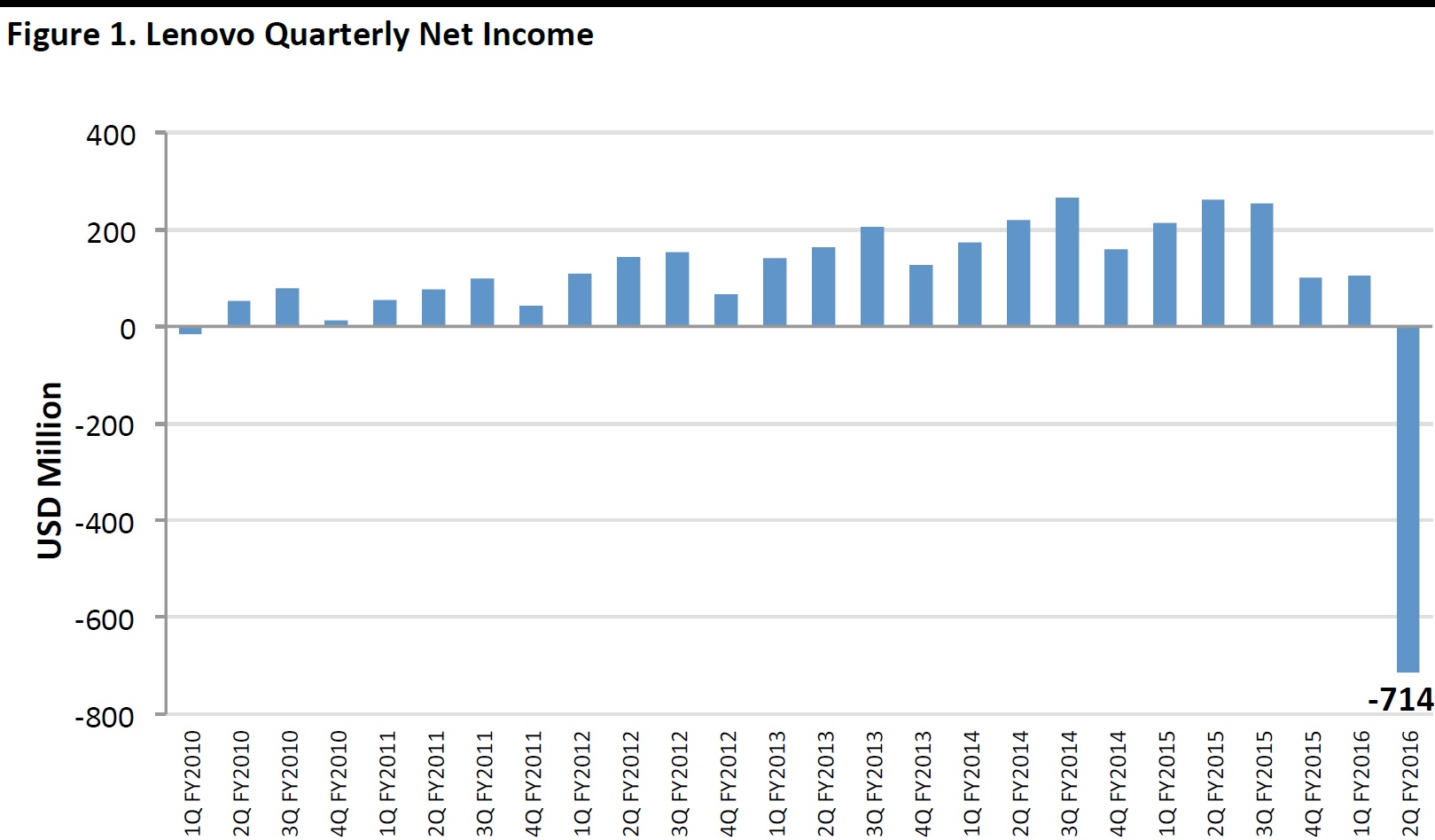

Results Were Better than Analysts Had Expected

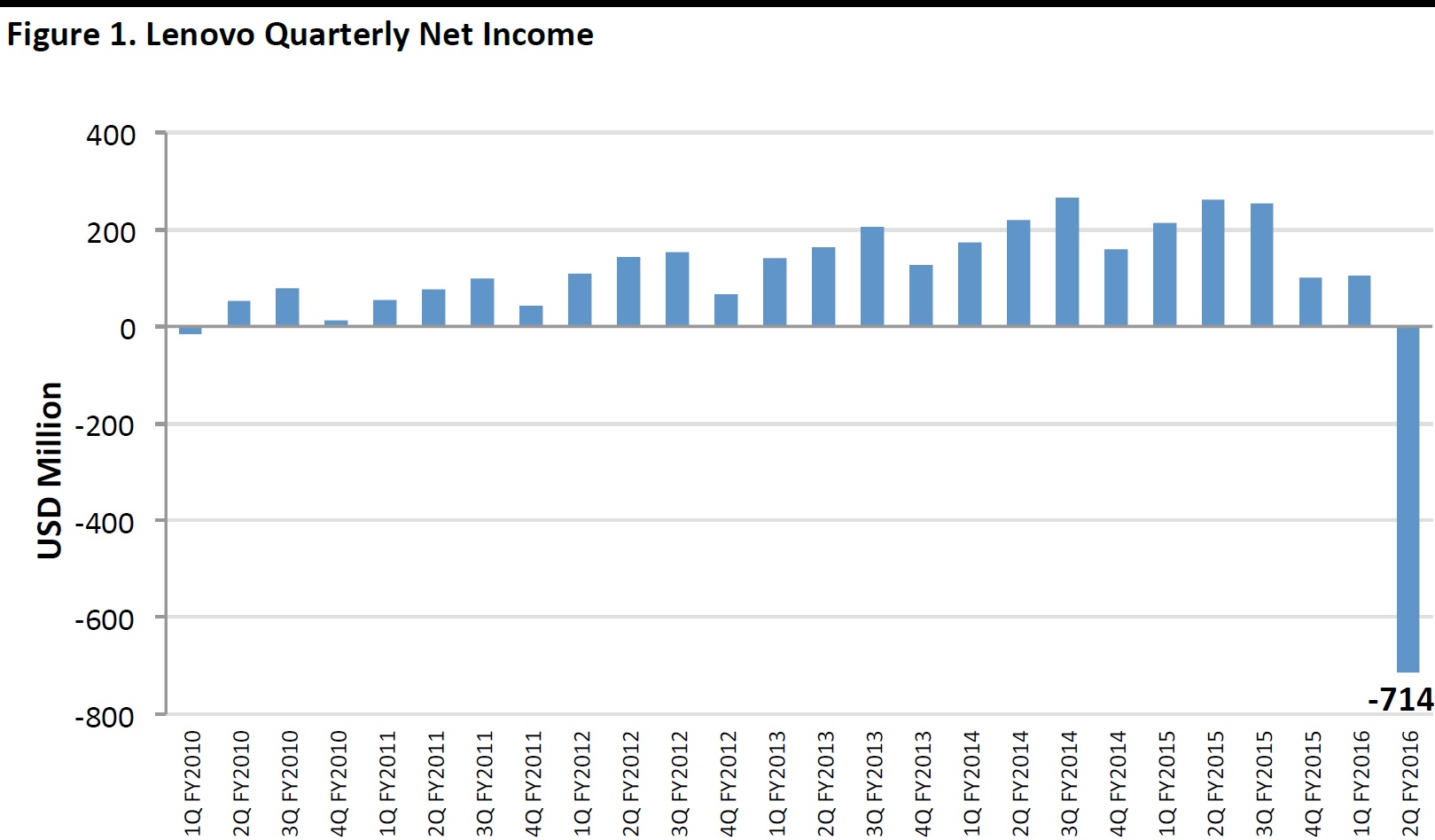

On November 12, Lenovo reported its first net loss since 2009 in its second-quarter results for fiscal year 2016—yet the company’s shares traded up 7.53% the day following the financial release. Investors felt bullish on Lenovo the following day because analysts had expected even gloomier results:

- Lenovo’s net loss was US$714 million, but the consensus estimate from S&P Capital IQ was for an even bigger loss, of US$793.67 million.

