Kroger Reaffirms Its Commitment to the Restock Kroger Plan

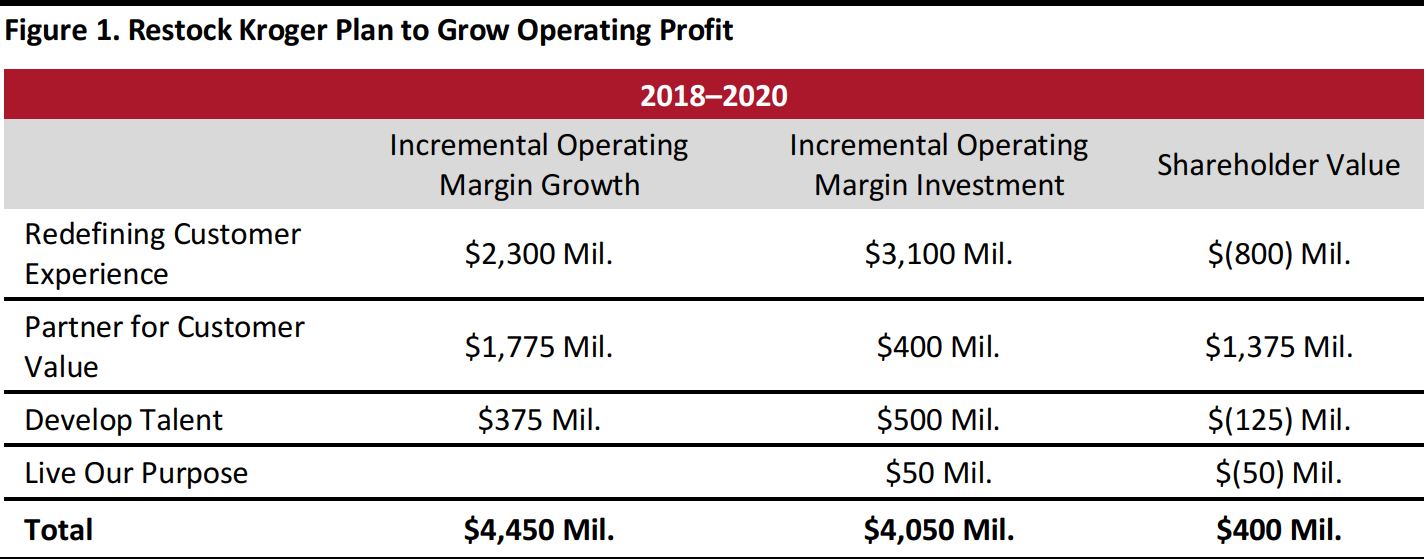

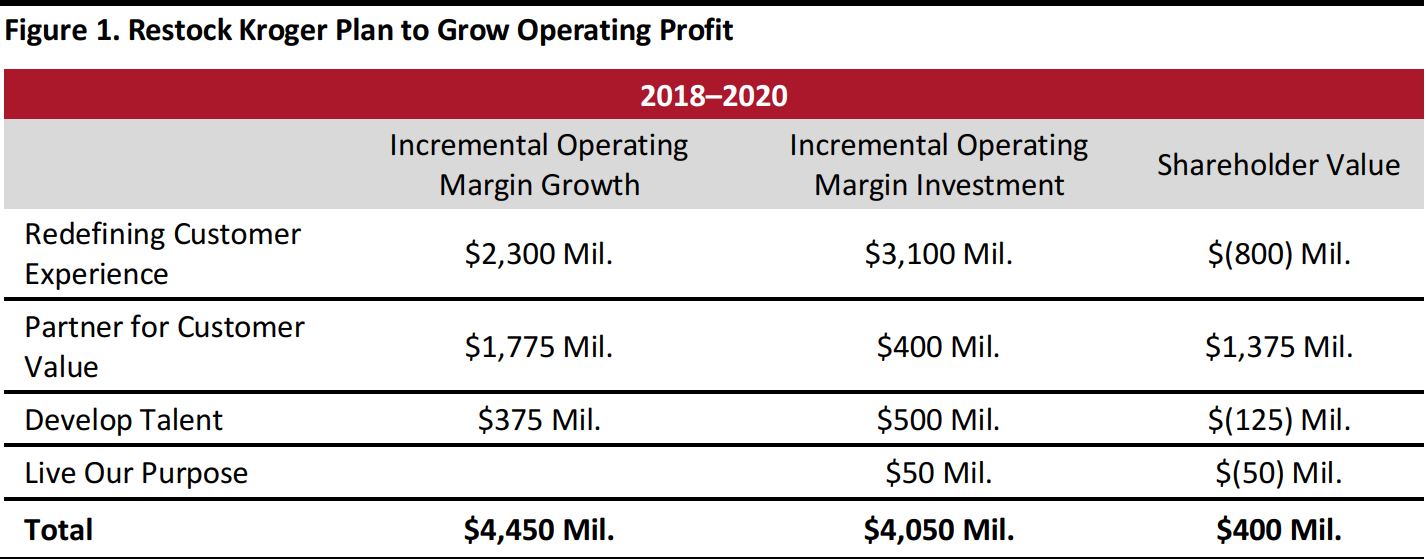

Chairman and CEO Rodney McMullen began the day by reiterating the importance of the company’s Restock Kroger plan, which was instituted last year, and noting that all companies need to reinvent themselves every 12–15 years in order to grow. McMullen reaffirmed Kroger’s commitment to delivering on its original Restock Kroger outline, including its clear path to generating $400 million in incremental operating profit by 2020.

