Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

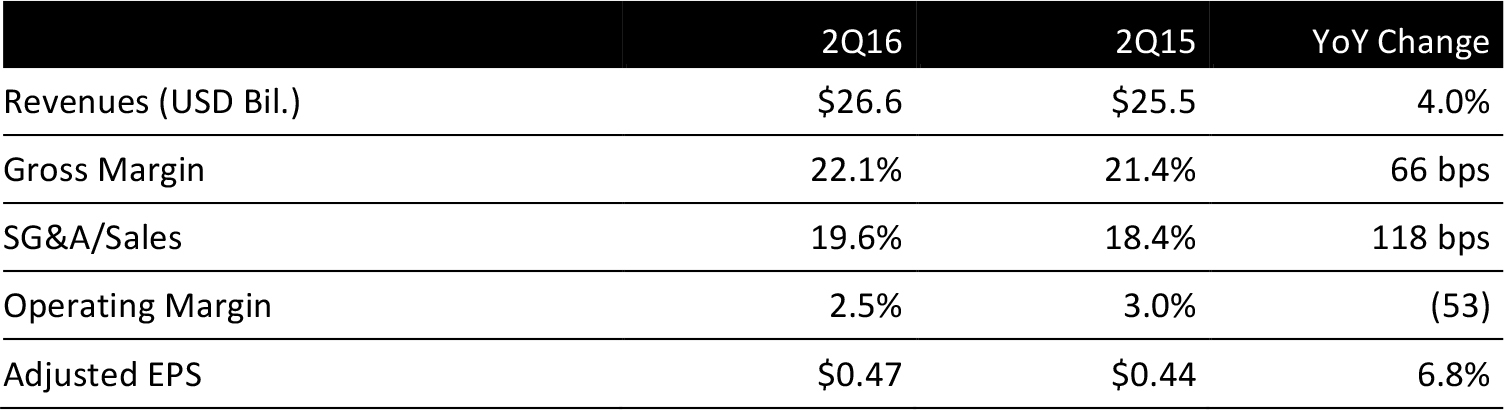

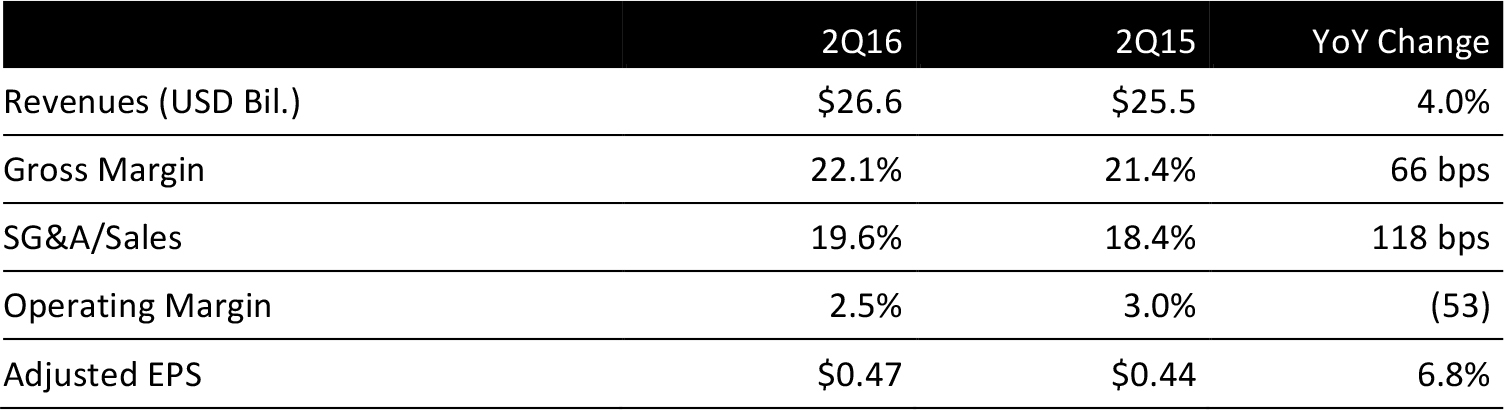

Kroger reported fiscal 2Q16 adjusted EPS of $0.47 versus $0.44 a year ago and beat consensus by two pennies. Generally accepted accounting principles (GAAP) EPS was $0.40, which includes a $0.07 per share charge for pension-plan agreements.

