DIpil Das

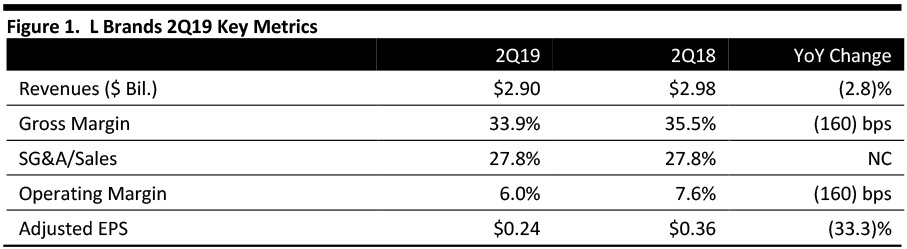

[caption id="attachment_95106" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

L Brands fiscal 2Q19 revenues were $2.90 billion, down 2.8% year over year and lower than the consensus estimate of $2.95 billion. The company reported 2Q19 adjusted EPS of $0.24, lower than the year ago period but higher than the consensus estimate of $0.20.

Comparable sales were down 1% compared to a 3% increase last year and below the consensus estimate of 2%. By brand, Victoria’s Secret comparable sales decreased 6% compared to down 1% in the year ago period. Bath & Body Works comparable sales increased 8% for the quarter compared to a 10% increase in the year ago period.

Operating profit decreased 23% overall for L Brands. Victoria’s Secret North America declined 86%, which was offset by a Bath & Body Works increase of 7%. The consolidated operating margin declined by 160 basis points (bps) to 6.0%. At Victoria’s Secret it declined 560 basis points to 1.0% and 50 basis points to 17.0% at BBW.

The company reported that improving performance at Victoria's Secret is a number one priority. L Brands has made changes to its merchandise assortments, which will be less promotional for the fall and include a greater percentage of sleep and lounge items.

The company highlighted that it reentered the swim category in March 2019, generating approximately $30 million of sales versus $40 million in the past. Management attributed the lower sales volume to a later seasonal entry and added there is meaningful category growth in swim and the company intends to pursue this category online, but not in stores.

For its intimates business, the company is focusing on reducing lead times, ordering frequently and adjusting regularly to maintain flexibility with consumer demand, to better read and react to consumer trends.

Management said Victoria’s Secret marketing was 5% of total sales historically, and the company is looking at all aspects of its marketing plan.

L Brands has flagship stores in China that play an important part in marketing the company but are currently generating losses. Management said it expects the stores will be profitable in three to four years.

Management added that China represents less than 20% of its total sourcing activity, that L Brands has diversified its sourcing and production teams over the past few years to broaden its supply base and so is less concerned about tariff impacts.

The company reported strong results to its Bath & Body Works refresh program across all mall tiers (Types A-C) and outlet centers, with few exceptions. Management will review the return on investment (ROI) as L Brands continues its BBW refresh program over the next few years. The in-store BBW comp was 4% this quarter compared to 7% in the same quarter last year.

The company operated 2,943 stores at the beginning of the quarter and 2,927 stores at the end of the quarter. The company closed 42 Victoria’s Secret stores and 10 Bath & Body Works stores in the quarter and opened twelve Victoria’s Secret stores and 24 Bath & Body Works stores.

Outlook

The company issued EPS 3Q19 guidance of ($0.05)-$0.05 compared to the consensus estimate of $0.08. The company expects 3Q19 comps to be down low single digits to up slightly and full year comps to be up low single digits. The company reiterated adjusted full-year EPS guidance of $2.30-2.60 compared to the consensus estimate of $2.46.

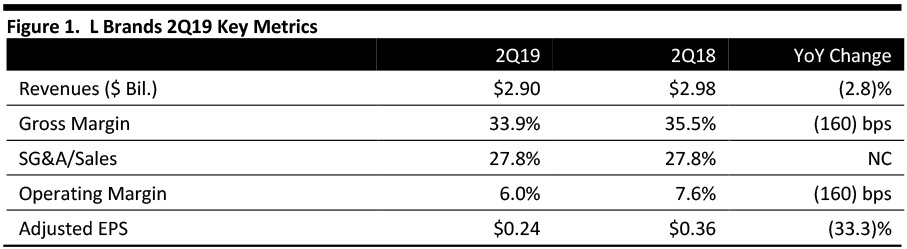

Source: Company reports/Coresight Research[/caption]

2Q19 Results

L Brands fiscal 2Q19 revenues were $2.90 billion, down 2.8% year over year and lower than the consensus estimate of $2.95 billion. The company reported 2Q19 adjusted EPS of $0.24, lower than the year ago period but higher than the consensus estimate of $0.20.