Source: Kroger

Source: Kroger

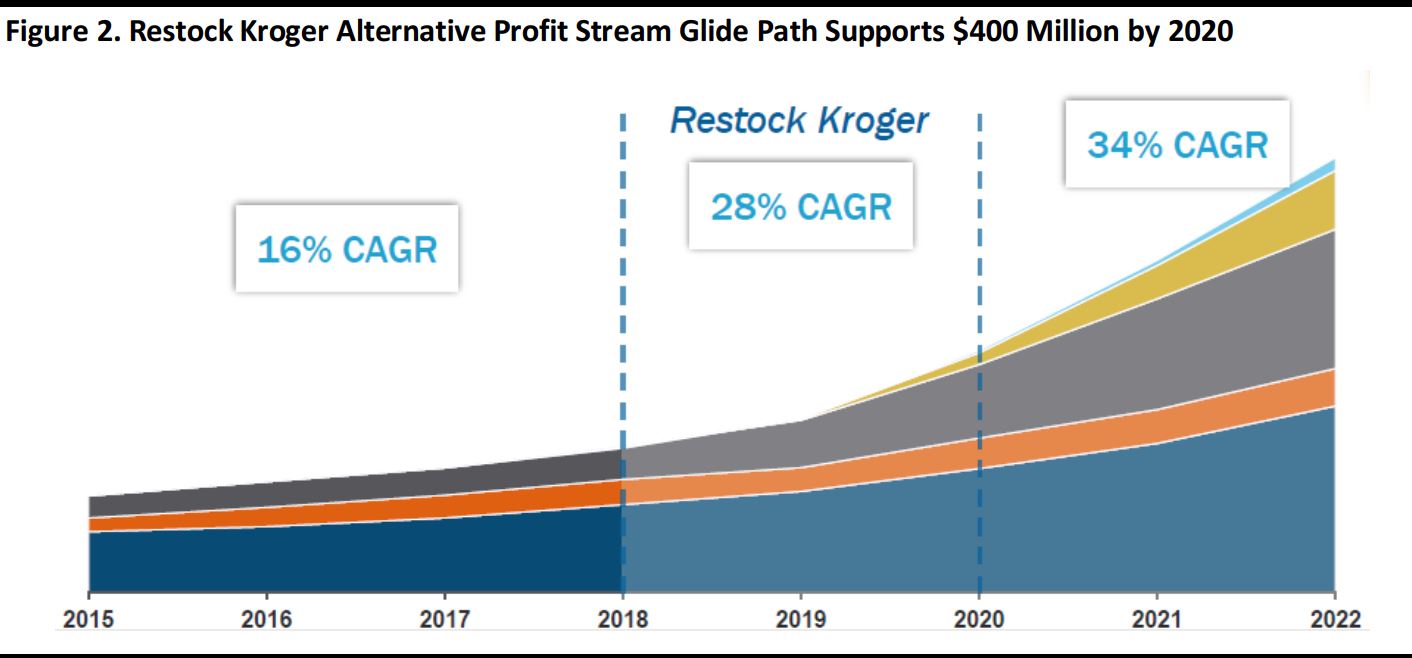

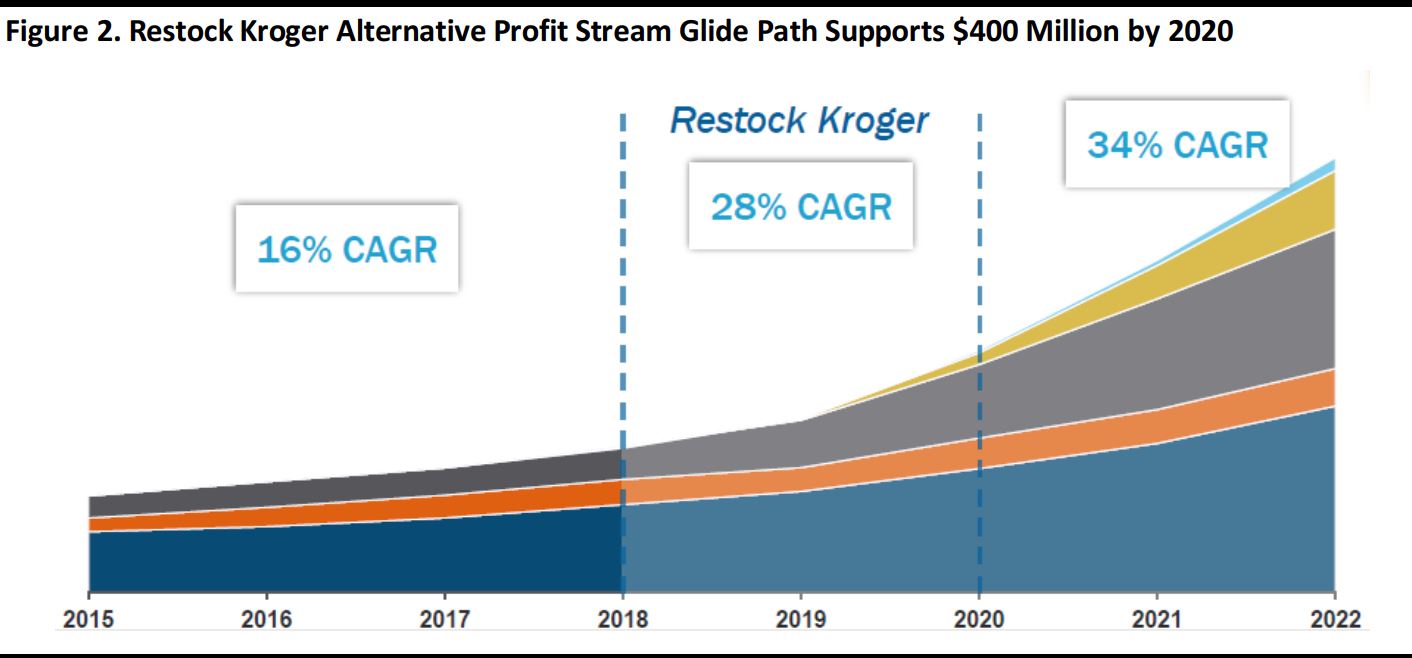

Near the end of the day, Stuart Aitken, Group VP, showed projections for Kroger’s operating profit CAGR, with Restock Kroger significantly improving the rate from 16% between 2015 and 2018 to 28% between 2018 and 2020. Alternative profit streams are expected to support this growth rate, providing the glide path to $400 million in incremental operating profit by 2020.

