Nitheesh NH

[caption id="attachment_91458" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

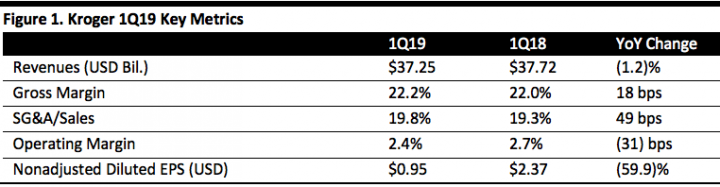

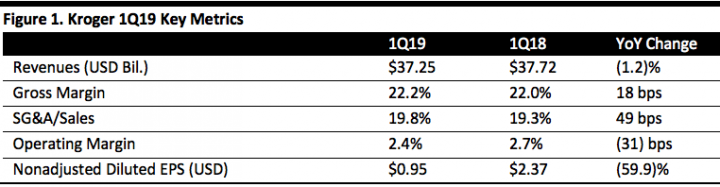

Kroger reported 1Q19 same-store sales growth ex fuel of 1.5%, below the consensus estimate of 1.7% recorded by StreetAccount and slowing from 1.9% in the prior quarter. Revenue of $37.25 billion came in marginally ahead of consensus, but was down 1.2% year over year due to the sale of the company’s convenience-store business. Management noted that, stripping out the effect of this sale, total sales ex fuel were up 2.0% year over year.

Adjusted EPS of $0.72 was just ahead of the $0.71 consensus but just below $0.73 in the year-ago period. This metric included adjustments for gains from the sale of the Turkey Hill business and YouTech, and for a mark to market gain on Ocado securities. Nonadjusted diluted EPS was down nearly 60% year over year, impacted by higher operating, general and administrative costs and an increase in depreciation and amortization.

Digital sales increased 42%, versus 58% in FY18.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kroger reported 1Q19 same-store sales growth ex fuel of 1.5%, below the consensus estimate of 1.7% recorded by StreetAccount and slowing from 1.9% in the prior quarter. Revenue of $37.25 billion came in marginally ahead of consensus, but was down 1.2% year over year due to the sale of the company’s convenience-store business. Management noted that, stripping out the effect of this sale, total sales ex fuel were up 2.0% year over year.

Adjusted EPS of $0.72 was just ahead of the $0.71 consensus but just below $0.73 in the year-ago period. This metric included adjustments for gains from the sale of the Turkey Hill business and YouTech, and for a mark to market gain on Ocado securities. Nonadjusted diluted EPS was down nearly 60% year over year, impacted by higher operating, general and administrative costs and an increase in depreciation and amortization.

Digital sales increased 42%, versus 58% in FY18.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kroger reported 1Q19 same-store sales growth ex fuel of 1.5%, below the consensus estimate of 1.7% recorded by StreetAccount and slowing from 1.9% in the prior quarter. Revenue of $37.25 billion came in marginally ahead of consensus, but was down 1.2% year over year due to the sale of the company’s convenience-store business. Management noted that, stripping out the effect of this sale, total sales ex fuel were up 2.0% year over year.

Adjusted EPS of $0.72 was just ahead of the $0.71 consensus but just below $0.73 in the year-ago period. This metric included adjustments for gains from the sale of the Turkey Hill business and YouTech, and for a mark to market gain on Ocado securities. Nonadjusted diluted EPS was down nearly 60% year over year, impacted by higher operating, general and administrative costs and an increase in depreciation and amortization.

Digital sales increased 42%, versus 58% in FY18.

Management pointed to progress in its Restock Kroger plan, including:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kroger reported 1Q19 same-store sales growth ex fuel of 1.5%, below the consensus estimate of 1.7% recorded by StreetAccount and slowing from 1.9% in the prior quarter. Revenue of $37.25 billion came in marginally ahead of consensus, but was down 1.2% year over year due to the sale of the company’s convenience-store business. Management noted that, stripping out the effect of this sale, total sales ex fuel were up 2.0% year over year.

Adjusted EPS of $0.72 was just ahead of the $0.71 consensus but just below $0.73 in the year-ago period. This metric included adjustments for gains from the sale of the Turkey Hill business and YouTech, and for a mark to market gain on Ocado securities. Nonadjusted diluted EPS was down nearly 60% year over year, impacted by higher operating, general and administrative costs and an increase in depreciation and amortization.

Digital sales increased 42%, versus 58% in FY18.

Management pointed to progress in its Restock Kroger plan, including:

- Increasing sales of Kroger private label products 3.3%, led by double-digit growth at Simple Truth.

- Expanding grocery pickup to 1,685 locations and grocery delivery to 2,126 locations, which the company says covers 93% of Kroger households.

- Forming PearlRock Partners, a platform to invest in consumer product brands.

- Breaking ground on the first Kroger-Ocado customer fulfillment center, in Monroe, Ohio.

- Selling cloud-based retail platform YouTech and the Turkey Hill food brand.

- Adjusted same-store sales growth of 2.0-2.25%.

- Operating profit of $2.9-3.0 billion.

- Adjusted EPS of $2.15-2.25.