DIpil Das

Kroger hosted its analyst day 2019 on November 5. In this report, we discuss key insights from the event.

Confidence in Restock Kroger Despite Headwinds and Missteps

Management underlined that its Restock Kroger strategy, launched in 2017, is the right strategy for 2020. The strategy is based on four pillars: product, talent, seamless (i.e., omnichannel) and price. CFO Gary Millerchip said it was the “right strategy” and management is “committed” to the four pillars. CEO Rodney McMullen called Restock Kroger the company’s “competitive moat.”

However, management noted headwinds and missteps. In September, Kroger management said they did not reconfirm the company’s prior guidance for $400 million in incremental operating profit from Restock Kroger by 2020. At the analyst day, Millerchip noted that this was because the company had seen $880 million of headwinds in the form of lower pharmacy gross margins, higher wage investments amid a tight labor market and “delayed” identical-store sales growth. The third factor was partly self-inflicted, Millerchip acknowledged, as the company launched multiple initiatives in its stores.

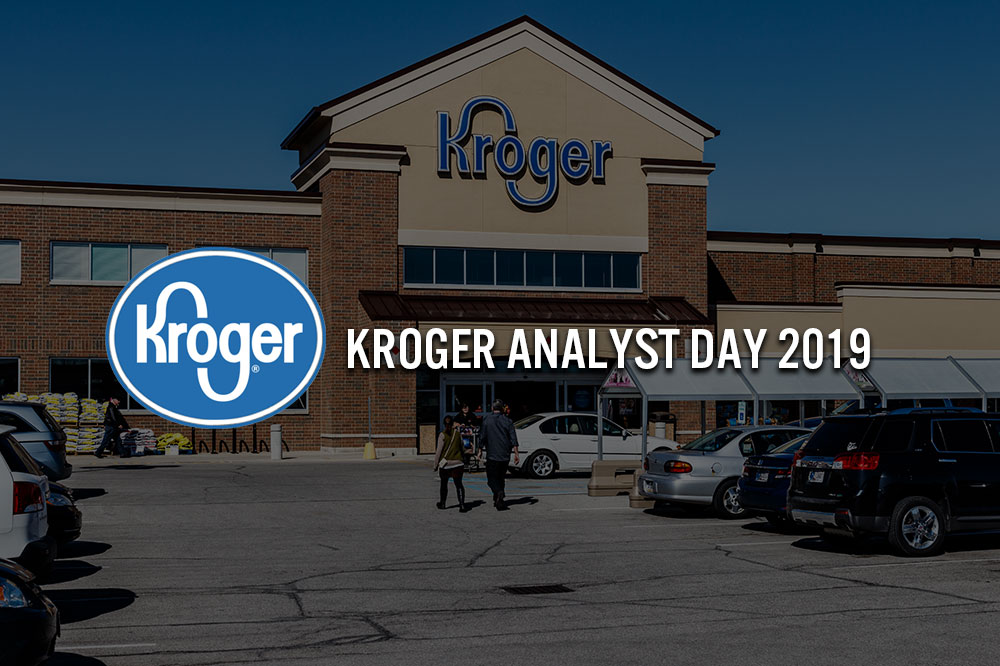

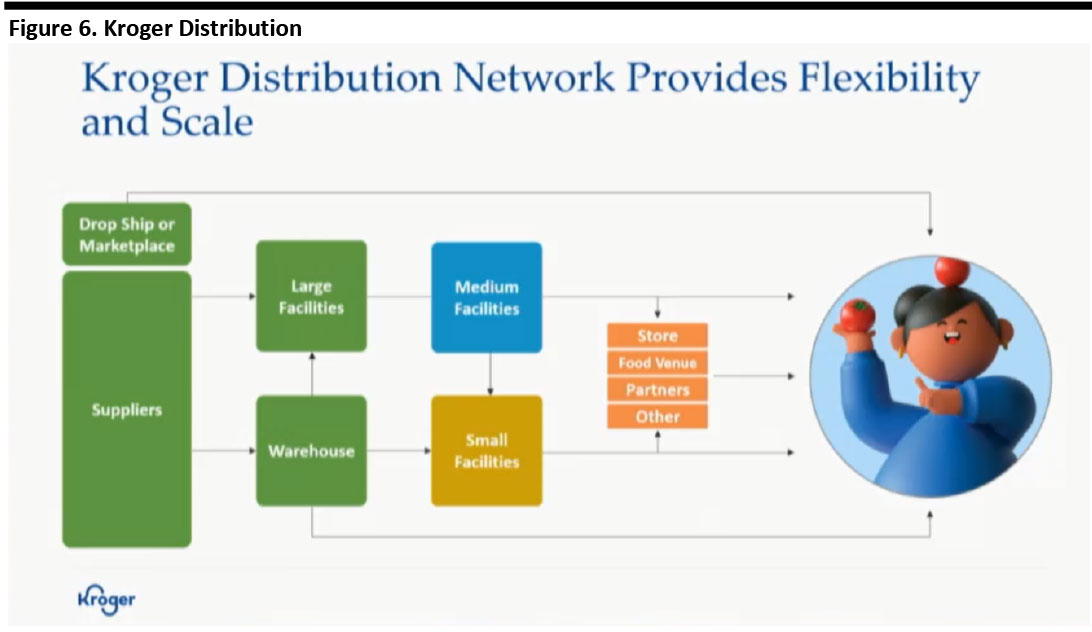

Millerchip pointed to progress in Restock, as measured by identical-store sales and EPS, as shown below. He also noted that Kroger had undertaken a successful cost-savings program that delivered $1 billion in savings in 2018 and that the company is on track for its 2019 plan.

[caption id="attachment_99036" align="aligncenter" width="700"] Source: Company reports[/caption]

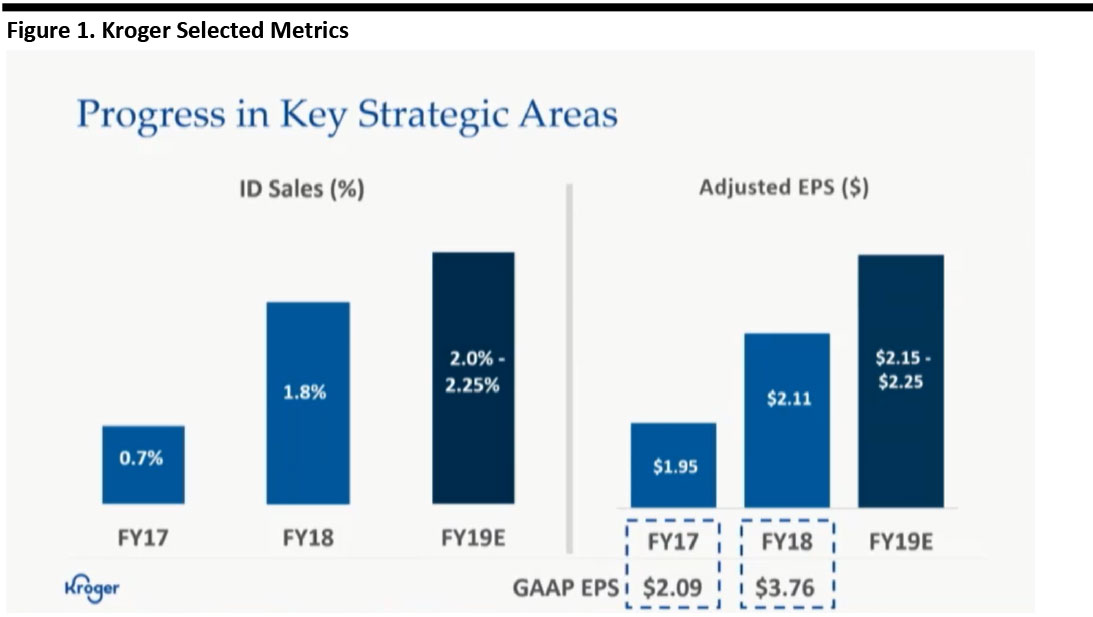

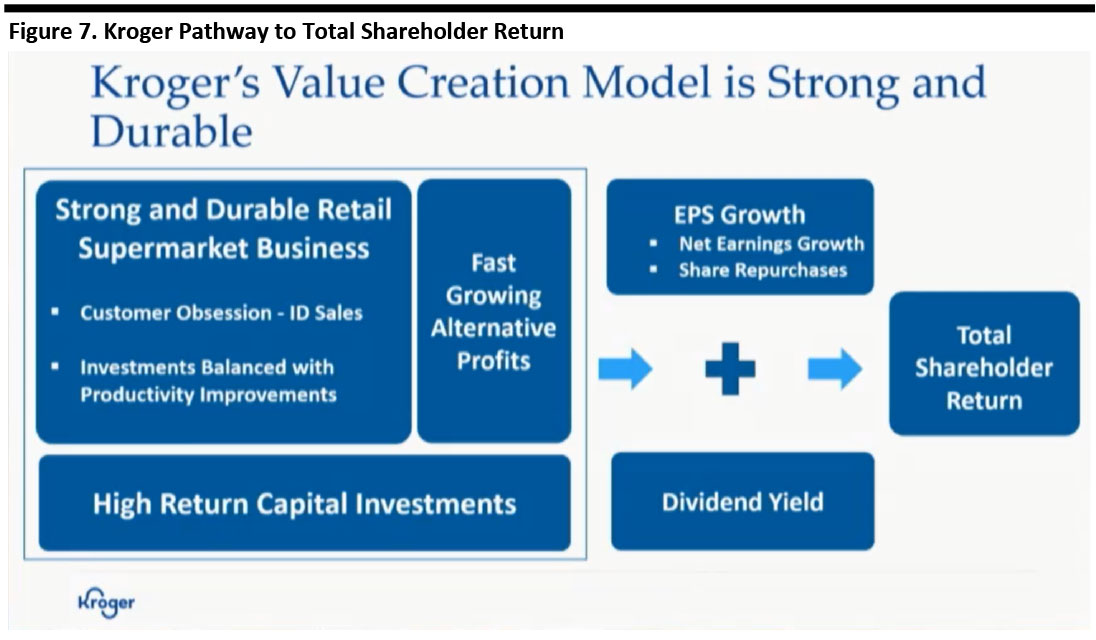

Kroger has a framework to drive long-term sustainable value, not just in 2020, Millerchip said. This includes investments in its “seamless” offering and capital allocation focused on high-return projects.

[caption id="attachment_99037" align="aligncenter" width="700"]

Source: Company reports[/caption]

Kroger has a framework to drive long-term sustainable value, not just in 2020, Millerchip said. This includes investments in its “seamless” offering and capital allocation focused on high-return projects.

[caption id="attachment_99037" align="aligncenter" width="700"] Source: Company reports[/caption]

Digital and Multi-Modal Shoppers

Yael Cosset, Chief Information and Digital Officer, outlined how Kroger’s “seamless experience ecosystem” drives up customer value. The company’s seamless strategy focuses on three themes:

Source: Company reports[/caption]

Digital and Multi-Modal Shoppers

Yael Cosset, Chief Information and Digital Officer, outlined how Kroger’s “seamless experience ecosystem” drives up customer value. The company’s seamless strategy focuses on three themes:

Source: Company reports[/caption]

