albert Chan

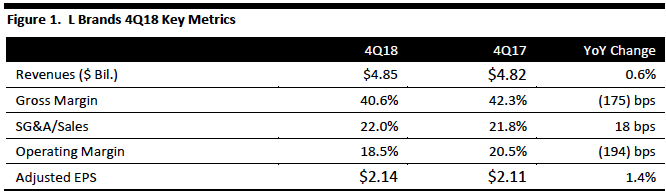

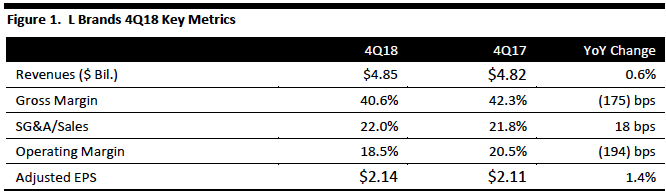

[caption id="attachment_78476" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

L Brands fiscal 4Q18 revenues were $4.85 billion, up 0.6% year over year and lower than the consensus estimate of $4.91 billion. The company reported 4Q18 adjusted EPS of $2.14, higher than the consensus estimate of $2.08, and above the company’s guidance of $1.90-2.10.

Revenues for 2018 were $12.2 billion, a 4.8% increase over the year ago period in which revenues were $12.6 billion. In 2018, the company closed the Henri Bendel division and sold its La Senza business.

Management highlighted that it is focused on improving performance in Victoria’s Secret. It is focused on staying close to the customer, improving the customer experience in store and online, and improving its assortment. The company has new CEOs at Victoria’s Secret Lingerie and PINK, John Mehas and Amy Hauk.

Overall, comparable sales increased 3% for the 13-week fourth quarter. By brand, Victoria’ Secret comparable sales decreased 3% in the fourth quarter, compared to a 1% decrease in the year ago period. Management commented that fourth quarter lingerie business comps were approximately flat while substantial growth in sleepwear was offset by a decline in intimate apparel. For PINK, comps decreased in the low-double digit range with the most significant decline in the loungewear category. Victoria’s Secret Beauty comps increased in the mid-single-digit range. Holiday performance was below expectations. Bath & Body Works comparable sales for its stores and direct business increased 12% for the quarter, compared to a 6% increase in the year ago period. Sales across the quarter were driven by strong growth in all three main categories of body care, home fragrance and soaps.

Management said it will actively manage its real estate portfolio. Over the past ten years it has opened 820 stores, closed 673 stores and sold 130 stores. Approximately one third of its stores are located in non-mall locations.

The company announced a 3% reduction in square footage of Victoria Secret stores and a 3% increase in Bath & Body Works stores. There were 1,143 Victoria’s Secret stores in the United States and Canada as of February 2, 2019. Management reported that given the decline in performance at Victoria’s Secret, it plans to close 53 stores in North America in its US and Canada stores. Victoria’s Secret closed 30 stores in 2018, and management stated that the company has closed an average of 15 stores per year.

Management reported overall spending on stores will decline from about 75% of total capital expenditures in 2018 to 55% in 2019.

Management said it plans to grow its international business in 2019, opening between 100 to 120 company-owned and partner-owned stores, skewed more towards partner-owned stores, looking for strong growth in China.

The company plans to increase investment in technology and logistics substantially in 2019 to support digital business and other retail capabilities.

Outlook

The company expects 2019 full-year earnings per share (EPS) to be between $2.20-2.60, below the consensus estimate of $2.71. 1Q19 EPS is expected to be breakeven, which is $0.12 below consensus estimate.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

L Brands fiscal 4Q18 revenues were $4.85 billion, up 0.6% year over year and lower than the consensus estimate of $4.91 billion. The company reported 4Q18 adjusted EPS of $2.14, higher than the consensus estimate of $2.08, and above the company’s guidance of $1.90-2.10.

Revenues for 2018 were $12.2 billion, a 4.8% increase over the year ago period in which revenues were $12.6 billion. In 2018, the company closed the Henri Bendel division and sold its La Senza business.

Management highlighted that it is focused on improving performance in Victoria’s Secret. It is focused on staying close to the customer, improving the customer experience in store and online, and improving its assortment. The company has new CEOs at Victoria’s Secret Lingerie and PINK, John Mehas and Amy Hauk.

Overall, comparable sales increased 3% for the 13-week fourth quarter. By brand, Victoria’ Secret comparable sales decreased 3% in the fourth quarter, compared to a 1% decrease in the year ago period. Management commented that fourth quarter lingerie business comps were approximately flat while substantial growth in sleepwear was offset by a decline in intimate apparel. For PINK, comps decreased in the low-double digit range with the most significant decline in the loungewear category. Victoria’s Secret Beauty comps increased in the mid-single-digit range. Holiday performance was below expectations. Bath & Body Works comparable sales for its stores and direct business increased 12% for the quarter, compared to a 6% increase in the year ago period. Sales across the quarter were driven by strong growth in all three main categories of body care, home fragrance and soaps.

Management said it will actively manage its real estate portfolio. Over the past ten years it has opened 820 stores, closed 673 stores and sold 130 stores. Approximately one third of its stores are located in non-mall locations.

The company announced a 3% reduction in square footage of Victoria Secret stores and a 3% increase in Bath & Body Works stores. There were 1,143 Victoria’s Secret stores in the United States and Canada as of February 2, 2019. Management reported that given the decline in performance at Victoria’s Secret, it plans to close 53 stores in North America in its US and Canada stores. Victoria’s Secret closed 30 stores in 2018, and management stated that the company has closed an average of 15 stores per year.

Management reported overall spending on stores will decline from about 75% of total capital expenditures in 2018 to 55% in 2019.

