DIpil Das

[caption id="attachment_96242" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kroger reported 2Q19 same-store sales growth ex fuel of 2.2%, comfortably ahead of the consensus estimate of 1.8% recorded by StreetAccount and accelerating from 1.5% in the prior quarter. Management noted this was its best same-store sales result since the launch of its Restock Kroger plan.

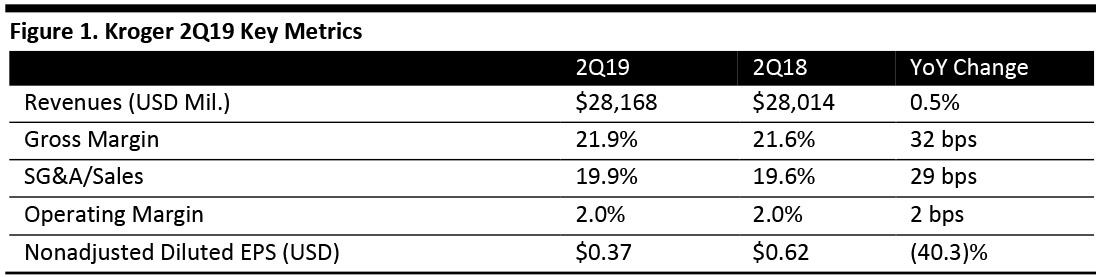

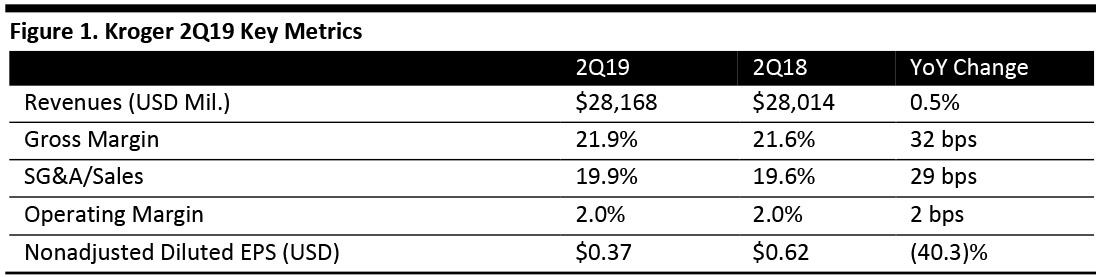

Revenue of $28.17 billion came in below consensus of $28.37 billion, and was up 0.5% year over year. Operating profit of $559 million was up 1.8% year over year.

Adjusted EPS of $0.44 was ahead of the $0.41 consensus and up from $0.41 in the year-ago period. Exceptional items in 2Q19 included adjustments for mark-to-market loss on Ocado securities and for pension plan agreements.

Digital sales increased 31%, versus a 42% gain in the prior quarter.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kroger reported 2Q19 same-store sales growth ex fuel of 2.2%, comfortably ahead of the consensus estimate of 1.8% recorded by StreetAccount and accelerating from 1.5% in the prior quarter. Management noted this was its best same-store sales result since the launch of its Restock Kroger plan.

Revenue of $28.17 billion came in below consensus of $28.37 billion, and was up 0.5% year over year. Operating profit of $559 million was up 1.8% year over year.

Adjusted EPS of $0.44 was ahead of the $0.41 consensus and up from $0.41 in the year-ago period. Exceptional items in 2Q19 included adjustments for mark-to-market loss on Ocado securities and for pension plan agreements.

Digital sales increased 31%, versus a 42% gain in the prior quarter.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kroger reported 2Q19 same-store sales growth ex fuel of 2.2%, comfortably ahead of the consensus estimate of 1.8% recorded by StreetAccount and accelerating from 1.5% in the prior quarter. Management noted this was its best same-store sales result since the launch of its Restock Kroger plan.

Revenue of $28.17 billion came in below consensus of $28.37 billion, and was up 0.5% year over year. Operating profit of $559 million was up 1.8% year over year.

Adjusted EPS of $0.44 was ahead of the $0.41 consensus and up from $0.41 in the year-ago period. Exceptional items in 2Q19 included adjustments for mark-to-market loss on Ocado securities and for pension plan agreements.

Digital sales increased 31%, versus a 42% gain in the prior quarter.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kroger reported 2Q19 same-store sales growth ex fuel of 2.2%, comfortably ahead of the consensus estimate of 1.8% recorded by StreetAccount and accelerating from 1.5% in the prior quarter. Management noted this was its best same-store sales result since the launch of its Restock Kroger plan.

Revenue of $28.17 billion came in below consensus of $28.37 billion, and was up 0.5% year over year. Operating profit of $559 million was up 1.8% year over year.

Adjusted EPS of $0.44 was ahead of the $0.41 consensus and up from $0.41 in the year-ago period. Exceptional items in 2Q19 included adjustments for mark-to-market loss on Ocado securities and for pension plan agreements.

Digital sales increased 31%, versus a 42% gain in the prior quarter.

Management pointed to progress in its Restock Kroger plan, including:

- Increasing sales of Kroger private-label products by 3.1%, with 203 new private-label products launched in the quarter.

- Expanding grocery pickup to 1,780 locations (versus 1,685 locations at the end of 1Q19) and grocery delivery to 2,225 locations (versus 2,126 locations at the end of the prior quarter), which the company says covers 95% of Kroger households.

- Announcing the expansion of its Walgreens exploratory pilot into Knoxville, Tennessee.

- Naming the location of its next Kroger-Ocado fulfillment center, in Georgia.

- Adjusted same-store sales growth of 2.0-2.25%.

- Operating profit of $2.9-3.0 billion.

- Adjusted EPS of $2.15-2.25.