albert Chan

On January 27, The Mail on Sunday broke two stories relating to U.K. market-leading retailers:

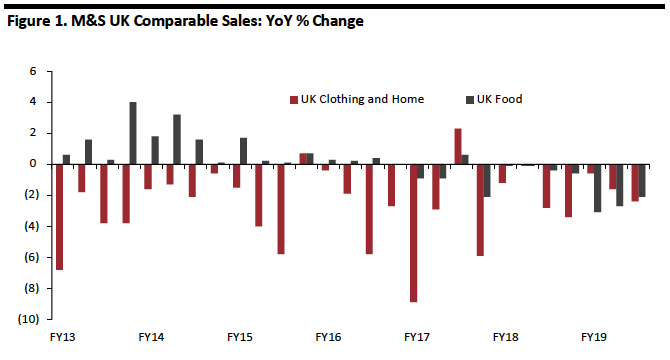

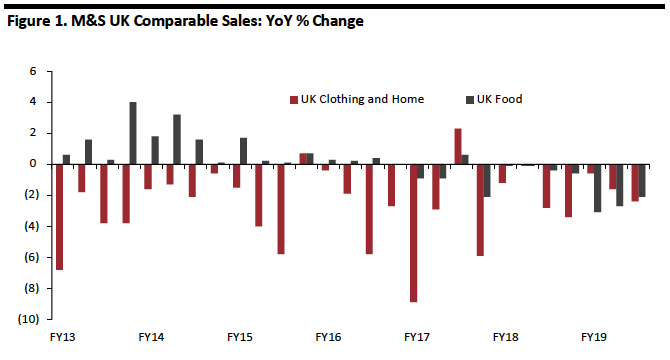

Through 3Q19

Through 3Q19

Source: Company reports[/caption] What It Means Both moves underscore the pinch legacy retailers are feeling from twin structural shifts in European retail: the shift of spending to discount formats and to e-commerce. Incumbent retailers are looking to strip out costs and tap new revenue streams in e-commerce, including by wholesaling to online names such as Amazon and Ocado. Readers may also be interested in the following recent reports:

- Tesco is planning to close meat, fish and delicatessen counters across a raft of stores, and reduce opening hours of counters in some stores. The Mail reported this could cost 15,000 jobs, though Tesco subsequently estimated it would impact 9,000 roles.

- M&S and Ocado are in talks for some form of partnership: The Mail reported that “M&S would buy key distribution centers, delivery vans and lorries” from Ocado, and suggesting that M&S would replace grocery rival Waitrose as a key supplier of grocery products to Ocado.

Through 3Q19

Through 3Q19Source: Company reports[/caption] What It Means Both moves underscore the pinch legacy retailers are feeling from twin structural shifts in European retail: the shift of spending to discount formats and to e-commerce. Incumbent retailers are looking to strip out costs and tap new revenue streams in e-commerce, including by wholesaling to online names such as Amazon and Ocado. Readers may also be interested in the following recent reports: