Introduction

On March 4, 2022, Kroger hosted its 2022 Business Update Event in Orlando, Florida. Kroger Chairman and CEO, Rodney McMullen, and the company’s executive team discussed key themes with investors during the day—including the company’s growth through its competitive moats, its digital strategies, its shareholder return model and its “Zero Hunger, Zero Waste” sustainability commitment.

Kroger 2022 Business Update: Coresight Research Insights

Kroger’s Vision for the Future

McMullen outlined four key strategies that will drive the organization’s vision in the long term:

1. Continue To Expand the Food Business Through Competitive Moats

Kroger’s four competitive moats—Fresh, Data and Personalization, Our Brands and Seamless Ecosystem—will enable it to convert pandemic-driven structural changes in customer behavior into lasting competitive advantages, according to McMullen.

[caption id="attachment_143005" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

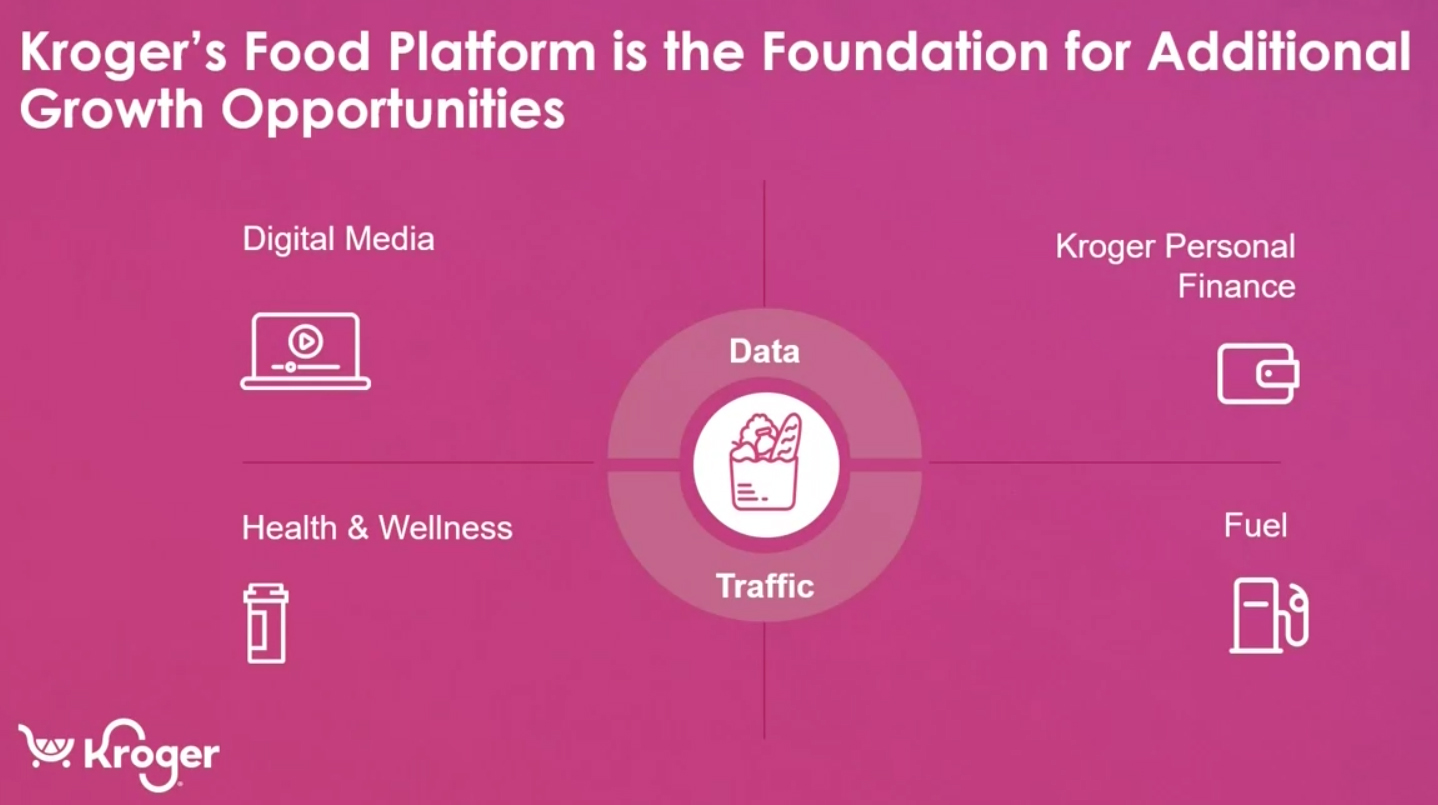

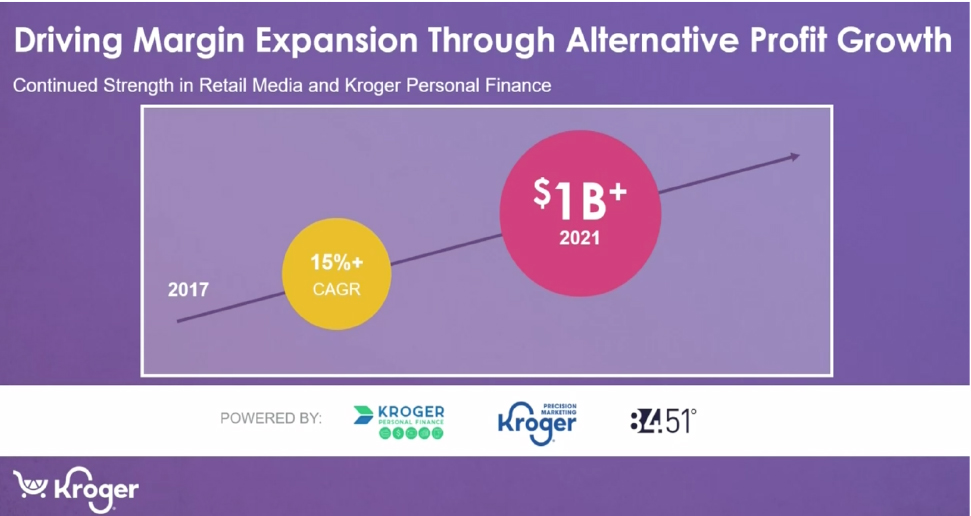

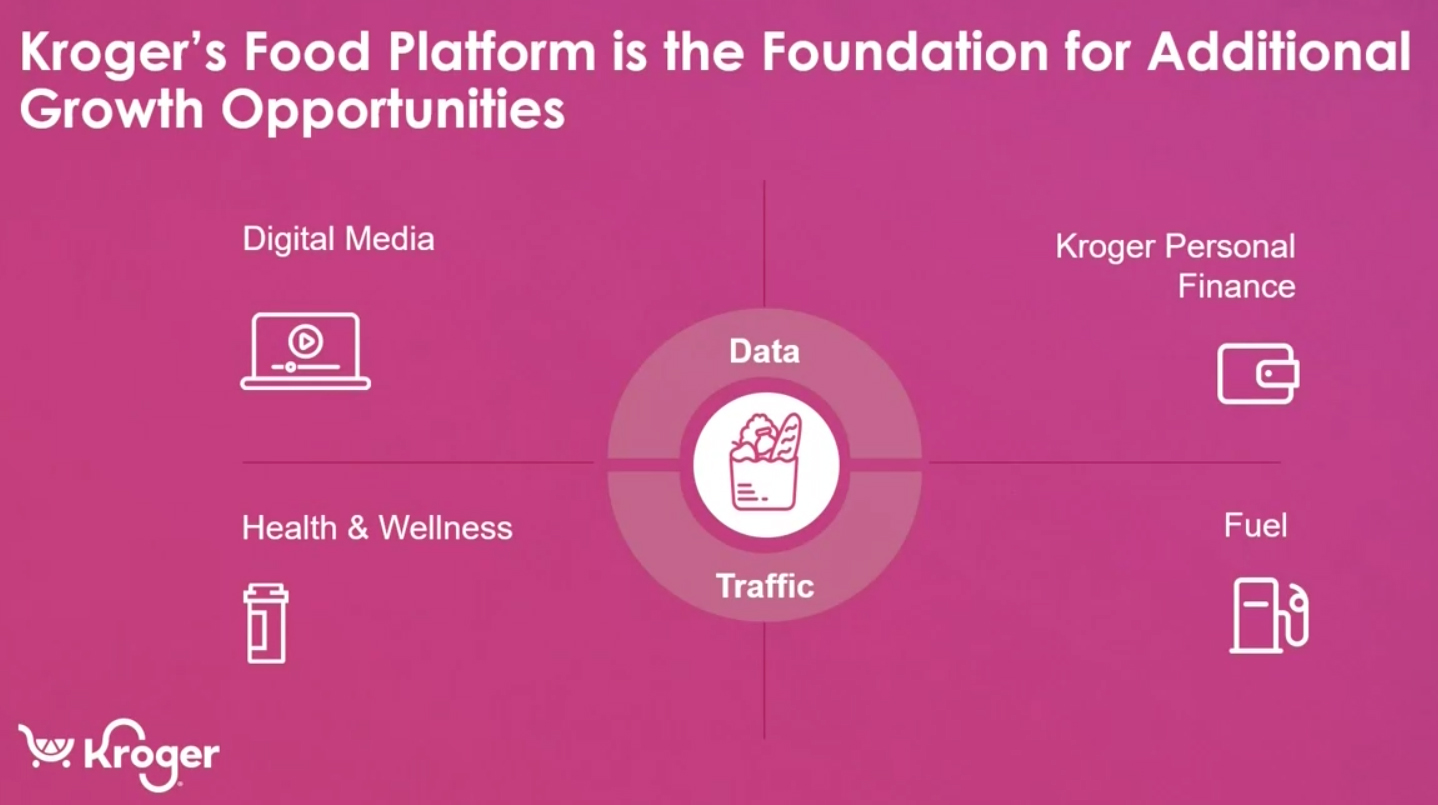

2. Develop Margin Accretion Using Core Food Platform as a Base

Kroger plans to develop margin accretive opportunities using its core food platform as a foundation, covering different products and services including Retail Media, health and wellness, fuel, and Kroger Personal Finance.

[caption id="attachment_143006" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

