What’s the Story?

On July 19, 2021, the Coresight Research team attended L Brands’ virtual Investor Day 2021. During the event, Bath & Body Works (BBW) and Victoria’s Secret & Co. were referred to as two independent companies, rather than as banners, anticipating the planned August 2021 separation through a tax-free spin-off of the Victoria’s Secret business.

In this report, we present insights from the Investor Day, outlining BBW’s expansion plans and Victoria’s Secret’s comeback strategy.

L Brands Investor Day 2021: Key Insights

Bath & Body Works (BBW)

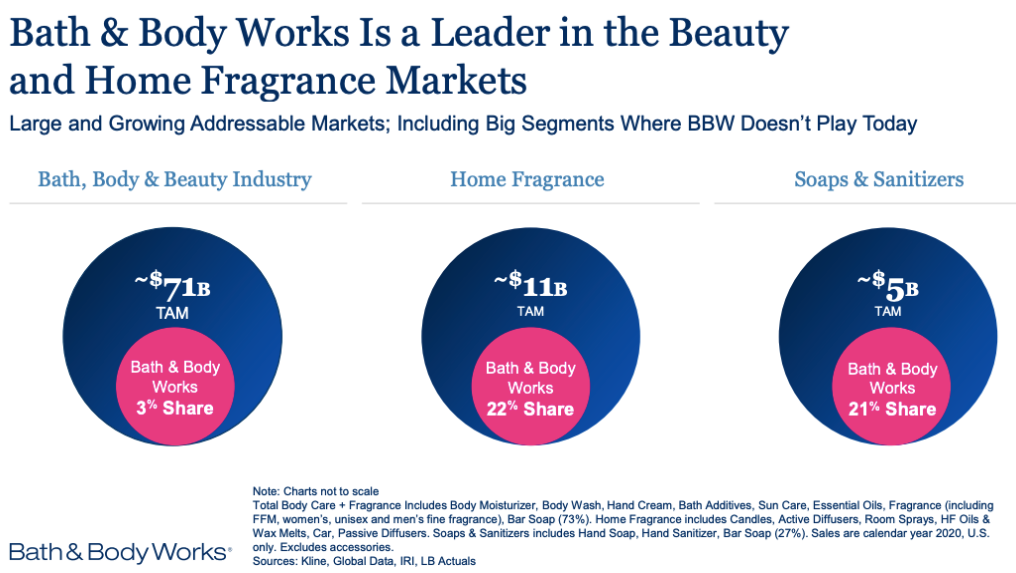

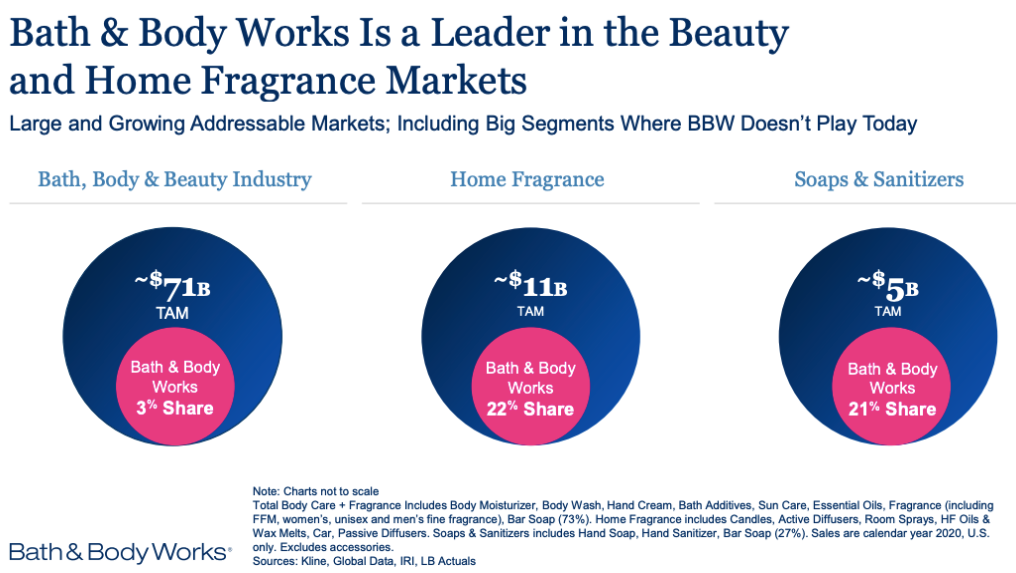

Strong Opportunity in the $71 Billion Bath, Body and Beauty Industry in the US

As of July 19, 2021, BBW holds just a 3% share in the $71 billion US bath, body and beauty market, according to combined data from company reports, IRI, Kline and GlobalData. The company sees strong opportunity in the total bath, body and beauty industry and aims to increase its share by entering new categories, including hair care, skincare and wellness products, as well as by expanding its existing home fragrance and soap and sanitizers categories, where BBW holds 22% and 21% market share, respectively. BBW also plans to expand its natural and organic product offerings to attract new customers.

[caption id="attachment_130406" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

BBW has two key focus areas as the company looks to boost engagement with its target consumers, which we outline below.