- Revenue grew by 16% year over year, to US$12.2 billion, while the consensus figure was lower, at US$11.8 billion.

- Earnings per share were down by 6 basis points, but that beat consensus expectations of a decline of 7 basis points.

So what happened? Why did Lenovo incur a profit loss? And why did second-quarter results beat analysts’ expectations?

Source: S&P Capital IQ

What Caused the Loss: One-Off Expenses and Restructuring Costs

Lenovo concluded two important acquisitions during the third quarter of its 2015 fiscal year:

- Motorola: Lenovo completed its acquisition of Motorola—the US-based telecommunications company and inventor of the first handheld portable phone—from previous owner Google on October 30, 2014, in a bid to increase its share of the global smartphone market. With the move, Lenovo became the third-largest smartphone manufacturer after Apple and Samsung, and ensured it would have a significant presence outside China, particularly in mature markets such as the US and Europe.

- x86 Server: Lenovo completed its acquisition of x86 Server—an IT system for companies—from IBM on October 1, 2014, through which it became the third-largest provider of x86-based server hardware, software and services.

As a result of these two acquisitions, Lenovo incurred one-off restructuring costs of US$599 million, which were accounted for in the second quarter. Following the Motorola acquisition, Lenovo engaged in a review of its mobile business, with the aim of clearing off its smartphone inventory and focusing on a simpler and more clearly differentiated range of models. This included a US$324 million write-down on smartphone inventory in the second quarter of fiscal year 2016.

Without the onetime costs, Lenovo’s pretax profits would have been US$166 million in the second quarter, down 50% from the second quarter of fiscal year 2015. The year-over-year slowdown that the company would have incurred even without the restructuring costs signals that there are factors beyond the restructuring costs that impacted profitability—and these appear to lie in challenging market conditions.

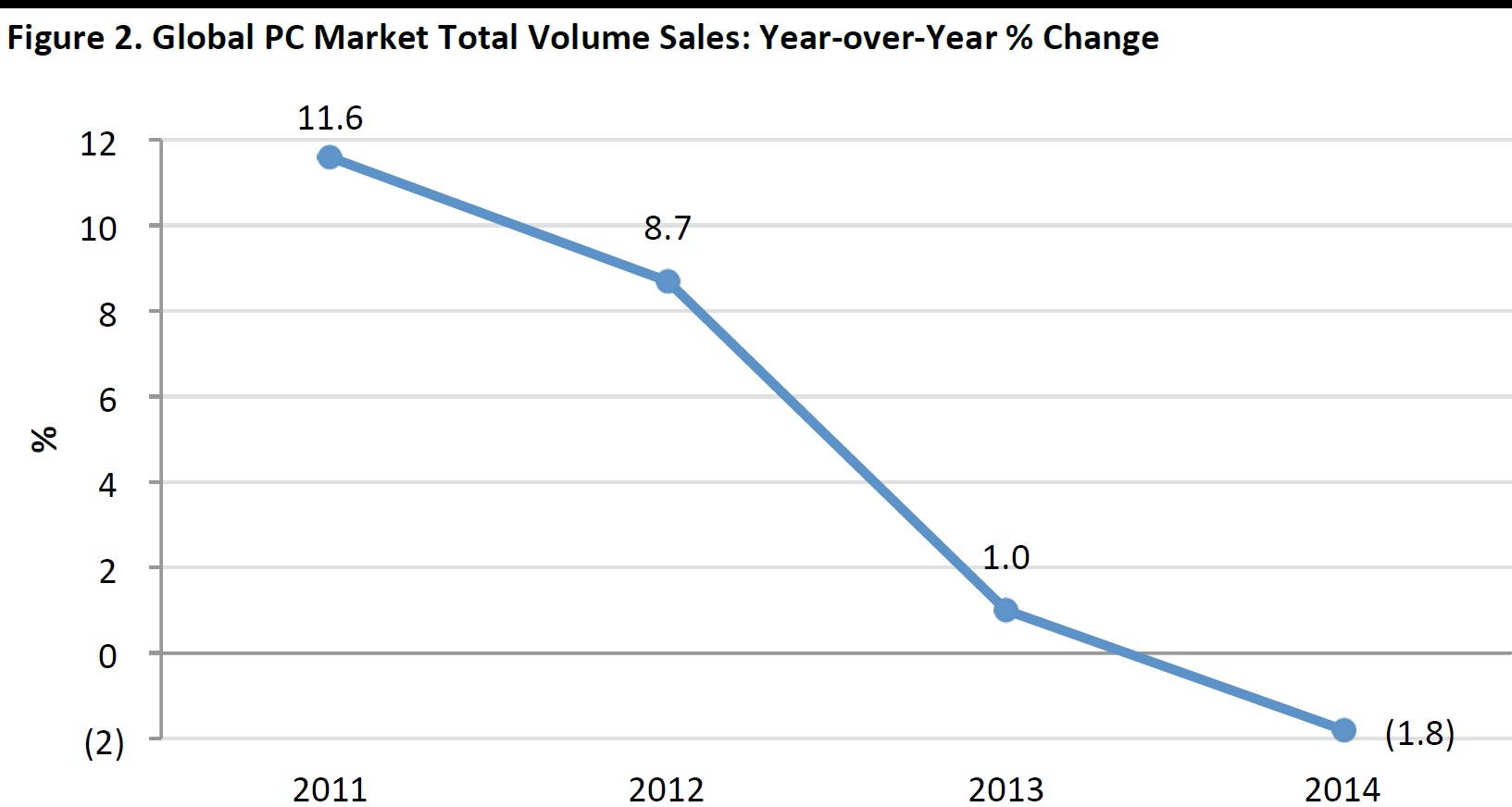

Why Was the Consensus Estimate Lower than the Actual Results? The Impact of the Challenging Market

