DIpil Das

L Brands hosted its Investor Day in Columbus, Ohio. The day featured management presentations, including those by: Les Wexner, Chairman & CEO; Stuart Burgdoerfer, Executive Vice President & Chief Financial Officer, Victoria’s Secret Lingerie; John Mehas, Chief Executive Officer, Victoria’s Secret Beauty; Greg Unis, Chief Executive Officer, Victoria’s Secret Beauty; and, Pink CEO Amy Hauk.

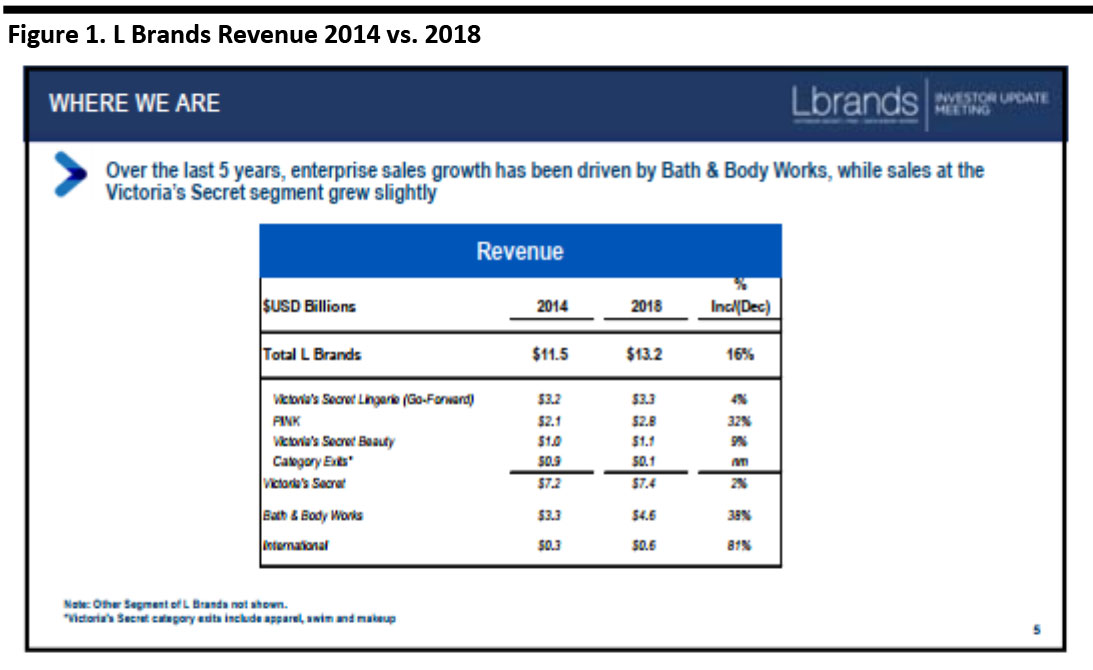

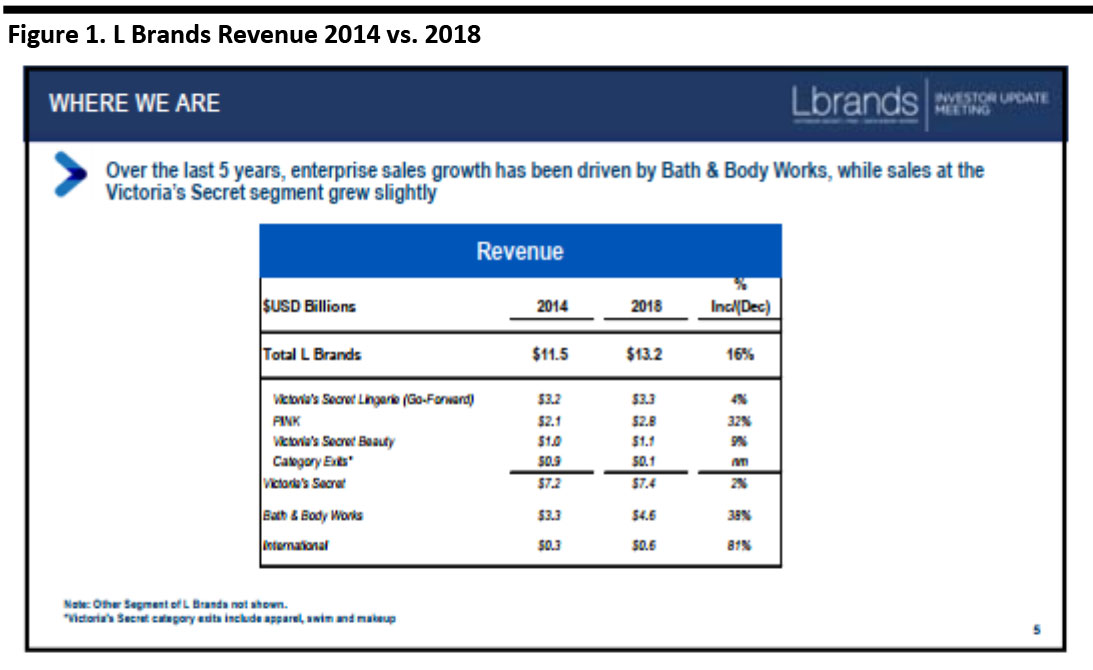

Revenue at L Brands has been Driven by Growth at BBW

Revenue at L Brands grew 16% from $11.5 billion in 2014 to $13.2 billion in 2018. Revenue at BBW increased 38%, while Victoria’s Secret increased just 2% over the same period.