Management said it plans to grow its international business in 2019, opening between 100 to 120 company-owned and partner-owned stores, skewed more towards partner-owned stores, looking for strong growth in China.

The company plans to increase investment in technology and logistics substantially in 2019 to support digital business and other retail capabilities.

Outlook

The company expects 2019 full-year earnings per share (EPS) to be between $2.20-2.60, below the consensus estimate of $2.71. 1Q19 EPS is expected to be breakeven, which is $0.12 below consensus estimate.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

L Brands fiscal 4Q18 revenues were $4.85 billion, up 0.6% year over year and lower than the consensus estimate of $4.91 billion. The company reported 4Q18 adjusted EPS of $2.14, higher than the consensus estimate of $2.08, and above the company’s guidance of $1.90-2.10.

Revenues for 2018 were $12.2 billion, a 4.8% increase over the year ago period in which revenues were $12.6 billion. In 2018, the company closed the Henri Bendel division and sold its La Senza business.

Management highlighted that it is focused on improving performance in Victoria’s Secret. It is focused on staying close to the customer, improving the customer experience in store and online, and improving its assortment. The company has new CEOs at Victoria’s Secret Lingerie and PINK, John Mehas and Amy Hauk.

Overall, comparable sales increased 3% for the 13-week fourth quarter. By brand, Victoria’ Secret comparable sales decreased 3% in the fourth quarter, compared to a 1% decrease in the year ago period. Management commented that fourth quarter lingerie business comps were approximately flat while substantial growth in sleepwear was offset by a decline in intimate apparel. For PINK, comps decreased in the low-double digit range with the most significant decline in the loungewear category. Victoria’s Secret Beauty comps increased in the mid-single-digit range. Holiday performance was below expectations. Bath & Body Works comparable sales for its stores and direct business increased 12% for the quarter, compared to a 6% increase in the year ago period. Sales across the quarter were driven by strong growth in all three main categories of body care, home fragrance and soaps.

Management said it will actively manage its real estate portfolio. Over the past ten years it has opened 820 stores, closed 673 stores and sold 130 stores. Approximately one third of its stores are located in non-mall locations.

The company announced a 3% reduction in square footage of Victoria Secret stores and a 3% increase in Bath & Body Works stores. There were 1,143 Victoria’s Secret stores in the United States and Canada as of February 2, 2019. Management reported that given the decline in performance at Victoria’s Secret, it plans to close 53 stores in North America in its US and Canada stores. Victoria’s Secret closed 30 stores in 2018, and management stated that the company has closed an average of 15 stores per year.

Management reported overall spending on stores will decline from about 75% of total capital expenditures in 2018 to 55% in 2019.

Management said it plans to grow its international business in 2019, opening between 100 to 120 company-owned and partner-owned stores, skewed more towards partner-owned stores, looking for strong growth in China.

The company plans to increase investment in technology and logistics substantially in 2019 to support digital business and other retail capabilities.

Outlook

The company expects 2019 full-year earnings per share (EPS) to be between $2.20-2.60, below the consensus estimate of $2.71. 1Q19 EPS is expected to be breakeven, which is $0.12 below consensus estimate.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

L Brands fiscal 4Q18 revenues were $4.85 billion, up 0.6% year over year and lower than the consensus estimate of $4.91 billion. The company reported 4Q18 adjusted EPS of $2.14, higher than the consensus estimate of $2.08, and above the company’s guidance of $1.90-2.10.

Revenues for 2018 were $12.2 billion, a 4.8% increase over the year ago period in which revenues were $12.6 billion. In 2018, the company closed the Henri Bendel division and sold its La Senza business.

Management highlighted that it is focused on improving performance in Victoria’s Secret. It is focused on staying close to the customer, improving the customer experience in store and online, and improving its assortment. The company has new CEOs at Victoria’s Secret Lingerie and PINK, John Mehas and Amy Hauk.

Overall, comparable sales increased 3% for the 13-week fourth quarter. By brand, Victoria’ Secret comparable sales decreased 3% in the fourth quarter, compared to a 1% decrease in the year ago period. Management commented that fourth quarter lingerie business comps were approximately flat while substantial growth in sleepwear was offset by a decline in intimate apparel. For PINK, comps decreased in the low-double digit range with the most significant decline in the loungewear category. Victoria’s Secret Beauty comps increased in the mid-single-digit range. Holiday performance was below expectations. Bath & Body Works comparable sales for its stores and direct business increased 12% for the quarter, compared to a 6% increase in the year ago period. Sales across the quarter were driven by strong growth in all three main categories of body care, home fragrance and soaps.

Management said it will actively manage its real estate portfolio. Over the past ten years it has opened 820 stores, closed 673 stores and sold 130 stores. Approximately one third of its stores are located in non-mall locations.

The company announced a 3% reduction in square footage of Victoria Secret stores and a 3% increase in Bath & Body Works stores. There were 1,143 Victoria’s Secret stores in the United States and Canada as of February 2, 2019. Management reported that given the decline in performance at Victoria’s Secret, it plans to close 53 stores in North America in its US and Canada stores. Victoria’s Secret closed 30 stores in 2018, and management stated that the company has closed an average of 15 stores per year.

Management reported overall spending on stores will decline from about 75% of total capital expenditures in 2018 to 55% in 2019.

Management said it plans to grow its international business in 2019, opening between 100 to 120 company-owned and partner-owned stores, skewed more towards partner-owned stores, looking for strong growth in China.

The company plans to increase investment in technology and logistics substantially in 2019 to support digital business and other retail capabilities.

Outlook

The company expects 2019 full-year earnings per share (EPS) to be between $2.20-2.60, below the consensus estimate of $2.71. 1Q19 EPS is expected to be breakeven, which is $0.12 below consensus estimate.