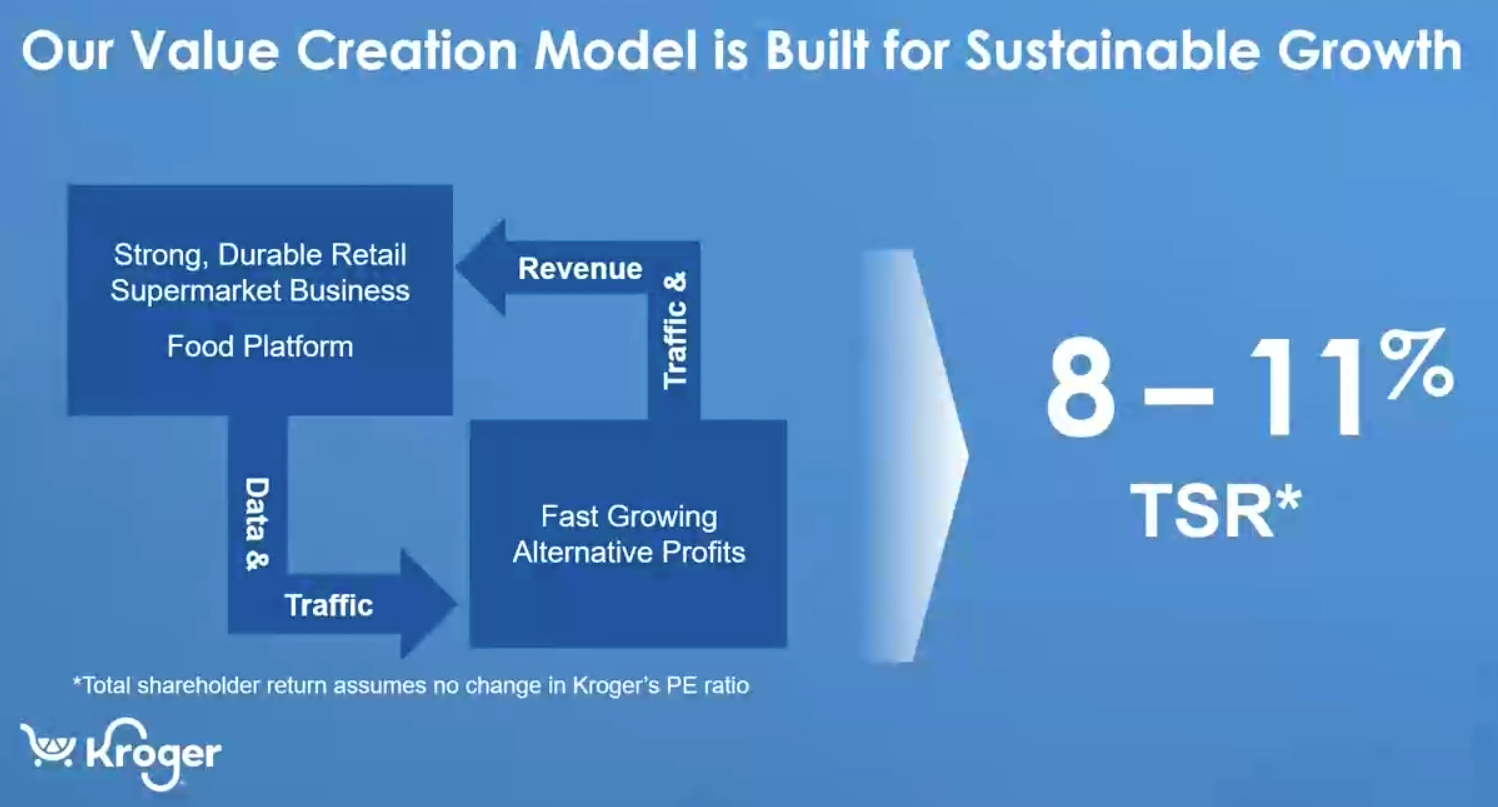

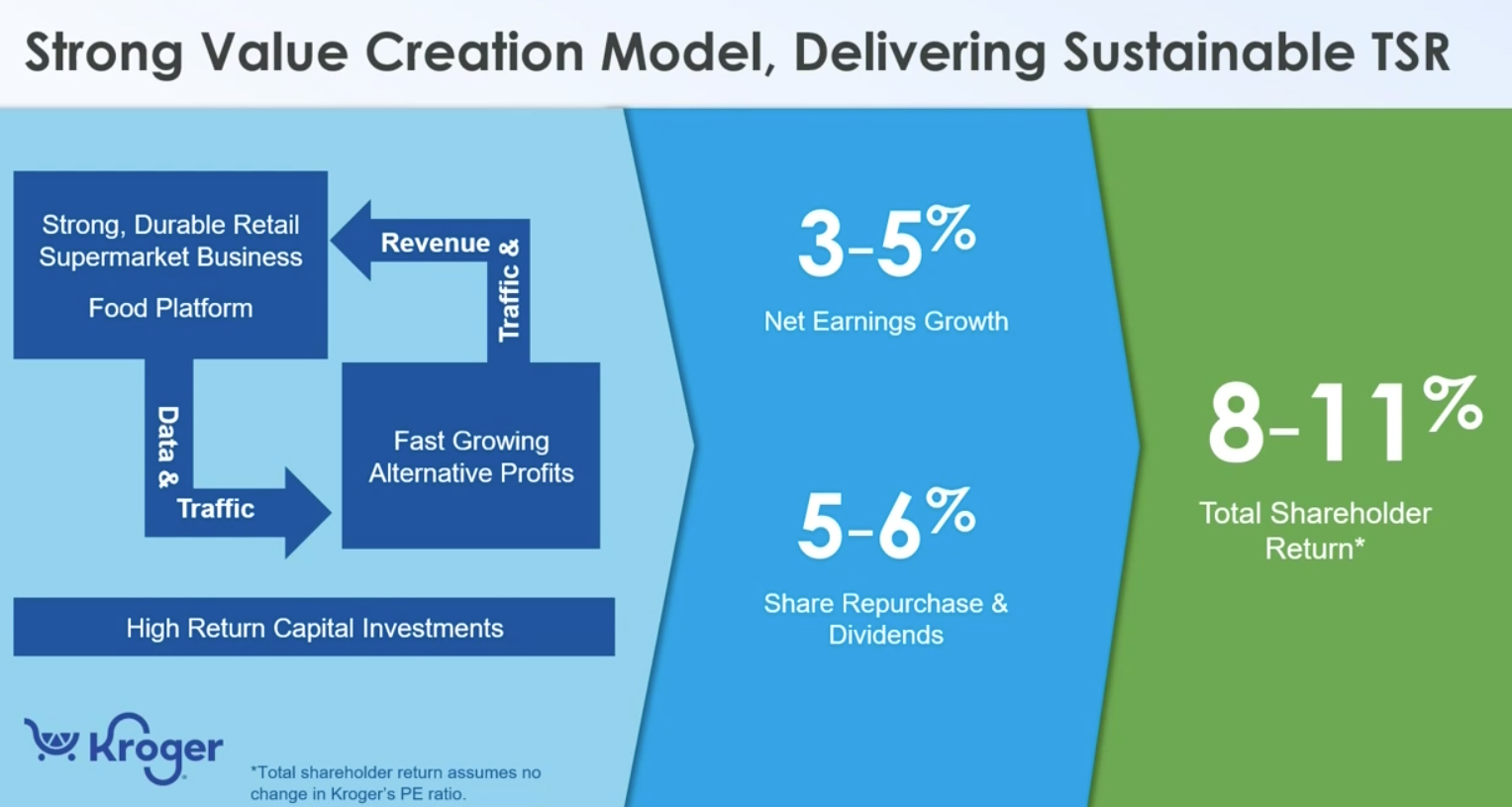

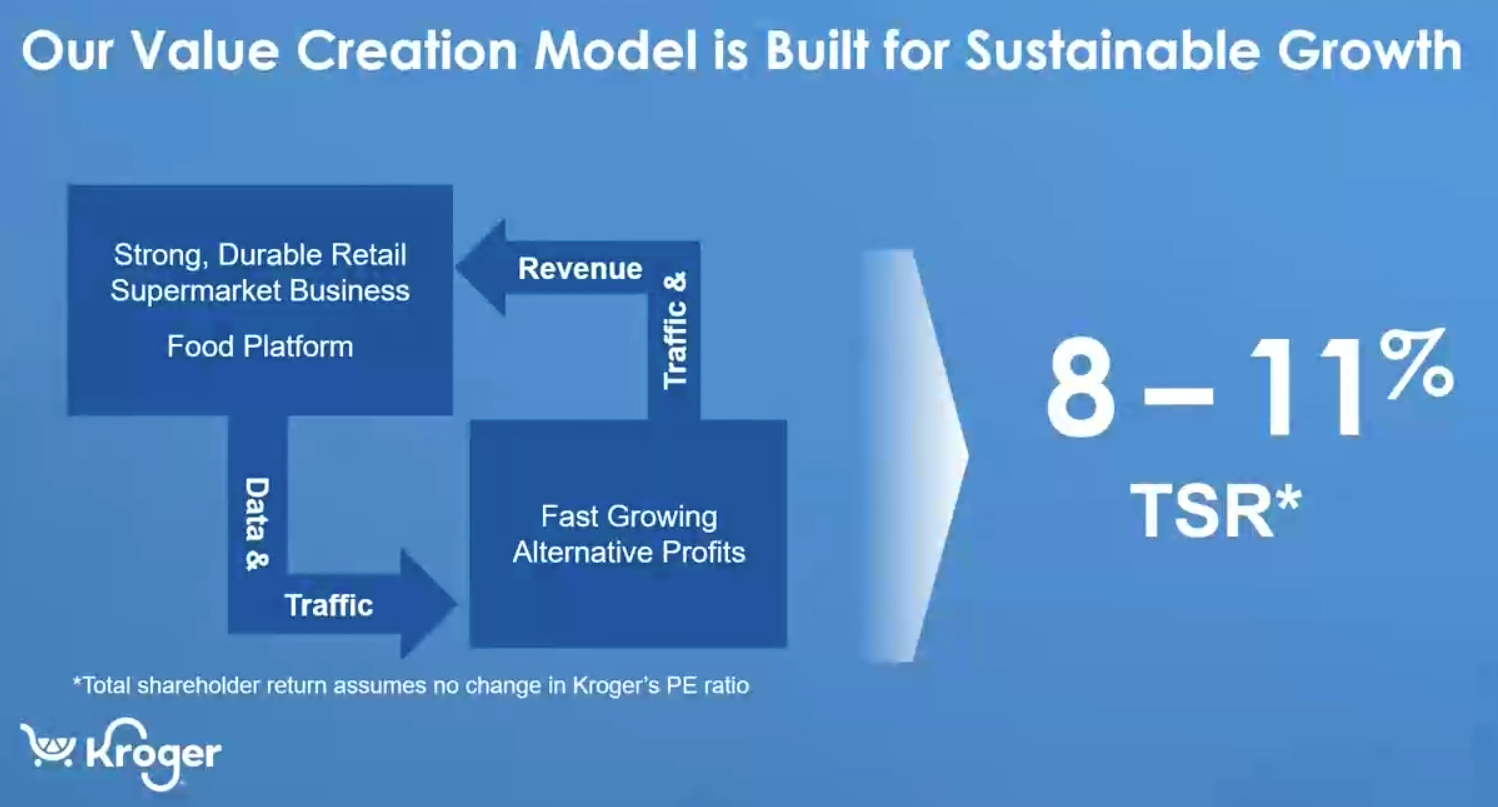

3. Continue To Use Cashflow To Invest

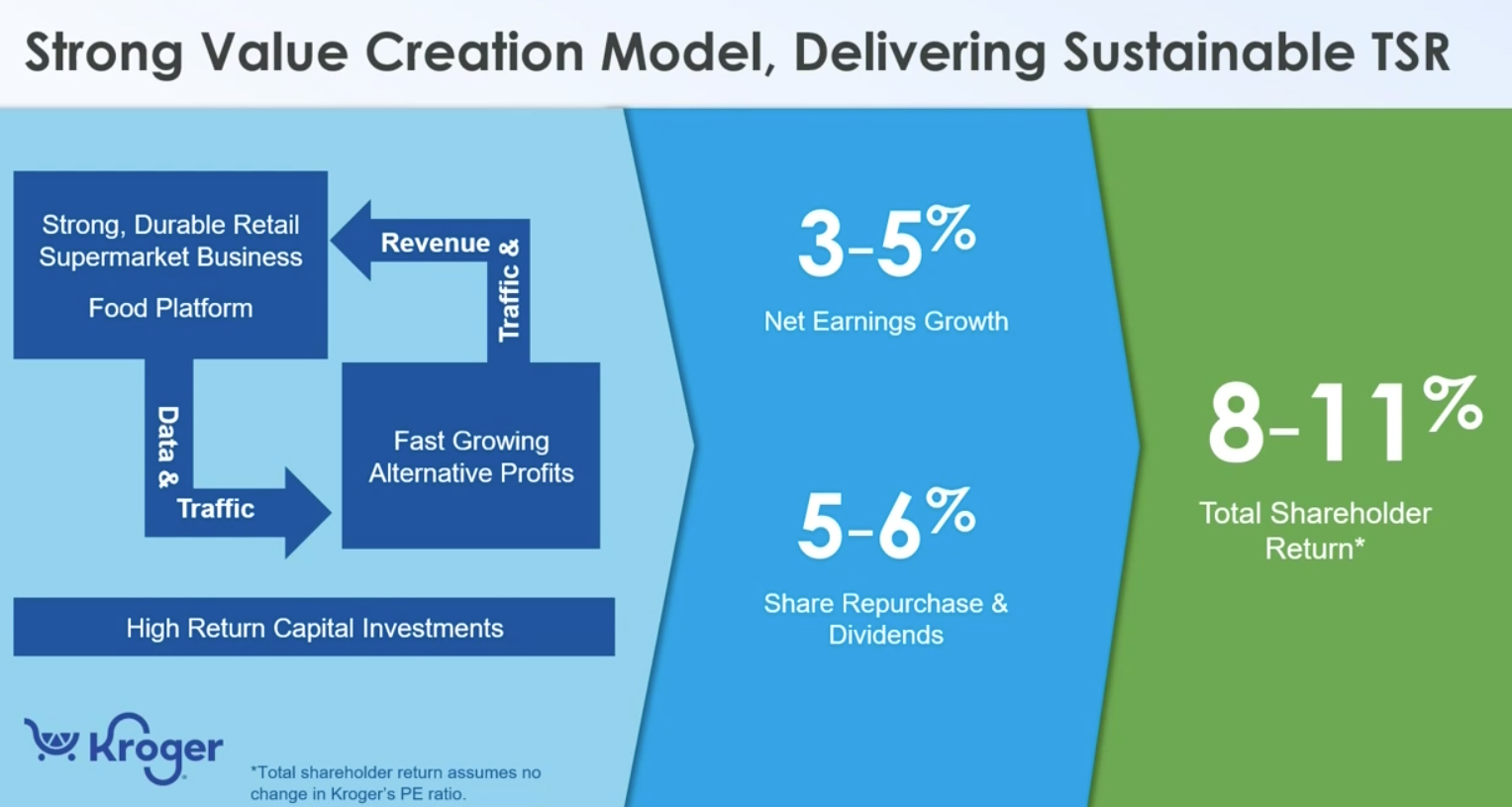

Kroger will continue to use its free cashflow to invest in businesses that will drive sustainable net earnings growth, creating value for shareholders and delivering 8%–11% total shareholder returns.

[caption id="attachment_143007" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

4. Commit to “Zero Hunger | Zero Waste”

Kroger’s ESG (environmental, social and corporate governance) initiative aims to create a more resilient and sustainable food ecosystem to fight food insecurity in communities.

