What’s the Story?

On March 31, 2021, the Coresight Research team attended Kroger’s Investor Day, which was held virtually this year. In this report, we present key insights from the event, covering Kroger’s three initiatives to increase profitability across digital and generate strong shareholder returns.

Kroger Investor Day 2021: Key Insights

Rodney McMullen, CEO at Kroger, outlined the retailer’s go-forward strategy, called “Leading With Fresh and Accelerating With Digital.” Through the three core elements of its strategy, the retailer is aiming to “drive its financial model forward, including a clear path to generate total shareholder return of 8–11%.” We explore each of the initiatives in detail below before summarizing Kroger’s financial guidance for 2021.

Three Strategic Initiatives

1. Grow Sales and Share by Leading with Fresh

McMullen outlined three significant trends that are shaping the grocery industry today: the e-commerce surge, increased cooking at home and growing demand for prepared meals to go (see image below). The shift to spending more time at home and less time dining out was a tailwind for the grocery industry in 2020. Kroger is positive that it will be able to convert the short-term boost into a long-term competitive advantage.

As the pandemic forced more consumers to turn to e-commerce last year, Kroger’s digital sales grew by triple digits, year over year, to reach $10 billion in fiscal 2020 (ended January 30, 2021). McMullen noted that this represents a massive shift compared to a few years ago and presents future opportunity for substantial growth.

Kroger plans to combine its strengths in fresh food with its growing digital business to create a successful combination that will enable it to continue winning share in the highly fragmented $1.4 trillion addressable US food market. Kroger currently has around a 10% share of the food-at-home market, according to the retailer.

[caption id="attachment_125552" align="aligncenter" width="520"]

Source: Kroger

Source: Kroger[/caption]

2. Accelerate Digital Growth and Profitability

Yael Cosset, Chief Information Officer at Kroger, noted that the retailer’s “seamless” customers (who engage with more than one channel to shop with Kroger) shop more frequently, spend more than twice as much and are more loyal to Kroger than other customers. The company plans to double its e-commerce sales (again) by 2023, having more than doubled its digital sales in the year ended January 30, 2021 as online demand soared during the pandemic. Future digital growth will be supported by the company increasing the capacity of its pickup and delivery services, expanding its assortment and evolving its personalization platform.

Cosset explained that Kroger is also planning to double its pass-through profitability rate by the end of 2023 by leveraging its stores, expanding its supply chain and fulfillment network and accelerating retail media business to generate overall digital profitability.

Kroger is testing a pilot program, “Hometown Pickup,” in which designated online grocery pickup locations are launched in rural and underserved areas. The program will bring Kroger’s pickup service to new geographies and customers who do not have immediate access to one of its stores.

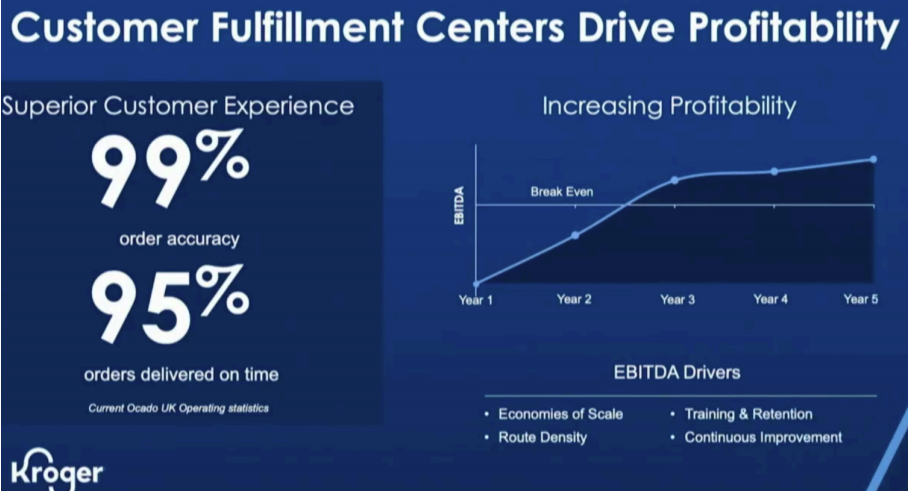

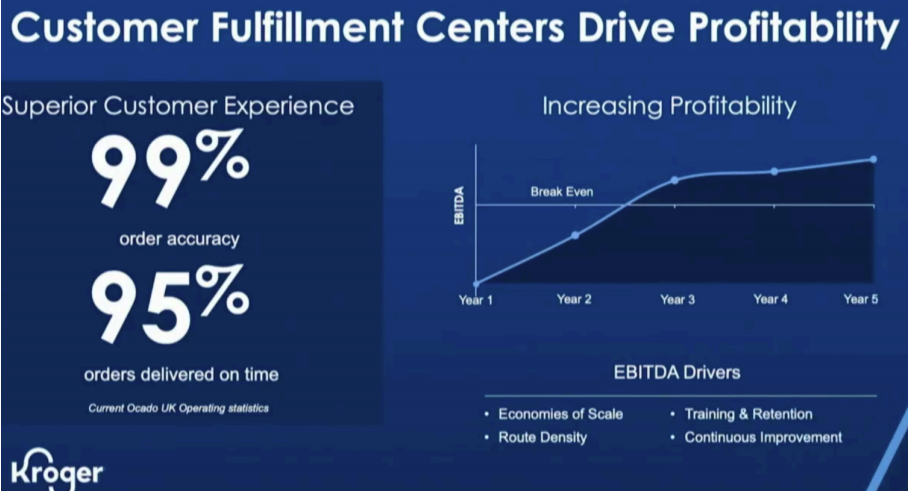

Kroger partnered with UK-based online grocery solutions provider Ocado in mid-2018 to open a total of 20 CFCs. Gabriel Arreaga, Kroger’s newly appointed SVP of Supply Chain, highlighted during the Investor Day that a CFC can handle the equivalent of 20 stores’ worth of sales and provides a superior customer experience (see image below). In the countries where Ocado’s CFCs have gone live, Arreaga pointed to the high net promoter scores that the facilities have achieved.

Arreaga shared a maturity curve for Kroger’s forthcoming fleet of CFCs, the first of which is located in Monroeville, Ohio and will become operational in April. Arreaga stated that the opening of more CFCs will enable Kroger to reach 75% of the US population within a 90-mile (145-kilometer) radius. The company expects the CFCs to reach the unit-level break-even point in the third year, and by the fourth year, it expects the centers to reach parity with the store operating profit rates. Over the long term, Kroger expects the unit economics of these facilities to be lower than its stores.

The retailer is set to open a 375,000-square-foot CFC in Florida in the coming weeks, which will see Kroger function as an online pure play in the state: The company currently does not operate any stores in Florida.

[caption id="attachment_125553" align="aligncenter" width="710"]

Source: Kroger

Source: Kroger[/caption]

Caroline Pratt, VP of Commercial and Product Strategy at Kroger, noted that the retail media business would be a key driver for digital profitability. The retailer aims to capitalize on the growing retail media industry through its Kroger Precision Marketing platform by offering CPG brands more touchpoints across the customer’s entire purchase-decision journey and helping them make data-driven advertising investments. Kroger projects the retail media business to grow by nearly 30% this year, well above the 16% for the rest of the media industry. The retailer sees the potential for a multibillion-dollar retail media business over the next few years.

3. Leverage Competitive Moats To Drive Sustainable Growth

Stuart Aitken, Chief Merchandising Officer at Kroger, said that the company plans to maximize its strengths in the supply chain by optimizing assortment, reducing days of supply in its distribution centers, expediting transit time and strategically aligning with suppliers that share the retailer’s vision of quality and freshness.

[caption id="attachment_125554" align="aligncenter" width="710"]

Source: Kroger

Source: Kroger[/caption]

Aitken expects the meal-kit portfolio Home Chef to be the next billion-dollar brand for Kroger. The company has created a variety of ready-to-cook, ready to heat and ready-to-eat meal solutions through its Home Chef business, which grew by 118% in 2020.

Aitken added that Kroger intends to scale and leverage its private-label portfolio Our Brands with even greater intensity going forward. It will launch more than 660 new Our Brands items in fiscal 2021, with 60% these under the Simple Truth or Private Selection brands.