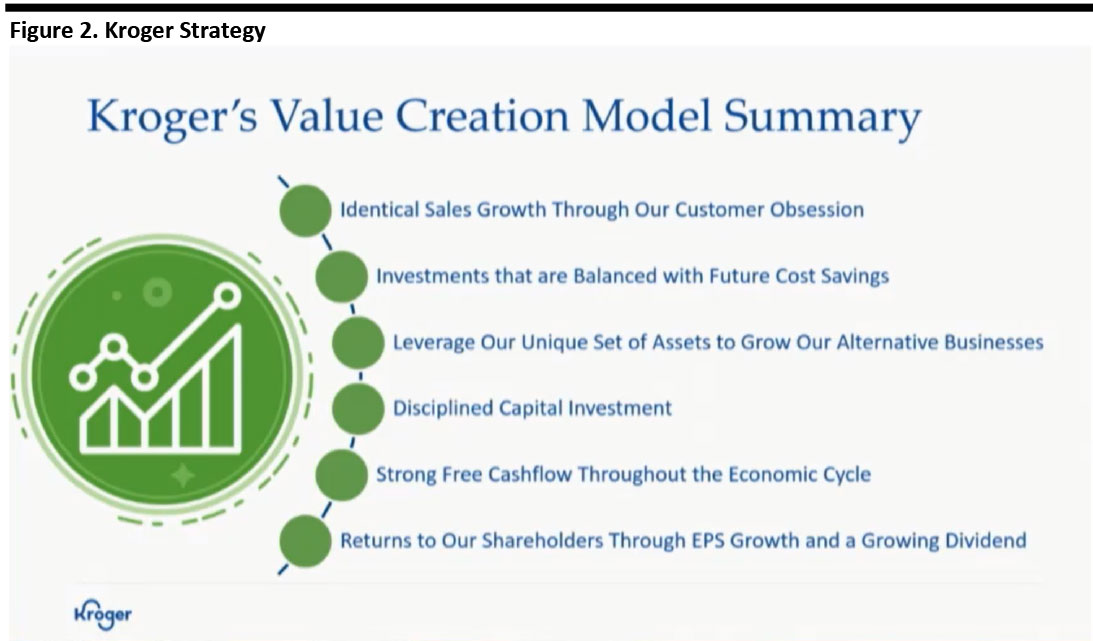

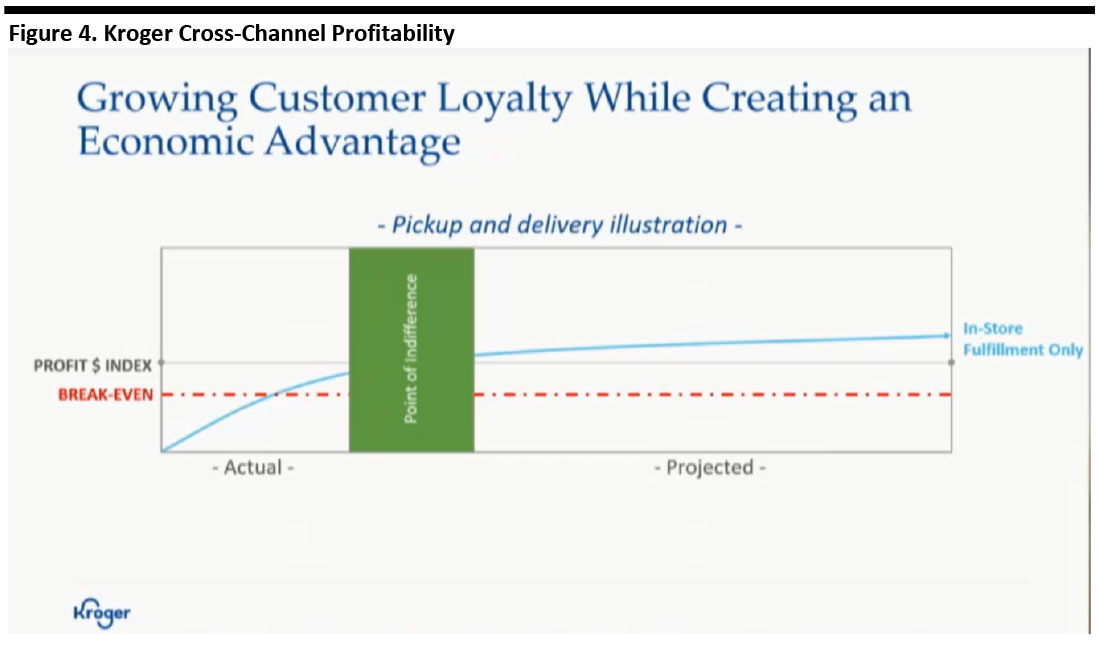

Digital channels bring added costs. But the seamless approach is creating productivity improvements — as the company grows engagement and generates incremental business, it first creates a point of breakeven and ultimately reaches a “point of indifference,” in which the value of customer engagement is such that the profit index is matched between channels.

[caption id="attachment_99039" align="aligncenter" width="700"]

Source: Company reports[/caption]

Digital channels bring added costs. But the seamless approach is creating productivity improvements — as the company grows engagement and generates incremental business, it first creates a point of breakeven and ultimately reaches a “point of indifference,” in which the value of customer engagement is such that the profit index is matched between channels.

[caption id="attachment_99039" align="aligncenter" width="700"] Source: Company reports[/caption]

Ocado Supporting Digital

Kroger’s seamless model is based on an integrated proposition of in-store retail, pickup and delivery; its partnership with Ocado, announced in 2018, supports the latter two elements. On Ocado, Cosset noted that its partner offered benefits that included a very high order-fulfillment rate and increased transparency for customers, such as expiry dates, and, for Kroger, low shrink rates and double the pick efficiency that Kroger sees in stores.

Cosset said Ocado’s flexibility was likely underestimated: while Ocado was focused on home delivery in its home market of the UK, it will help Kroger fulfill some pickup demand.

[caption id="attachment_99040" align="aligncenter" width="700"]

Source: Company reports[/caption]

Ocado Supporting Digital

Kroger’s seamless model is based on an integrated proposition of in-store retail, pickup and delivery; its partnership with Ocado, announced in 2018, supports the latter two elements. On Ocado, Cosset noted that its partner offered benefits that included a very high order-fulfillment rate and increased transparency for customers, such as expiry dates, and, for Kroger, low shrink rates and double the pick efficiency that Kroger sees in stores.

Cosset said Ocado’s flexibility was likely underestimated: while Ocado was focused on home delivery in its home market of the UK, it will help Kroger fulfill some pickup demand.

[caption id="attachment_99040" align="aligncenter" width="700"] Source: Company reports[/caption]

CFO Millerchip noted that the cost of the first Ocado facilities had come in a little higher than anticipated due to higher land and construction costs, but that Ocado still expects a strong return on investment from the Ocado facilities.