[caption id="attachment_143008" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Growing with Food, Leading with Fresh

Stuart Aitken, Kroger’s Senior Vice President and Chief Merchandising and Marketing Officer, discussed the company’s “Go-to-Market Strategy,” which aims to position Kroger for sales growth and margin expansion.

The strategy is supported by company’s four competitive moats (pictured below), which drive customer trips and loyalty, enabling the company to win market share, according to Aitken. Kroger will continue to invest in these moats to further help accelerate growth and differentiation.

[caption id="attachment_143009" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Aitkin broke down the company’s Go-to-Market Strategy into six components, covering three of the company’s competitive moats and three other components, which we detail below.

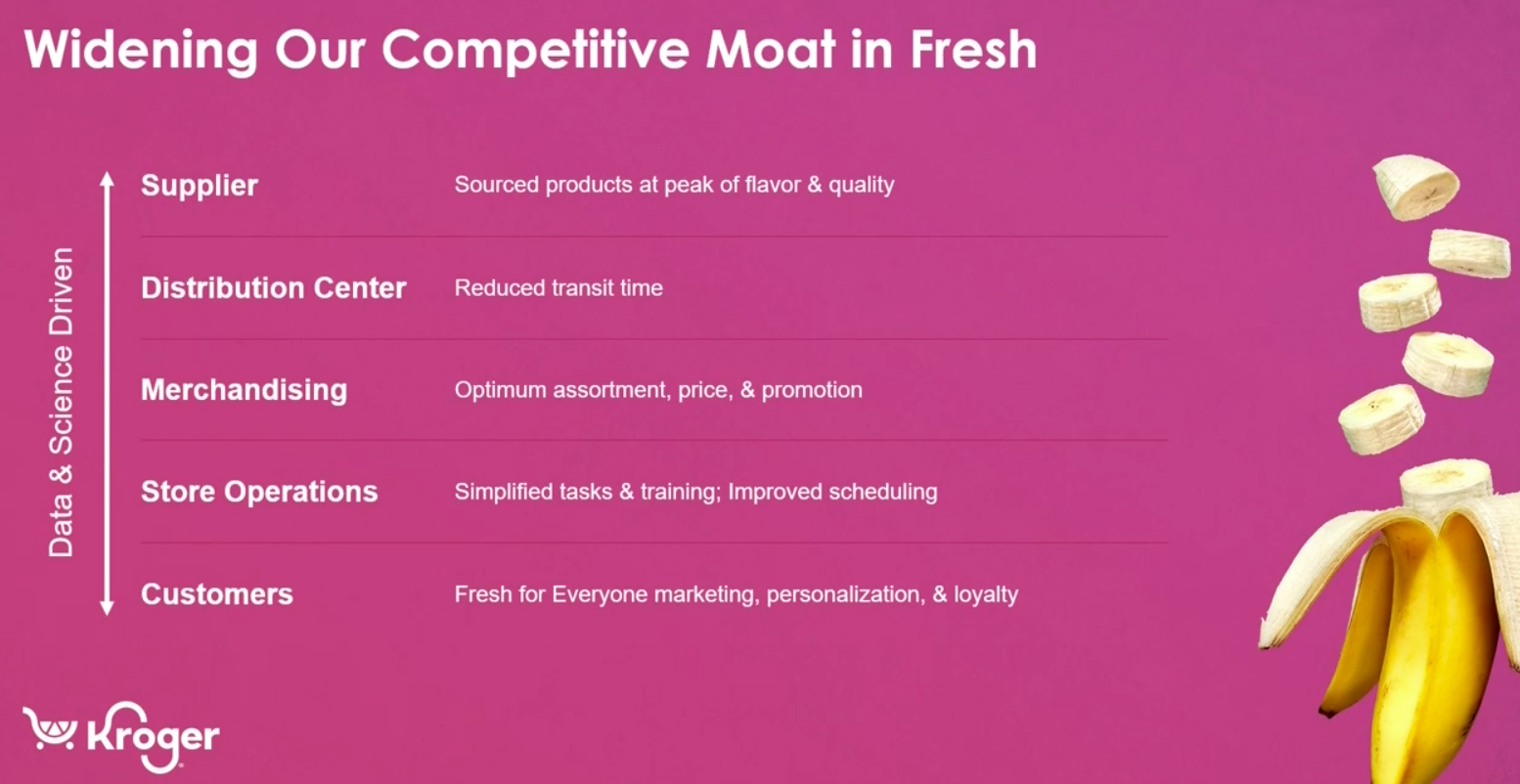

1. Fresh

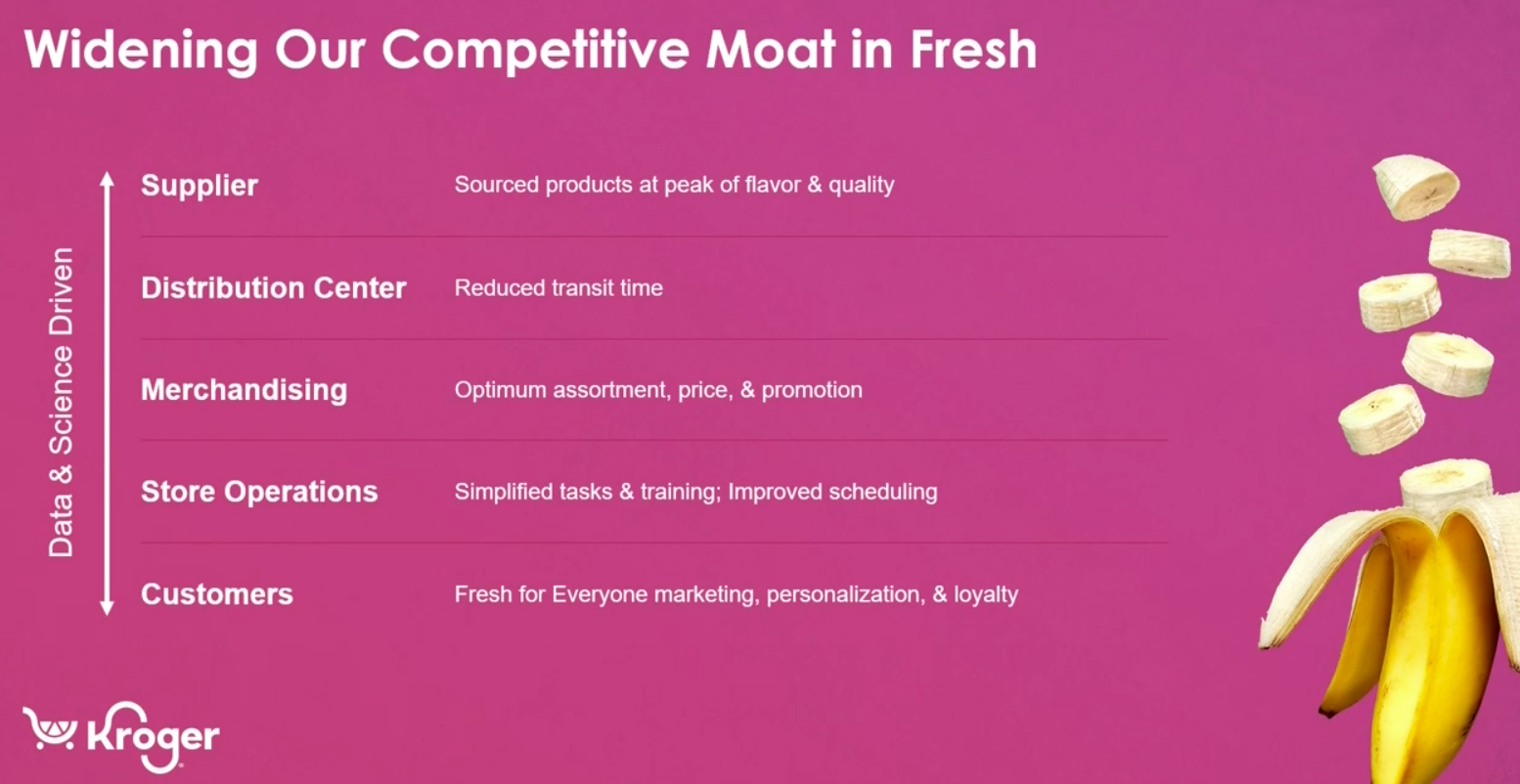

Aitken stated that fresh products are the primary determinant of consumer store choice: Around 70% of all customers decide where to shop based on the availability of fresh products—prompting Kroger to focus on fresh food.

The company is strengthening its supply chain to ensure products are as fresh as possible, aiming to decrease the time products spend in transit between distribution centers, stores and customers’ homes. It is also leveraging data science to optimize its assortment and implement pricing strategies. Additionally, the company is investing capital in mobile refrigeration, so products stay fresh for longer across the supply chain and during last-mile delivery.