[caption id="attachment_96141" align="aligncenter" width="700"] Source: Company reports [/caption]

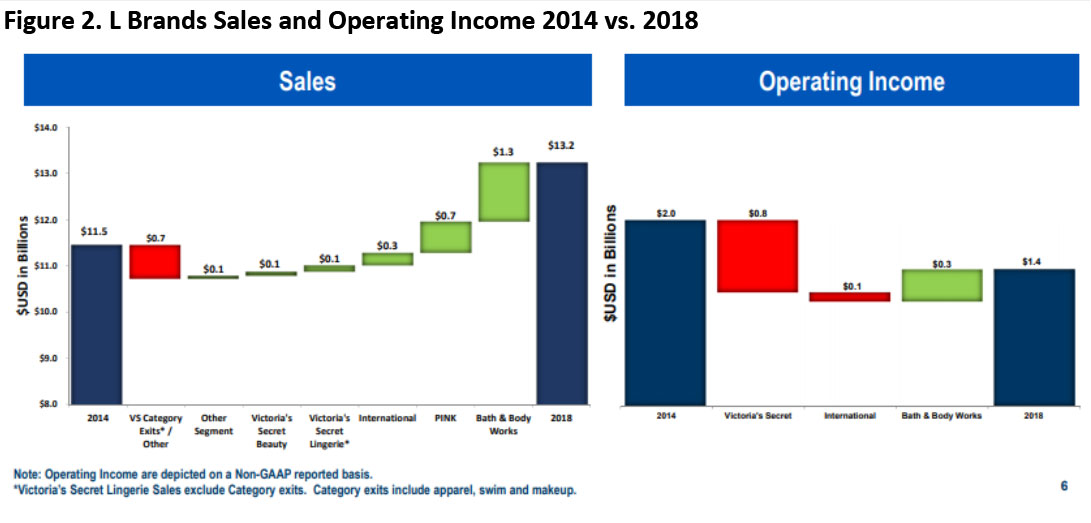

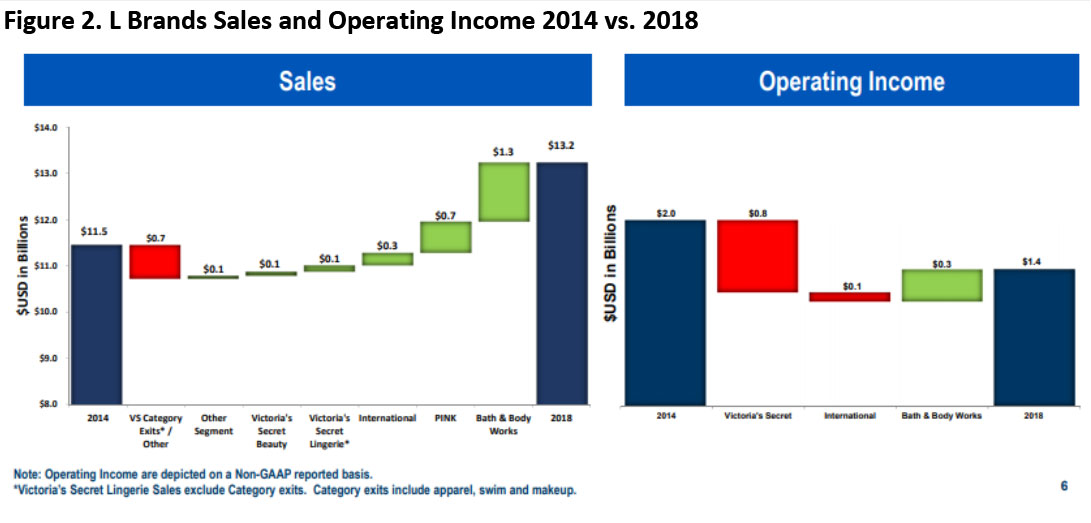

Operating Income Has Declined $800 Million at Victoria’s Secret Over the Past Five Years

In the 2014 to 2018 period, sales at Victoria’s Secret segment grew $200 million (or 2%) to $7.4 billion. However, operating income declined $800 million over the same time span.

The company reported that improving the performance at Victoria’s Secret is its number one priority.

[caption id="attachment_96142" align="aligncenter" width="700"]

Source: Company reports [/caption]

Operating Income Has Declined $800 Million at Victoria’s Secret Over the Past Five Years

In the 2014 to 2018 period, sales at Victoria’s Secret segment grew $200 million (or 2%) to $7.4 billion. However, operating income declined $800 million over the same time span.

The company reported that improving the performance at Victoria’s Secret is its number one priority.

