Web Developers

At L Brands’ Annual Investor Update Meeting, which was held in Columbus, Ohio, on November 1, the company outlined its two primary focuses: disciplined execution of retail fundamentals and pursuit of growth opportunities for the business. Below, we discuss each in detail.

Challenges at Victoria’s Secret Continued in October, and Are Expected to Weigh on 3Q16 Results

Ahead of the investor meeting, L Brands updated its expectations for the third quarter of 2016, guiding to the low end of its EPS range of $0.40–$0.45; the revised guidance now calls for EPS of $0.40, which is approximately 13% below the consensus EPS estimate of $0.46. Management noted that weakness in Victoria’s Secret October comps (which were down 2.0%) and merchandise margins were significant drivers of the revision. Overall comps for October are expected to be up 1%, driven by a 6% increase at Bath & Body Works.

Source:Shutterstock

Victoria’s Secret Brand Undergoing Evolution

The Victoria’s Secret business has seen challenges for the last several years in its core lingerie and beauty segments. L Brands Chairman and CEO Les Wexner commented that most brands typically have a natural shelf life of 10 years before they become much less relevant. The company is working to evolve the Victoria’s Secret brand in order to keep it young and relevant, he said. Growth in the beauty segment has been flat over the last five to seven years. The overall promotional strategy that was established years ago became less relevant to customers over time. The original intention had been to get customers into stores and then upsell them, but that was no longer proving as effective, as customers were coming in only to get the promotion that was offered. The company is now working to evolve the promotional strategy to focus on more effective brand-building promotions. Victoria’s Secret is undergoing significant changes this year. On an organizational level, there are now three separate business units: Lingerie is led by Jan Singer, PINK by Denise Landman and Beauty by Greg Unis. The company exited the swim and apparel businesses earlier this year, and is now focusing on core categories. L Brands also eliminated nearly 300 positions earlier this year as part of its effort to streamline the business and increase efficiency.Sales Growth Target of 7%–10% Set; Continued Focus on Speed

Looking forward, the company set a sales growth target of 7%–10%, to be driven by low- to mid-single-digit growth in comps in North America, low- to mid-single-digit square footage growth in North America, mid- to high-teens growth in direct sales and low- to mid-twenties growth in the international business. Management expects continued pressure from Victoria’s Secret’s exiting of the swim and apparel categories through the first half of 2017, but thinks the company could be in a position to generate that 7%–10% revenue growth in the second half of next year. The company expects comps in North America to be driven by category-dominant brands with high emotional content at Victoria’s Secret, PINK and Bath & Body Works. Management will continue to focus on newness and speed as well as on in-store selling initiatives. Victoria’s Secret is the number-one lingerie brand, while PINK is the leading specialty collegiate brand, generating annual sales of nearly $3 billion. PINK has also more than doubled sales in the last five years. Bath & Body Works is one of the largest specialty retail beauty brands in the world. Management continued to highlight the importance of improving speed, as it drives improved inventory turns (these increased to 4.1 times in 2015 from 3.9 times in 2014). The company had approximately 90% of its inventories for the fourth quarter available to buy at the beginning of the fall season, which allows for agility and for a “read, react and chase” approach to planning the business.

Source:Shutterstock

Store Real Estate Tied into Emotional Connection with Customers

In terms of square footage, Victoria’s Secret/PINK and Bath & Body Works square footage growth in North America is accelerating, which is driving total company growth. The company also continues to invest in store remodels and is focused on the resulting improvement in productivity. According to Wexner, store locations can typically operate for about eight to 10 years before needing a significant remodel. The company does not want its locations to become obsolete and is focused on offering a compelling in-store experience to its customers. The company tests various remodels and looks for an improvement in store sales performance before rolling those improvements out across a chain. Remodeling improvements that were tested at Bath & Body Works, for example, generated 25% higher sales in the remodeled locations. The company worked for three years to find a remodel formula that would generate that level of improvement.

Source: Bathandbodyworks

Growth Opportunities Lie in International Markets, Particularly China

We see China as the most compelling growth opportunity for the company and it is overwhelmingly L Brands’ biggest priority in terms of international markets. In the past year, the company moved to an owned model in China, which suggests it sees the magnitude of the opportunity in the country—in other international markets, it works with retail partners. The brand already has a following in China, as 350 million people in the country watched the last Victoria’s Secret fashion show. L Brands currently operates 31 Victoria’s Secret Beauty and Accessories stores in China and will launch its Chinese e-commerce site in the coming days. Later this year, the company plans to open three full-assortment Victoria’s Secret stores in the country. The company is currently working to educate itself and its teams about the Chinese market and about cultural and political differences in the country.

