albert Chan

L Brands, Inc.

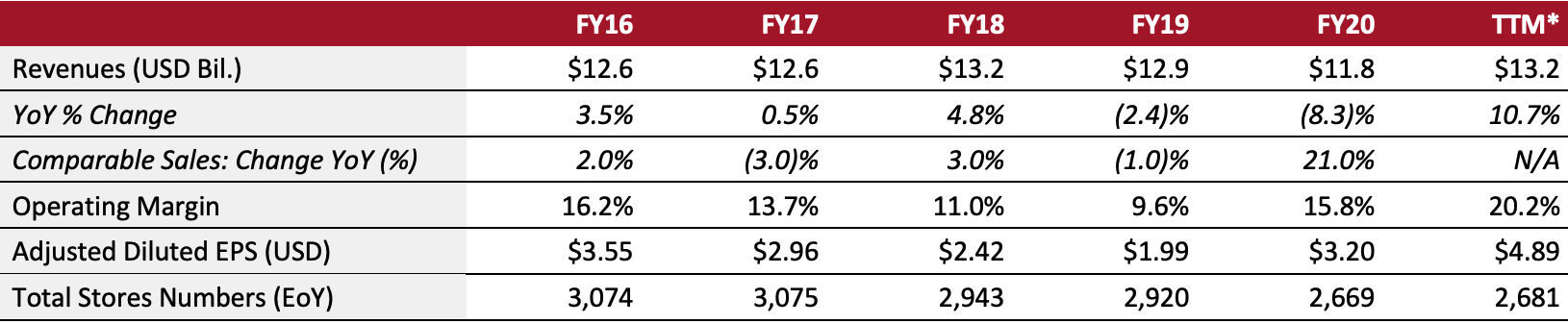

Sector: Apparel specialty retail Countries of operation: Canada, China, Hong Kong, Ireland, the UK and the US Key product categories: Apparel, beauty and personal care, and home goods Annual Metrics [caption id="attachment_130289" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