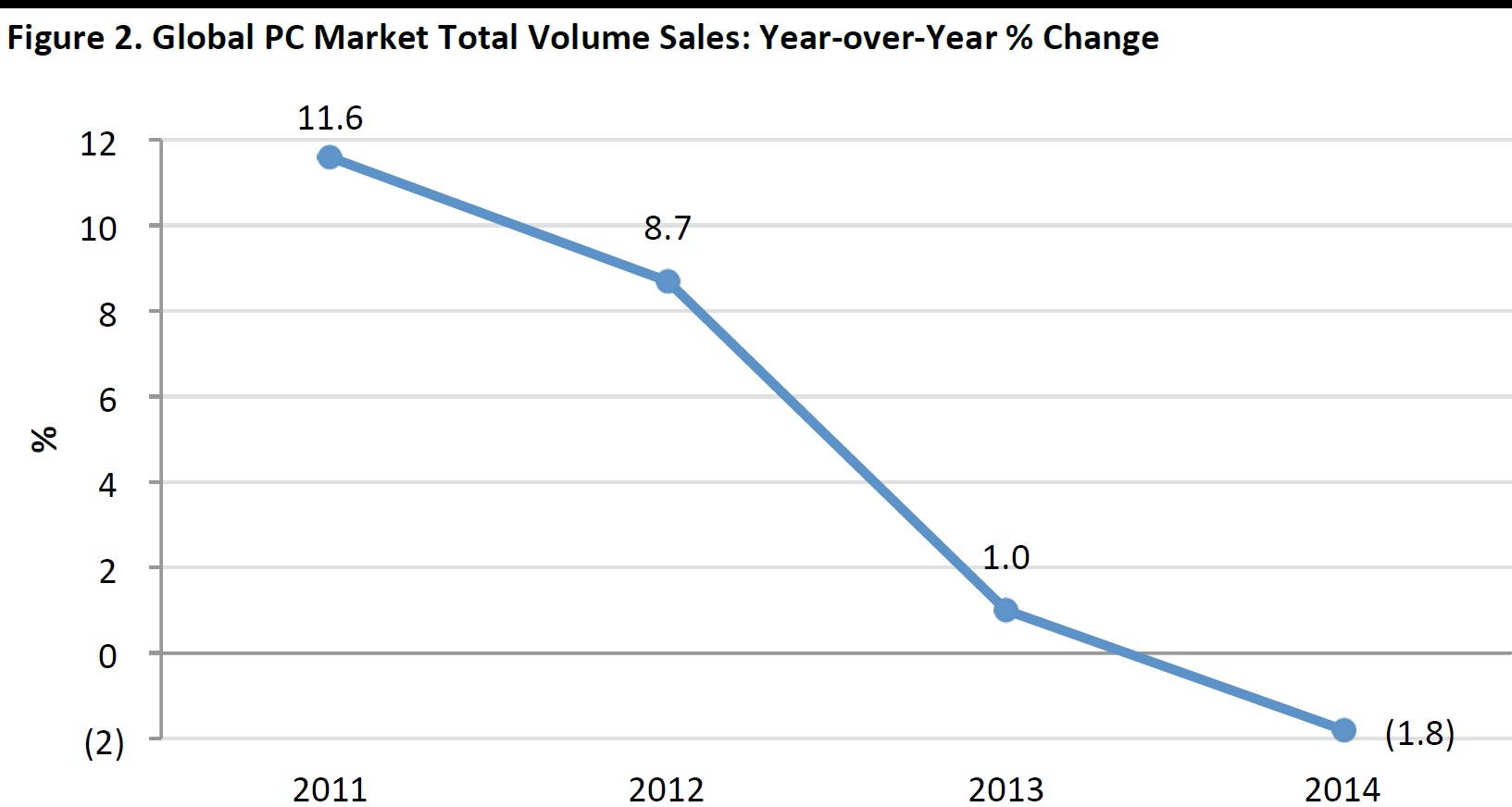

Lenovo faces a tough environment, with PC sales declining and growing competition in the smartphone industry in China, the company’s domestic market. PC volume sales declined by almost 2% globally in 2014, according to Euromonitor International estimates

:

Source: Euromonitor International

Lenovo’s PC sales declined by 17% year over year in the second quarter of fiscal year 2016, but the company remains the leading PC vendor globally—a position it attained after it took over IBM’s PC business in 2005—with a market share of 21.2%, according to the company’s financial release.

