Source: Company reports/Fung Global Retail & Technology

1Q17 Results

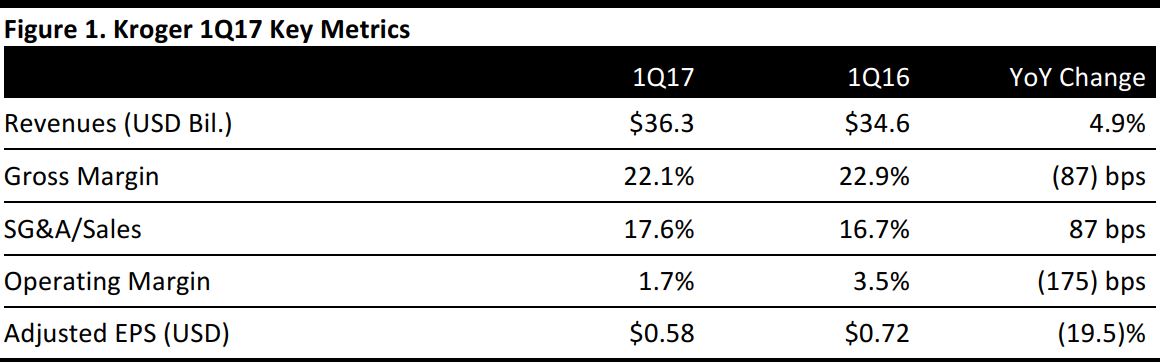

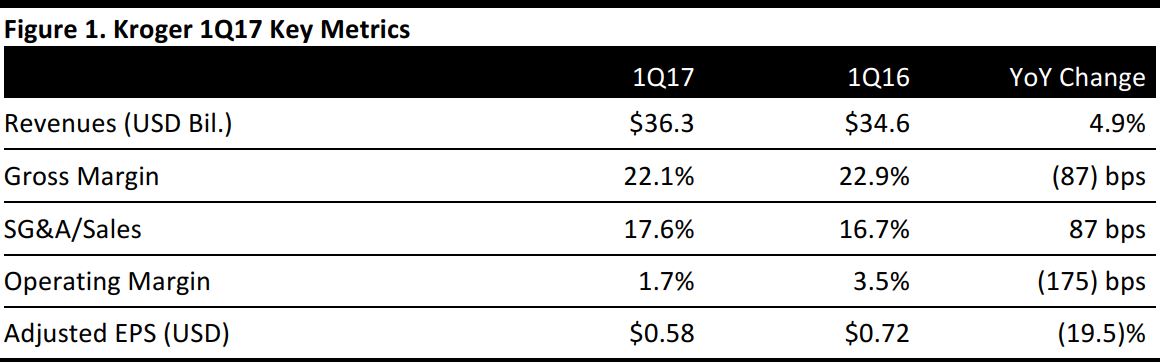

Kroger reported 1Q17 revenues of $36.3 billion, up 4.9% year over year and above the $35.6 billion consensus estimate. Including fuel, total sales increased by 2.9% year over year.

Identical supermarket sales excluding fuel were down 0.2%, beating the (0.5)% consensus estimate. Including fuel, identical sales increased by 1.6%.

Kroger recorded a $25 million LIFO inventory credit during the quarter, compared with a $15 million LIFO charge in the year-ago quarter.

Adjusted EPS was $0.58, in line with the consensus estimate, excluding a $126 million adjustment for pension-plan withdrawal liabilities and a $117 million adjustment for voluntary retirement offerings. GAAP EPS was $0.32, compared with $0.71 a year ago.

Management commented that it remains focused on the company’s strategy, including connecting with the customer via various means, maintaining a staff of friendly associates and lowering costs so as to provide value. In addition, identical supermarket sales have remained positive for the past nine weeks, continuing into the second quarter.

Additional Details from the Quarter

Tonnage was positive in the quarter. Basket size and price per unit were down, but the declines were offset by household growth. Loyal households grew by 3.2% year over year and also had positive identical sales growth in the quarter.

The deflationary environment receded during the quarter, accounting for 20 basis points, excluding fuel. Meat, however, showed inflation in the last four weeks, and pharmacy was inflationary, leading the company to increase its LIFO expectation for the year.

Management commented that the company experienced 30% growth in new digital customers and an increase of more than 30% in general visits, with faster growth in mobile than in the year-ago quarter.

Management outlined its investments in the following areas:

- Personalization—The company deployed its 84.51° subsidiary to deliver more than 6 million personalized copies of My Magazine.

- People—Kroger is improving customer service by increasing both labor hours and starting wages in certain markets.

In the quarter, Kroger’s private-label brands represented approximately 28% of total units sold and 25.6% of sales dollars, excluding fuel and pharmacy.

Outlook

Kroger lowered its adjusted EPS guidance range to $2.00–$2.05 from $2.21–$2.25 previously. The updated range incorporates an $80 million LIFO inventory charge, versus the original estimate of $25 million, and the effect of incremental price investments in certain markets and incremental investments in hours and wages.

Total capital spending (excluding mergers, acquisitions and purchases of leased facilities) is expected to be $3.2–$3.5 billion in the year.