Source: Kroger

Source: Kroger

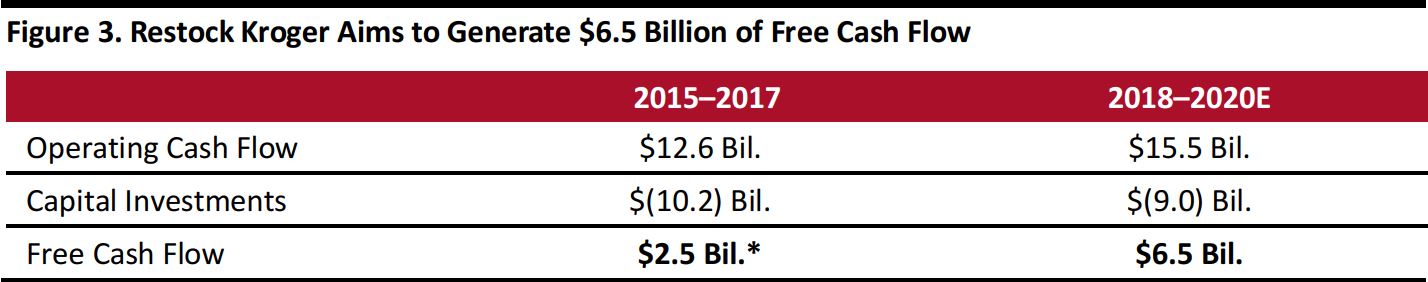

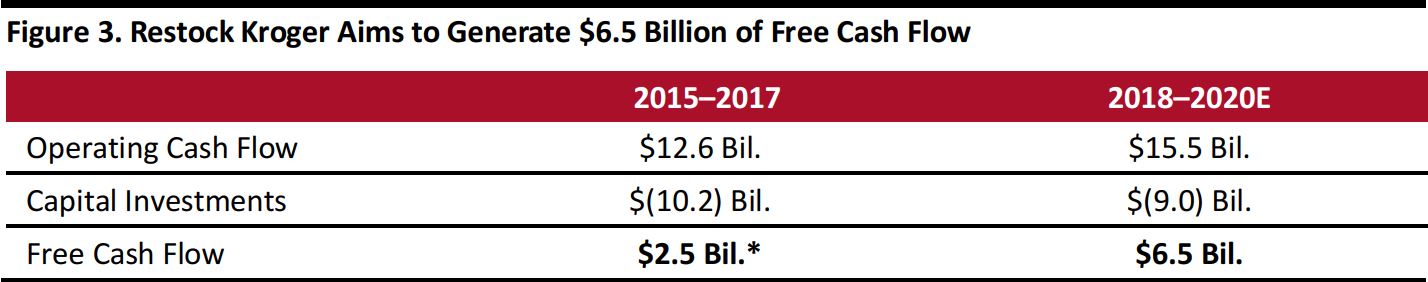

From 2015 to 2017, Kroger generated $2.5 billion of free cash flow. The company is committed to increasing operating cash flow and decreasing capital investments in order to generate $6.5 billion of free cash flow between 2018 and 2020.

*Does not sum due to rounding.Figure excludes M&A.

