Source: Company reports/FGRT

3Q17 Results

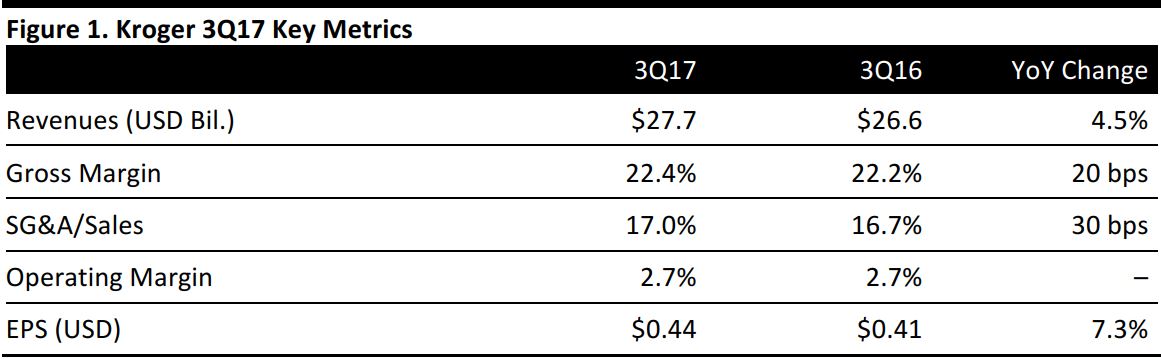

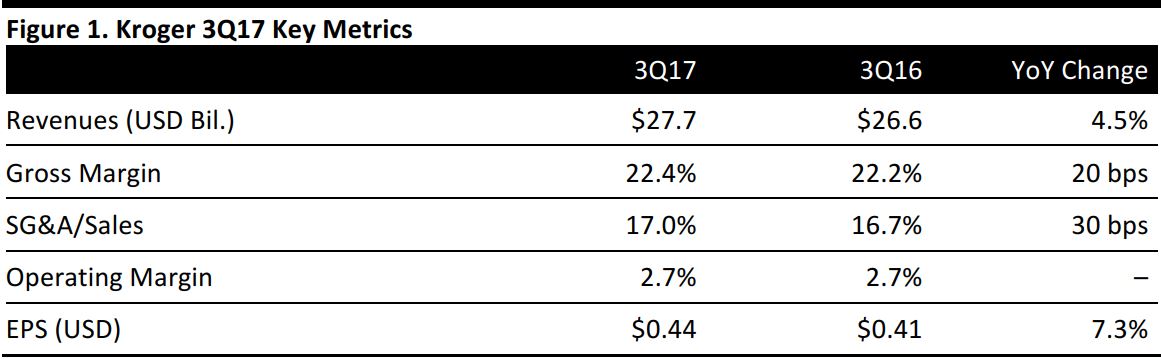

Kroger reported 3Q17 total sales of $27.75 billion, up 4.5% year over year and above the $27.48 billion consensus estimate. Excluding fuel, sales were up 1.1% during the quarter. EPS was $0.44, beating the $0.40 consensus estimate.

Comp sales grew by 1.1% for the quarter, reflecting strong results in both the core business and the fuel business. Gross margin was 22.4% in 3Q17, up 20 basis points from the same period last year. Management was pleased with the results and commented that sales on Black Friday were the best ever for the general merchandise category, led by record sales at the Fred Meyer chain.

Details from the Quarter

- Kroger’s strong quarterly results were driven by good performance in its fresh departments; the company saw double-digit growth in natural foods.

- The company plans to expand its click-and-collect locations to 1,000, powered by its online ordering system, ClickList. Digital revenues grew by 109% year over year in 3Q17, driven by ClickList.

- By partnering with third-party service providers, the company managed to offer home delivery services at 300 locations within a little over a year.

- Management provided an update on the previously announced exploration of a sale of Kroger’s convenience store business, saying that there has been a high level of interest.

Outlook

FY17

For FY17, Kroger expects:

- Comparable sales growth of flat–1%.

- Adjusted EPS of $2.00–$2.05 and GAAP EPS of $1.74–$1.79. The adjustments include the effect of this year’s hurricanes. The low end of both estimate ranges is $0.04 above the industry consensus.

- Capital investments excluding mergers, acquisitions and purchases of leased facilities to total about $3.0 billion.

4Q17

For 4Q17, Kroger expects:

- Comparable sales growth above 1.1%, excluding fuel. The company also expects the fuel margin to moderate in the quarter.