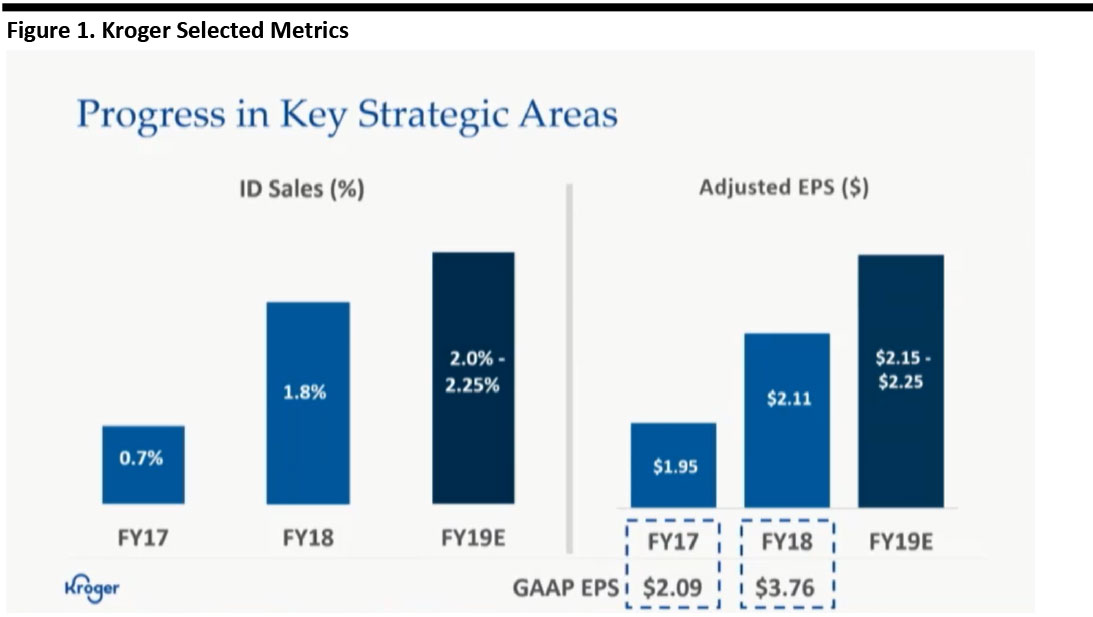

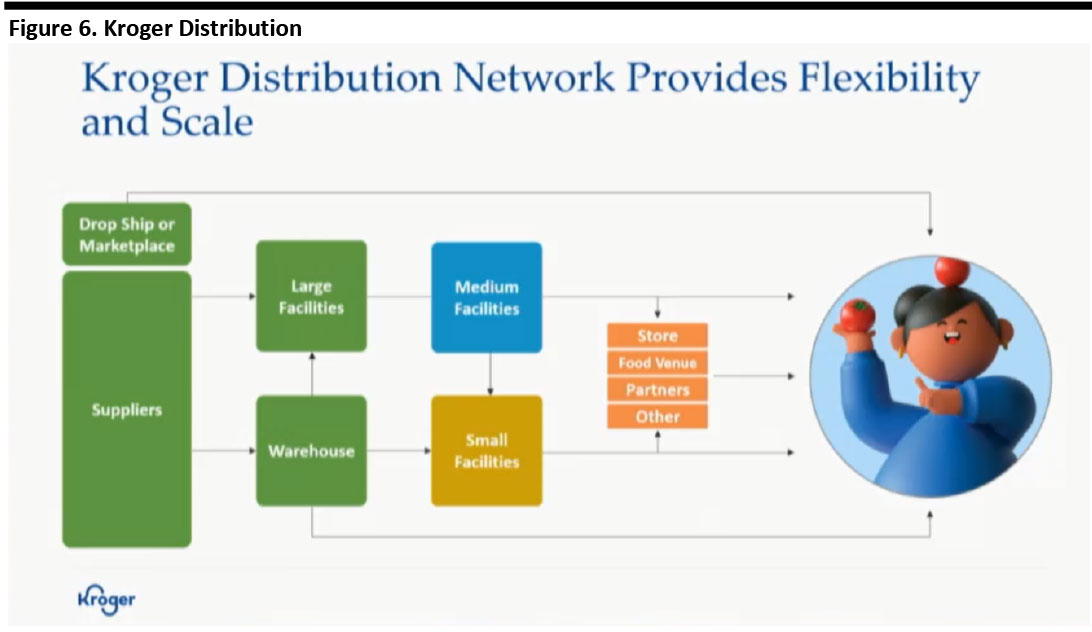

Kroger’s diversified distribution model allows it to take advantage of proximity when it matters and scale and aggregation when it has that opportunity, Cosset said.

[caption id="attachment_99041" align="aligncenter" width="700"]

Source: Company reports[/caption]

CFO Millerchip noted that the cost of the first Ocado facilities had come in a little higher than anticipated due to higher land and construction costs, but that Ocado still expects a strong return on investment from the Ocado facilities.

Kroger’s diversified distribution model allows it to take advantage of proximity when it matters and scale and aggregation when it has that opportunity, Cosset said.

[caption id="attachment_99041" align="aligncenter" width="700"] Source: Company reports[/caption]

Millerchip also noted that partnerships are important to support Kroger’s digital and supply-chain operations, but that the company is deliberate in selecting partners. Kroger has partnered with Nuro on self-driving cars, Walgreens on product distribution and Microsoft on digital technologies — as well as Ocado for online grocery fulfillment.