Source:Kroger

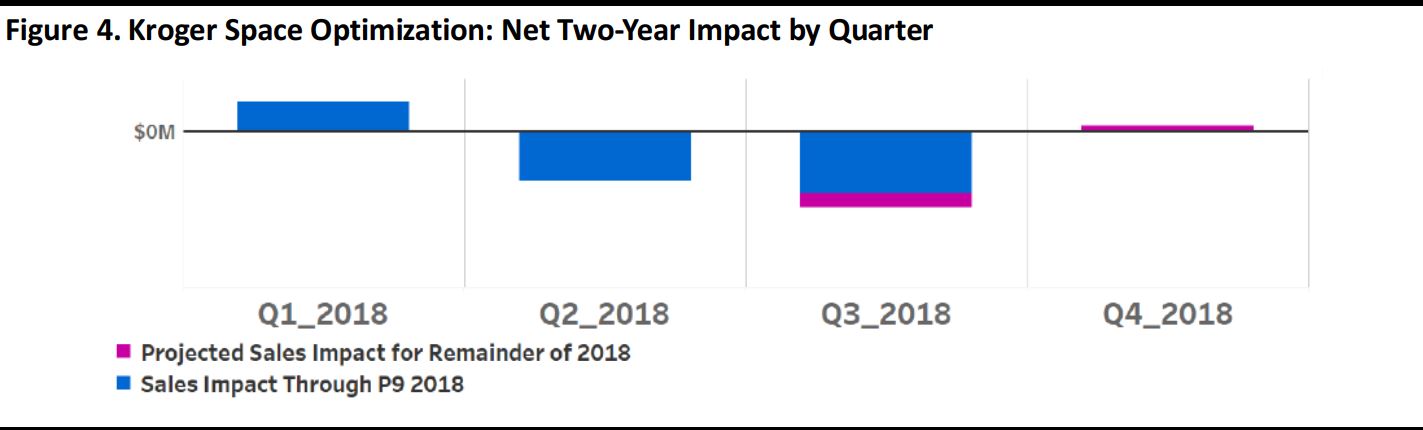

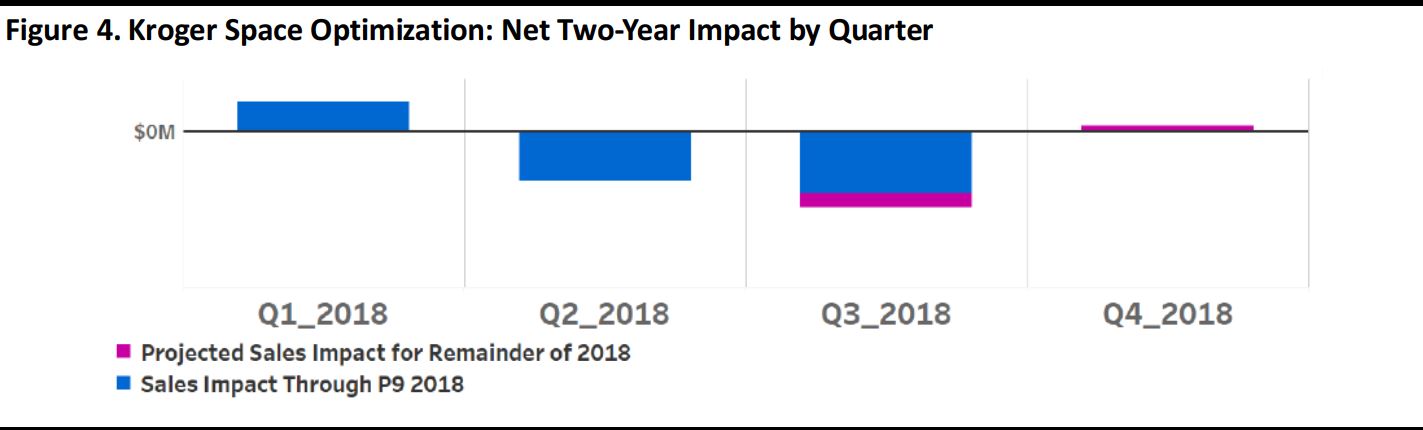

Kroger has made significant progress on its space optimization plan. The company has optimized 80% of the stores it planned to, and it aims to have 1,000 stores optimized by the end of the year. This store disruption has negatively impacted sales, and it created a headwind in both the second and third quarters. However, Kroger expects its space optimization efforts to positively impact sales in the fourth quarter.

Source: Kroger

Source: Kroger

To Achieve Further Growth, Kroger Is Focusing on Alternative Profit Streams

McMullen emphasized that focusing on Kroger’s grocery business for growth is like “looking in the rearview mirror” while driving forward. He said that the company cannot rely on growth models from the past anymore and must look to alternative profit streams for the future.