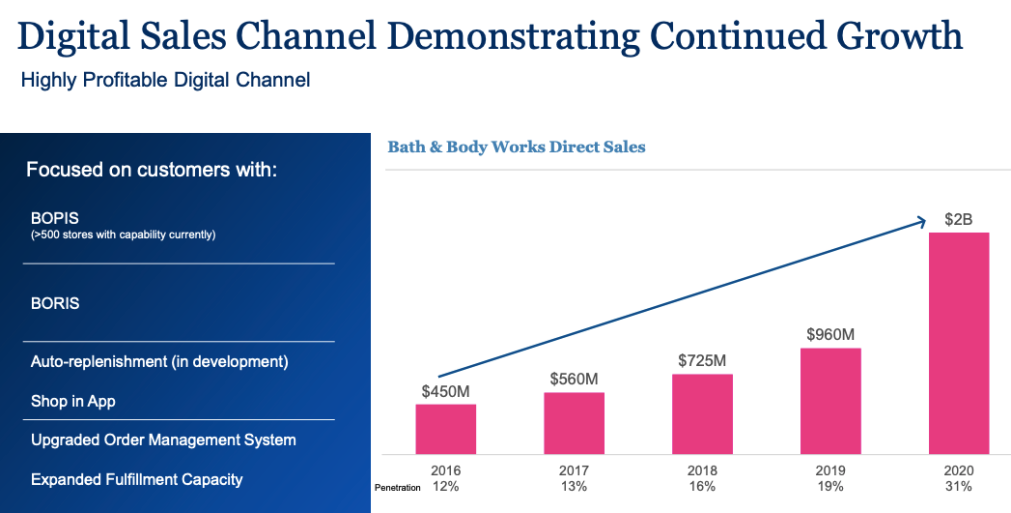

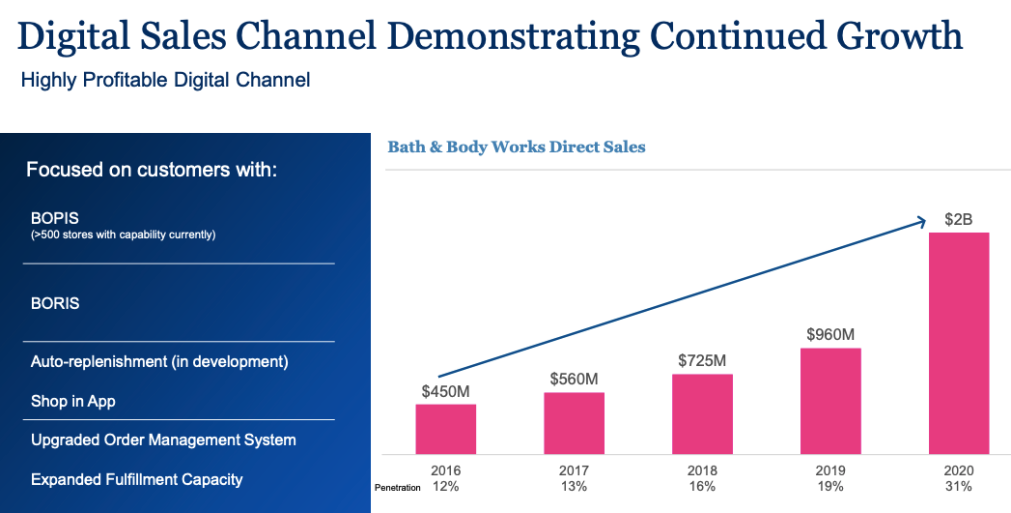

- Digital: Forefront of Growth Strategy

BBW will continue its investment into enhancing its digital and omnichannel capabilities, including extending the rollout of BOPIS (buy online, pick up in store) and BORIS (buy online, return in store) functionalities. In the near future, BBW plans to implement the BOPIS facility in 700–800 of its stores, from 500 stores currently. The company is also developing an automatic replenishment system, which it expects to accurately analyze lead times and stock levels at stores and distribution centers and re-order inventory to meet forecasted demand on time.

Furthermore, BBW is building a new 1

million-square-foot fulfillment center in Columbus, Ohio. The company expects the new center to be operational in fall 2022 and be at full capacity by fall 2023. At present, BBW uses three company-owned fulfillment centers and five third-party fulfillment centers to support its US and international digital customers. The company expects its new fulfillment center to further enhance its sales in the digital channel.

[caption id="attachment_130407" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

