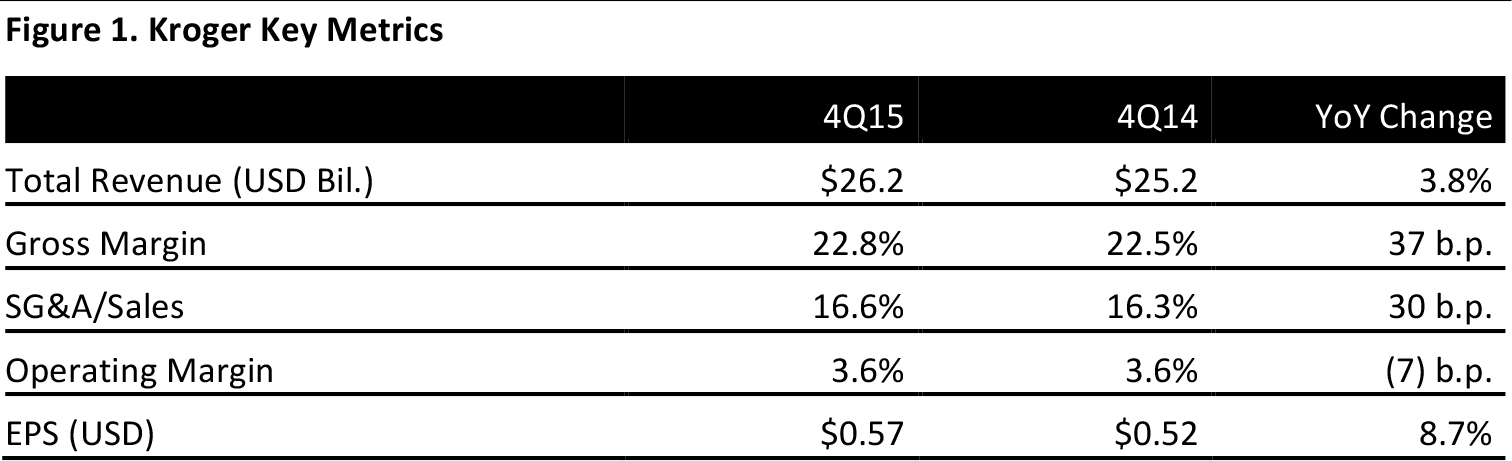

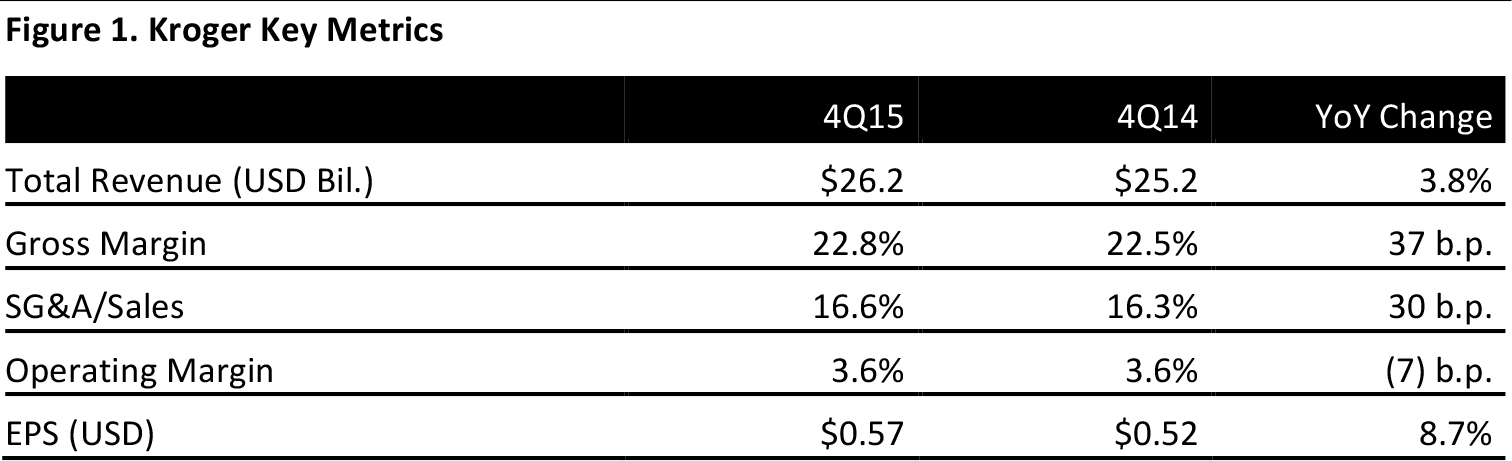

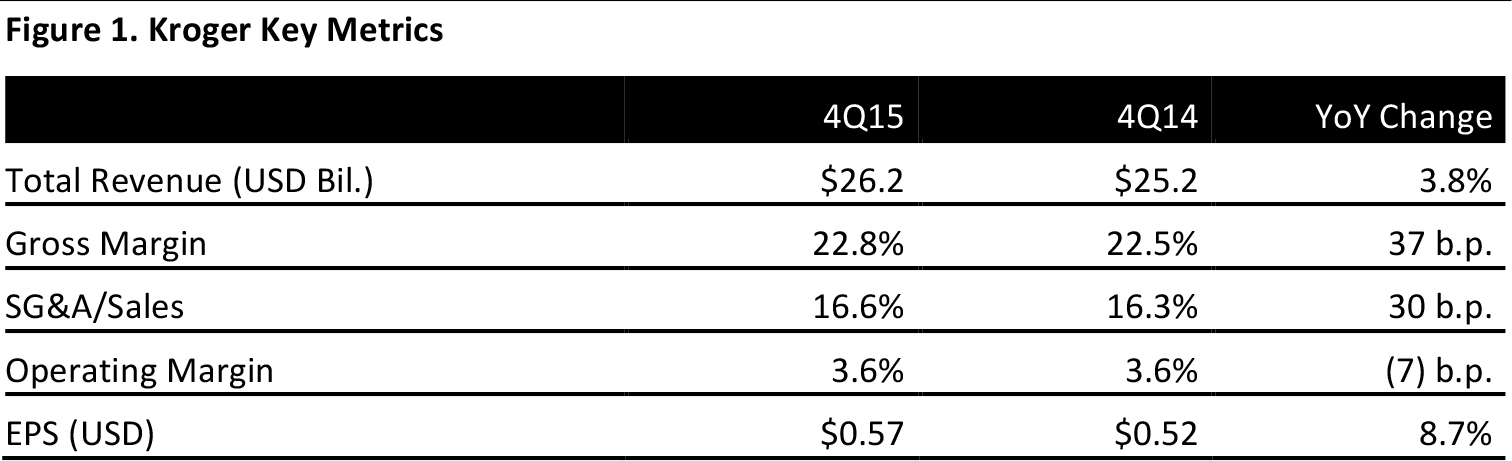

Source: Company reports

4Q15 RESULTS

Kroger reported 4Q15 total revenues of $26.2 billion, an increase of 3.8% year over year. Excluding fuel, total sales increased by 6.5%. Excluding fuel and the contribution from Roundy’s, which Kroger acquired in December 2015, sales increased by 4.4%.

Kroger reported its 49th consecutive quarter of positive same-store sales, excluding fuel. Same-store sales growth excluding fuel was 3.9% in 4Q15. Including six weeks of results from Roundy’s, same-store sales growth excluding fuel was 3.7%.

Operating expenses in the quarter included expenses from the addition of Roundy’s, a $30 million contribution to the UFCW Consolidated Pension Plan, a $60 million contribution to The Kroger Co. Foundation, higher healthcare and pension costs, and charge-backs related to the EMV credit card transition.

FY15 RESULTS

Kroger’s total sales increased by 1.3%, to $109.8 billion, in 2015. Excluding fuel, total sales increased by 6.0%. Excluding fuel and the contribution from Roundy’s, total sales increased by 5.5%.

Same-store sales growth excluding fuel was 5.0% in 2015.

During the year, Kroger repurchased approximately 19 million common shares for a total of $703 million. The company returned more than $1.1 billion to shareholders through share buybacks and dividends in 2015.

EPS in 2015 was $2.06, up 19.8% from $1.72 in 2014.

OUTLOOK

In 2016, Kroger expects supermarket sales excluding fuel to grow by approximately 2.5%–3.5%, identical to 2015. This forecast includes the expectation of lower inflation during the year plus the effects of the company’s merger with Roundy’s.

The company also expects EPS of $2.19–$2.28, with the actual figure depending on actual fuel margins, which are expected to be at or slightly below the five-year average.

In 2016, Kroger expects its core business to grow by 8%–11%, in line with its long-term net-earnings-per-diluted-share growth rate.

Kroger expects capital investments of $4.1–$4.4 billion in 2016.