Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

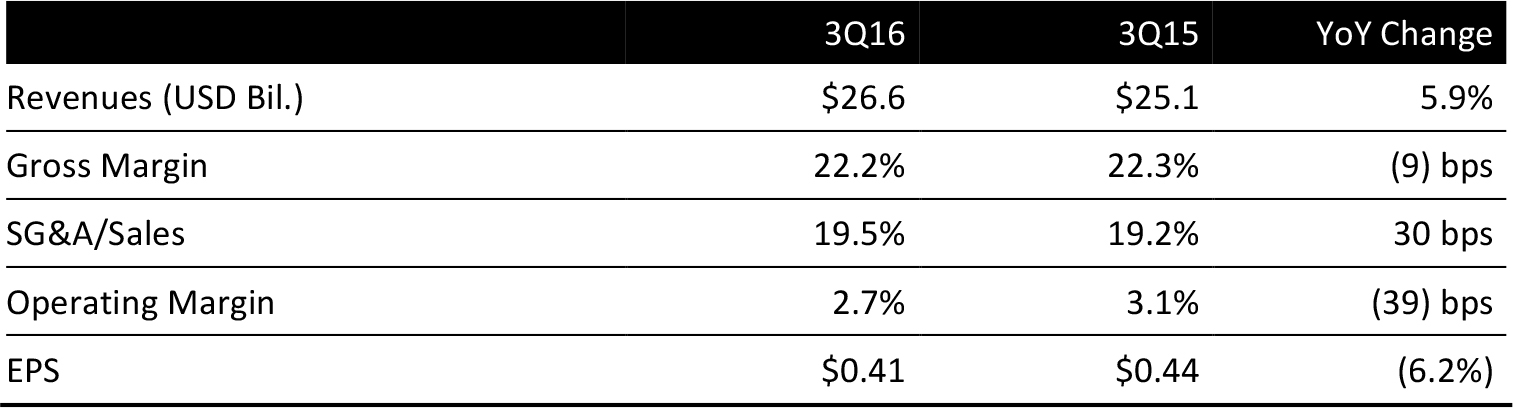

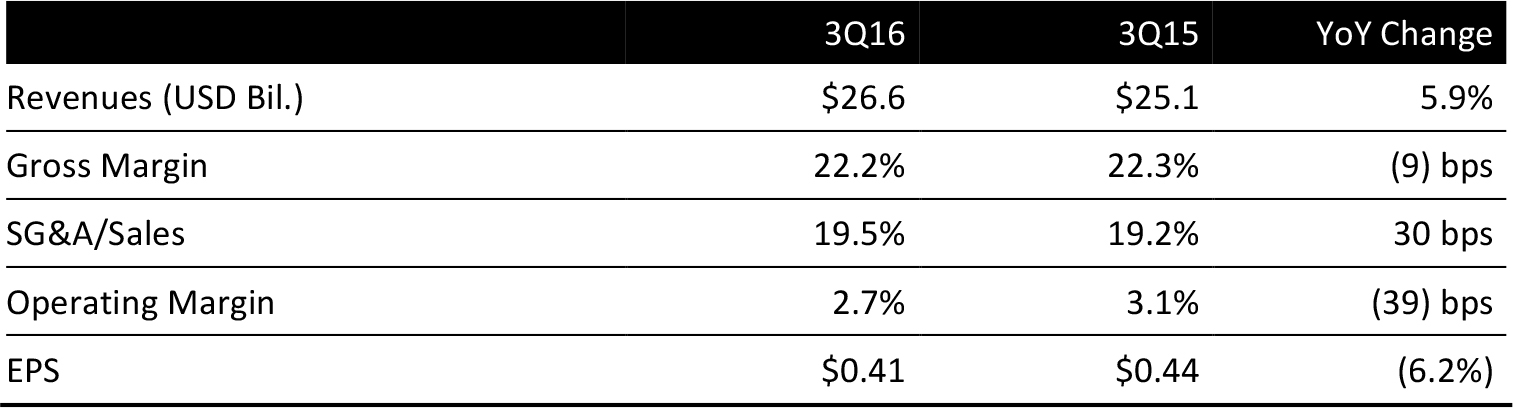

Kroger reported 3Q16 revenues of $26.6 billion, up 5.9% year over year and above the $26.3 billion consensus estimate. Total sales, excluding fuel, increased 7.1% year over year in the quarter. Total supermarket sales for 3Q, excluding fuel and Roundy’s, increased 1.6% year over year.

Same-store sales ex fuel were up 0.1%, below the +0.5% consensus estimate, and driven by higher transaction sizes that were more than offset by softer customer traffic.

Deflation has persisted and also increased, with overall deflation, excluding pharmacy, increasing from 1.3% in 2Q to 1.5% in 3Q. Pharmacy inflation declined 130 basis points to 3.3% during 3Q.

Total operating expenses—excluding fuel, Roundy’s and an $80 million contribution to the UFCW Consolidated Pension Plan—increased 19 bps year over year, of which 15 bps were related to depreciation due to capital investments.

Kroger recorded an $8 million LIFO inventory credit during the quarter, compared to a $9 million LIFO charge in the year-ago quarter.

EPS was $0.41, in line with the consensus estimate.

ADDITIONAL DETAILS FROM THE QUARTER

Management commented that transition periods create difficult operating environments, and this quarter represented the third period of deflation in 30 years, and these periods have historically lasted three to five quarters. Management further commented that tonnage continued to grow and that the company continues to gain market share.

Kroger continues to benefit from trends favoring natural, organic and healthy foods, and its Simple Truth brand reported double-digit sales increases. Highlighted products include kombucha and distilled water. Sales growth was also strong in produce, fresh-prepared and deli departments, sushi, Starbucks, as well as for wine and liquor sales.

Management reiterated that Kroger is addressing a $100 billion-plus US food market, which offers substantial opportunities for growth and share expansion. Customers typically eat 35–40 times per week, and Kroger is targeting all these meals and snacks.

The company’s 84.51° division performs data analytics that help spot trends and create unique customer experiences to drive growth, and Kroger now offers its ClickList click-and-collect service in more than 550 stores, up 50 locations from just four weeks ago. Customers have now downloaded more than 3.5 billion digital offers.

OUTLOOK 2016

Kroger lowered the high end of its EPS guidance range to $2.03–$2.08 from $2.03–$2.13 previously. The company also lowered the high end of its adjusted EPS guidance range to $2.10–$2.15—which excludes a $0.07 pension restructuring charge—from $2.10–$2.20 previously.

Total capital spending (excluding mergers, acquisitions and purchases of leased facilities) is expected to be $3.6–$3.9 billion this year.

4Q16

The updated recent annual guidance range implies adjusted EPS of $0.51–$0.56, whose midpoint is below the consensus estimate of $0.55.

In the quarter, Kroger expects slightly positive identical supermarket sales growth, excluding fuel.

Preliminary 2017 Guidance

Although the company plans to offer specific 2017 guidance in March, Kroger expects the operating environment in the first half of 2017 to be similar to today, with improvement in the second half. Management offered three additional expectations:

- Same-store (supermarket) sales are expected to be positive.

- EPS growth is expected to be positive, excluding the 53rd week.

- EPS growth is likely to be below the low end of its 8%–11% long-term target range in 2017.

Kroger management commented that it does not change its strategy based on quarterly swings in results and remains committed to achieving an EPS growth rate of 8%–11%, plus growing dividends.