[caption id="attachment_99042" align="aligncenter" width="700"]

Source: Company reports[/caption]

Millerchip also noted that partnerships are important to support Kroger’s digital and supply-chain operations, but that the company is deliberate in selecting partners. Kroger has partnered with Nuro on self-driving cars, Walgreens on product distribution and Microsoft on digital technologies — as well as Ocado for online grocery fulfillment.

[caption id="attachment_99042" align="aligncenter" width="700"] Source: Company reports[/caption]

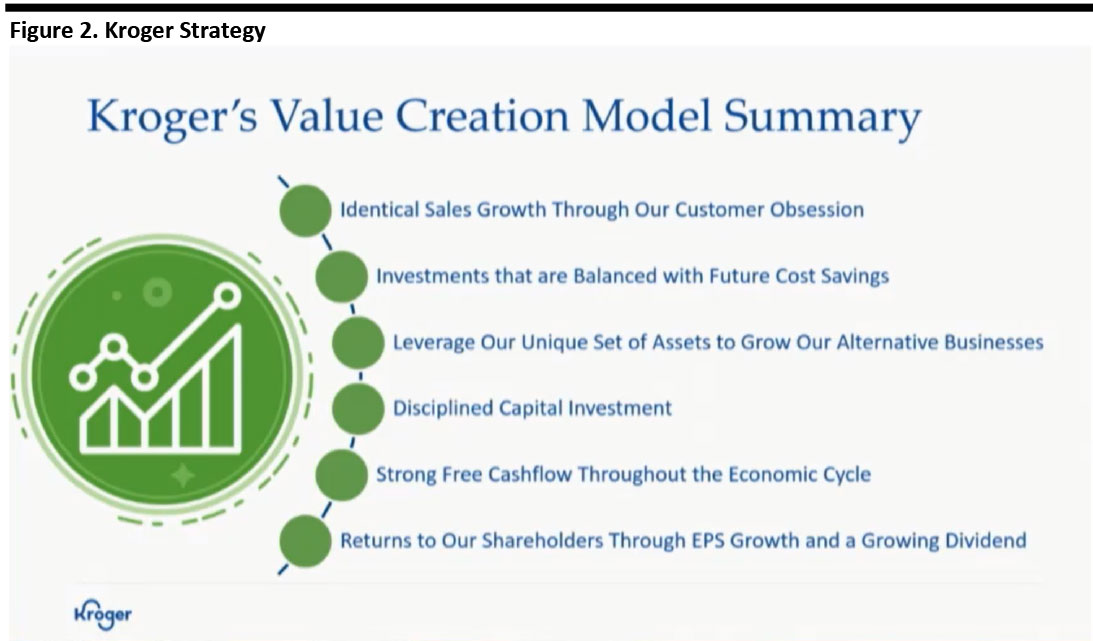

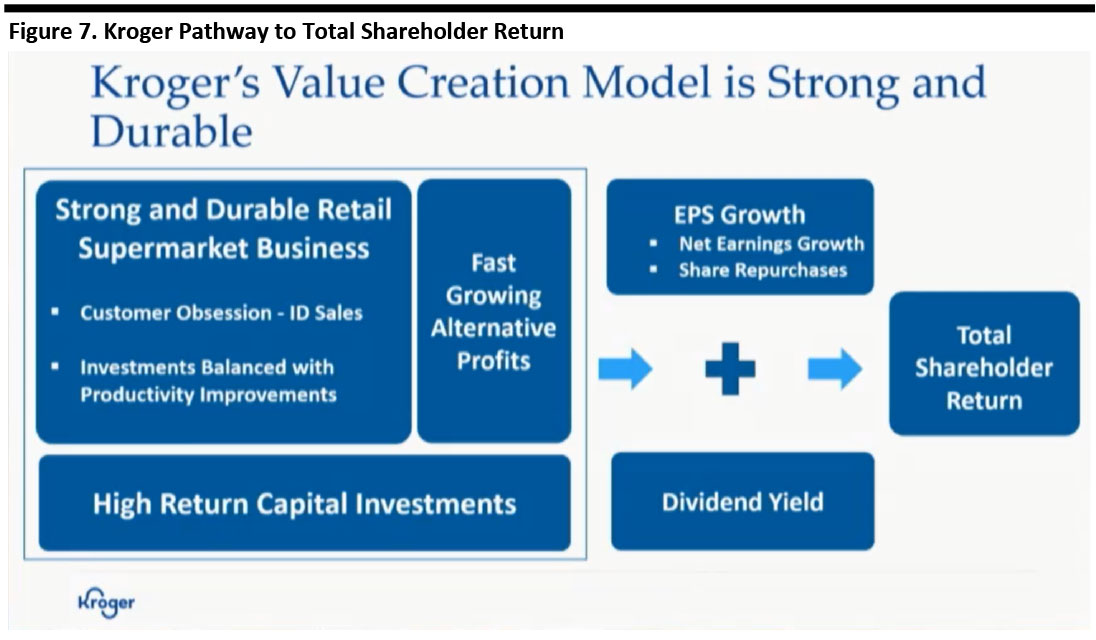

A Focus on Total Shareholder Return

McMullen said Kroger’s aspiration is to generate a strong, attractive total shareholder return year over year. CFO Millerchip outlined Kroger’s pathway to this return. As shown below, this is underpinned by a stable and growing core grocery business, complemented with asset-light alternative profit streams combined with a focus on high-return capital investments.

For 2020, management anticipates a total shareholder return in the 7-11.5% range. Beyond 2020, management anticipates a minimum total shareholder return of 8%.

[caption id="attachment_99043" align="aligncenter" width="700"]

Source: Company reports[/caption]

A Focus on Total Shareholder Return

McMullen said Kroger’s aspiration is to generate a strong, attractive total shareholder return year over year. CFO Millerchip outlined Kroger’s pathway to this return. As shown below, this is underpinned by a stable and growing core grocery business, complemented with asset-light alternative profit streams combined with a focus on high-return capital investments.

For 2020, management anticipates a total shareholder return in the 7-11.5% range. Beyond 2020, management anticipates a minimum total shareholder return of 8%.

[caption id="attachment_99043" align="aligncenter" width="700"] Source: Company reports[/caption]

Financial Guidance

Shareholder returns will be the result of a stable and growing core grocery business plus alternative profit streams, McMullen said.

Management reconfirmed 2019 guidance:

Source: Company reports[/caption]

Financial Guidance

Shareholder returns will be the result of a stable and growing core grocery business plus alternative profit streams, McMullen said.

Management reconfirmed 2019 guidance:

Source: Company reports[/caption]

Kroger has a framework to drive long-term sustainable value, not just in 2020, Millerchip said. This includes investments in its “seamless” offering and capital allocation focused on high-return projects.

[caption id="attachment_99037" align="aligncenter" width="700"]

Source: Company reports[/caption]

Kroger has a framework to drive long-term sustainable value, not just in 2020, Millerchip said. This includes investments in its “seamless” offering and capital allocation focused on high-return projects.