[caption id="attachment_96142" align="aligncenter" width="700"] Source: Company reports [/caption]

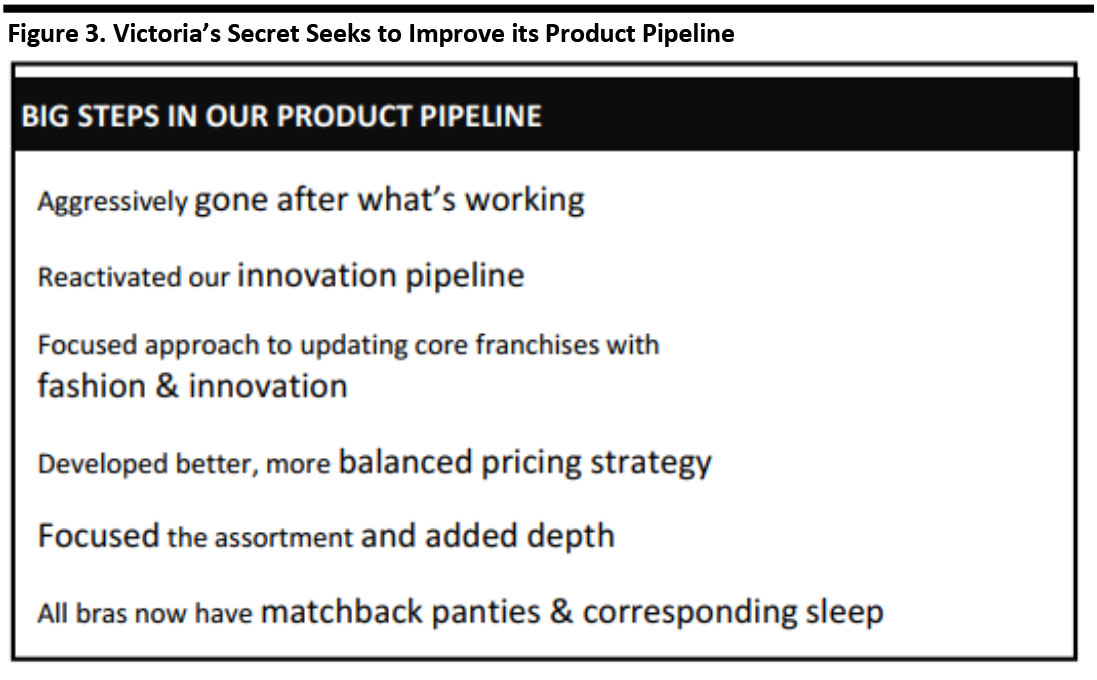

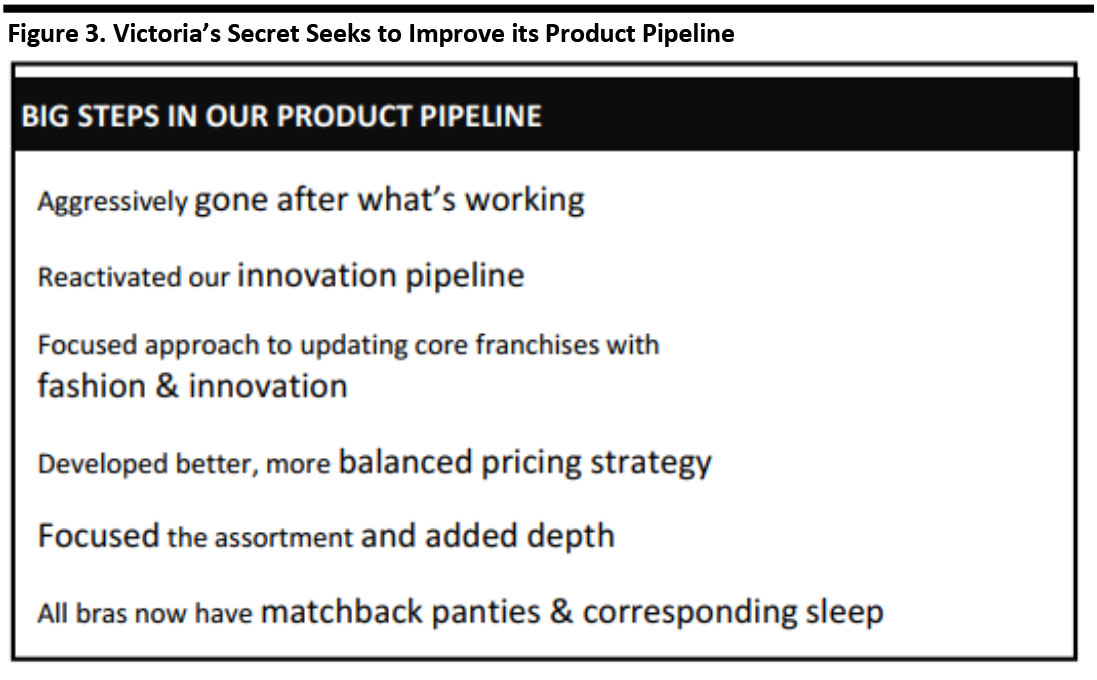

Victoria’s Secret is Working to Improve its Product

Victoria’s Secret is focusing on its product pipeline. The company reported it is updating stores and putting in fewer, simpler styles. The company is also working with third party brands such as Bluebella, for Love & Lemons and Livy as part of its reinvention and innovation program.

[caption id="attachment_96143" align="aligncenter" width="700"]

Source: Company reports [/caption]

Victoria’s Secret is Working to Improve its Product

Victoria’s Secret is focusing on its product pipeline. The company reported it is updating stores and putting in fewer, simpler styles. The company is also working with third party brands such as Bluebella, for Love & Lemons and Livy as part of its reinvention and innovation program.