Revenues were $26.6 billion, up 4% year over year and slightly below the consensus estimate of $26.8 billion. Total sales excluding fuel increased 7.3% year over year. Total sales excluding fuel and Roundy’s Supermarkets increased 2.9%year over year.

Identical supermarket sales were 1.7%, with deflation in most categories, except produce and pharmacy. The most affected categories were milk, eggs and cheese.

Kroger estimated the effect of deflation at 1.25% without pharmacy and 1.5% within the grocery category, however, management commented the company had weathered deflationary environments before.

In the quarter, corporate brands represented approximately 27% of total units sold and 26% of sales in dollar terms, excluding fuel and pharmacy.

Gross margin increased 66 basis points to 22.1%. However, the gross margin declined 13 basis points excluding fuel, Roundy’s Supermarkets and a $12 million last in, first out (LIFO) inventory charge. The decline was attributed to the addition of hours worked to keep pace with unit growth and price investments, i.e., price reductions.

Operating costs, excluding fuel, Roundy’s and pension agreements, improved by six basis points in the quarter, partially from lower expected bonuses. Management pledged to maintain its focus on cost control and use those savings to offer additional value to customers.

A lower-than-expected tax rate due to the adoption of a new accounting standard somewhat offset the effect of deflation on EPS in the quarter.

BUSINESS UPDATE

Management commented the company’s core business remains strong and Kroger continues to gain market share, improve tonnage and increase the number of loyal customers. Management also said they are pursuing the correct strategy, for example by adding hours to support tonnage in a deflationary environment, which increased cost but improved customer satisfaction.

Management further remarked the retail environment changes constantly and said its team at 84.51°, the resulting entity formed when from Kroger’s bought buying out Tesco’s stake in the DunnhumbyUSA marketing business, which uses rigorous data analytics that enable Kroger to make highly informed strategic investments.

The company offered the following observations based on conversations with customers:

- Kroger sees a gradual tightening of budgets.

- Customers are less confident about the economy than three months ago.

- Moreover, customers expect the economic situation to worsen over the next three months.

In the quarter, the average retail gas price declined by $0.47 year over year and puts the fuel margin at approximately $0.198 per gallon, compared to $0.19 a year ago. The company’s fuel margin is $0.184 for the past four quarters, compared to $0.186 in the prior period.

The integration of Roundy’s Supermarkets continues to go according to plan, with two dedicated management teams—one team for Roundy’s in Wisconsin and another team for Mariano’s in Illinois—which accounts for the uniqueness of the formats in each location. Management commented they are pleased with the early results from the Roundy’s investment in Wisconsin.

In terms of labor relations, the company agreed to new contracts that cover store associates in Arkansas, Tennessee and California and is currently negotiating contracts with the union in Arizona and with store associates in Michigan and Georgia. They are also negotiating a new contract for the Roundy’s distribution center.

OUTLOOK

The company reduced guidance in the following categories:

- EPS to $2.10–$2.20 from $2.19–$2.28 due to continued deflation.

- Supermarket same-store sales to +0.5%–1.5% in 2H and +1.4%–1.8% for the full year from +2.5%–3.5% previously.

- Capex to $3.6–$3.9 billion from $4.1–$4.4 billion.

Management commented the $400 million reduction in capital spending could be used to satisfy the company’s $500 share-repurchase authorization.

Kroger maintained its long-term EPS growth target of +8%–11%.

