Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

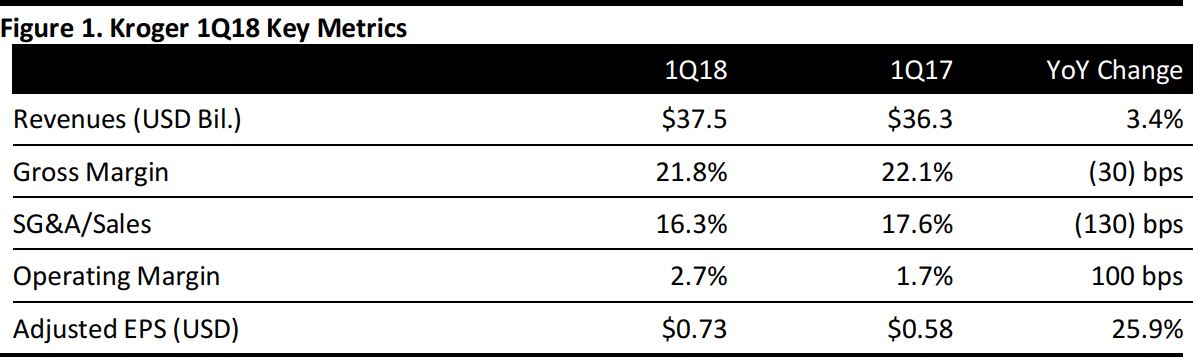

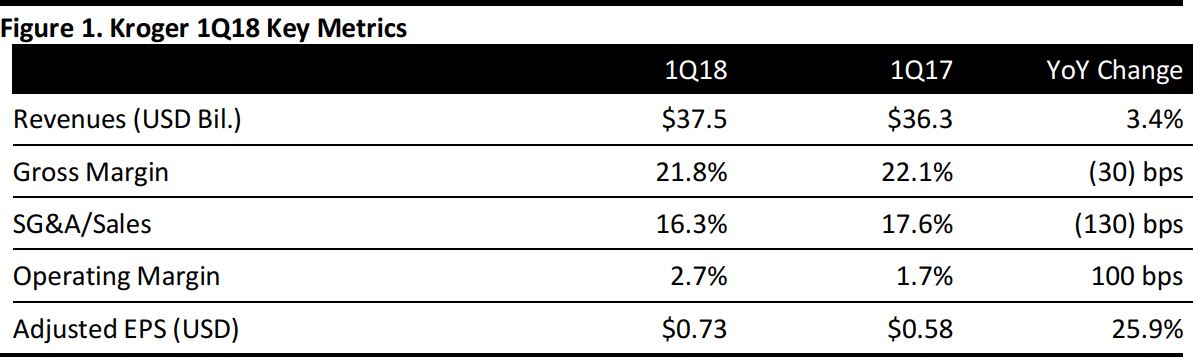

1Q18 Results

Kroger reported 1Q18 adjusted EPS of $0.73, up from $0.58 in the year-ago period and above the $0.63 consensus estimate. Revenues were $37.5 billion, up 3.4% year over year and above the $37.3 billion consensus estimate. Digital sales increased by 66% from the year-ago quarter, primarily driven by ongoing expansion of ClickList and other delivery initiatives.

Same-store sales excluding fuel were up 1.4%, below the 1.5% consensus estimate and inline with company guidance. The meat, seafood and floral departments outperformed the company average in the quarter. Natural foods continued their strong, double-digit growth in the quarter.

Kroger’s focus on optimizing store space, layouts and assortment (the Kroger Restock initiative)continues to be a headwind to same-store sales calculation, management noted. The company plans to remove dozens of products sold at nearly 2,800 Kroger stores to emphasize better-selling products and store-brand goods. Private-label assortment and private labels’ share of total sales continue to grow; store brands now represent approximately 30% of total sales.

The company’s gross margin was 21.8%, down 30 basis points from the year-ago period, driven by pricing pressure and higher expenses.

Kroger’s stated long-term growth strategy is to focus on cost controls, operational efficiency and directing free cash flow into promising investments. Management noted two of those investments, a $250 million deal with British e-grocer Ocado and the $200 million acquisition of meal-kit maker Home Chef, both announced in May. Kroger also announced in May that it would expand its partnership with Instacart to increase customer delivery coverage area.

Kroger plans to utilize Ocado’s technology platform to bring automated fulfillment to Kroger stores across the country, boost online order accuracy and home delivery capabilities, and reach parts of the country where it doesn’t currently have a presence, such as the Northeast. The Ocado technology will run automated warehouses and process online orders, which Kroger expects will bolster deliveries that it offers through third-party providers and in-store pickup points it is introducing for online orders. The first Ocado-powered facility is expected to come online in two to three years.

The company plans to sell Home Chef’s meal kits in its stores. Management noted the value of the brand for driving in-store traffic and providing a way to reach new consumers.

Kroger is also rolling out store technology to boost efficiencies and improve the store experience. By the end of this year, roughly 200 stores will have digital shelf displays that customers can scan with their smartphones to unlock personalized deals.

Outlook

Management provided the following guidance for FY18:

- The company raised its FY18 EPS guidance range to $2.00–$2.15 from $1.95–$2.15 previously. The consensus estimate calls for full-year EPS of $2.07.

- Kroger expects full-year same-store sales growth of 2%–2.5% versus 1.5%–2% previously.

- The company continues to expect capital investments and purchases of leased facilities to total about $3 billion.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research