[caption id="attachment_96143" align="aligncenter" width="700"] Source: Company reports [/caption]

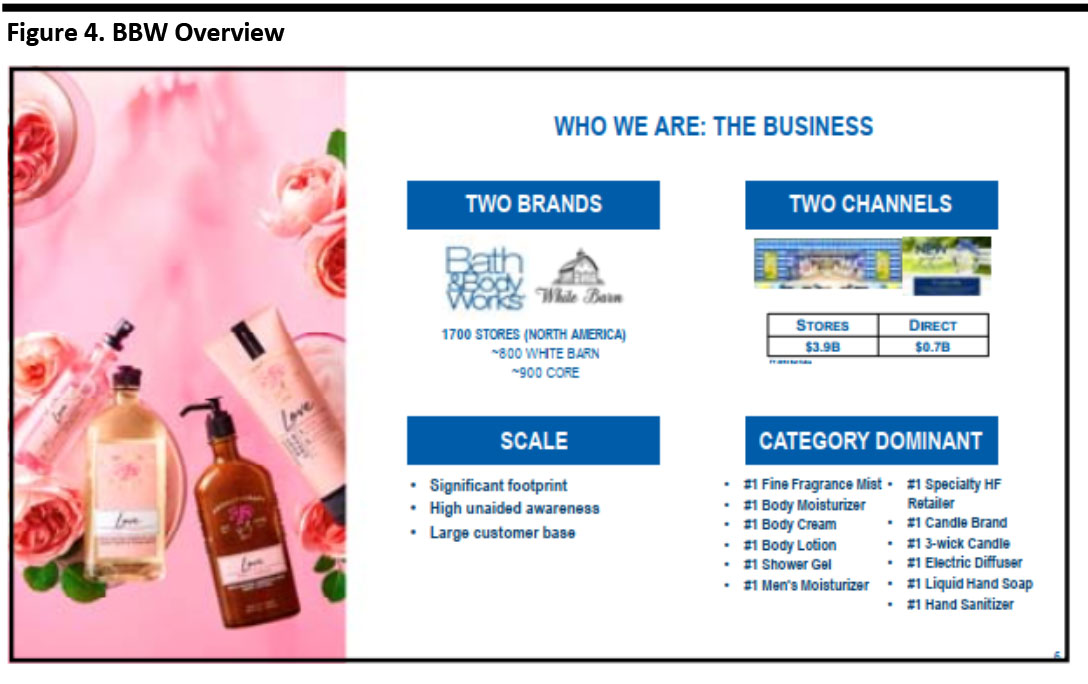

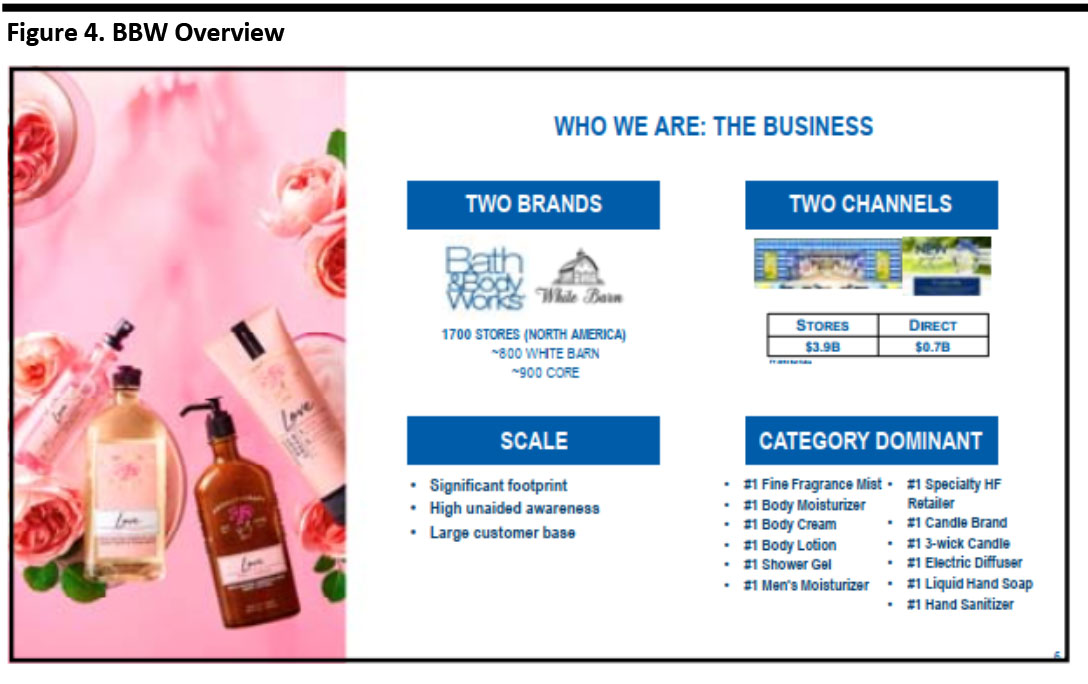

BBW is a $4.6 Billion Business that Attributes Success to its Differentiated Product Packaging and Masstige Price Positioning

BBW has been successful due in part to its category dominance in body care, home and soaps. According to Nicolas Coe, BBW CEO and President, the company entered the home fragrance category at the right time, and the brand has a clear point of view through its differentiated product packaging and its masstige price points across all its categories.