[caption id="attachment_143010" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

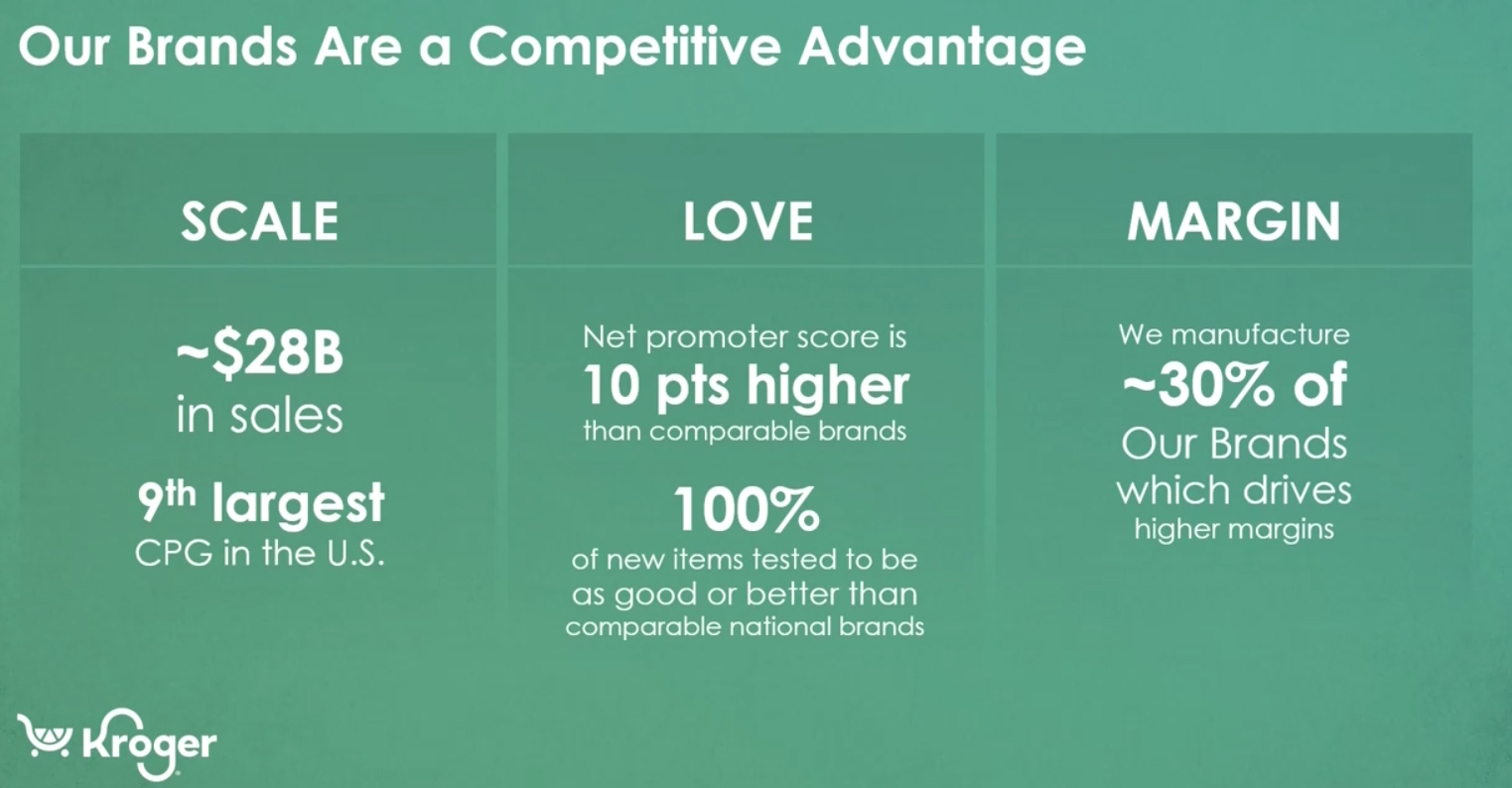

2. Our Brands

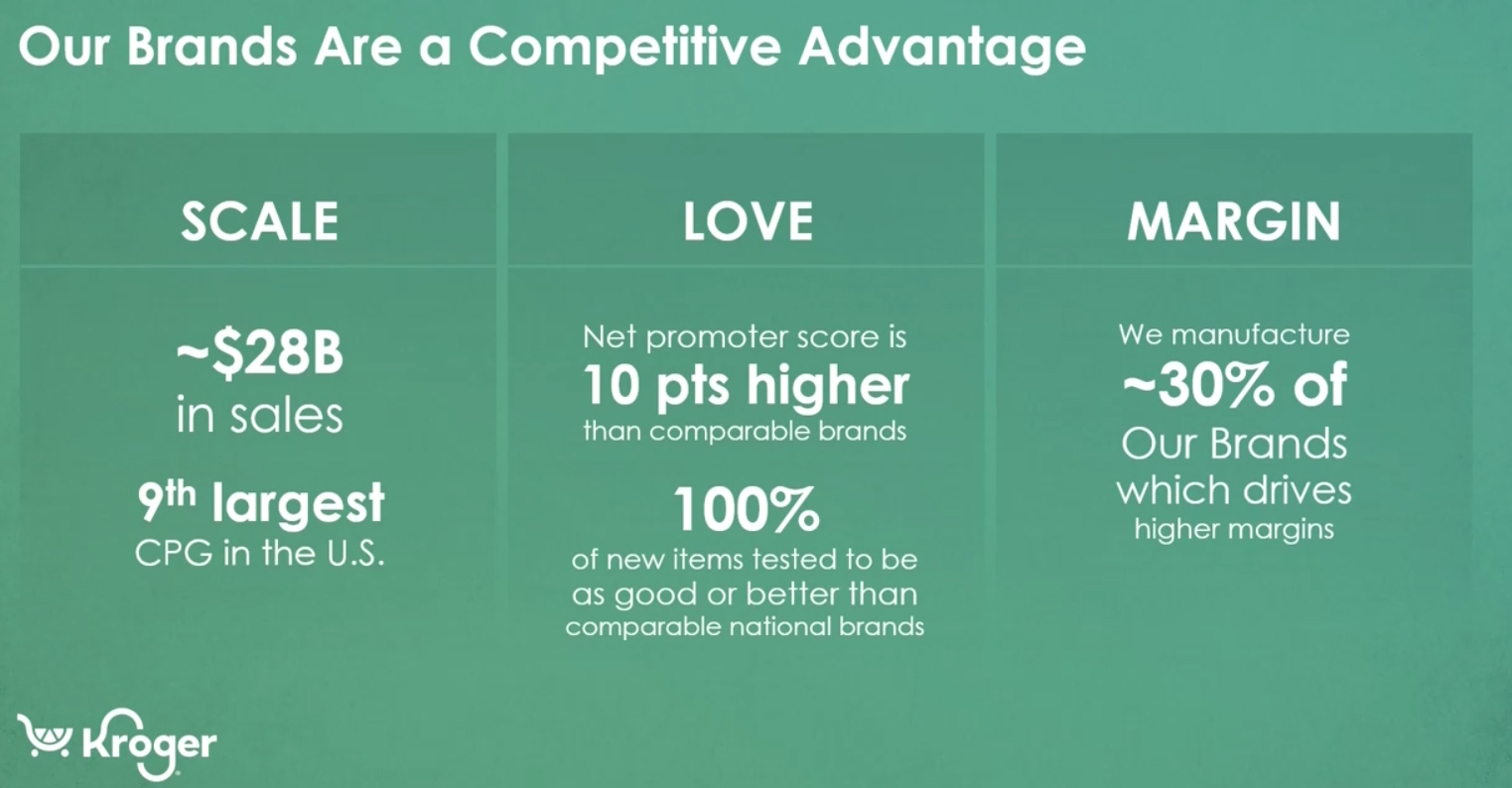

Kroger’s private-label portfolio, Our Brands, saw $28 billion in annual sales in fiscal 2022—making Kroger the ninth-largest CPG company in the US. The company manufactures nearly 30% of its Our Brands products, enabling it to gain greater control of supply and quality, and increasing its ability to offer innovative products, according to the company.

The company stated that its flagship private-label brand, Kroger, saw $15 billion in sales, delivering value and quality for customers in the current inflationary environment. It plans to accelerate the Kroger brand’s expansion.

The company stated that its brands Simple Truth and Private Selection are capitalizing on growing demand for natural and organic products, alongside premiumization trends. The company plans to expand both brands’ assortments. The company also plans to expand the Home Chef brand—which became a $1 billion brand in 2021—across its family of companies.

[caption id="attachment_143011" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

3. Data and Personalization

Kroger is leveraging data science to make surgical price investments in categories, as well as investments in elastic items that increase sales and margins, according to the company. The company uses machine-learning algorithms and optimized forecasting models to enhance personalized pricing and maximize the reach and effectiveness of its promotional investments. It also uses data science to personalize the digital shopping experience and offer customized recommendations.