Comparable sales were down 1% compared to a 3% increase last year and below the consensus estimate of 2%. By brand, Victoria’s Secret comparable sales decreased 6% compared to down 1% in the year ago period. Bath & Body Works comparable sales increased 8% for the quarter compared to a 10% increase in the year ago period.

Operating profit decreased 23% overall for L Brands. Victoria’s Secret North America declined 86%, which was offset by a Bath & Body Works increase of 7%. The consolidated operating margin declined by 160 basis points (bps) to 6.0%. At Victoria’s Secret it declined 560 basis points to 1.0% and 50 basis points to 17.0% at BBW.

The company reported that improving performance at Victoria's Secret is a number one priority. L Brands has made changes to its merchandise assortments, which will be less promotional for the fall and include a greater percentage of sleep and lounge items.

The company highlighted that it reentered the swim category in March 2019, generating approximately $30 million of sales versus $40 million in the past. Management attributed the lower sales volume to a later seasonal entry and added there is meaningful category growth in swim and the company intends to pursue this category online, but not in stores.

For its intimates business, the company is focusing on reducing lead times, ordering frequently and adjusting regularly to maintain flexibility with consumer demand, to better read and react to consumer trends.

Management said Victoria’s Secret marketing was 5% of total sales historically, and the company is looking at all aspects of its marketing plan.

L Brands has flagship stores in China that play an important part in marketing the company but are currently generating losses. Management said it expects the stores will be profitable in three to four years.

Management added that China represents less than 20% of its total sourcing activity, that L Brands has diversified its sourcing and production teams over the past few years to broaden its supply base and so is less concerned about tariff impacts.

The company reported strong results to its Bath & Body Works refresh program across all mall tiers (Types A-C) and outlet centers, with few exceptions. Management will review the return on investment (ROI) as L Brands continues its BBW refresh program over the next few years. The in-store BBW comp was 4% this quarter compared to 7% in the same quarter last year.

The company operated 2,943 stores at the beginning of the quarter and 2,927 stores at the end of the quarter. The company closed 42 Victoria’s Secret stores and 10 Bath & Body Works stores in the quarter and opened twelve Victoria’s Secret stores and 24 Bath & Body Works stores.

Outlook

The company issued EPS 3Q19 guidance of ($0.05)-$0.05 compared to the consensus estimate of $0.08. The company expects 3Q19 comps to be down low single digits to up slightly and full year comps to be up low single digits. The company reiterated adjusted full-year EPS guidance of $2.30-2.60 compared to the consensus estimate of $2.46.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

L Brands fiscal 2Q19 revenues were $2.90 billion, down 2.8% year over year and lower than the consensus estimate of $2.95 billion. The company reported 2Q19 adjusted EPS of $0.24, lower than the year ago period but higher than the consensus estimate of $0.20.

Comparable sales were down 1% compared to a 3% increase last year and below the consensus estimate of 2%. By brand, Victoria’s Secret comparable sales decreased 6% compared to down 1% in the year ago period. Bath & Body Works comparable sales increased 8% for the quarter compared to a 10% increase in the year ago period.

Operating profit decreased 23% overall for L Brands. Victoria’s Secret North America declined 86%, which was offset by a Bath & Body Works increase of 7%. The consolidated operating margin declined by 160 basis points (bps) to 6.0%. At Victoria’s Secret it declined 560 basis points to 1.0% and 50 basis points to 17.0% at BBW.

The company reported that improving performance at Victoria's Secret is a number one priority. L Brands has made changes to its merchandise assortments, which will be less promotional for the fall and include a greater percentage of sleep and lounge items.

The company highlighted that it reentered the swim category in March 2019, generating approximately $30 million of sales versus $40 million in the past. Management attributed the lower sales volume to a later seasonal entry and added there is meaningful category growth in swim and the company intends to pursue this category online, but not in stores.

For its intimates business, the company is focusing on reducing lead times, ordering frequently and adjusting regularly to maintain flexibility with consumer demand, to better read and react to consumer trends.

Management said Victoria’s Secret marketing was 5% of total sales historically, and the company is looking at all aspects of its marketing plan.

L Brands has flagship stores in China that play an important part in marketing the company but are currently generating losses. Management said it expects the stores will be profitable in three to four years.

Management added that China represents less than 20% of its total sourcing activity, that L Brands has diversified its sourcing and production teams over the past few years to broaden its supply base and so is less concerned about tariff impacts.

The company reported strong results to its Bath & Body Works refresh program across all mall tiers (Types A-C) and outlet centers, with few exceptions. Management will review the return on investment (ROI) as L Brands continues its BBW refresh program over the next few years. The in-store BBW comp was 4% this quarter compared to 7% in the same quarter last year.

The company operated 2,943 stores at the beginning of the quarter and 2,927 stores at the end of the quarter. The company closed 42 Victoria’s Secret stores and 10 Bath & Body Works stores in the quarter and opened twelve Victoria’s Secret stores and 24 Bath & Body Works stores.

Outlook

The company issued EPS 3Q19 guidance of ($0.05)-$0.05 compared to the consensus estimate of $0.08. The company expects 3Q19 comps to be down low single digits to up slightly and full year comps to be up low single digits. The company reiterated adjusted full-year EPS guidance of $2.30-2.60 compared to the consensus estimate of $2.46.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

L Brands fiscal 2Q19 revenues were $2.90 billion, down 2.8% year over year and lower than the consensus estimate of $2.95 billion. The company reported 2Q19 adjusted EPS of $0.24, lower than the year ago period but higher than the consensus estimate of $0.20.

Comparable sales were down 1% compared to a 3% increase last year and below the consensus estimate of 2%. By brand, Victoria’s Secret comparable sales decreased 6% compared to down 1% in the year ago period. Bath & Body Works comparable sales increased 8% for the quarter compared to a 10% increase in the year ago period.

Operating profit decreased 23% overall for L Brands. Victoria’s Secret North America declined 86%, which was offset by a Bath & Body Works increase of 7%. The consolidated operating margin declined by 160 basis points (bps) to 6.0%. At Victoria’s Secret it declined 560 basis points to 1.0% and 50 basis points to 17.0% at BBW.

The company reported that improving performance at Victoria's Secret is a number one priority. L Brands has made changes to its merchandise assortments, which will be less promotional for the fall and include a greater percentage of sleep and lounge items.

The company highlighted that it reentered the swim category in March 2019, generating approximately $30 million of sales versus $40 million in the past. Management attributed the lower sales volume to a later seasonal entry and added there is meaningful category growth in swim and the company intends to pursue this category online, but not in stores.

For its intimates business, the company is focusing on reducing lead times, ordering frequently and adjusting regularly to maintain flexibility with consumer demand, to better read and react to consumer trends.

Management said Victoria’s Secret marketing was 5% of total sales historically, and the company is looking at all aspects of its marketing plan.

L Brands has flagship stores in China that play an important part in marketing the company but are currently generating losses. Management said it expects the stores will be profitable in three to four years.

Management added that China represents less than 20% of its total sourcing activity, that L Brands has diversified its sourcing and production teams over the past few years to broaden its supply base and so is less concerned about tariff impacts.

The company reported strong results to its Bath & Body Works refresh program across all mall tiers (Types A-C) and outlet centers, with few exceptions. Management will review the return on investment (ROI) as L Brands continues its BBW refresh program over the next few years. The in-store BBW comp was 4% this quarter compared to 7% in the same quarter last year.

The company operated 2,943 stores at the beginning of the quarter and 2,927 stores at the end of the quarter. The company closed 42 Victoria’s Secret stores and 10 Bath & Body Works stores in the quarter and opened twelve Victoria’s Secret stores and 24 Bath & Body Works stores.

Outlook

The company issued EPS 3Q19 guidance of ($0.05)-$0.05 compared to the consensus estimate of $0.08. The company expects 3Q19 comps to be down low single digits to up slightly and full year comps to be up low single digits. The company reiterated adjusted full-year EPS guidance of $2.30-2.60 compared to the consensus estimate of $2.46.