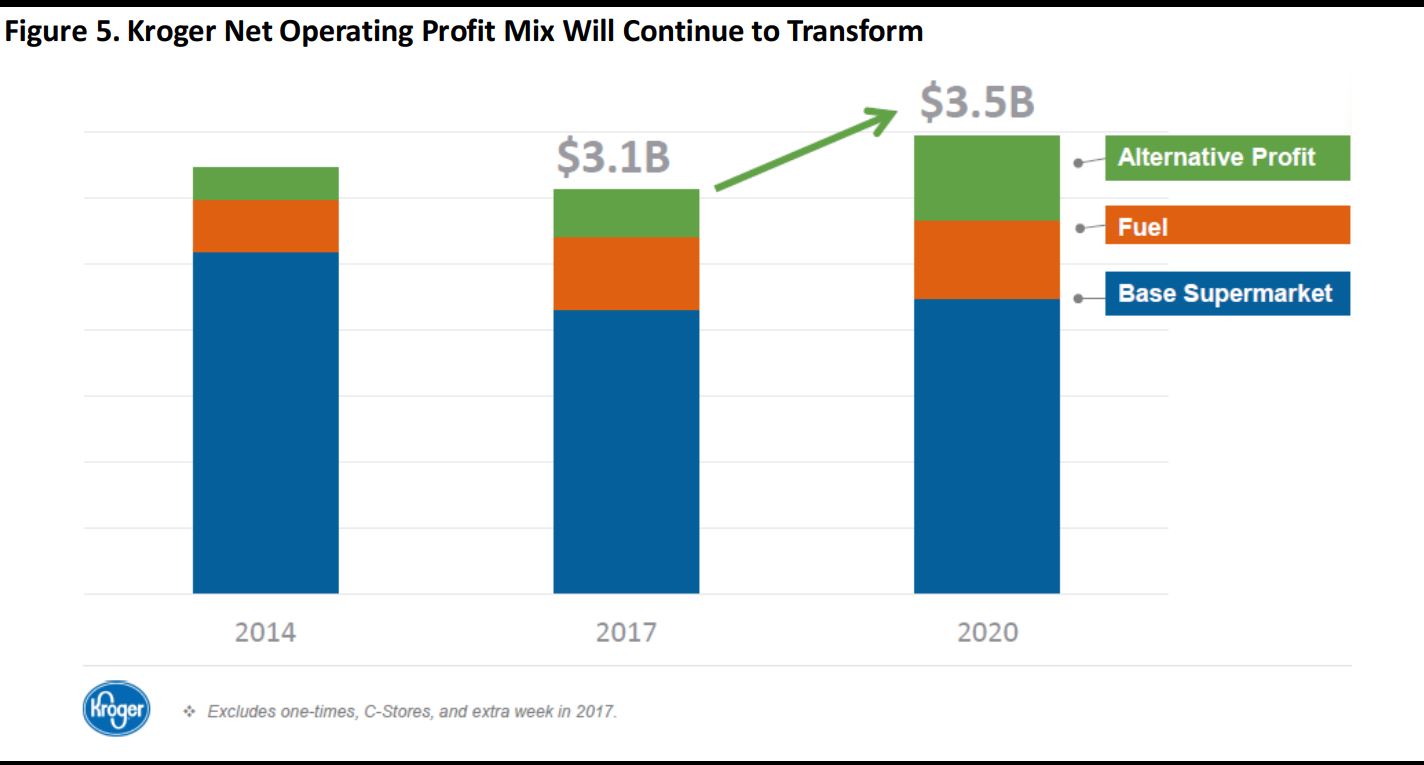

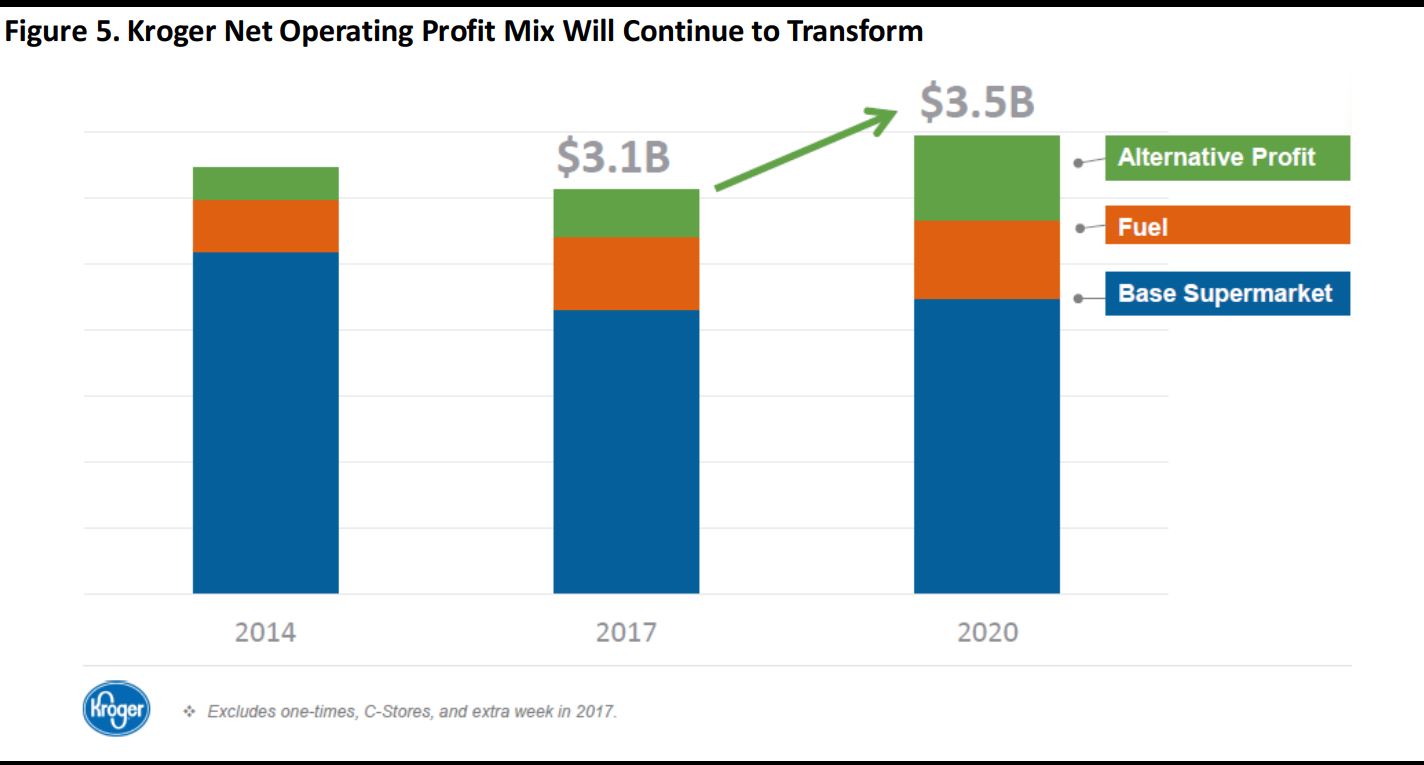

Kroger believes its net operating profit will grow from $3.1 billion in 2017 to $3.5 billion by 2020. The company expects its base supermarket business to stay roughly the same size and its fuel business to grow slightly, but it expects alternative profit streams to make up the majority of the growth, reflecting its belief that it must focus on new areas of development.