[caption id="attachment_99037" align="aligncenter" width="700"] Source: Company reports[/caption]

Digital and Multi-Modal Shoppers

Yael Cosset, Chief Information and Digital Officer, outlined how Kroger’s “seamless experience ecosystem” drives up customer value. The company’s seamless strategy focuses on three themes:

Source: Company reports[/caption]

Digital and Multi-Modal Shoppers

Yael Cosset, Chief Information and Digital Officer, outlined how Kroger’s “seamless experience ecosystem” drives up customer value. The company’s seamless strategy focuses on three themes:

- Available: through physical stores and its fulfillment network.

- Accessible: including building the right technology platform for shoppers to connect with Kroger.

- Relevant: including not compromising on convenience or simplicity.

Source: Company reports[/caption]

Digital channels bring added costs. But the seamless approach is creating productivity improvements — as the company grows engagement and generates incremental business, it first creates a point of breakeven and ultimately reaches a “point of indifference,” in which the value of customer engagement is such that the profit index is matched between channels.

[caption id="attachment_99039" align="aligncenter" width="700"]

Source: Company reports[/caption]

Digital channels bring added costs. But the seamless approach is creating productivity improvements — as the company grows engagement and generates incremental business, it first creates a point of breakeven and ultimately reaches a “point of indifference,” in which the value of customer engagement is such that the profit index is matched between channels.

[caption id="attachment_99039" align="aligncenter" width="700"] Source: Company reports[/caption]

Ocado Supporting Digital

Kroger’s seamless model is based on an integrated proposition of in-store retail, pickup and delivery; its partnership with Ocado, announced in 2018, supports the latter two elements. On Ocado, Cosset noted that its partner offered benefits that included a very high order-fulfillment rate and increased transparency for customers, such as expiry dates, and, for Kroger, low shrink rates and double the pick efficiency that Kroger sees in stores.

Cosset said Ocado’s flexibility was likely underestimated: while Ocado was focused on home delivery in its home market of the UK, it will help Kroger fulfill some pickup demand.

[caption id="attachment_99040" align="aligncenter" width="700"]

Source: Company reports[/caption]

Ocado Supporting Digital

Kroger’s seamless model is based on an integrated proposition of in-store retail, pickup and delivery; its partnership with Ocado, announced in 2018, supports the latter two elements. On Ocado, Cosset noted that its partner offered benefits that included a very high order-fulfillment rate and increased transparency for customers, such as expiry dates, and, for Kroger, low shrink rates and double the pick efficiency that Kroger sees in stores.