[caption id="attachment_96144" align="aligncenter" width="700"]

Source: Company reports [/caption]

BBW is a $4.6 Billion Business that Attributes Success to its Differentiated Product Packaging and Masstige Price Positioning

BBW has been successful due in part to its category dominance in body care, home and soaps. According to Nicolas Coe, BBW CEO and President, the company entered the home fragrance category at the right time, and the brand has a clear point of view through its differentiated product packaging and its masstige price points across all its categories.

[caption id="attachment_96144" align="aligncenter" width="700"] Source: Company reports [/caption]

Coe said the brand has been able to consistently deliver quality in what appears to be an easy category – but is not easy. He said, “A candle should be easy to make, only they're not. So, it's very difficult to make a candle that burns consistently, has a melt pool that is consistent, that the throw of the fragrance is good and be able to replenish it. And so, it's interesting, in my mind, when I walk into the competition, they want to do what we're doing, but they can't do it as well as we do it, is the way I'm looking at it.”

BBW has been able to create an entire home experience around its position as a masstige brand that is sophisticated like a prestige brand, but has accessible prices. Consumers shop for the products because they want the packaging in their home, so it is as much about the packaging as the product. The company said it takes its cues from fashion, and hires people from fashion.

BBW Sees Growth Opportunity in Aromatherapy and Men’s Business

Aromatherapy is on a growth trajectory, as today’s consumers are interested in healthier, holistic trends. Additionally, the male customer is becoming more important for BBW: He is more emotionally involved than before - with how he looks, how he smells and what he is wearing. Management said that it has seen incredible initial growth in the men’s category and sees potential incremental future opportunities.

L Brands Identified its Core PINK Target Customer as a 19-year-old College Student, a Demographic that Totals 30 Million

Amy Hauk, PINK CEO, said the PINK customer has changed over time, and the company lost sight of who the PINK customer was. L Brands researched and identified who the PINK customer target is and what she wants, and discovered she is a 19-year-old college student who values femininity as empowerment, sees vulnerability as strength and seeks an elevated self-care routine. There are approximately 30 million women in this age group. The company sees its core Pink customer age ranging from 14 to 24, and hopes to create a loyal VS brand following by introducing them to PINK and then “graduating to Victoria’s Secret,” as the company said.

[caption id="attachment_96145" align="aligncenter" width="700"]

Source: Company reports [/caption]

Coe said the brand has been able to consistently deliver quality in what appears to be an easy category – but is not easy. He said, “A candle should be easy to make, only they're not. So, it's very difficult to make a candle that burns consistently, has a melt pool that is consistent, that the throw of the fragrance is good and be able to replenish it. And so, it's interesting, in my mind, when I walk into the competition, they want to do what we're doing, but they can't do it as well as we do it, is the way I'm looking at it.”

BBW has been able to create an entire home experience around its position as a masstige brand that is sophisticated like a prestige brand, but has accessible prices. Consumers shop for the products because they want the packaging in their home, so it is as much about the packaging as the product. The company said it takes its cues from fashion, and hires people from fashion.

BBW Sees Growth Opportunity in Aromatherapy and Men’s Business

Aromatherapy is on a growth trajectory, as today’s consumers are interested in healthier, holistic trends. Additionally, the male customer is becoming more important for BBW: He is more emotionally involved than before - with how he looks, how he smells and what he is wearing. Management said that it has seen incredible initial growth in the men’s category and sees potential incremental future opportunities.

L Brands Identified its Core PINK Target Customer as a 19-year-old College Student, a Demographic that Totals 30 Million

Amy Hauk, PINK CEO, said the PINK customer has changed over time, and the company lost sight of who the PINK customer was. L Brands researched and identified who the PINK customer target is and what she wants, and discovered she is a 19-year-old college student who values femininity as empowerment, sees vulnerability as strength and seeks an elevated self-care routine. There are approximately 30 million women in this age group. The company sees its core Pink customer age ranging from 14 to 24, and hopes to create a loyal VS brand following by introducing them to PINK and then “graduating to Victoria’s Secret,” as the company said.

[caption id="attachment_96145" align="aligncenter" width="700"] Source: Company reports [/caption]

PINK Aims to Grow to its “Seamless” Business to $1 Billion by 2022

Pink is innovating around workout bras and tights. The company launched its “Seamless” line in September 2019, a line of athletic bras and tights with no seams. Management said it hopes to build this business to $1 billion by 2022.

[caption id="attachment_96192" align="aligncenter" width="700"]

Source: Company reports [/caption]

PINK Aims to Grow to its “Seamless” Business to $1 Billion by 2022

Pink is innovating around workout bras and tights. The company launched its “Seamless” line in September 2019, a line of athletic bras and tights with no seams. Management said it hopes to build this business to $1 billion by 2022.

[caption id="attachment_96192" align="aligncenter" width="700"] Source: Company reports [/caption]

L Brands is Testing Smaller Format Stores Internationally called “Victoria's Secret Beauty and Lingerie”

L Brands also announced it is testing a smaller format store internationally that combines both beauty and lingerie. The company has tested the concept internationally in nine smaller format stores ranging from approximately 1,300 to 1,700 square feet. Management said initial results have been positive. As the company accelerated store closures in 2019, closing 55 stores, up from 10 to 30 stores 2015-2018, this smaller format may provide several advantages. First, it will allow Victoria’s Secret to showcase 80% of its beauty collection and over half of its lingerie collection, according to the company. The smaller format also carries a lower capex cost, lowering opening costs and is easier to manage.