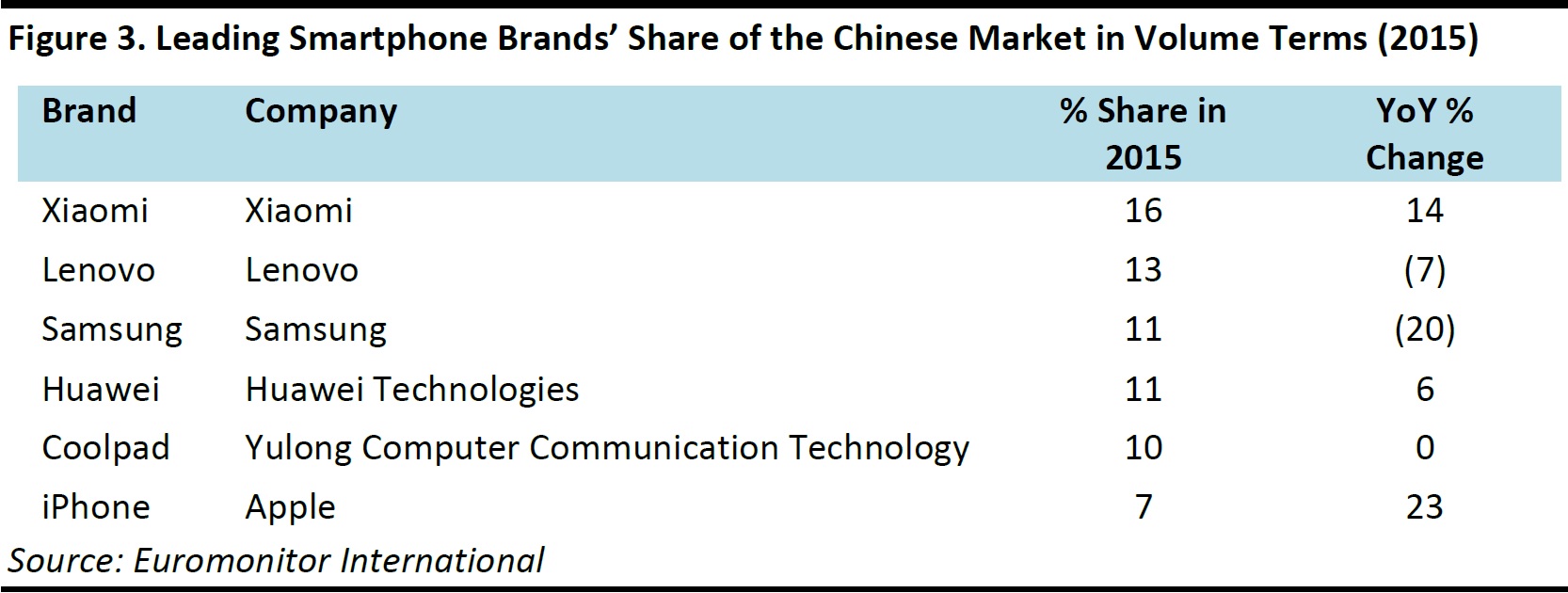

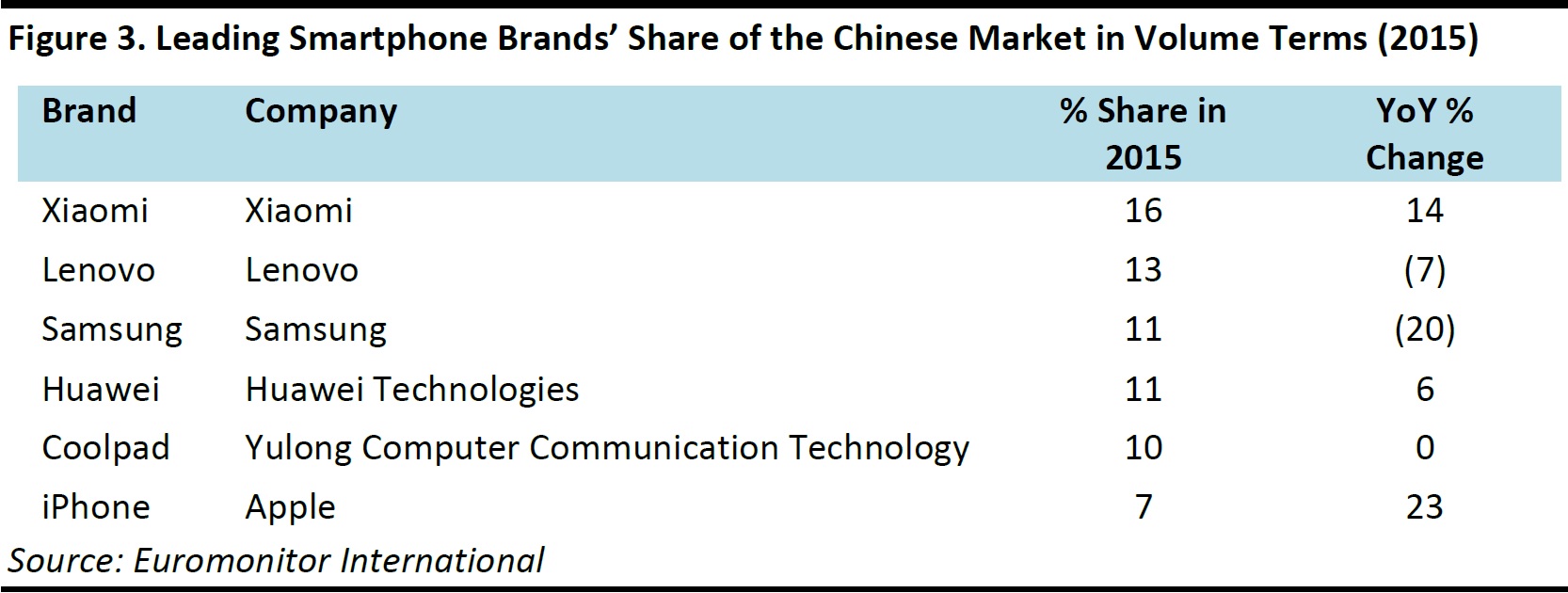

In smartphones, Lenovo faces an increasingly competitive domestic market. The company retained its second-place position in 2015, but lost market share to domestic manufacturers Xiaomi and Huawei and international competitor Apple, according to Euromonitor International.

Source: Euromonitor International

Lenovo’s mobile business grew by 104% year over year in the second quarter, following the acquisition of Motorola, but Lenovo’s smartphone sales in China slowed. While we do not have a specific figure, the company commented that its overall sales in China declined by 12% year over year mainly because of the performance in mobile.

Focus Outside China Paid Off

China is Lenovo’s main market; it contributed 32% of the company’s total revenue at the end of fiscal year 2015, but that figure was down by six percentage points compared to the end of the previous fiscal year.

The acquisition of Motorola is part of Lenovo’s strategy of geographical diversification, as the brand is used by the company to expand in mature markets such as Europe and the US. In emerging markets, Lenovo continues to focus on penetrating the smartphone market through its Lenovo brand. The proportion of overseas sales of smartphones grew from 20% to 70% of Lenovo’s total smartphone sales in the first half of fiscal year 2016, thanks to the company’s strategic focus on overseas markets and the Motorola acquisition.

