Source: Company reports

1Q16 RESULTS

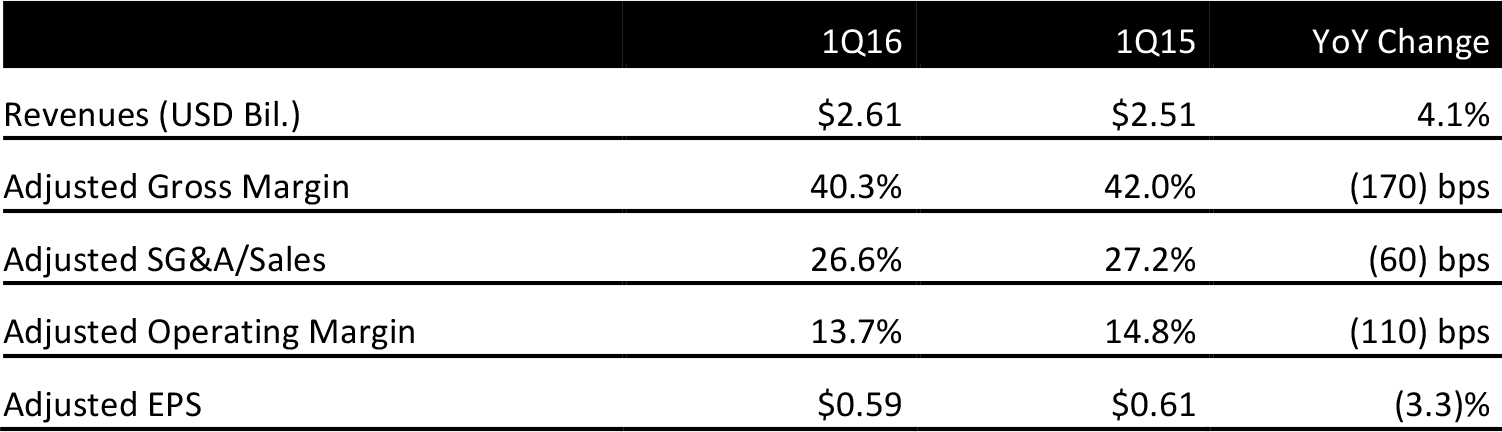

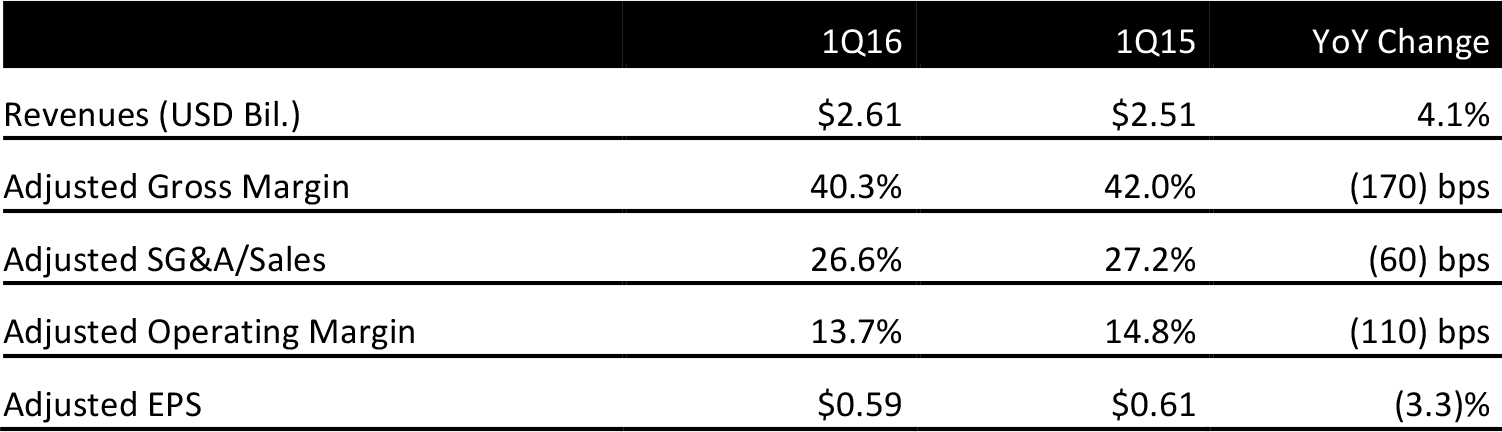

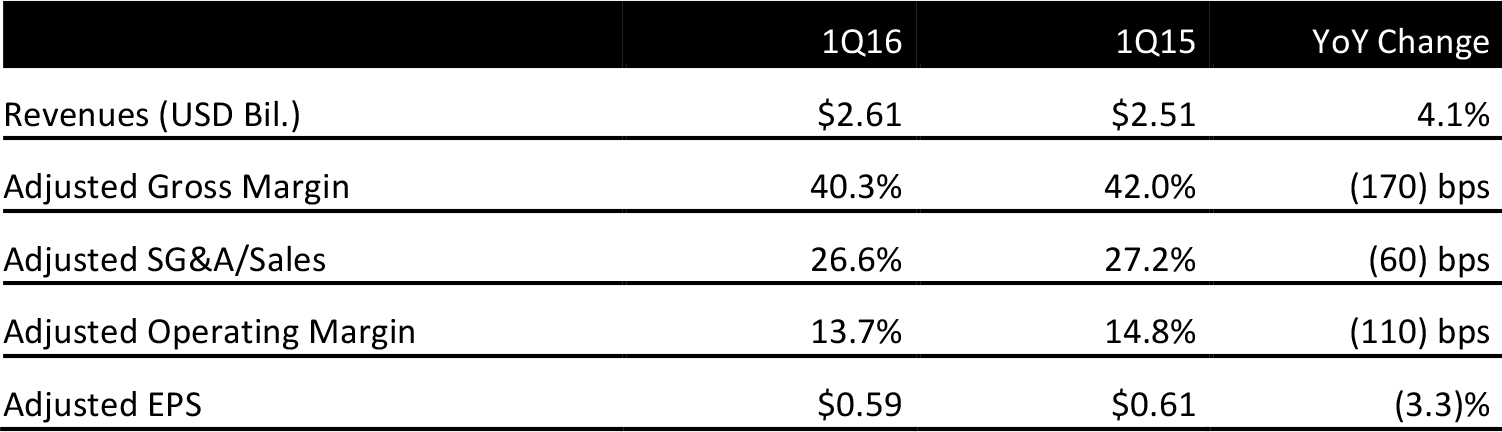

L Brands reported 1Q16 adjusted EPS of $0.59 versus guidance that it provided earlier in the month for the high end of $0.50–$0.55.

Total revenues were $2.61 billion, up 4.1% year over year, as reported on May 5. Comps increased by 3%; comps were up 2% at Victoria’s Secret and up 6% at Bath & Body Works.

Management was not satisfied with the quarter’s results, particularly at Victoria’s Secret. PINK saw a double-digit increase in sales, and Bath & Body Works posted strong results. Victoria’s Secret’s core lingerie sales were up only slightly (and decelerated sequentially) and beauty category sales were weaker. Trends decelerated as the quarter progressed.

Retail inventory per square foot ended the quarter up 3% versus last year.

MANAGEMENT CHANGES AT VICTORIA’S SECRET

In line with a previously announced strategic restructuring at Victoria’s Secret and following the departure of CEO Sharen Turney in February, the company announced that Victoria’s Secret will be managed as three separate divisions: PINK, lingerie and beauty. PINK will continue to be led by Denise Landman, who has been with the brand since its inception. The lingerie division will be led by Jan Singer, who will join the company in September. Singer was formerly CEO of Spanx. The beauty division will be run by Greg Unis, who recently joined the company from Coach. Each of these leaders will report to L Brands CEO Les Wexner.

The company also announced the elimination of Victoria’s Secret Swim as well as shoes, accessories and apparel that were only sold online. These categories had combined sales of $525 million in 2015.

2016 OUTLOOK

The company provided 2Q16 EPS guidance of $0.50–$0.60 versus consensus of $0.68. Comps in the quarter are expected to be flat to down by low single digits. May comps are expected to decline by low-to-mid-single digits. May comps are expected to fall by mid-single digits at Victoria’s Secret and to rise by low single digits at Bath & Body Works.

Management lowered its full-year guidance to $3.60–$3.80 from $3.90–$4.10 previously. Consensus is for EPS of $4.03. Full-year comps are expected to be roughly flat, with total sales up 2%, driven by square footage growth.

The more modest outlook is based on two factors: (1) Victoria’s Secret is expected to see an impact of $0.20, which takes into account both an estimate related to previously announced strategic changes and a deceleration in sales trends, and (2) a plan to develop a company-owned China business is expected to result in an impact of $0.10 related to incremental expenses.