Source: Kroger

Source: Kroger

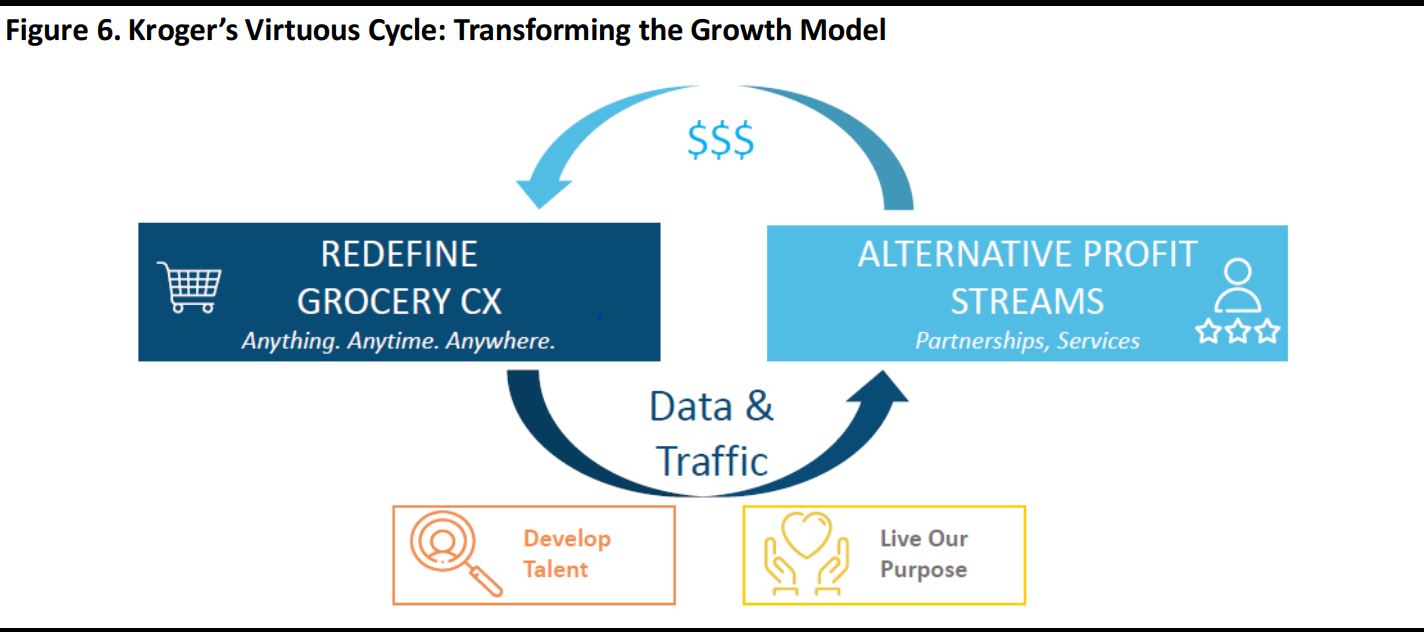

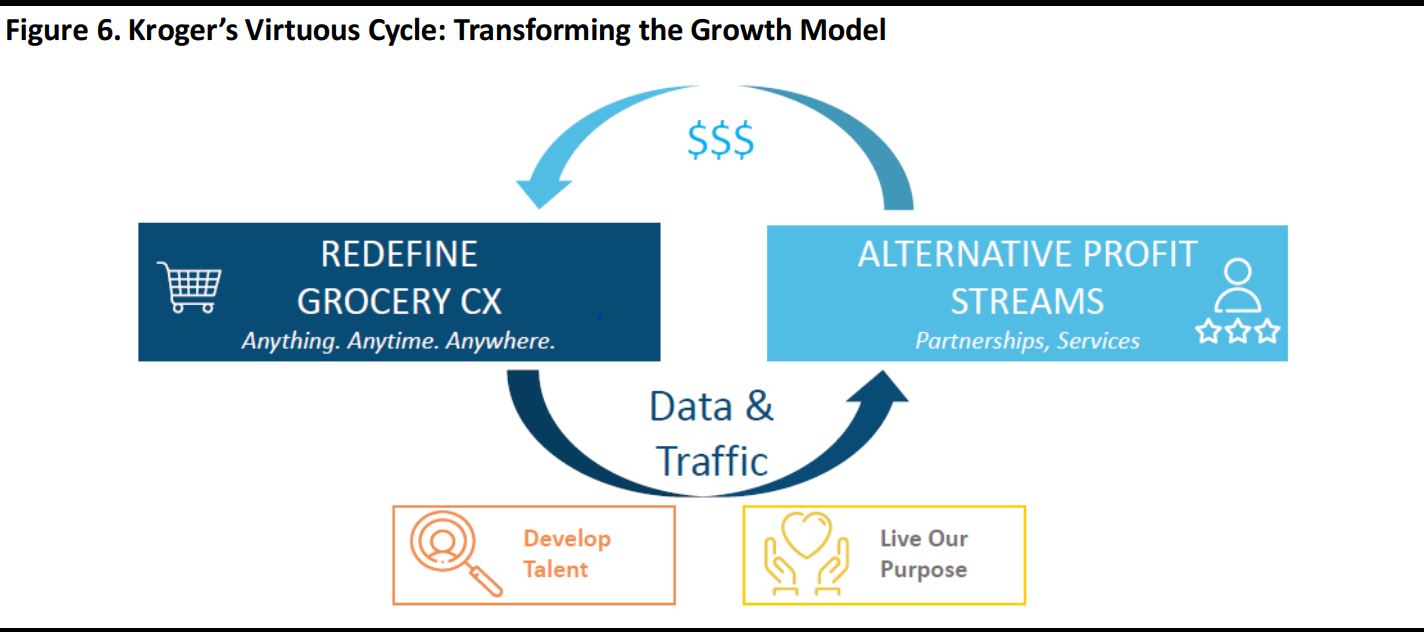

Kroger expects its investments in technology, its strengthening ecosystem and its deep customer loyalty to support growth. However, even though new developments were at the center of the presentations at the conference, the Kroger team maintained that the company’s core businesses must remain strong to support these alternative profit streams. The company believes that its plan to redefine the grocery customer experience and its plan to pursue alternative profit streams form a virtuous cycle. Its core grocery business and unique assets allow it to strengthen customer loyalty and develop alternative profit streams, while those alternative streams will grow profit that can bolster the core grocery business and customer experiences.

Source: Kroger

Source: Kroger

The Kroger team also sees the company’s unique assets as vital components that give Kroger a competitive advantage in the market. Kroger’s 2,800 stores, 42 distribution centers and 38 plants give it an edge with regard to immediacy and proximity. The company says that, with $125 billion in annual sales and 11 million customers in stores and fuel stations every day, its scale gives it a unique platform to reach and communicate with customers. Kroger also highlighted its access to 60 million households and its customer-first approach, including its subsidiary customer-centric data analytics and marketing firm, 84.51°, which allows the company to create personalized experiences for its shoppers. More holistically, Kroger has found that its customers trust the company as a transparent partner, and the company feels confident that it can leverage its data to communicate relevant offers and rewards in new channels.

Kroger Is Redefining Customer Experiences to Meet Customer Expectations

Mike Donnelly, EVP and COO, noted that customer trends are changing; he specifically highlighted an increase in the number of customer households, customers trading up on products, increasing digital engagement and growth in natural foods categories. He cited a year-over-year increase in households, and noted that the “very price sensitive” customer segment is growing the fastest. Donnelly stated that, in the second quarter, spend per item increased by 1.7%, while active price decreased by 0.5% and product mix increased by 2.1%, showing that customers are spending more per item and trading up. He pointed to a 40%–50% increase in digital visits and 82% growth in the number of households shopping online. Finally, he talked about how natural food sales have grown by double-digit percentages for five consecutive years, driven significantly by Simple Truth, Kroger’s private-label brand. According to the company, 50% of all households buy natural foods.

