Nitheesh NH

[caption id="attachment_79606" align="aligncenter" width="620"] *Nonadjusted

*Nonadjusted

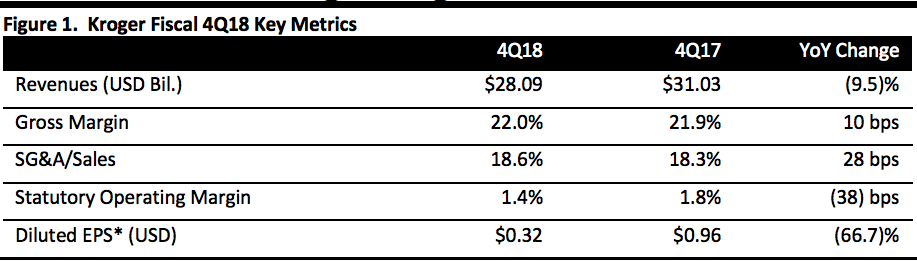

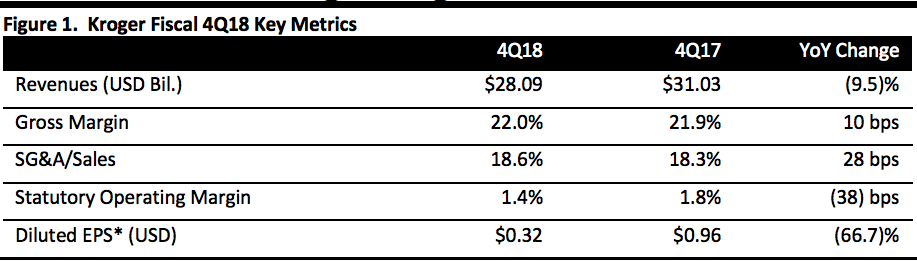

Source: Company reports/Coresight Research[/caption] 4Q18 Results In fiscal 4Q18, Kroger reported further solid same-store sales growth excluding fuel: This metric came in at 1.9% year over year, nudging up from 1.6% in the third quarter and in line with analyst expectations. The company’s 9.5% decline in total sales was driven by the sale of its convenience-store business in early 2018. Excluding the impact from this divestiture as well as the impact from the merger with Home Chef, total sales were up 1.6% year over year in 4Q18. The company recorded a LIFO credit of $10 million in 4Q18, compared to a $54 million LIFO credit one year earlier. Excluding fuel, the 53rd week, and the LIFO credit, the gross margin decreased 93 bps year over year; management attributed this margin decline to changes in the mix, investments in its supply chain and investments in price. The SG&A ratio increased "due entirely to incentive pay and continuing to staff digital initiatives.” 4Q18 52-week adjusted EPS of $0.48 compared to $0.54 in the prior year and came in shy of the $0.52 consensus. Management pointed to a number of highlights in its three-year Restock Kroger transformation program in 4Q18:

*Nonadjusted

*NonadjustedSource: Company reports/Coresight Research[/caption] 4Q18 Results In fiscal 4Q18, Kroger reported further solid same-store sales growth excluding fuel: This metric came in at 1.9% year over year, nudging up from 1.6% in the third quarter and in line with analyst expectations. The company’s 9.5% decline in total sales was driven by the sale of its convenience-store business in early 2018. Excluding the impact from this divestiture as well as the impact from the merger with Home Chef, total sales were up 1.6% year over year in 4Q18. The company recorded a LIFO credit of $10 million in 4Q18, compared to a $54 million LIFO credit one year earlier. Excluding fuel, the 53rd week, and the LIFO credit, the gross margin decreased 93 bps year over year; management attributed this margin decline to changes in the mix, investments in its supply chain and investments in price. The SG&A ratio increased "due entirely to incentive pay and continuing to staff digital initiatives.” 4Q18 52-week adjusted EPS of $0.48 compared to $0.54 in the prior year and came in shy of the $0.52 consensus. Management pointed to a number of highlights in its three-year Restock Kroger transformation program in 4Q18:

- It introduced Kroger Pay mobile payment option and the Kroger Rewards debit card.

- The company expanded the nationwide retail rollout of Home Chef meal kits.

- It launched the Rx Savings Club to reduce the cost of prescription drugs for customers.

- It hosted a “First Pitch” event at the Natural Products Expo West to partner with more natural and organic suppliers.

- Kroger announced a collaboration with Microsoft to launch a “connected store” experience pilot, which includes smart shelves and digital tools to help staff pick grocery orders; it also launched a Retail-as-a-Service product to sell to other retailers.

- It announced two additional Ocado distribution center locations, in Florida and the Mid-Atlantic.

- It launched the world's first-ever unstaffed grocery delivery service using autonomous delivery pods in partnership with startup Nuro.

- Same-store sales growth strengthened year over year.

- It achieved FIFO operating profit and free cash flow goals.

- The company achieved over $1 billion in cost savings through process improvements.

- The company grew digital sales by 58% year over year. The company expanded pickup or delivery services to 91% of Kroger households.

- It announced partnerships with Home Chef, Microsoft, Nuro, Ocado and Walgreens.

- Alternative profit streams Media and Kroger Personal Finance beat their operating profit goals.

- The company raised its dividend for 12th consecutive year.

- It invested in wages and launched its Feed Your Future education program for associates.

- Same-store sales growth, ex fuel, of between 2.0% and 2.25%.

- Diluted EPS of between $2.15 and $2.25, and FIFO operating profit of between $2.9 and $3.0 billion.

- Capital investments, excluding M&A and purchases of leased facilities, of between $3.0 and $3.2 billion.