[caption id="attachment_125555" align="aligncenter" width="720"]

Source: Kroger

Source: Kroger[/caption]

Financial Guidance

Gary Millerchip, Chief Financial Officer at Kroger, said that the investments made by the company during Restock Kroger helped it to capitalize on the dramatic shifts created by the pandemic. Millerchip added that the company is reconfirming the outlook which it introduced in the fourth quarter of fiscal 2020. He specifically highlighted the following guidance for 2021:

- Two-year stacked comparable sales (excluding fuel) in the range of 9–11%

- Adjusted FIFO operating profit annual growth in the range of 5.4–8.5%

- Cost savings of around $1 billion in 2021

Source: Kroger[/caption]

2. Accelerate Digital Growth and Profitability

Yael Cosset, Chief Information Officer at Kroger, noted that the retailer’s “seamless” customers (who engage with more than one channel to shop with Kroger) shop more frequently, spend more than twice as much and are more loyal to Kroger than other customers. The company plans to double its e-commerce sales (again) by 2023, having more than doubled its digital sales in the year ended January 30, 2021 as online demand soared during the pandemic. Future digital growth will be supported by the company increasing the capacity of its pickup and delivery services, expanding its assortment and evolving its personalization platform.

Cosset explained that Kroger is also planning to double its pass-through profitability rate by the end of 2023 by leveraging its stores, expanding its supply chain and fulfillment network and accelerating retail media business to generate overall digital profitability.

Kroger is testing a pilot program, “Hometown Pickup,” in which designated online grocery pickup locations are launched in rural and underserved areas. The program will bring Kroger’s pickup service to new geographies and customers who do not have immediate access to one of its stores.

Kroger partnered with UK-based online grocery solutions provider Ocado in mid-2018 to open a total of 20 CFCs. Gabriel Arreaga, Kroger’s newly appointed SVP of Supply Chain, highlighted during the Investor Day that a CFC can handle the equivalent of 20 stores’ worth of sales and provides a superior customer experience (see image below). In the countries where Ocado’s CFCs have gone live, Arreaga pointed to the high net promoter scores that the facilities have achieved.

Arreaga shared a maturity curve for Kroger’s forthcoming fleet of CFCs, the first of which is located in Monroeville, Ohio and will become operational in April. Arreaga stated that the opening of more CFCs will enable Kroger to reach 75% of the US population within a 90-mile (145-kilometer) radius. The company expects the CFCs to reach the unit-level break-even point in the third year, and by the fourth year, it expects the centers to reach parity with the store operating profit rates. Over the long term, Kroger expects the unit economics of these facilities to be lower than its stores.

The retailer is set to open a 375,000-square-foot CFC in Florida in the coming weeks, which will see Kroger function as an online pure play in the state: The company currently does not operate any stores in Florida.

[caption id="attachment_125553" align="aligncenter" width="710"]

Source: Kroger[/caption]

2. Accelerate Digital Growth and Profitability

Yael Cosset, Chief Information Officer at Kroger, noted that the retailer’s “seamless” customers (who engage with more than one channel to shop with Kroger) shop more frequently, spend more than twice as much and are more loyal to Kroger than other customers. The company plans to double its e-commerce sales (again) by 2023, having more than doubled its digital sales in the year ended January 30, 2021 as online demand soared during the pandemic. Future digital growth will be supported by the company increasing the capacity of its pickup and delivery services, expanding its assortment and evolving its personalization platform.

Cosset explained that Kroger is also planning to double its pass-through profitability rate by the end of 2023 by leveraging its stores, expanding its supply chain and fulfillment network and accelerating retail media business to generate overall digital profitability.

Kroger is testing a pilot program, “Hometown Pickup,” in which designated online grocery pickup locations are launched in rural and underserved areas. The program will bring Kroger’s pickup service to new geographies and customers who do not have immediate access to one of its stores.

Kroger partnered with UK-based online grocery solutions provider Ocado in mid-2018 to open a total of 20 CFCs. Gabriel Arreaga, Kroger’s newly appointed SVP of Supply Chain, highlighted during the Investor Day that a CFC can handle the equivalent of 20 stores’ worth of sales and provides a superior customer experience (see image below). In the countries where Ocado’s CFCs have gone live, Arreaga pointed to the high net promoter scores that the facilities have achieved.