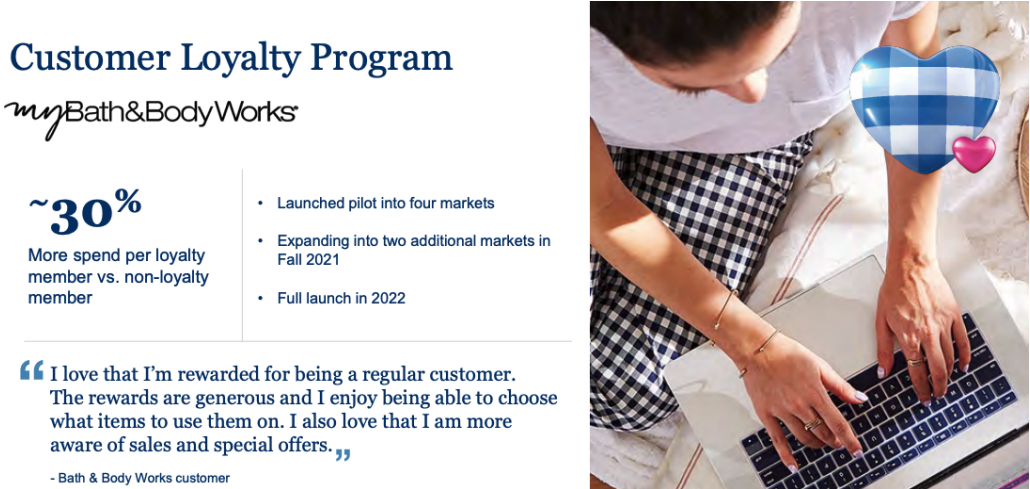

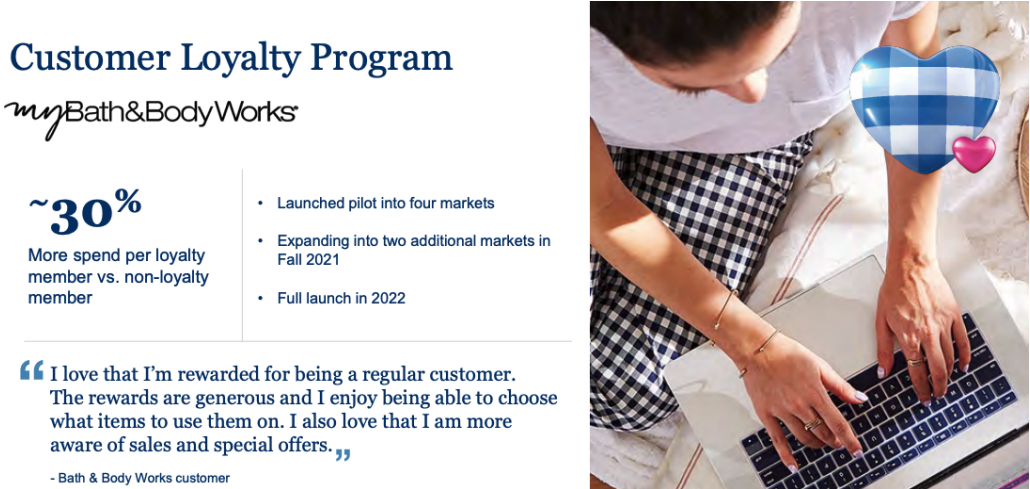

- Expansion of Customer Loyalty Program

BBW expects its My Bath & Body Works customer loyalty program to significantly increase consumer spending in the near future. The company noted that across the markets where it has been piloting the My Bath & Body Works program—including California, Georgia, Illinois, Indiana, Missouri, North Carolina, Ohio, South Carolina and Virginia—BBW has seen loyalty members spend around 30% more than non-loyalty members. Driven by strong results during the pilot phase, BBW plans for a full US launch of its customer loyalty program by the end of 2022.

[caption id="attachment_130408" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

International Business: A Key Future Growth Driver

BBW noted that its international business has grown remarkably in the past 10 years, from $5 million to over $450 million, and will continue to remain a strong growth driver in the near future. In the next couple of years, the company expects year-over-year percentage growth of its international sales in the high teens or low twenties, as it expands its fleet of international stores by over 15% every year.

Furthermore, BBW plans to expand its business operations in its new markets, particularly Europe, where the company has low penetration. Management also said that the company is testing new emerging markets for entry, but did not identify them.

[caption id="attachment_130409" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Victoria’s Secret

Medium-Term Financial Targets

For the next three to five years, Victoria’s Secret forecasts global sales growth in the mid-single digits and high-single-digit operating income growth, with operating margin in mid-teens in percentage terms. The company expects its digital penetration to expand to 50% in the next five years, from about 40% currently.

[caption id="attachment_130410" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Victoria’s Secret has listed two key focus areas to achieve its financial targets, which we outline below.

- Category Expansion and Innovative Product Launches

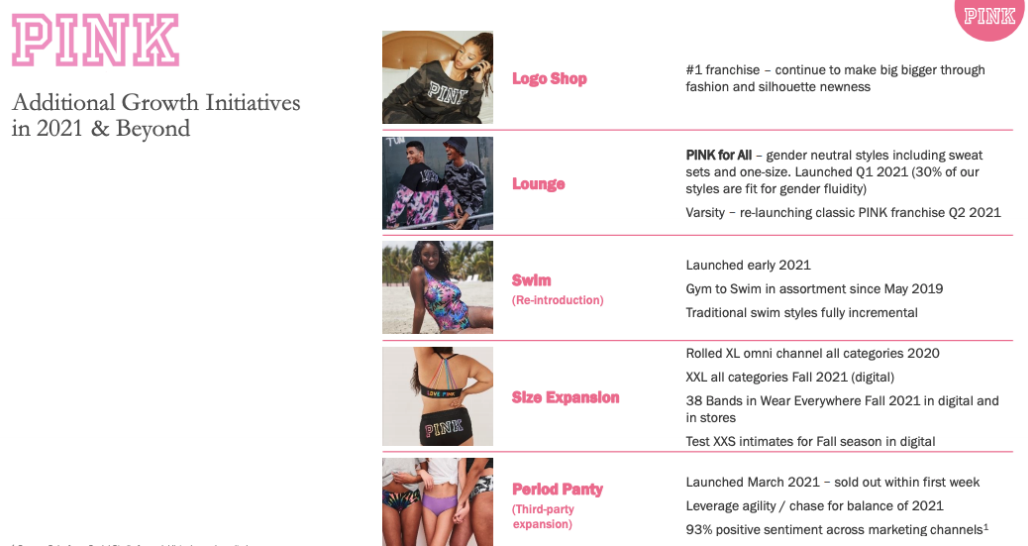

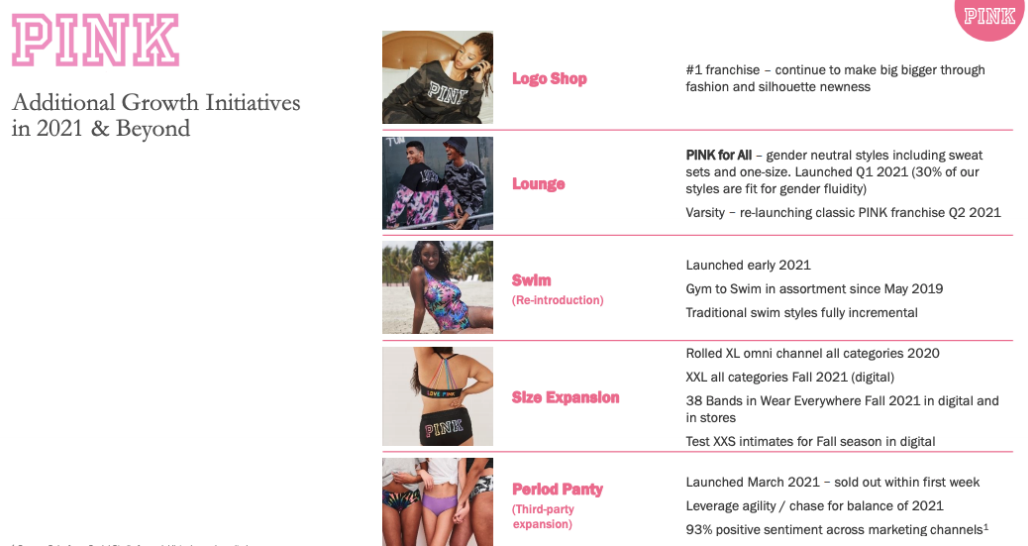

Victoria’s Secret will continue to expand into new categories and invest in innovative product launches in addition to those described below, which the company states will bolster its total sales growth by 15–20% in 2021 and beyond.

Bridal, maternity and shapewear: Victoria’s Secret noted that its bridal, maternity and shapewear businesses will play a key role in driving the company’s sales growth in the near future, despite each category being a smaller addressable market than the company’s key markets of global intimates, apparel and loungewear. Management said that Victoria’s Secret is investing and collaborating with designers to capitalize on strong opportunities in the bridal, maternity and shapewear markets.

Period Panty: In March 2021, Victoria’s Secret launched its disruptive new “Period Panty” category, an undergarment intended to replace disposable period-protection products such as pads or tampons. Management said that Period Panty saw 93% positive sentiment across the marketing channel, and the initial stock sold out within the first week of its launch, highlighting the strength of customer demand.

PINK for All: Victoria’s Secret massively expanded the target audience of its PINK brand through the launch of its new PINK for All line in the first quarter of fiscal 2021, ended May 1, 2021. PINK for All offers gender-neutral styles, including sweat sets and one-size. The company noted that the PINK for All range is seeing strong customer engagement among men.

Swimwear: Victoria’s Secret reintroduced its recycled and environmentally friendly swimwear category in early 2021. The company expects this category to generate about $100 million in sales in fiscal 2021. Victoria’s Secret sees significant growth opportunity in the swimwear category and believes it has the potential to generate annual sales of about $400 million in the near future.

[caption id="attachment_130411" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

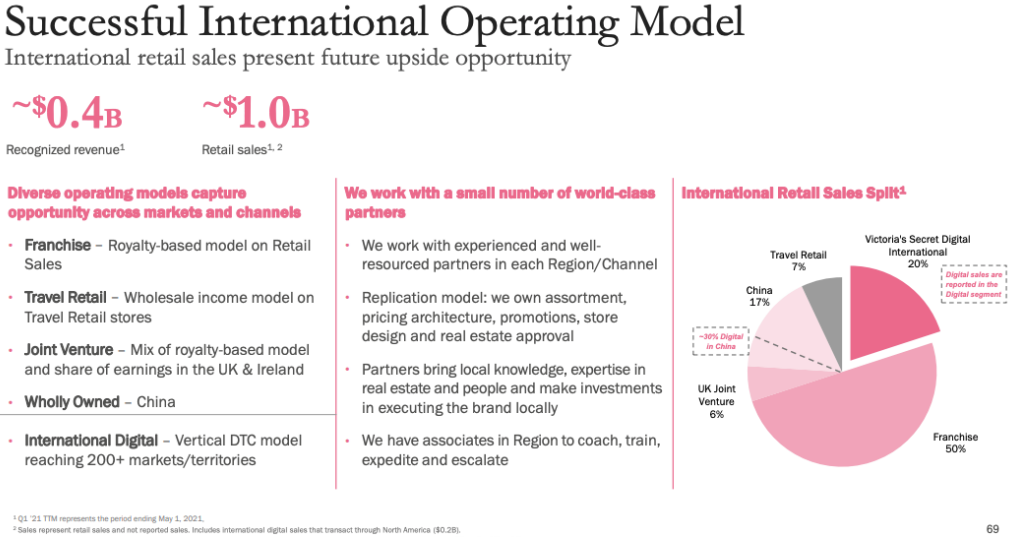

- International Segment To Drive Significant Future Sales Growth

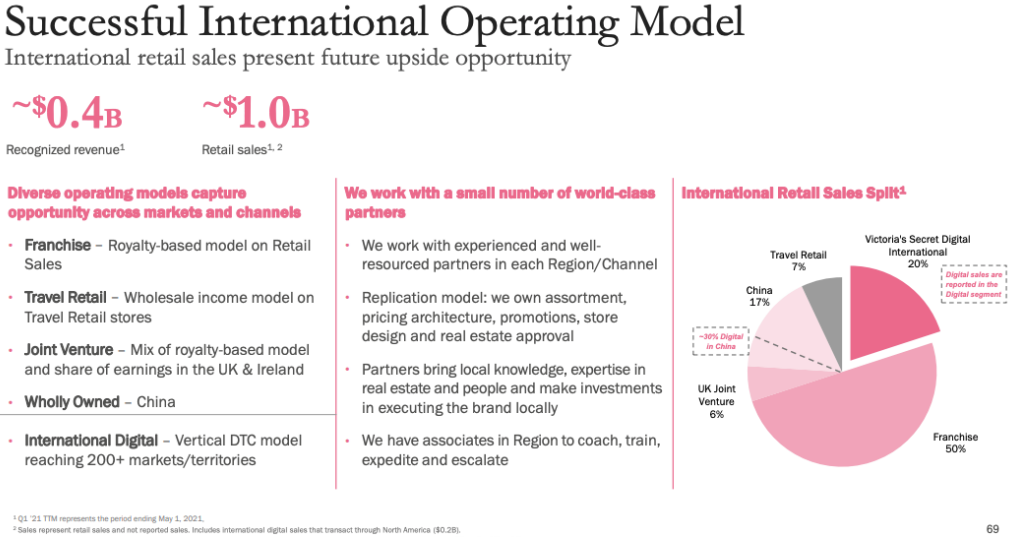

Victoria’s Secret noted that its international business will be an important driver in achieving its financial targets. The company plans to bolster international sales by focusing on five distinct parts of the business:

- Franchise network: Victoria’s Secret will continue to expand its franchise network in the next couple of years. At present, the company operates its international business from seven franchise partners across the globe. The company predicted that its franchise business will continue to see a turnaround in its profitability in fiscal 2021 and beyond, led by store expansion and digital sales growth.

- Travel retail: The company’s travel retail business is recovering strongly as pandemic-related restrictions are eased. Management said that the recovery in the travel retail business is fueling sales growth in the key regions of the Americas and Europe, and will create a significant sales growth opportunity in China.

- Digital business: In fiscal 2021, ended January 30, 2021, about 20% of Victoria’s Secret international sales came from digital channels. The company expects international digital penetration to continue to expand in the next couple of years, driven by investment in digital capabilities such as BOPIS and BORIS, website enhancements, improved translation features and other digital optimization initiatives.

- UK joint venture: Victoria’s Secret entered a joint venture with UK-based apparel retailer Next in September 2020 in order to expand operations in the UK and Ireland. Driven by Next’s large-scale operations and strong omnichannel capabilities, management expects a significant sales and profitability growth opportunity in the UK in the next few years.

- China: Victoria’s Secret noted that it had overhauled its China operating model in early 2021—from managing China from the US to a “China for China” in-country approach, with merchandise developed and sold in China, and marketing campaigns developed and executed in China. Victoria’s Secret’s management said that this new approach will increase sales and profitability.

[caption id="attachment_130412" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Profit-Improvement Plan

Victoria’s Secret noted that the company remained on track to achieve annualized savings of $300 million in 2021 through four key initiatives:

- Improved store productivity: Management said that the company is improving the profitability of its North America stores channel by rationalizing its store fleet and optimizing its store selling cost.

- Merchandise margin-rate expansion: Victoria’s Secret continues to expand its merchandise margin through a combination of negotiated product cost savings and disciplined inventory management.

- Reorganized corporate office: Management said that the company is migrating all of its key corporate functions from its mid-level management team to its top leadership team, which has a common incentive plan and is working toward a common set of goals of improving sales and profitability.

- Restructured international segment: Victoria’s Secret is revamping its China and UK businesses to eliminate losses in the company’s international segment. In China, the company is reducing stores, negotiating rent savings and achieving office overhead cost reductions. In the UK, the company migrated to a joint venture structure with its retail partner Next in September 2020, and it expects notable cost savings from this move.

[caption id="attachment_130413" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Source: Company reports[/caption]

BBW has two key focus areas as the company looks to boost engagement with its target consumers, which we outline below.

Source: Company reports[/caption]

BBW has two key focus areas as the company looks to boost engagement with its target consumers, which we outline below.

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

International Business: A Key Future Growth Driver

BBW noted that its international business has grown remarkably in the past 10 years, from $5 million to over $450 million, and will continue to remain a strong growth driver in the near future. In the next couple of years, the company expects year-over-year percentage growth of its international sales in the high teens or low twenties, as it expands its fleet of international stores by over 15% every year.

Furthermore, BBW plans to expand its business operations in its new markets, particularly Europe, where the company has low penetration. Management also said that the company is testing new emerging markets for entry, but did not identify them.

[caption id="attachment_130409" align="aligncenter" width="700"]

Source: Company reports[/caption]

International Business: A Key Future Growth Driver

BBW noted that its international business has grown remarkably in the past 10 years, from $5 million to over $450 million, and will continue to remain a strong growth driver in the near future. In the next couple of years, the company expects year-over-year percentage growth of its international sales in the high teens or low twenties, as it expands its fleet of international stores by over 15% every year.

Furthermore, BBW plans to expand its business operations in its new markets, particularly Europe, where the company has low penetration. Management also said that the company is testing new emerging markets for entry, but did not identify them.

[caption id="attachment_130409" align="aligncenter" width="700"] Source: Company reports[/caption]

Victoria’s Secret

Medium-Term Financial Targets

For the next three to five years, Victoria’s Secret forecasts global sales growth in the mid-single digits and high-single-digit operating income growth, with operating margin in mid-teens in percentage terms. The company expects its digital penetration to expand to 50% in the next five years, from about 40% currently.

[caption id="attachment_130410" align="aligncenter" width="700"]

Source: Company reports[/caption]

Victoria’s Secret

Medium-Term Financial Targets

For the next three to five years, Victoria’s Secret forecasts global sales growth in the mid-single digits and high-single-digit operating income growth, with operating margin in mid-teens in percentage terms. The company expects its digital penetration to expand to 50% in the next five years, from about 40% currently.

[caption id="attachment_130410" align="aligncenter" width="700"] Source: Company reports[/caption]

Victoria’s Secret has listed two key focus areas to achieve its financial targets, which we outline below.

Source: Company reports[/caption]

Victoria’s Secret has listed two key focus areas to achieve its financial targets, which we outline below.

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Profit-Improvement Plan

Victoria’s Secret noted that the company remained on track to achieve annualized savings of $300 million in 2021 through four key initiatives:

Source: Company reports[/caption]

Profit-Improvement Plan

Victoria’s Secret noted that the company remained on track to achieve annualized savings of $300 million in 2021 through four key initiatives:

Source: Company reports[/caption]

Source: Company reports[/caption]