Additionally, the company stated that loyalty programs are a critical element of its data and personalization efforts. It stated that Boost—its premium loyalty program launched in November 2021—is growing rapidly. The company is seeing a significant portion of customers not enrolled in either its fuel or delivery program that are enrolling in Boost.

[caption id="attachment_143012" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

4. Growth Drivers

Aitken defined growth drivers as the top areas of its business, where it is seeing double-digit growth. The company sees a huge opportunity in the natural and organics segment, which grew at a 14% CAGR prior to the pandemic. It also sees opportunities in global cuisines as consumer preferences shift.

Aitken stated that new product innovation accounted for $2 billion sales in 2021. The company will continue to build on partnerships with Bed Bath & Beyond, third-party meal delivery services such as DoorDash and alternative farming company 80 Acres Farms.

In addition, health, hygiene and home-cleaning is growing significantly, as American consumers have become increasingly attuned to the segment amid the pandemic. Kroger saw 8.2 million households shopping these categories and aims to keep them purchasing within its ecosystem.

[caption id="attachment_143013" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

5. Margin Expansion

Kroger’s data science capabilities enable the company to invest in price by focusing its promotional plan on highly elastic items. As a result, it can manage cost increases, maintain margins and stay competitive on price, according to the company.

The company also aims to expand its margins by improving its product mix. Its trade-up programs encourage customers to purchase more profitable items, and its Our Brands portfolio is also a key margin driver. Its product mix is further improved through personalized offers, according to the company.

Additionally, Kroger aims to reduce costs through more efficient sourcing. It is simultaneously lowering the cost to serve through technology and by simplifying processes.

[caption id="attachment_143014" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

6. Customer and Associate Experience

Aitken stated that the customer and associate experience is at the heart of Kroger’s business. It has made major commitments to train its current associates on the latest trends and technologies—in turn, helping drive the customer experience.

Growing Sales and Elevating the Customer Experience

Mary Ellen Adcock, Senior Vice President of Operations, discussed the company’s programs for growing sales and elevating the customer experience in more depth. She stated that these initiatives are built on three key areas: operational excellence, the associate experience and cost savings.

Operational Excellence

To improve customer experience, Kroger is strengthening its core Fresh moat through enhanced operational processes and technological innovation—aiming to enhance the Fresh experience across all channels, including pickup and delivery. The company has set up cross-functional and collaborative in-stock teams dedicated to solving supply chain issues and working with suppliers for detailed plans on constrained items. The company is also enhancing its checkout experience, through the introduction of its “Krogo” smart carts.

[caption id="attachment_143015" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Associate Experience

Kroger is continuing to invest in its associates, aiming to attract and retain top talent, build retention, and improve management.

Cost Savings

Kroger aims to continue lowering costs without sacrificing the customer experience. The company is leveraging its more than 2,200 pickup locations and stores as an asset to further its Seamless Ecosystem moat. In 2021, the company optimized the customer experience with enhanced online inventory visibility, an improved digital experience and increased direct communication, according to Adcock. These improvements have made it easier for customers to notify the company when they are on their way to a pickup location—which means Kroger can have their orders ready faster. Adcock stated that this new functionality enhanced productivity and improved wait time by 20%, elevating the customer experience.

[caption id="attachment_143016" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Accelerate Digital Growth and Profitability

Yael Cosset, Kroger’s Chief Information Officer, discussed strategies to accelerate the company’s digital growth, create a seamless omnichannel ecosystem and grow sales. He stated that company has structured its ecosystem to capture its full growth potential and offer the most relevant experience for its customers, by leveraging both its store network and its automated customer fulfillment centers (CFCs). This allows the company to capture a larger number of shopping trips, from planned weekly shops to unexpected and time-sensitive dinner orders.

Path to Doubling Sales by the End of 2023

Kroger will employ personalization to simplify the online experience, as well as improving relevance and convenience. Kroger Delivery Now, its thirty-minute delivery option available on Instacart, will also leverage stores to grow its share of convenience orders. Additionally, new and upcoming CFCs will drive new customer acquisition in both existing and new geographies.

[caption id="attachment_143017" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Kroger unveiled plans to build more Ocado-automated “spoke” e-commerce fulfillment facilities to help process online orders. The new spoke sites will be located in Austin and San Antonio, Texas, as well as Atlanta and Birmingham, and are expected be in operation by the end of 2022. They will support bigger CFCs, including one that is currently live in Atlanta and another planned for Dallas.

[caption id="attachment_143018" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

Delivering Today and Investing for the Future

The company’s Chief Financial Officer, Gary Millerchip, outlined Kroger’s value creation model, which is underpinned by its strong core grocery business and complemented with alternative profits streams. He stated that Kroger plans to consistently deliver net earnings growth of 3%–5% in the future. He also stated that the company remains committed to growing its dividend over time, returning excess cash to shareholders via stock repurchases, which will result in a total shareholder return between 8% and 11%.

[caption id="attachment_143019" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

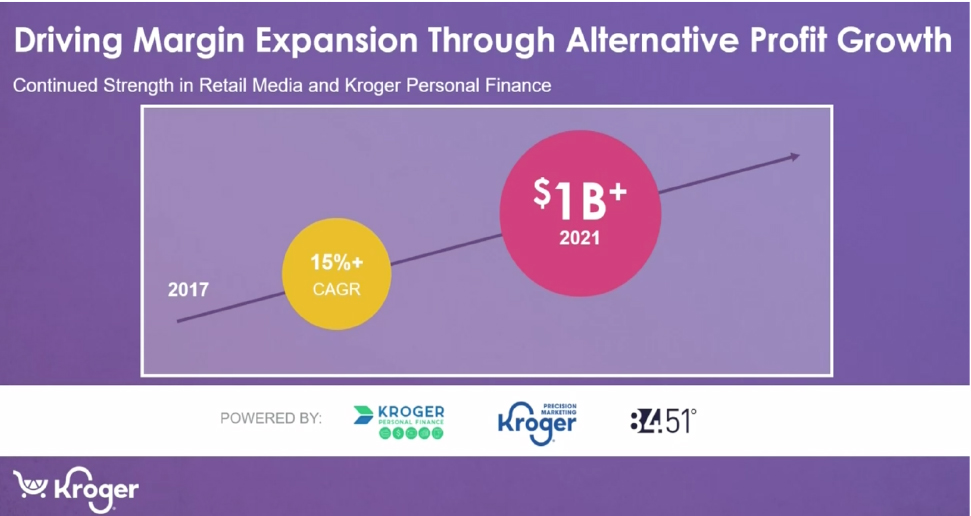

In 2021, Kroger’s alternative profit streams contributed over $1 billion in operating profit. Its Retail Media segment, which allows advertising placements within its brick-and-mortar locations and its digital properties, has experienced phenomenal growth in the last two years. The company will continue to capitalize on this opportunity, helping its partners achieve a greater return on their investment through first-party data, according to Millerchip. The company expects alternative profit streams to grow at a double-digit rate for the foreseeable future, driving margin expansion over time.

[caption id="attachment_143020" align="aligncenter" width="700"]

Source: Kroger

Source: Kroger[/caption]

What We Think

- We expect that Kroger’s plan to continue investing in private-label brands will position it well to attract inflation-weary consumers and capitalize on the ongoing health and wellness trend.

- Kroger sees automated CFCs and stores as two complementary parts of its evolving online fulfillment ecosystem. The diversified fulfillment model will give Kroger a unique advantage over competitors that primarily utilize one type or the other.

- We expect retail media to become a permanent and integral part of Kroger’s revenue mix, helping it to offset higher operating expenses associated with online fulfillment.

Source: Kroger[/caption]

2. Develop Margin Accretion Using Core Food Platform as a Base

Kroger plans to develop margin accretive opportunities using its core food platform as a foundation, covering different products and services including Retail Media, health and wellness, fuel, and Kroger Personal Finance.

[caption id="attachment_143006" align="aligncenter" width="700"]

Source: Kroger[/caption]

2. Develop Margin Accretion Using Core Food Platform as a Base

Kroger plans to develop margin accretive opportunities using its core food platform as a foundation, covering different products and services including Retail Media, health and wellness, fuel, and Kroger Personal Finance.

[caption id="attachment_143006" align="aligncenter" width="700"] Source: Kroger[/caption]

3. Continue To Use Cashflow To Invest

Kroger will continue to use its free cashflow to invest in businesses that will drive sustainable net earnings growth, creating value for shareholders and delivering 8%–11% total shareholder returns.

[caption id="attachment_143007" align="aligncenter" width="700"]

Source: Kroger[/caption]

3. Continue To Use Cashflow To Invest

Kroger will continue to use its free cashflow to invest in businesses that will drive sustainable net earnings growth, creating value for shareholders and delivering 8%–11% total shareholder returns.