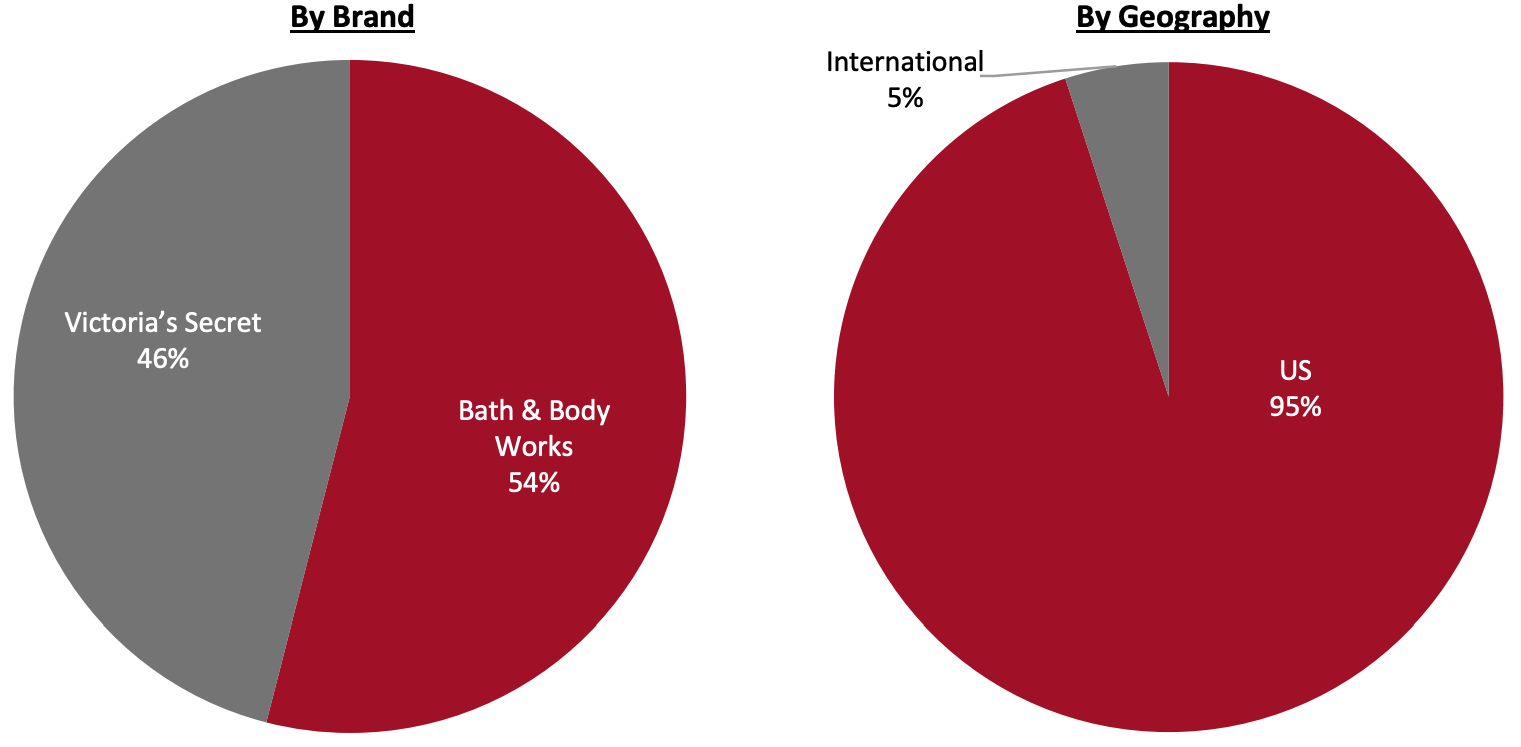

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended May 1, 2021[/caption] Summary Founded in 1963 and headquartered in Columbus, Ohio, L Brands is a specialty retailer that sells women’s apparel, beauty and personal care products, and home fragrances. The company comprises two segments: Bath & Body Works and Victoria’s Secret. Its offerings include aromatherapy items, athletic apparel bras, body products, handbags, intimates, jewelry, loungewear, personal care accessories, shower gels and lotions, and soaps and sanitizers. The company sells under the brands Bath & Body Works, PINK and Victoria’s Secret. L Brands offers merchandise through company-owned specialty retail stores in Canada, China, Hong Kong, Ireland, the UK and the US. Its stores are primarily mall-based. The company also operates websites and sells through international franchises, as well as license and wholesale partners. As of May 1, 2021, it operates 2,681 company-owned specialty stores and sells its products through more than 700 franchised locations and online worldwide. Company Analysis Coresight Research insight: L Brands has improved its operational performance in the past four reported quarters (its latest quarter ended May 1, 2021), as the company navigates pandemic disruptions. The company’s non-apparel banner, Bath & Body Works, has experienced outstanding growth as consumer demand in its key categories increased during the crisis—including beauty, home, personal care and sanitization. Additionally, Victoria’s Secret strongly increased sales in its latest reported quarter (ended May 1, 2021), benefiting from improving consumer demand, an optimized inventory and operational enhancement. We see the company’s current strategies as steps in the right direction. These include its plan to save $400 million annually through more than 250 store closures and headcount rightsizing, as well as its decision to spin off Victoria’s Secret into a private company, leaving Bath & Body Works as a standalone public firm. The company’s digital platform is gaining traction, particularly at Bath & Body Works, where omnichannel shoppers spent three times more than a single-channel shopper in fiscal 2020 (ended January 30, 2021). Within product categories, we expect both soap and sanitizers to enjoy solid demand through the remainder of 2021.

| Tailwinds | Headwinds |

|

|

- Open about 50 new Bath & Body Works stores in North America in 2021, mostly off-mall.

- Open 50–70 international Bath & Body Works stores in 2021, increasing its international store count by 15–23%, in collaboration with its partners. Additionally, its partners plan to open 20 new websites for Victoria’s Secret’s international digital operations in 2021.

- Manage its inventory through lead-time reductions and in-season agility to bolster sales and reduce promotional activity.

- Review its real estate portfolio proactively and rigorously.

- Develop fulfillment capacity to speed up the delivery of online orders.

- Invest in trained, talented and productive store associates.

- Gather and share resources to offer education, insights and tools for its employees to manage bias and to be better allies.

- Increase investments in organizations that fight against inequality and racism.

- Procure 50% of the company’s cotton requirements through more sustainable sources by the end of 2021.

- Select suppliers based on the company’s stringent standards for labor safety, quality and the environment. The majority of the retailer’s production occurs in China, India, Indonesia, Sri Lanka, the US and Vietnam.

- Audit suppliers for compliance with its code of conduct, with a strong focus on forced labor.

| Date | Development |

| May 19, 2021 | L Brands announces that on the completion of Victoria’s Secret’s spin-off in August 2021, Wendy Arlin, currently Senior Vice President of Finance and Controller for L Brands, will become Bath & Body Works CFO. Tim Johnson, previously working as CFO and Chief Administrative Officer for Big Lots, will become Victoria’s Secret CFO. L Brands’ current CFO Stuart Burgdoerfer will retire. |

| May 11, 2021 | L Brands’ Board of Directors unanimously approves a plan to separate Bath & Body Works and Victoria’s Secret through a tax-free spin-off of Victoria’s Secret to L Brands’ shareholders. The spin-off is expected to be completed in August 2021. |

| February 4, 2021 | L Brands announces that Stuart Burgdoerfer will retire as CFO of the company, effective August 2021, and as interim CEO of the Victoria’s Secret business, effective immediately. Martin Waters, CEO of Victoria’s Secret Lingerie, is promoted to CEO of the Victoria’s Secret business, effective immediately. L Brands has started looking for both internal and external candidates for Burgdoerfer’s successor as CFO. |

| December 21, 2020 | L Brands announces key leadership appointments at Bath & Body Works: Julie Rosen joins as President with immediate effect, while Deon Riley joins as Chief Human Resources Officer, effective December 2020. Bath & Body Works also announces internal promotions: Chris Cramer is promoted to COO, Danielle Demko is promoted to EVP and General Manager of Direct Channels; George Arenschield is promoted to EVP, Merchandise, Planning and Allocation; and Ron Ford is named as EVP and Head of Stores and Sales. |

| November 25, 2020 | L Brands announces key leadership appointments at Victoria’s Secret: Martin Waters is named as CEO of Victoria’s Secret Lingerie, effective immediately, replacing John Mehas, who served in the role since February 2019. Furthermore, Laurel Miller is named as Chief Human Resources Officer of Victoria’s Secret; Becky Behringer is promoted to EVP of North America Store Sales and Operations; and Janie Schaffer is named as Chief Design Officer of Victoria’s Secret Lingerie. |

| September 14, 2020 | L Brands announces a partnership with Next Plc, forming a joint venture that will acquire the majority stake in the Victoria’s Secret UK business. Next will own a 51% stake in the joint venture, while Victoria’s Secret will own 49%. |

- Andrew Meslow—CEO

- Stuart Burgdoerfer—CFO, EVP

- Amy Hauk—CEO of Victoria’s Secret PINK

- Greg Unis—CEO of Victoria’s Secret Beauty

- Martin Waters—CEO of Victoria’s Secret Lingerie

Source: Company reports/S&P Capital IQ