[caption id="attachment_96147" align="aligncenter" width="700"]

Source: Company reports [/caption]

L Brands is Testing Smaller Format Stores Internationally called “Victoria's Secret Beauty and Lingerie”

L Brands also announced it is testing a smaller format store internationally that combines both beauty and lingerie. The company has tested the concept internationally in nine smaller format stores ranging from approximately 1,300 to 1,700 square feet. Management said initial results have been positive. As the company accelerated store closures in 2019, closing 55 stores, up from 10 to 30 stores 2015-2018, this smaller format may provide several advantages. First, it will allow Victoria’s Secret to showcase 80% of its beauty collection and over half of its lingerie collection, according to the company. The smaller format also carries a lower capex cost, lowering opening costs and is easier to manage.

[caption id="attachment_96147" align="aligncenter" width="700"] Source: Company reports [/caption]

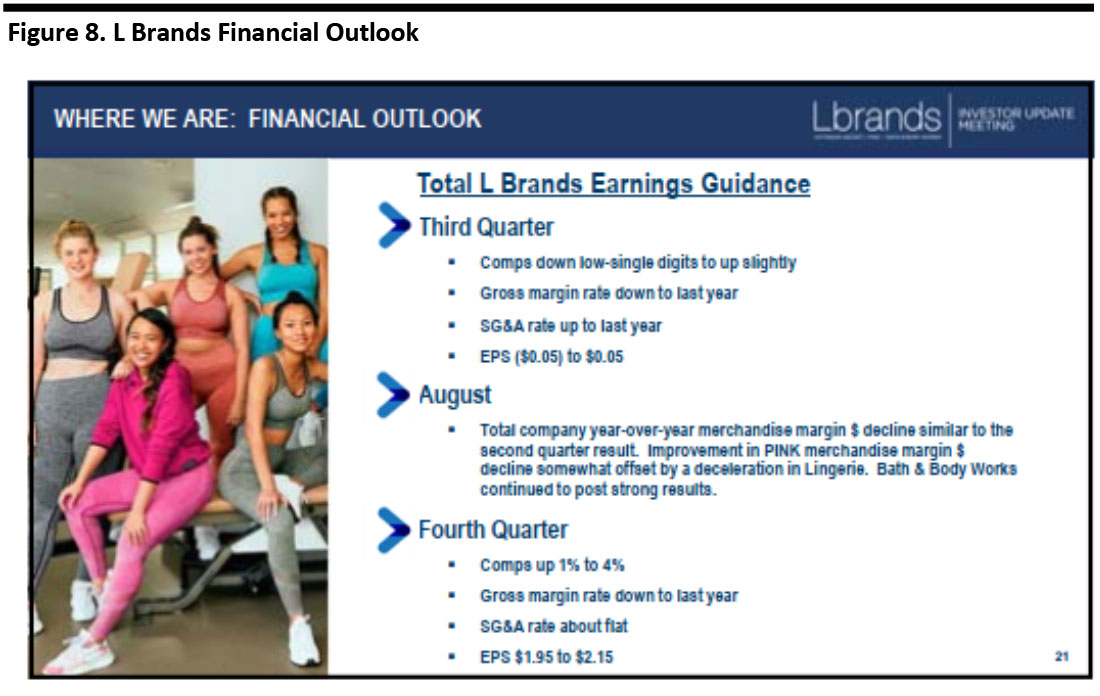

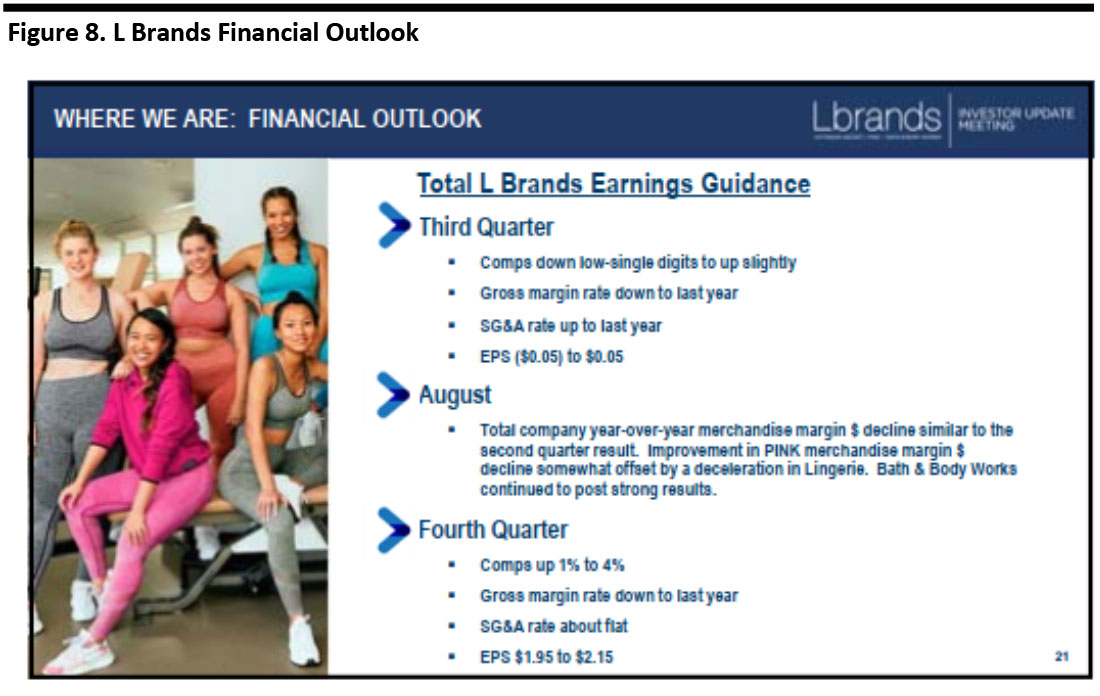

L Brands Affirmed Earnings Guidance for 3Q19 and 4Q19

Management affirmed prior guidance for the third quarter and fourth quarters. For 3Q19, the company expects total comps to be down low single digits to up slightly, and earning per share (EPS) of $(0.05) to $0.05. For 4Q19, the company expects comps to be up 1% to 4% and EPS of $1.95 to $2.15.

[caption id="attachment_96148" align="aligncenter" width="700"]

Source: Company reports [/caption]

L Brands Affirmed Earnings Guidance for 3Q19 and 4Q19

Management affirmed prior guidance for the third quarter and fourth quarters. For 3Q19, the company expects total comps to be down low single digits to up slightly, and earning per share (EPS) of $(0.05) to $0.05. For 4Q19, the company expects comps to be up 1% to 4% and EPS of $1.95 to $2.15.

[caption id="attachment_96148" align="aligncenter" width="700"] Source: Company reports [/caption]

Source: Company reports [/caption]

Source: Company reports [/caption]

Operating Income Has Declined $800 Million at Victoria’s Secret Over the Past Five Years

In the 2014 to 2018 period, sales at Victoria’s Secret segment grew $200 million (or 2%) to $7.4 billion. However, operating income declined $800 million over the same time span.

The company reported that improving the performance at Victoria’s Secret is its number one priority.

[caption id="attachment_96142" align="aligncenter" width="700"]

Source: Company reports [/caption]

Operating Income Has Declined $800 Million at Victoria’s Secret Over the Past Five Years

In the 2014 to 2018 period, sales at Victoria’s Secret segment grew $200 million (or 2%) to $7.4 billion. However, operating income declined $800 million over the same time span.

The company reported that improving the performance at Victoria’s Secret is its number one priority.

[caption id="attachment_96142" align="aligncenter" width="700"] Source: Company reports [/caption]

Victoria’s Secret is Working to Improve its Product

Victoria’s Secret is focusing on its product pipeline. The company reported it is updating stores and putting in fewer, simpler styles. The company is also working with third party brands such as Bluebella, for Love & Lemons and Livy as part of its reinvention and innovation program.

[caption id="attachment_96143" align="aligncenter" width="700"]

Source: Company reports [/caption]

Victoria’s Secret is Working to Improve its Product