[caption id="attachment_143007" align="aligncenter" width="700"] Source: Kroger[/caption]

4. Commit to “Zero Hunger | Zero Waste”

Kroger’s ESG (environmental, social and corporate governance) initiative aims to create a more resilient and sustainable food ecosystem to fight food insecurity in communities.

[caption id="attachment_143008" align="aligncenter" width="700"]

Source: Kroger[/caption]

4. Commit to “Zero Hunger | Zero Waste”

Kroger’s ESG (environmental, social and corporate governance) initiative aims to create a more resilient and sustainable food ecosystem to fight food insecurity in communities.

[caption id="attachment_143008" align="aligncenter" width="700"] Source: Kroger[/caption]

Growing with Food, Leading with Fresh

Stuart Aitken, Kroger’s Senior Vice President and Chief Merchandising and Marketing Officer, discussed the company’s “Go-to-Market Strategy,” which aims to position Kroger for sales growth and margin expansion.

The strategy is supported by company’s four competitive moats (pictured below), which drive customer trips and loyalty, enabling the company to win market share, according to Aitken. Kroger will continue to invest in these moats to further help accelerate growth and differentiation.

[caption id="attachment_143009" align="aligncenter" width="700"]

Source: Kroger[/caption]

Growing with Food, Leading with Fresh

Stuart Aitken, Kroger’s Senior Vice President and Chief Merchandising and Marketing Officer, discussed the company’s “Go-to-Market Strategy,” which aims to position Kroger for sales growth and margin expansion.

The strategy is supported by company’s four competitive moats (pictured below), which drive customer trips and loyalty, enabling the company to win market share, according to Aitken. Kroger will continue to invest in these moats to further help accelerate growth and differentiation.

[caption id="attachment_143009" align="aligncenter" width="700"] Source: Kroger[/caption]

Aitkin broke down the company’s Go-to-Market Strategy into six components, covering three of the company’s competitive moats and three other components, which we detail below.

1. Fresh

Aitken stated that fresh products are the primary determinant of consumer store choice: Around 70% of all customers decide where to shop based on the availability of fresh products—prompting Kroger to focus on fresh food.

The company is strengthening its supply chain to ensure products are as fresh as possible, aiming to decrease the time products spend in transit between distribution centers, stores and customers’ homes. It is also leveraging data science to optimize its assortment and implement pricing strategies. Additionally, the company is investing capital in mobile refrigeration, so products stay fresh for longer across the supply chain and during last-mile delivery.

[caption id="attachment_143010" align="aligncenter" width="700"]

Source: Kroger[/caption]

Aitkin broke down the company’s Go-to-Market Strategy into six components, covering three of the company’s competitive moats and three other components, which we detail below.

1. Fresh

Aitken stated that fresh products are the primary determinant of consumer store choice: Around 70% of all customers decide where to shop based on the availability of fresh products—prompting Kroger to focus on fresh food.

The company is strengthening its supply chain to ensure products are as fresh as possible, aiming to decrease the time products spend in transit between distribution centers, stores and customers’ homes. It is also leveraging data science to optimize its assortment and implement pricing strategies. Additionally, the company is investing capital in mobile refrigeration, so products stay fresh for longer across the supply chain and during last-mile delivery.

[caption id="attachment_143010" align="aligncenter" width="700"] Source: Kroger[/caption]

2. Our Brands

Kroger’s private-label portfolio, Our Brands, saw $28 billion in annual sales in fiscal 2022—making Kroger the ninth-largest CPG company in the US. The company manufactures nearly 30% of its Our Brands products, enabling it to gain greater control of supply and quality, and increasing its ability to offer innovative products, according to the company.

The company stated that its flagship private-label brand, Kroger, saw $15 billion in sales, delivering value and quality for customers in the current inflationary environment. It plans to accelerate the Kroger brand’s expansion.

The company stated that its brands Simple Truth and Private Selection are capitalizing on growing demand for natural and organic products, alongside premiumization trends. The company plans to expand both brands’ assortments. The company also plans to expand the Home Chef brand—which became a $1 billion brand in 2021—across its family of companies.

[caption id="attachment_143011" align="aligncenter" width="700"]

Source: Kroger[/caption]

2. Our Brands

Kroger’s private-label portfolio, Our Brands, saw $28 billion in annual sales in fiscal 2022—making Kroger the ninth-largest CPG company in the US. The company manufactures nearly 30% of its Our Brands products, enabling it to gain greater control of supply and quality, and increasing its ability to offer innovative products, according to the company.

The company stated that its flagship private-label brand, Kroger, saw $15 billion in sales, delivering value and quality for customers in the current inflationary environment. It plans to accelerate the Kroger brand’s expansion.

The company stated that its brands Simple Truth and Private Selection are capitalizing on growing demand for natural and organic products, alongside premiumization trends. The company plans to expand both brands’ assortments. The company also plans to expand the Home Chef brand—which became a $1 billion brand in 2021—across its family of companies.

[caption id="attachment_143011" align="aligncenter" width="700"] Source: Kroger[/caption]

3. Data and Personalization

Kroger is leveraging data science to make surgical price investments in categories, as well as investments in elastic items that increase sales and margins, according to the company. The company uses machine-learning algorithms and optimized forecasting models to enhance personalized pricing and maximize the reach and effectiveness of its promotional investments. It also uses data science to personalize the digital shopping experience and offer customized recommendations.

Additionally, the company stated that loyalty programs are a critical element of its data and personalization efforts. It stated that Boost—its premium loyalty program launched in November 2021—is growing rapidly. The company is seeing a significant portion of customers not enrolled in either its fuel or delivery program that are enrolling in Boost.

[caption id="attachment_143012" align="aligncenter" width="700"]

Source: Kroger[/caption]

3. Data and Personalization

Kroger is leveraging data science to make surgical price investments in categories, as well as investments in elastic items that increase sales and margins, according to the company. The company uses machine-learning algorithms and optimized forecasting models to enhance personalized pricing and maximize the reach and effectiveness of its promotional investments. It also uses data science to personalize the digital shopping experience and offer customized recommendations.

Additionally, the company stated that loyalty programs are a critical element of its data and personalization efforts. It stated that Boost—its premium loyalty program launched in November 2021—is growing rapidly. The company is seeing a significant portion of customers not enrolled in either its fuel or delivery program that are enrolling in Boost.

[caption id="attachment_143012" align="aligncenter" width="700"] Source: Kroger[/caption]

4. Growth Drivers

Aitken defined growth drivers as the top areas of its business, where it is seeing double-digit growth. The company sees a huge opportunity in the natural and organics segment, which grew at a 14% CAGR prior to the pandemic. It also sees opportunities in global cuisines as consumer preferences shift.

Aitken stated that new product innovation accounted for $2 billion sales in 2021. The company will continue to build on partnerships with Bed Bath & Beyond, third-party meal delivery services such as DoorDash and alternative farming company 80 Acres Farms.

In addition, health, hygiene and home-cleaning is growing significantly, as American consumers have become increasingly attuned to the segment amid the pandemic. Kroger saw 8.2 million households shopping these categories and aims to keep them purchasing within its ecosystem.

[caption id="attachment_143013" align="aligncenter" width="700"]

Source: Kroger[/caption]

4. Growth Drivers

Aitken defined growth drivers as the top areas of its business, where it is seeing double-digit growth. The company sees a huge opportunity in the natural and organics segment, which grew at a 14% CAGR prior to the pandemic. It also sees opportunities in global cuisines as consumer preferences shift.

Aitken stated that new product innovation accounted for $2 billion sales in 2021. The company will continue to build on partnerships with Bed Bath & Beyond, third-party meal delivery services such as DoorDash and alternative farming company 80 Acres Farms.

In addition, health, hygiene and home-cleaning is growing significantly, as American consumers have become increasingly attuned to the segment amid the pandemic. Kroger saw 8.2 million households shopping these categories and aims to keep them purchasing within its ecosystem.

[caption id="attachment_143013" align="aligncenter" width="700"] Source: Kroger[/caption]

5. Margin Expansion

Kroger’s data science capabilities enable the company to invest in price by focusing its promotional plan on highly elastic items. As a result, it can manage cost increases, maintain margins and stay competitive on price, according to the company.

The company also aims to expand its margins by improving its product mix. Its trade-up programs encourage customers to purchase more profitable items, and its Our Brands portfolio is also a key margin driver. Its product mix is further improved through personalized offers, according to the company.

Additionally, Kroger aims to reduce costs through more efficient sourcing. It is simultaneously lowering the cost to serve through technology and by simplifying processes.

[caption id="attachment_143014" align="aligncenter" width="700"]

Source: Kroger[/caption]

5. Margin Expansion

Kroger’s data science capabilities enable the company to invest in price by focusing its promotional plan on highly elastic items. As a result, it can manage cost increases, maintain margins and stay competitive on price, according to the company.