Source: Shutterstock

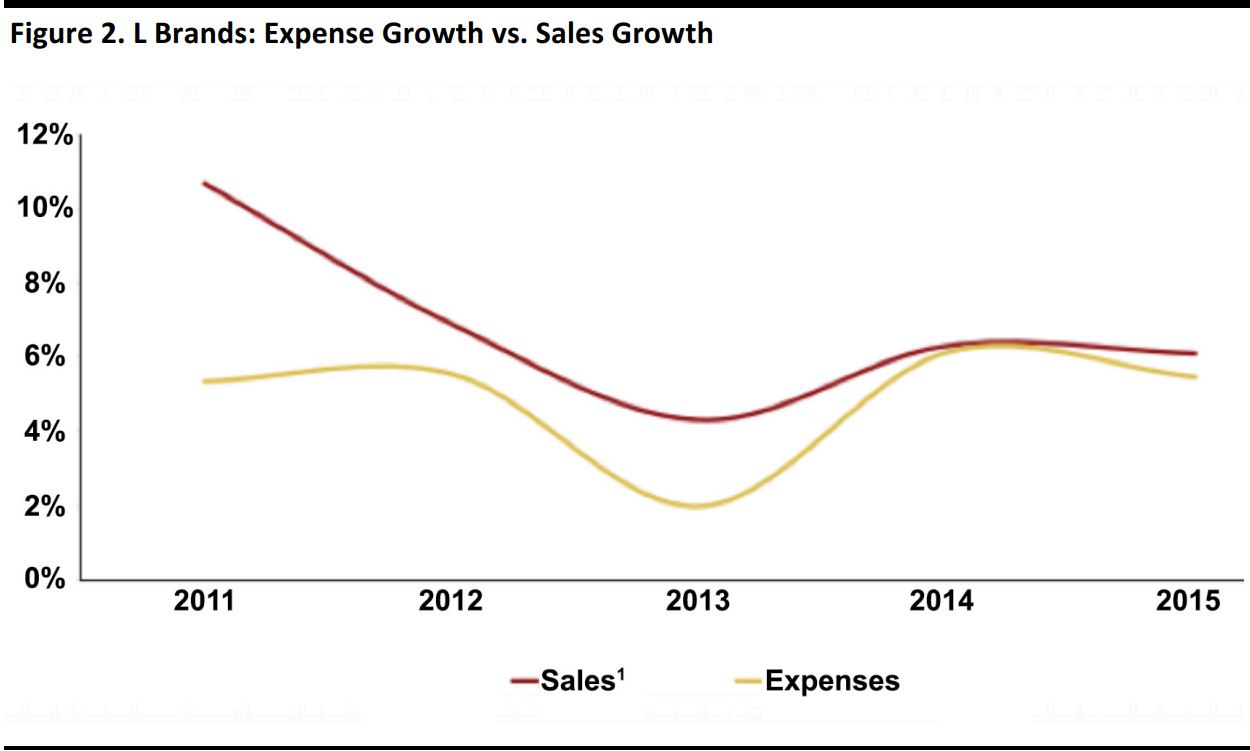

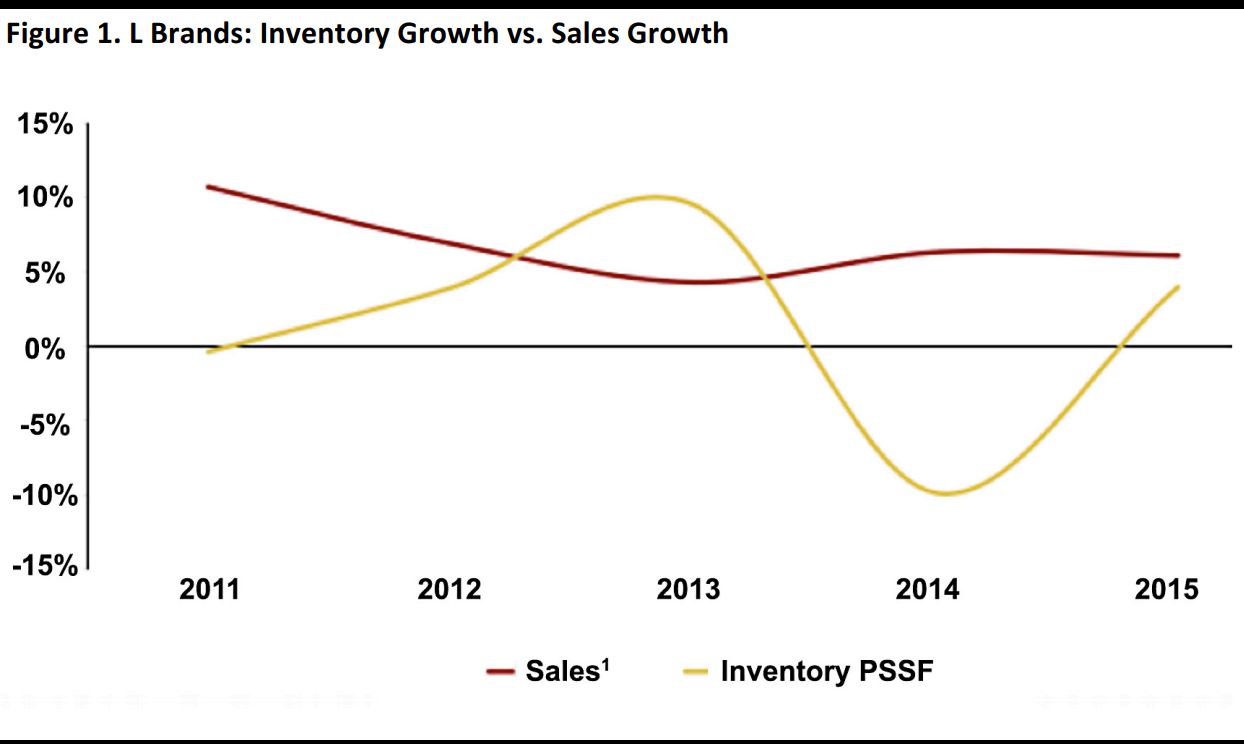

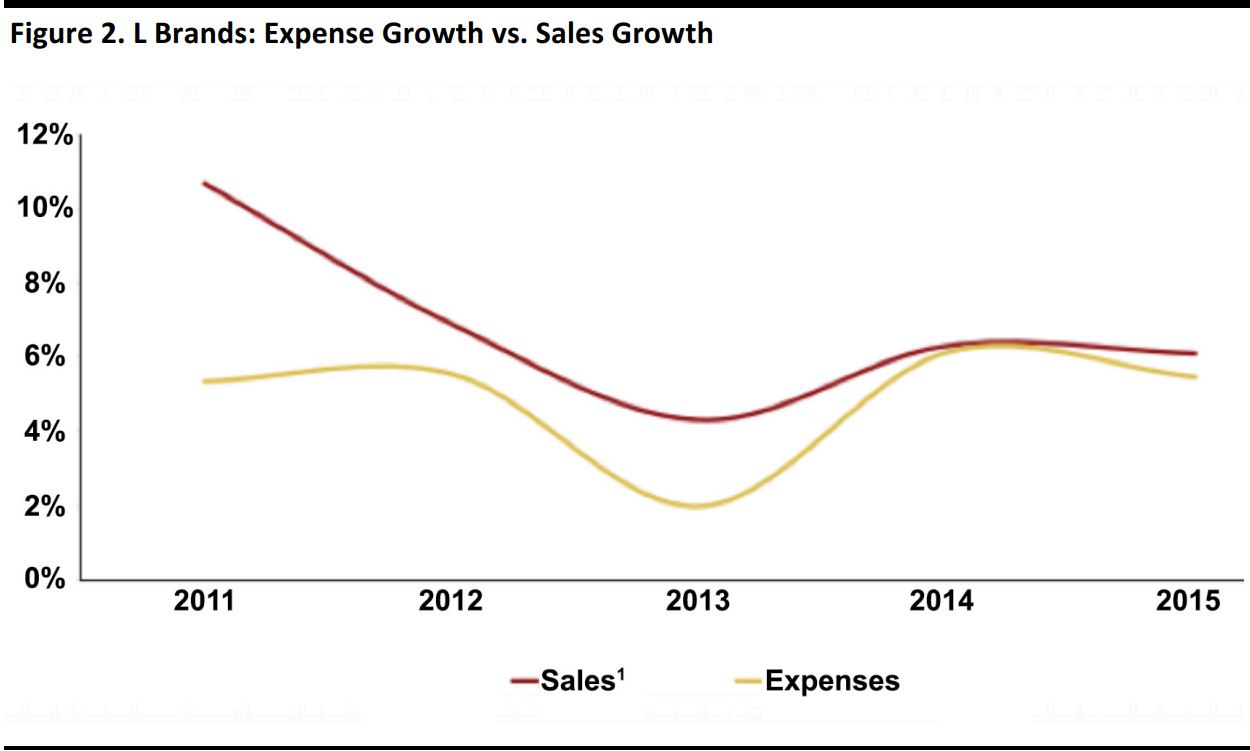

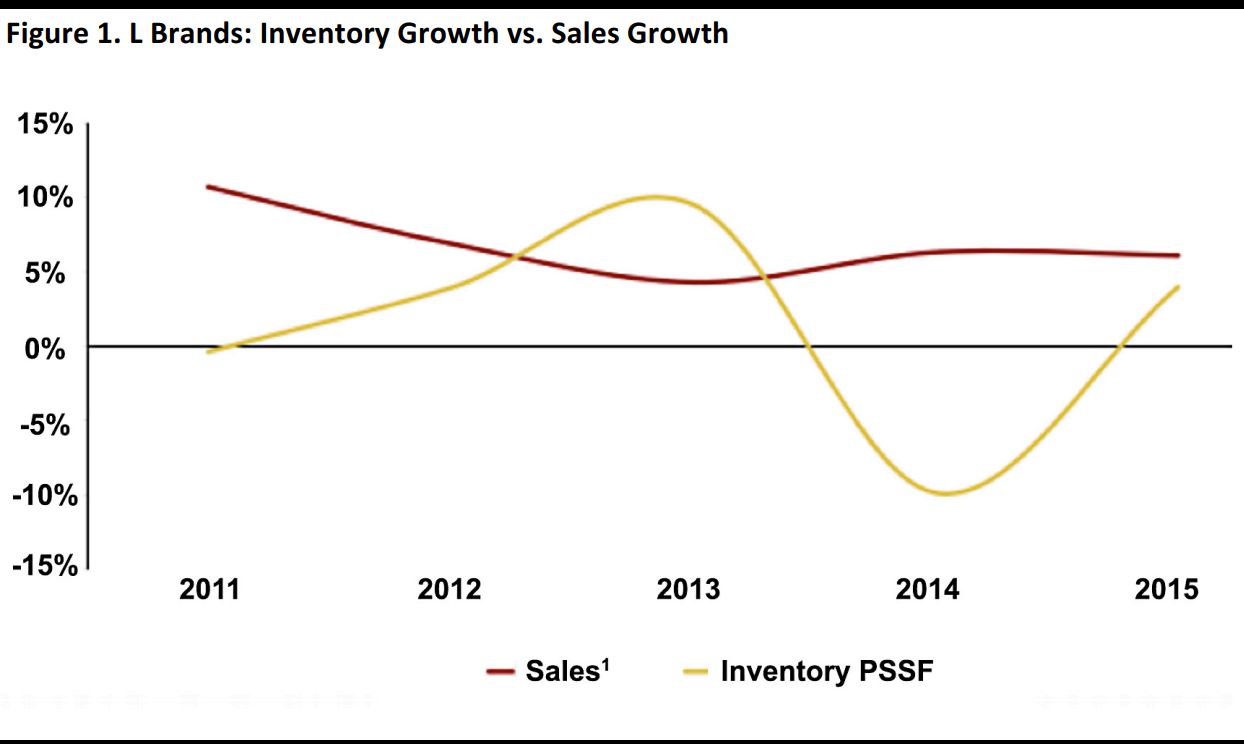

Track Record of Achieving Targets

The company has discussed a number of guidelines in the past for successfully executing on retail fundamentals; these include growing inventory per square foot more slowly than sales, growing expenses more slowly than sales, growing operating-income dollars by more than 10%, achieving a high-teens operating margin rate and maintaining a healthy real estate fleet. While recent efforts in these areas have proven somewhat challenging for the company, its longer-term track record has been more consistent. Inventory per square foot grew at a slower rate than sales in four out of the last five years. Expense growth was slower than sales growth in each of the last five years. The company grew operating-income dollars by at least 10% in four of the last five years. And L Brands achieved an operating margin of 18.0% at the end of 2015.

Sales on like businesses Source: Company reports