Cosset said Ocado’s flexibility was likely underestimated: while Ocado was focused on home delivery in its home market of the UK, it will help Kroger fulfill some pickup demand.

[caption id="attachment_99040" align="aligncenter" width="700"] Source: Company reports[/caption]

CFO Millerchip noted that the cost of the first Ocado facilities had come in a little higher than anticipated due to higher land and construction costs, but that Ocado still expects a strong return on investment from the Ocado facilities.

Kroger’s diversified distribution model allows it to take advantage of proximity when it matters and scale and aggregation when it has that opportunity, Cosset said.

[caption id="attachment_99041" align="aligncenter" width="700"]

Source: Company reports[/caption]

CFO Millerchip noted that the cost of the first Ocado facilities had come in a little higher than anticipated due to higher land and construction costs, but that Ocado still expects a strong return on investment from the Ocado facilities.

Kroger’s diversified distribution model allows it to take advantage of proximity when it matters and scale and aggregation when it has that opportunity, Cosset said.

[caption id="attachment_99041" align="aligncenter" width="700"] Source: Company reports[/caption]

Millerchip also noted that partnerships are important to support Kroger’s digital and supply-chain operations, but that the company is deliberate in selecting partners. Kroger has partnered with Nuro on self-driving cars, Walgreens on product distribution and Microsoft on digital technologies — as well as Ocado for online grocery fulfillment.

[caption id="attachment_99042" align="aligncenter" width="700"]

Source: Company reports[/caption]

Millerchip also noted that partnerships are important to support Kroger’s digital and supply-chain operations, but that the company is deliberate in selecting partners. Kroger has partnered with Nuro on self-driving cars, Walgreens on product distribution and Microsoft on digital technologies — as well as Ocado for online grocery fulfillment.

[caption id="attachment_99042" align="aligncenter" width="700"] Source: Company reports[/caption]

A Focus on Total Shareholder Return

McMullen said Kroger’s aspiration is to generate a strong, attractive total shareholder return year over year. CFO Millerchip outlined Kroger’s pathway to this return. As shown below, this is underpinned by a stable and growing core grocery business, complemented with asset-light alternative profit streams combined with a focus on high-return capital investments.

For 2020, management anticipates a total shareholder return in the 7-11.5% range. Beyond 2020, management anticipates a minimum total shareholder return of 8%.

[caption id="attachment_99043" align="aligncenter" width="700"]

Source: Company reports[/caption]

A Focus on Total Shareholder Return

McMullen said Kroger’s aspiration is to generate a strong, attractive total shareholder return year over year. CFO Millerchip outlined Kroger’s pathway to this return. As shown below, this is underpinned by a stable and growing core grocery business, complemented with asset-light alternative profit streams combined with a focus on high-return capital investments.

For 2020, management anticipates a total shareholder return in the 7-11.5% range. Beyond 2020, management anticipates a minimum total shareholder return of 8%.

[caption id="attachment_99043" align="aligncenter" width="700"] Source: Company reports[/caption]

Financial Guidance

Shareholder returns will be the result of a stable and growing core grocery business plus alternative profit streams, McMullen said.

Management reconfirmed 2019 guidance:

Source: Company reports[/caption]

Financial Guidance

Shareholder returns will be the result of a stable and growing core grocery business plus alternative profit streams, McMullen said.

Management reconfirmed 2019 guidance:

- Adjusted EPS $2.15-2.25 versus the FactSet consensus of $2.19.

- Identical-store sales growth of 2.0-2.25%.

- Operating profit $2.9-3.0 billion.

- Capital investments, excluding mergers, acquisitions and purchases of leased facilities, in the range of $3.0 and $3.2 billion.

- Adjusted EPS $2.30-2.40 versus the FactSet consensus of $2.30.

- Identical-store sales growth, ex fuel, to be greater than 2.25%.

- Alternative profit businesses to grow incremental operating profit between $125 million to $150 million.

- Adjusted FIFO operating profit between $3.0 billion and $3.1 billion.

- Capital investments, excluding mergers, acquisitions and purchases of leased facilities, to range between $3.2 billion and $3.4 billion.

- Free cash flow to be in the range of $1.6 billion to $1.8 billion.

- To repurchase shares in the range of $500 million to $1 billion.

- A tax rate of approximately 23%.

- Total shareholder return of between 8% and 11%.

- Growth of 3-5% from improved earnings, and growth in the company's free cash flow payout rate through a combination of share repurchases and dividends.

- This company noted that total shareholder return target excludes any potential change in its price-to-earnings multiple, and the potential for additional growth beyond 2020 created through strategic partnerships.