The company also aims to expand its margins by improving its product mix. Its trade-up programs encourage customers to purchase more profitable items, and its Our Brands portfolio is also a key margin driver. Its product mix is further improved through personalized offers, according to the company.

Additionally, Kroger aims to reduce costs through more efficient sourcing. It is simultaneously lowering the cost to serve through technology and by simplifying processes.

[caption id="attachment_143014" align="aligncenter" width="700"] Source: Kroger[/caption]

6. Customer and Associate Experience

Aitken stated that the customer and associate experience is at the heart of Kroger’s business. It has made major commitments to train its current associates on the latest trends and technologies—in turn, helping drive the customer experience.

Growing Sales and Elevating the Customer Experience

Mary Ellen Adcock, Senior Vice President of Operations, discussed the company’s programs for growing sales and elevating the customer experience in more depth. She stated that these initiatives are built on three key areas: operational excellence, the associate experience and cost savings.

Operational Excellence

To improve customer experience, Kroger is strengthening its core Fresh moat through enhanced operational processes and technological innovation—aiming to enhance the Fresh experience across all channels, including pickup and delivery. The company has set up cross-functional and collaborative in-stock teams dedicated to solving supply chain issues and working with suppliers for detailed plans on constrained items. The company is also enhancing its checkout experience, through the introduction of its “Krogo” smart carts.

[caption id="attachment_143015" align="aligncenter" width="700"]

Source: Kroger[/caption]

6. Customer and Associate Experience

Aitken stated that the customer and associate experience is at the heart of Kroger’s business. It has made major commitments to train its current associates on the latest trends and technologies—in turn, helping drive the customer experience.

Growing Sales and Elevating the Customer Experience

Mary Ellen Adcock, Senior Vice President of Operations, discussed the company’s programs for growing sales and elevating the customer experience in more depth. She stated that these initiatives are built on three key areas: operational excellence, the associate experience and cost savings.

Operational Excellence

To improve customer experience, Kroger is strengthening its core Fresh moat through enhanced operational processes and technological innovation—aiming to enhance the Fresh experience across all channels, including pickup and delivery. The company has set up cross-functional and collaborative in-stock teams dedicated to solving supply chain issues and working with suppliers for detailed plans on constrained items. The company is also enhancing its checkout experience, through the introduction of its “Krogo” smart carts.

[caption id="attachment_143015" align="aligncenter" width="700"] Source: Kroger[/caption]

Associate Experience

Kroger is continuing to invest in its associates, aiming to attract and retain top talent, build retention, and improve management.

Cost Savings

Kroger aims to continue lowering costs without sacrificing the customer experience. The company is leveraging its more than 2,200 pickup locations and stores as an asset to further its Seamless Ecosystem moat. In 2021, the company optimized the customer experience with enhanced online inventory visibility, an improved digital experience and increased direct communication, according to Adcock. These improvements have made it easier for customers to notify the company when they are on their way to a pickup location—which means Kroger can have their orders ready faster. Adcock stated that this new functionality enhanced productivity and improved wait time by 20%, elevating the customer experience.

[caption id="attachment_143016" align="aligncenter" width="700"]

Source: Kroger[/caption]

Associate Experience

Kroger is continuing to invest in its associates, aiming to attract and retain top talent, build retention, and improve management.

Cost Savings

Kroger aims to continue lowering costs without sacrificing the customer experience. The company is leveraging its more than 2,200 pickup locations and stores as an asset to further its Seamless Ecosystem moat. In 2021, the company optimized the customer experience with enhanced online inventory visibility, an improved digital experience and increased direct communication, according to Adcock. These improvements have made it easier for customers to notify the company when they are on their way to a pickup location—which means Kroger can have their orders ready faster. Adcock stated that this new functionality enhanced productivity and improved wait time by 20%, elevating the customer experience.

[caption id="attachment_143016" align="aligncenter" width="700"] Source: Kroger[/caption]

Accelerate Digital Growth and Profitability

Yael Cosset, Kroger’s Chief Information Officer, discussed strategies to accelerate the company’s digital growth, create a seamless omnichannel ecosystem and grow sales. He stated that company has structured its ecosystem to capture its full growth potential and offer the most relevant experience for its customers, by leveraging both its store network and its automated customer fulfillment centers (CFCs). This allows the company to capture a larger number of shopping trips, from planned weekly shops to unexpected and time-sensitive dinner orders.

Path to Doubling Sales by the End of 2023

Kroger will employ personalization to simplify the online experience, as well as improving relevance and convenience. Kroger Delivery Now, its thirty-minute delivery option available on Instacart, will also leverage stores to grow its share of convenience orders. Additionally, new and upcoming CFCs will drive new customer acquisition in both existing and new geographies.

[caption id="attachment_143017" align="aligncenter" width="700"]

Source: Kroger[/caption]

Accelerate Digital Growth and Profitability

Yael Cosset, Kroger’s Chief Information Officer, discussed strategies to accelerate the company’s digital growth, create a seamless omnichannel ecosystem and grow sales. He stated that company has structured its ecosystem to capture its full growth potential and offer the most relevant experience for its customers, by leveraging both its store network and its automated customer fulfillment centers (CFCs). This allows the company to capture a larger number of shopping trips, from planned weekly shops to unexpected and time-sensitive dinner orders.

Path to Doubling Sales by the End of 2023

Kroger will employ personalization to simplify the online experience, as well as improving relevance and convenience. Kroger Delivery Now, its thirty-minute delivery option available on Instacart, will also leverage stores to grow its share of convenience orders. Additionally, new and upcoming CFCs will drive new customer acquisition in both existing and new geographies.

[caption id="attachment_143017" align="aligncenter" width="700"] Source: Kroger[/caption]

Kroger unveiled plans to build more Ocado-automated “spoke” e-commerce fulfillment facilities to help process online orders. The new spoke sites will be located in Austin and San Antonio, Texas, as well as Atlanta and Birmingham, and are expected be in operation by the end of 2022. They will support bigger CFCs, including one that is currently live in Atlanta and another planned for Dallas.

[caption id="attachment_143018" align="aligncenter" width="700"]

Source: Kroger[/caption]

Kroger unveiled plans to build more Ocado-automated “spoke” e-commerce fulfillment facilities to help process online orders. The new spoke sites will be located in Austin and San Antonio, Texas, as well as Atlanta and Birmingham, and are expected be in operation by the end of 2022. They will support bigger CFCs, including one that is currently live in Atlanta and another planned for Dallas.

[caption id="attachment_143018" align="aligncenter" width="700"] Source: Kroger[/caption]

Delivering Today and Investing for the Future

The company’s Chief Financial Officer, Gary Millerchip, outlined Kroger’s value creation model, which is underpinned by its strong core grocery business and complemented with alternative profits streams. He stated that Kroger plans to consistently deliver net earnings growth of 3%–5% in the future. He also stated that the company remains committed to growing its dividend over time, returning excess cash to shareholders via stock repurchases, which will result in a total shareholder return between 8% and 11%.

[caption id="attachment_143019" align="aligncenter" width="700"]

Source: Kroger[/caption]

Delivering Today and Investing for the Future

The company’s Chief Financial Officer, Gary Millerchip, outlined Kroger’s value creation model, which is underpinned by its strong core grocery business and complemented with alternative profits streams. He stated that Kroger plans to consistently deliver net earnings growth of 3%–5% in the future. He also stated that the company remains committed to growing its dividend over time, returning excess cash to shareholders via stock repurchases, which will result in a total shareholder return between 8% and 11%.

[caption id="attachment_143019" align="aligncenter" width="700"] Source: Kroger[/caption]

In 2021, Kroger’s alternative profit streams contributed over $1 billion in operating profit. Its Retail Media segment, which allows advertising placements within its brick-and-mortar locations and its digital properties, has experienced phenomenal growth in the last two years. The company will continue to capitalize on this opportunity, helping its partners achieve a greater return on their investment through first-party data, according to Millerchip. The company expects alternative profit streams to grow at a double-digit rate for the foreseeable future, driving margin expansion over time.

[caption id="attachment_143020" align="aligncenter" width="700"]

Source: Kroger[/caption]

In 2021, Kroger’s alternative profit streams contributed over $1 billion in operating profit. Its Retail Media segment, which allows advertising placements within its brick-and-mortar locations and its digital properties, has experienced phenomenal growth in the last two years. The company will continue to capitalize on this opportunity, helping its partners achieve a greater return on their investment through first-party data, according to Millerchip. The company expects alternative profit streams to grow at a double-digit rate for the foreseeable future, driving margin expansion over time.

[caption id="attachment_143020" align="aligncenter" width="700"] Source: Kroger[/caption]

Source: Kroger[/caption]