DIpil Das

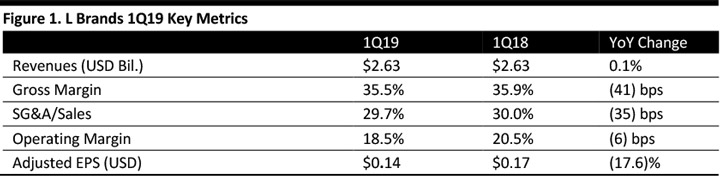

[caption id="attachment_89349" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

L Brands fiscal 1Q19 revenues were $2.63 billion, up 0.1% year over year and higher than the consensus estimate of $2.56 billion. The company reported 1Q19 adjusted EPS of $0.14, lower than the year ago period but higher than the consensus estimate of $0.00 and above company guidance of breakeven. The company attributed the performance of Bath & Body Works and favorable income taxes to the company’s $0.14 EPS exceeding its guidance of $0.00.

Comparable sales were flat compared to a 3% increase last year and above the consensus estimate of (1.3)%. By brand, Victoria’s Secret comparable sales decreased 5% compared to a 1% increase in the year ago period, and compared to the consensus estimate of (4.9)%. Bath & Body Works comparable sales increased 13% for the quarter, compared to an 8% increase in the year-ago period and the consensus estimate of 5.2%.

The company reported that while performance was mixed among brands and segments (Victoria's Secret Lingerie, PINK, Victoria's Secret Beauty and International), they all performed in line with company forecasts.

Management said the company is committed to improving performance in Victoria's Secret, improving the merchandise assortment and focusing on fashion that resonates with the consumer across its major categories of bras, panties, sleep and loungewear. Over the quarter, management reported customers responded well to the “incredible bra” launch.

In its PINK business, the company reported strong performance in intimates and good volumes in sport bras in particular. Management said the company is focusing on understanding the target customer and reworking assortments in bras and panties. Management said its current mix in PINK is 50% intimates and 50% apparel, commenting that its competitive advantage is around customer loyalty to intimate apparel. PINK will focus on growing its intimates business faster than apparel over the next two years. In apparel, the team is assessing price points, fabric, fabrication, surface design, and logos, and conducting consumer testing.

Management said Bath & Body Works is seeing strong response to merchandise in its home fragrance, hand soap and body care businesses.

When asked about reevaluating whether the Victoria’s Secret annual fashion show would air on television, management responded that everything is on the table with respect to evaluating the Victoria’s Secret business. The company said it is looking at all aspects of the business, including merchandise, store square footage and marketing.

The company operated 2,943 stores at the beginning of the quarter and 2,920 stores at the end of the quarter. The company closed 37 Victoria’s Secret stores and three Bath & Body Works stores in the quarter and opened three Victoria’s Secret stores and 14 Bath & Body Works stores in the quarter.

Outlook

The company raised its 2019 full-year EPS guidance to $2.30-2.60, up from $2.20-2.60, compared to the consensus estimate of $2.37.

The company expects second-quarter earnings per share to be $0.15-0.20, compared to the consensus estimate of $0.23.

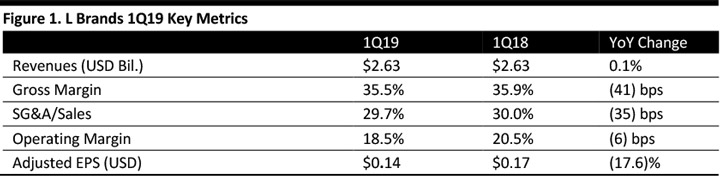

Source: Company reports/Coresight Research[/caption]

1Q19 Results

L Brands fiscal 1Q19 revenues were $2.63 billion, up 0.1% year over year and higher than the consensus estimate of $2.56 billion. The company reported 1Q19 adjusted EPS of $0.14, lower than the year ago period but higher than the consensus estimate of $0.00 and above company guidance of breakeven. The company attributed the performance of Bath & Body Works and favorable income taxes to the company’s $0.14 EPS exceeding its guidance of $0.00.

Comparable sales were flat compared to a 3% increase last year and above the consensus estimate of (1.3)%. By brand, Victoria’s Secret comparable sales decreased 5% compared to a 1% increase in the year ago period, and compared to the consensus estimate of (4.9)%. Bath & Body Works comparable sales increased 13% for the quarter, compared to an 8% increase in the year-ago period and the consensus estimate of 5.2%.

The company reported that while performance was mixed among brands and segments (Victoria's Secret Lingerie, PINK, Victoria's Secret Beauty and International), they all performed in line with company forecasts.

Management said the company is committed to improving performance in Victoria's Secret, improving the merchandise assortment and focusing on fashion that resonates with the consumer across its major categories of bras, panties, sleep and loungewear. Over the quarter, management reported customers responded well to the “incredible bra” launch.

In its PINK business, the company reported strong performance in intimates and good volumes in sport bras in particular. Management said the company is focusing on understanding the target customer and reworking assortments in bras and panties. Management said its current mix in PINK is 50% intimates and 50% apparel, commenting that its competitive advantage is around customer loyalty to intimate apparel. PINK will focus on growing its intimates business faster than apparel over the next two years. In apparel, the team is assessing price points, fabric, fabrication, surface design, and logos, and conducting consumer testing.

Management said Bath & Body Works is seeing strong response to merchandise in its home fragrance, hand soap and body care businesses.

When asked about reevaluating whether the Victoria’s Secret annual fashion show would air on television, management responded that everything is on the table with respect to evaluating the Victoria’s Secret business. The company said it is looking at all aspects of the business, including merchandise, store square footage and marketing.

The company operated 2,943 stores at the beginning of the quarter and 2,920 stores at the end of the quarter. The company closed 37 Victoria’s Secret stores and three Bath & Body Works stores in the quarter and opened three Victoria’s Secret stores and 14 Bath & Body Works stores in the quarter.

Outlook

The company raised its 2019 full-year EPS guidance to $2.30-2.60, up from $2.20-2.60, compared to the consensus estimate of $2.37.

The company expects second-quarter earnings per share to be $0.15-0.20, compared to the consensus estimate of $0.23.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

L Brands fiscal 1Q19 revenues were $2.63 billion, up 0.1% year over year and higher than the consensus estimate of $2.56 billion. The company reported 1Q19 adjusted EPS of $0.14, lower than the year ago period but higher than the consensus estimate of $0.00 and above company guidance of breakeven. The company attributed the performance of Bath & Body Works and favorable income taxes to the company’s $0.14 EPS exceeding its guidance of $0.00.

Comparable sales were flat compared to a 3% increase last year and above the consensus estimate of (1.3)%. By brand, Victoria’s Secret comparable sales decreased 5% compared to a 1% increase in the year ago period, and compared to the consensus estimate of (4.9)%. Bath & Body Works comparable sales increased 13% for the quarter, compared to an 8% increase in the year-ago period and the consensus estimate of 5.2%.

The company reported that while performance was mixed among brands and segments (Victoria's Secret Lingerie, PINK, Victoria's Secret Beauty and International), they all performed in line with company forecasts.

Management said the company is committed to improving performance in Victoria's Secret, improving the merchandise assortment and focusing on fashion that resonates with the consumer across its major categories of bras, panties, sleep and loungewear. Over the quarter, management reported customers responded well to the “incredible bra” launch.

In its PINK business, the company reported strong performance in intimates and good volumes in sport bras in particular. Management said the company is focusing on understanding the target customer and reworking assortments in bras and panties. Management said its current mix in PINK is 50% intimates and 50% apparel, commenting that its competitive advantage is around customer loyalty to intimate apparel. PINK will focus on growing its intimates business faster than apparel over the next two years. In apparel, the team is assessing price points, fabric, fabrication, surface design, and logos, and conducting consumer testing.

Management said Bath & Body Works is seeing strong response to merchandise in its home fragrance, hand soap and body care businesses.

When asked about reevaluating whether the Victoria’s Secret annual fashion show would air on television, management responded that everything is on the table with respect to evaluating the Victoria’s Secret business. The company said it is looking at all aspects of the business, including merchandise, store square footage and marketing.

The company operated 2,943 stores at the beginning of the quarter and 2,920 stores at the end of the quarter. The company closed 37 Victoria’s Secret stores and three Bath & Body Works stores in the quarter and opened three Victoria’s Secret stores and 14 Bath & Body Works stores in the quarter.

Outlook

The company raised its 2019 full-year EPS guidance to $2.30-2.60, up from $2.20-2.60, compared to the consensus estimate of $2.37.

The company expects second-quarter earnings per share to be $0.15-0.20, compared to the consensus estimate of $0.23.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

L Brands fiscal 1Q19 revenues were $2.63 billion, up 0.1% year over year and higher than the consensus estimate of $2.56 billion. The company reported 1Q19 adjusted EPS of $0.14, lower than the year ago period but higher than the consensus estimate of $0.00 and above company guidance of breakeven. The company attributed the performance of Bath & Body Works and favorable income taxes to the company’s $0.14 EPS exceeding its guidance of $0.00.

Comparable sales were flat compared to a 3% increase last year and above the consensus estimate of (1.3)%. By brand, Victoria’s Secret comparable sales decreased 5% compared to a 1% increase in the year ago period, and compared to the consensus estimate of (4.9)%. Bath & Body Works comparable sales increased 13% for the quarter, compared to an 8% increase in the year-ago period and the consensus estimate of 5.2%.

The company reported that while performance was mixed among brands and segments (Victoria's Secret Lingerie, PINK, Victoria's Secret Beauty and International), they all performed in line with company forecasts.

Management said the company is committed to improving performance in Victoria's Secret, improving the merchandise assortment and focusing on fashion that resonates with the consumer across its major categories of bras, panties, sleep and loungewear. Over the quarter, management reported customers responded well to the “incredible bra” launch.

In its PINK business, the company reported strong performance in intimates and good volumes in sport bras in particular. Management said the company is focusing on understanding the target customer and reworking assortments in bras and panties. Management said its current mix in PINK is 50% intimates and 50% apparel, commenting that its competitive advantage is around customer loyalty to intimate apparel. PINK will focus on growing its intimates business faster than apparel over the next two years. In apparel, the team is assessing price points, fabric, fabrication, surface design, and logos, and conducting consumer testing.

Management said Bath & Body Works is seeing strong response to merchandise in its home fragrance, hand soap and body care businesses.

When asked about reevaluating whether the Victoria’s Secret annual fashion show would air on television, management responded that everything is on the table with respect to evaluating the Victoria’s Secret business. The company said it is looking at all aspects of the business, including merchandise, store square footage and marketing.

The company operated 2,943 stores at the beginning of the quarter and 2,920 stores at the end of the quarter. The company closed 37 Victoria’s Secret stores and three Bath & Body Works stores in the quarter and opened three Victoria’s Secret stores and 14 Bath & Body Works stores in the quarter.

Outlook

The company raised its 2019 full-year EPS guidance to $2.30-2.60, up from $2.20-2.60, compared to the consensus estimate of $2.37.

The company expects second-quarter earnings per share to be $0.15-0.20, compared to the consensus estimate of $0.23.