Source: Company reports

2Q 2016 RESULTS

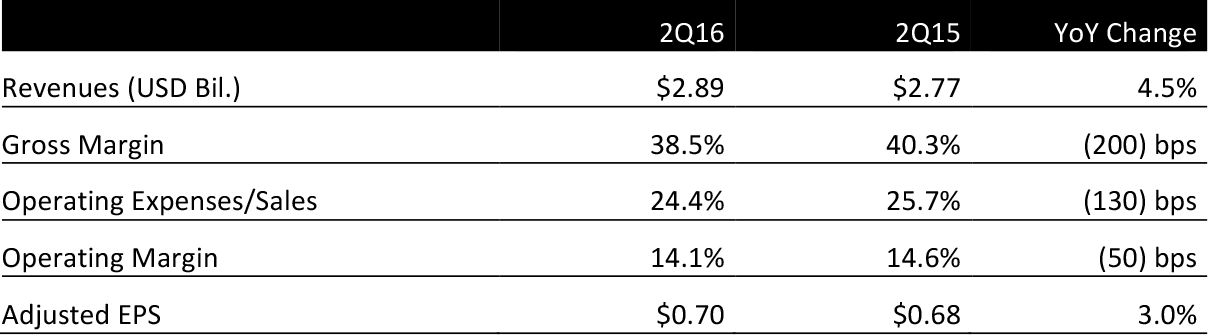

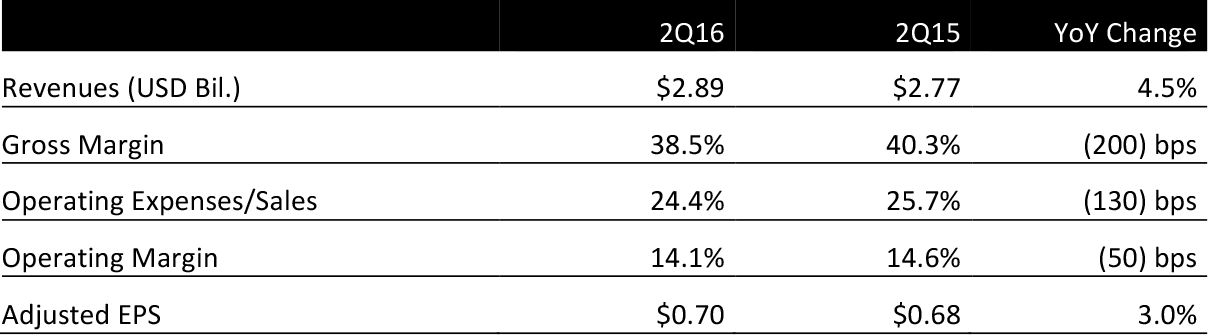

L Brands reported 2Q 2016 adjusted EPS of $0.70 versus the guidance it provided earlier in the month for the high end of $0.50–$0.60.

Total revenues were $2.89 billion, up 4.5% year over year, as reported on August 5. L Brand comps, including direct, increased 3%. Store-only comps increased 1%.

At Victoria’s Secret, 2Q 2016 sales increased 3% to $1.87 billion and comps increased 2%. Management plans to continue its focus on fashion in its Body by Victoria collection that features its lounge bra. In PINK, the company will focus on back-to-school shoppers.

Bath & Body Works sales increased 7% to $801.4 million and comps increased 5% on top of last year’s 6% increase. The segment transitioned to a farm-fresh theme, which features new and seasonal selections in its Signature Collection, home fragrance and soap and sanitizer businesses.

Highlights by Month

- L Brand July comps, including direct, increased 2%. Store-only comps were flat. At Victoria’s Secret, July comps were flat compared to last year. Growth in PINK and core lingerie was offset by declines in its Beauty business. At Bath & Body Works, July comps were up 6% on top of a 5% increase last year.

- L Brand June comps, including direct, increased 6% and were positively impacted by about 2 points from timing shifts in the Memorial Day and July 4th holidays. Store-only comps increased 4%. At Victoria’s Secret, comps were up 6% year over year, driven by PINK and core lingerie businesses, which was partially offset by softness in non-core categories of swim and apparel. At Bath & Body Works, comps were up 7%.

- L Brand May comps, including direct, were flat and negatively impacted by about 2 points from this year’s later than usual Memorial Day. Store-only comps decreased 1%. At Victoria’s Secret, May comps were down 1% year over year. Growth in PINK business was offset by declines in beauty and core lingerie bras. At Bath & Body Works, comps were up 3% on top of 6% last year.

2016 OUTLOOK

The company expects 3Q 2016 EPS to be $0.40–$0.45 versus consensus of $0.47. Expectations are for comps to decline (0.3%), driven by Victoria’s Secret (0.9%), partially offset by a 2.7% increase at Bath & Body Works.

Management increased its full-year adjusted EPS guidance to $3.70–$3.85 from $3.60–$3.80 previously and versus the consensus of $3.74. Expectations are for full-year comps to increase 1.3%, driven by Victoria’s Secret (+0.1%) and Bath & Body Works (+3.9%).