Victoria’s Secret is focusing on its product pipeline. The company reported it is updating stores and putting in fewer, simpler styles. The company is also working with third party brands such as Bluebella, for Love & Lemons and Livy as part of its reinvention and innovation program.

[caption id="attachment_96143" align="aligncenter" width="700"] Source: Company reports [/caption]

BBW is a $4.6 Billion Business that Attributes Success to its Differentiated Product Packaging and Masstige Price Positioning

BBW has been successful due in part to its category dominance in body care, home and soaps. According to Nicolas Coe, BBW CEO and President, the company entered the home fragrance category at the right time, and the brand has a clear point of view through its differentiated product packaging and its masstige price points across all its categories.

[caption id="attachment_96144" align="aligncenter" width="700"]

Source: Company reports [/caption]

BBW is a $4.6 Billion Business that Attributes Success to its Differentiated Product Packaging and Masstige Price Positioning

BBW has been successful due in part to its category dominance in body care, home and soaps. According to Nicolas Coe, BBW CEO and President, the company entered the home fragrance category at the right time, and the brand has a clear point of view through its differentiated product packaging and its masstige price points across all its categories.

[caption id="attachment_96144" align="aligncenter" width="700"] Source: Company reports [/caption]

Coe said the brand has been able to consistently deliver quality in what appears to be an easy category – but is not easy. He said, “A candle should be easy to make, only they're not. So, it's very difficult to make a candle that burns consistently, has a melt pool that is consistent, that the throw of the fragrance is good and be able to replenish it. And so, it's interesting, in my mind, when I walk into the competition, they want to do what we're doing, but they can't do it as well as we do it, is the way I'm looking at it.”

BBW has been able to create an entire home experience around its position as a masstige brand that is sophisticated like a prestige brand, but has accessible prices. Consumers shop for the products because they want the packaging in their home, so it is as much about the packaging as the product. The company said it takes its cues from fashion, and hires people from fashion.

BBW Sees Growth Opportunity in Aromatherapy and Men’s Business

Aromatherapy is on a growth trajectory, as today’s consumers are interested in healthier, holistic trends. Additionally, the male customer is becoming more important for BBW: He is more emotionally involved than before - with how he looks, how he smells and what he is wearing. Management said that it has seen incredible initial growth in the men’s category and sees potential incremental future opportunities.

L Brands Identified its Core PINK Target Customer as a 19-year-old College Student, a Demographic that Totals 30 Million

Amy Hauk, PINK CEO, said the PINK customer has changed over time, and the company lost sight of who the PINK customer was. L Brands researched and identified who the PINK customer target is and what she wants, and discovered she is a 19-year-old college student who values femininity as empowerment, sees vulnerability as strength and seeks an elevated self-care routine. There are approximately 30 million women in this age group. The company sees its core Pink customer age ranging from 14 to 24, and hopes to create a loyal VS brand following by introducing them to PINK and then “graduating to Victoria’s Secret,” as the company said.

[caption id="attachment_96145" align="aligncenter" width="700"]

Source: Company reports [/caption]

Coe said the brand has been able to consistently deliver quality in what appears to be an easy category – but is not easy. He said, “A candle should be easy to make, only they're not. So, it's very difficult to make a candle that burns consistently, has a melt pool that is consistent, that the throw of the fragrance is good and be able to replenish it. And so, it's interesting, in my mind, when I walk into the competition, they want to do what we're doing, but they can't do it as well as we do it, is the way I'm looking at it.”

BBW has been able to create an entire home experience around its position as a masstige brand that is sophisticated like a prestige brand, but has accessible prices. Consumers shop for the products because they want the packaging in their home, so it is as much about the packaging as the product. The company said it takes its cues from fashion, and hires people from fashion.

BBW Sees Growth Opportunity in Aromatherapy and Men’s Business

Aromatherapy is on a growth trajectory, as today’s consumers are interested in healthier, holistic trends. Additionally, the male customer is becoming more important for BBW: He is more emotionally involved than before - with how he looks, how he smells and what he is wearing. Management said that it has seen incredible initial growth in the men’s category and sees potential incremental future opportunities.

L Brands Identified its Core PINK Target Customer as a 19-year-old College Student, a Demographic that Totals 30 Million

Amy Hauk, PINK CEO, said the PINK customer has changed over time, and the company lost sight of who the PINK customer was. L Brands researched and identified who the PINK customer target is and what she wants, and discovered she is a 19-year-old college student who values femininity as empowerment, sees vulnerability as strength and seeks an elevated self-care routine. There are approximately 30 million women in this age group. The company sees its core Pink customer age ranging from 14 to 24, and hopes to create a loyal VS brand following by introducing them to PINK and then “graduating to Victoria’s Secret,” as the company said.

[caption id="attachment_96145" align="aligncenter" width="700"] Source: Company reports [/caption]

PINK Aims to Grow to its “Seamless” Business to $1 Billion by 2022

Pink is innovating around workout bras and tights. The company launched its “Seamless” line in September 2019, a line of athletic bras and tights with no seams. Management said it hopes to build this business to $1 billion by 2022.

[caption id="attachment_96192" align="aligncenter" width="700"]

Source: Company reports [/caption]

PINK Aims to Grow to its “Seamless” Business to $1 Billion by 2022

Pink is innovating around workout bras and tights. The company launched its “Seamless” line in September 2019, a line of athletic bras and tights with no seams. Management said it hopes to build this business to $1 billion by 2022.

[caption id="attachment_96192" align="aligncenter" width="700"] Source: Company reports [/caption]

L Brands is Testing Smaller Format Stores Internationally called “Victoria's Secret Beauty and Lingerie”

L Brands also announced it is testing a smaller format store internationally that combines both beauty and lingerie. The company has tested the concept internationally in nine smaller format stores ranging from approximately 1,300 to 1,700 square feet. Management said initial results have been positive. As the company accelerated store closures in 2019, closing 55 stores, up from 10 to 30 stores 2015-2018, this smaller format may provide several advantages. First, it will allow Victoria’s Secret to showcase 80% of its beauty collection and over half of its lingerie collection, according to the company. The smaller format also carries a lower capex cost, lowering opening costs and is easier to manage.

[caption id="attachment_96147" align="aligncenter" width="700"]

Source: Company reports [/caption]

L Brands is Testing Smaller Format Stores Internationally called “Victoria's Secret Beauty and Lingerie”

L Brands also announced it is testing a smaller format store internationally that combines both beauty and lingerie. The company has tested the concept internationally in nine smaller format stores ranging from approximately 1,300 to 1,700 square feet. Management said initial results have been positive. As the company accelerated store closures in 2019, closing 55 stores, up from 10 to 30 stores 2015-2018, this smaller format may provide several advantages. First, it will allow Victoria’s Secret to showcase 80% of its beauty collection and over half of its lingerie collection, according to the company. The smaller format also carries a lower capex cost, lowering opening costs and is easier to manage.

[caption id="attachment_96147" align="aligncenter" width="700"] Source: Company reports [/caption]

L Brands Affirmed Earnings Guidance for 3Q19 and 4Q19

Management affirmed prior guidance for the third quarter and fourth quarters. For 3Q19, the company expects total comps to be down low single digits to up slightly, and earning per share (EPS) of $(0.05) to $0.05. For 4Q19, the company expects comps to be up 1% to 4% and EPS of $1.95 to $2.15.

[caption id="attachment_96148" align="aligncenter" width="700"]

Source: Company reports [/caption]

L Brands Affirmed Earnings Guidance for 3Q19 and 4Q19

Management affirmed prior guidance for the third quarter and fourth quarters. For 3Q19, the company expects total comps to be down low single digits to up slightly, and earning per share (EPS) of $(0.05) to $0.05. For 4Q19, the company expects comps to be up 1% to 4% and EPS of $1.95 to $2.15.

[caption id="attachment_96148" align="aligncenter" width="700"] Source: Company reports [/caption]

Source: Company reports [/caption]