Lenovo’s shift in focus from China to the rest of the world—in particular to less saturated emerging markets—rewarded it with significant sales growth, to an extent that exceeded analysts’ expectations. For instance, smartphone sales in India and Russia grew by 70% and 160%, respectively, during the second quarter of fiscal year 2016, according to Lenovo’s sources and as reported by the

Financial Times.

Cost Cuts Should Bring Further Growth

On August 12, Lenovo announced it would lay off 3,200 people in nonmanufacturing positions around the world—about 6% of its total global workforce—as part of an effort to increase efficiency and cope better with the challenging market conditions.

Altogether, the company expects that the restructuring efforts will deliver cost savings of about US$650 million during the second half of fiscal year 2016 and, going forward, savings of about US$1.35 billion per year. This should make Lenovo—in the words of CEO Yang Yuanqing—more competitive, and allow it to unleash further resources that can be used for investments in new areas and to more aggressively tackle competitors.

Expected Return to Profit in Challenging Market Conditions

Lenovo is expected to return to profit in the third quarter of fiscal year 2016 by delivering US$235.86 million in net profit, and to grow total sales in fiscal year 2016 by 3% year over year, according to consensus estimates from S&P Capital IQ.

However, the market is expected to remain challenging, with PC sales, which are Lenovo’s core business, likely to continue their decline. And the smartphone market is expected to become even more competitive in China.

It remains to be seen whether Lenovo’s strategy of targeting less saturated emerging markets such as India and Russia will continue to deliver sales growth.