Arreaga shared a maturity curve for Kroger’s forthcoming fleet of CFCs, the first of which is located in Monroeville, Ohio and will become operational in April. Arreaga stated that the opening of more CFCs will enable Kroger to reach 75% of the US population within a 90-mile (145-kilometer) radius. The company expects the CFCs to reach the unit-level break-even point in the third year, and by the fourth year, it expects the centers to reach parity with the store operating profit rates. Over the long term, Kroger expects the unit economics of these facilities to be lower than its stores.

The retailer is set to open a 375,000-square-foot CFC in Florida in the coming weeks, which will see Kroger function as an online pure play in the state: The company currently does not operate any stores in Florida.

[caption id="attachment_125553" align="aligncenter" width="710"] Source: Kroger[/caption]

Caroline Pratt, VP of Commercial and Product Strategy at Kroger, noted that the retail media business would be a key driver for digital profitability. The retailer aims to capitalize on the growing retail media industry through its Kroger Precision Marketing platform by offering CPG brands more touchpoints across the customer’s entire purchase-decision journey and helping them make data-driven advertising investments. Kroger projects the retail media business to grow by nearly 30% this year, well above the 16% for the rest of the media industry. The retailer sees the potential for a multibillion-dollar retail media business over the next few years.

3. Leverage Competitive Moats To Drive Sustainable Growth

Stuart Aitken, Chief Merchandising Officer at Kroger, said that the company plans to maximize its strengths in the supply chain by optimizing assortment, reducing days of supply in its distribution centers, expediting transit time and strategically aligning with suppliers that share the retailer’s vision of quality and freshness.

[caption id="attachment_125554" align="aligncenter" width="710"]

Source: Kroger[/caption]

Caroline Pratt, VP of Commercial and Product Strategy at Kroger, noted that the retail media business would be a key driver for digital profitability. The retailer aims to capitalize on the growing retail media industry through its Kroger Precision Marketing platform by offering CPG brands more touchpoints across the customer’s entire purchase-decision journey and helping them make data-driven advertising investments. Kroger projects the retail media business to grow by nearly 30% this year, well above the 16% for the rest of the media industry. The retailer sees the potential for a multibillion-dollar retail media business over the next few years.

3. Leverage Competitive Moats To Drive Sustainable Growth

Stuart Aitken, Chief Merchandising Officer at Kroger, said that the company plans to maximize its strengths in the supply chain by optimizing assortment, reducing days of supply in its distribution centers, expediting transit time and strategically aligning with suppliers that share the retailer’s vision of quality and freshness.

[caption id="attachment_125554" align="aligncenter" width="710"] Source: Kroger[/caption]

Aitken expects the meal-kit portfolio Home Chef to be the next billion-dollar brand for Kroger. The company has created a variety of ready-to-cook, ready to heat and ready-to-eat meal solutions through its Home Chef business, which grew by 118% in 2020.

Aitken added that Kroger intends to scale and leverage its private-label portfolio Our Brands with even greater intensity going forward. It will launch more than 660 new Our Brands items in fiscal 2021, with 60% these under the Simple Truth or Private Selection brands.

[caption id="attachment_125555" align="aligncenter" width="720"]

Source: Kroger[/caption]

Aitken expects the meal-kit portfolio Home Chef to be the next billion-dollar brand for Kroger. The company has created a variety of ready-to-cook, ready to heat and ready-to-eat meal solutions through its Home Chef business, which grew by 118% in 2020.

Aitken added that Kroger intends to scale and leverage its private-label portfolio Our Brands with even greater intensity going forward. It will launch more than 660 new Our Brands items in fiscal 2021, with 60% these under the Simple Truth or Private Selection brands.

[caption id="attachment_125555" align="aligncenter" width="720"] Source: Kroger[/caption]

Financial Guidance

Gary Millerchip, Chief Financial Officer at Kroger, said that the investments made by the company during Restock Kroger helped it to capitalize on the dramatic shifts created by the pandemic. Millerchip added that the company is reconfirming the outlook which it introduced in the fourth quarter of fiscal 2020. He specifically highlighted the following guidance for 2021:

Source: Kroger[/caption]

Financial Guidance

Gary Millerchip, Chief Financial Officer at Kroger, said that the investments made by the company during Restock Kroger helped it to capitalize on the dramatic shifts created by the pandemic. Millerchip added that the company is reconfirming the outlook which it introduced in the fourth quarter of fiscal 2020. He specifically highlighted the following guidance for 2021: