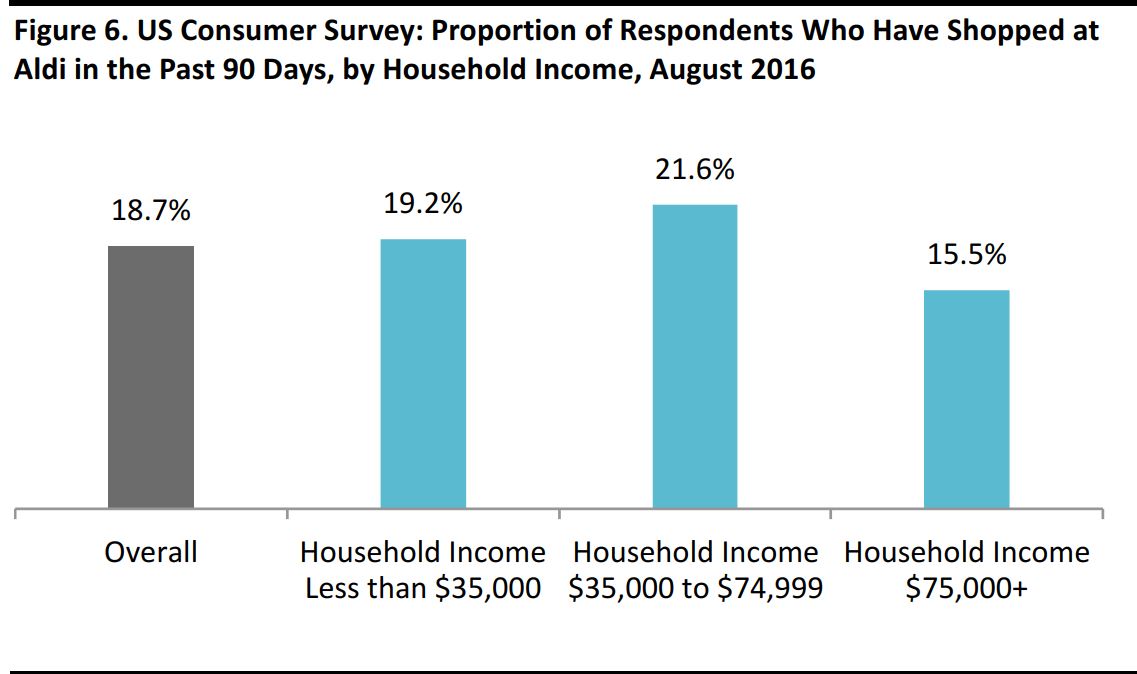

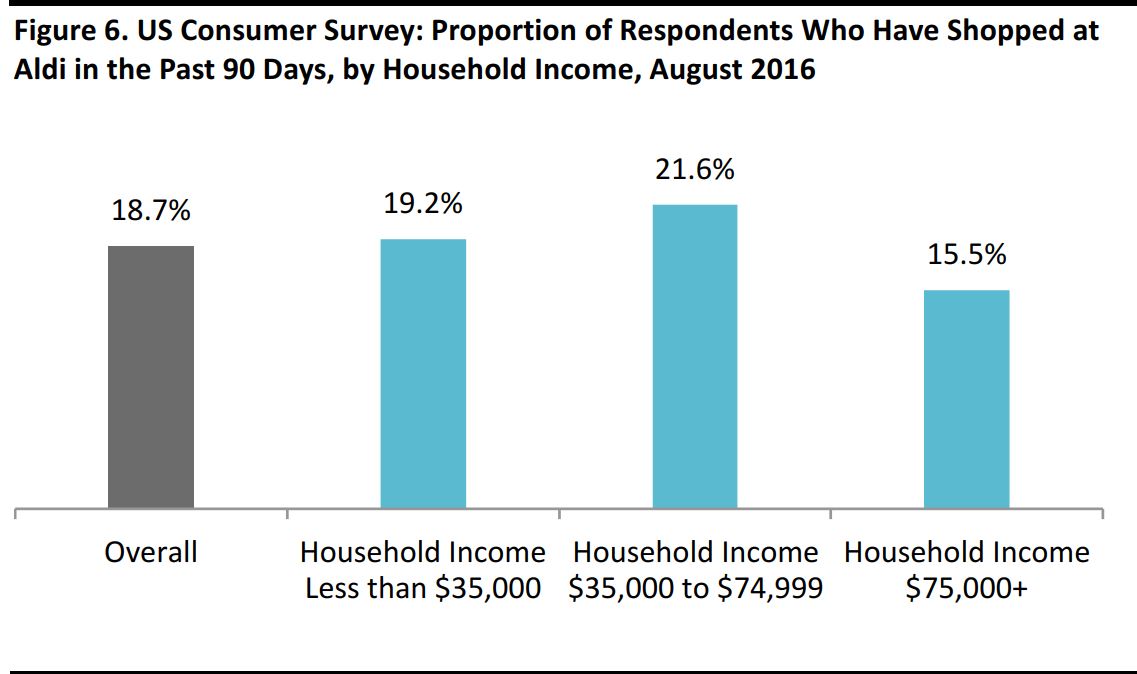

The tendency to shop at Aldi peaks among those in the middle bracket, with incomes of $35,000–$74,999. The tendency to shop at Aldi peaks not among the lowest-income households, but among those households in the middle bracket, with incomes of $35,000–$74,999.