Source: Company reports/Coresight Research

2Q18 Results

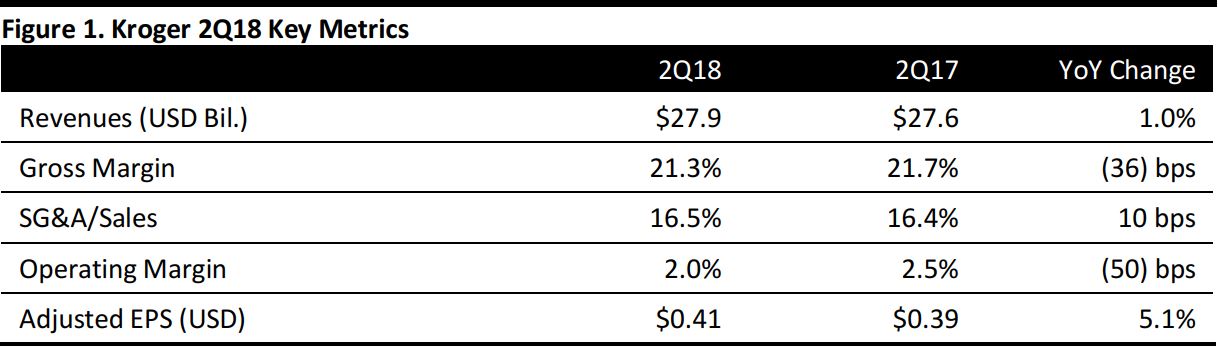

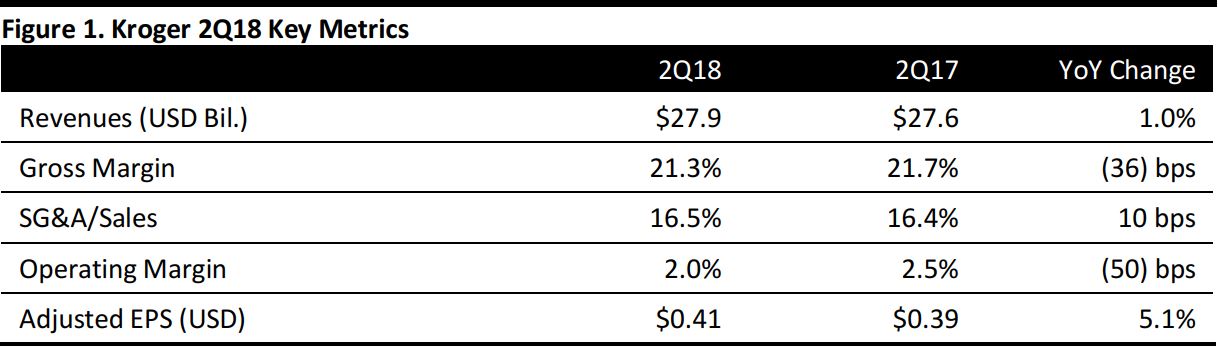

Kroger reported its 2Q18 results with adjusted diluted EPS of $0.41, up 5.1% year over year, which beat the consensus estimates of $0.38 post adjusting for change in the market value of Kroger's investment in Ocado securities. Revenues grew by 1.0% year over year, to $27.9 billion, narrowly missing the consensus estimate of $28.0 billion. Digital sales grew by 50%, led by online expansion initiatives.

Gross margin contracted 36 basis points year over year to 21.3%.

Operating profits fell by 19.7% year over year to $549 million due to increase in operating, general, and administrative costs. Operating margin fell 50 basis points year over year to 2.0%.

Kroger recorded a LIFO charge of $12 million in the current quarter, versus a $18 million LIFO charge in the corresponding quarter last year.

As a part of its Restock Kroger plan, the company launched the Kroger Ship program in four markets: Cincinnati, Houston, Louisville, and Nashville. Through this program, customers can choose to shop online and receive free doorstep delivery for orders worth more than $35 or pay a fee of $4.99 for smaller orders to avail doorstep delivery service.

Kroger expanded its partnership with Instacart to increase customer delivery coverage area to 75 more markets throughout the US by late October this year. It has also partnered with Nuro, a self-driving vehicle start-up, to launch delivery service in Arizona using autonomous vehicles.

Kroger’s new launches are: Dip, an apparel brand launched with help from Joe Mimran; and, Bromley's For Men, a men’s toiletry brand.

Kroger started expanding its presence internationally by introducing Simple Truth products in China through Alibaba's Tmall Global.

The Company is striking a balance between investments in capitals and distributions to shareholders. It highlighted that in the last four quarters, it had:

- spent an incremental $1.1 billion (pre-tax) on company-sponsored pension plans and $467 million (pre-tax) to satisfy withdrawal obligations to the Central States Pension Fund;

- repurchased 103 million common shares for $2.6 billion, which includes $1.2 billion repurchased with after-tax proceeds from the sale of Kroger's convenience store business;

- paid $435 million in dividends; and,

- invested $2.9 billion in capital.

Outlook

Kroger guided its 2018 sales growth, excluding fuel, to 2.0%-2.5% in 2018.

On an adjusted basis, the EPS guidance was in the range $2.00-$2.15.

The company has target capital investment of $3.0 billion in 2018, excluding mergers, acquisitions, and purchases of leased facilities.