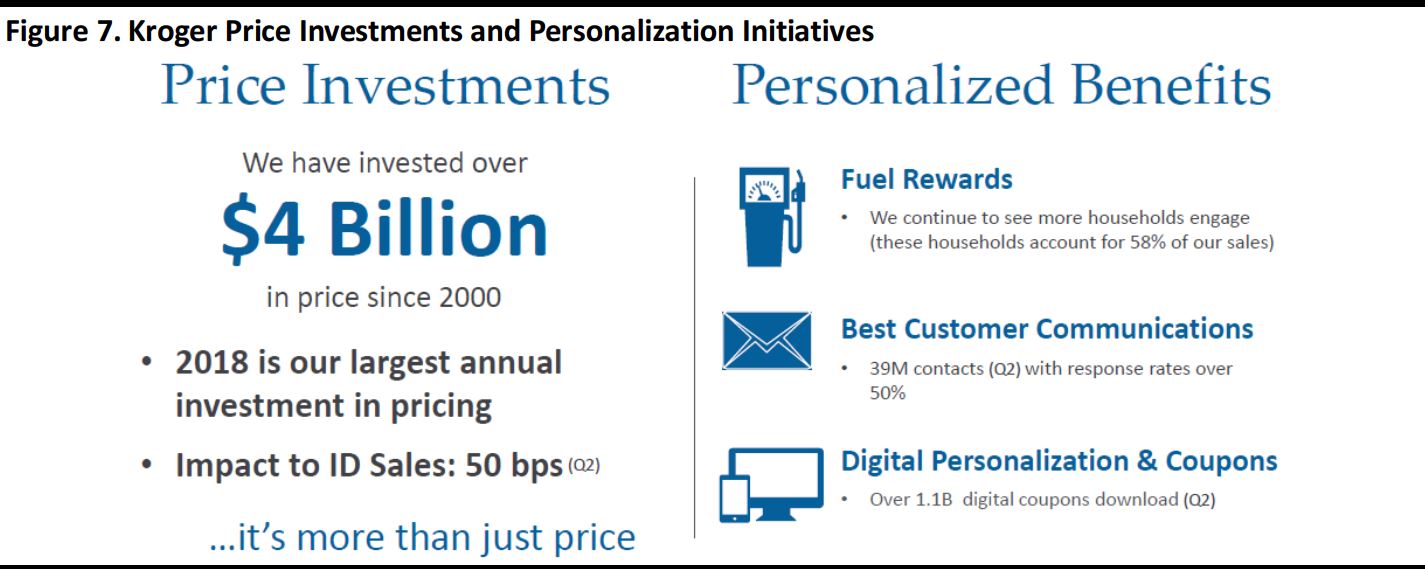

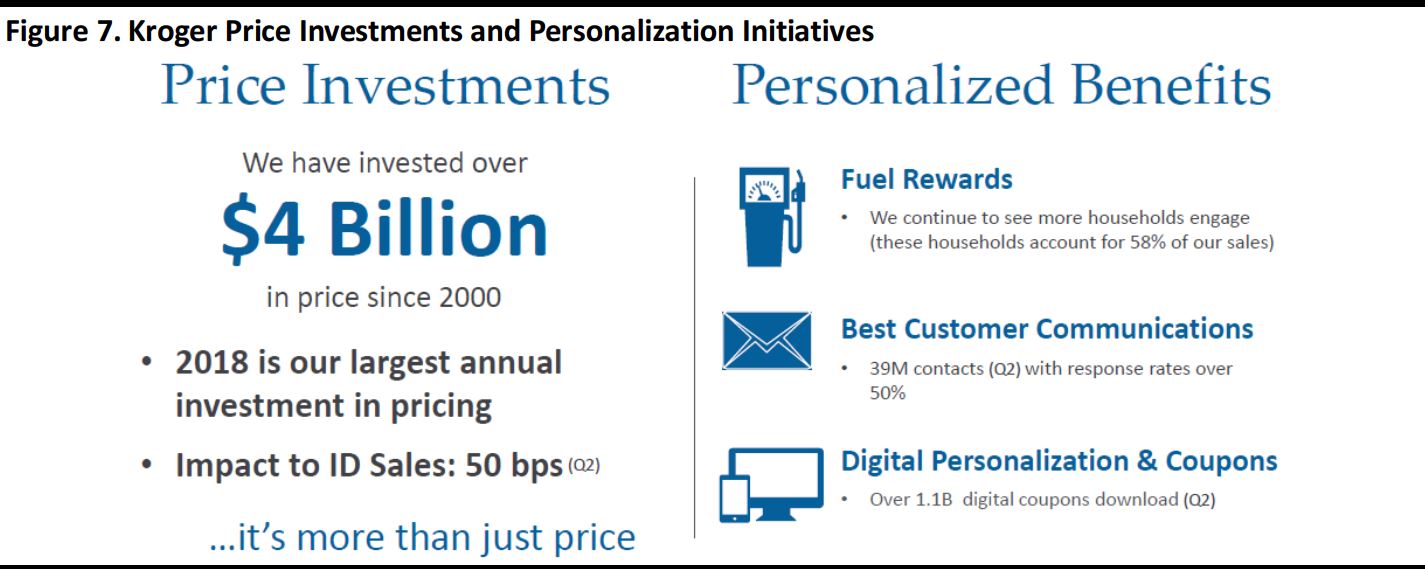

Kroger maintains that it has been making strides in terms of personalizing the shopping experience for customers. Donnelly said that the company has made $4 billion in price investments since 2000, with 2018 marking the largest annual investment in price so far. This impacted same-store sales by 50 basis points in the second quarter, according to the company. These benefits are personalized through digital coupons, fuel rewards and other forms of customer communications. Kroger is investing to broaden its customer base and provide unique pricing promotions that will keep customers in its ecosystem. This strategy, in part, responds to the increasing number of Kroger customers who are very sensitive to price.

Source: Kroger

Source: Kroger

Yael Cosset, Group VP and Chief Digital Officer, noted Kroger’s commitment to its customers and highlighted the trust customers put in the company, saying that they are giving the “gift of loyalty.” Cosset said that Kroger’s digital offerings support its three pillars of being available, accessible and relevant to customers. In 2018, the company’s services—including brick-and-mortar, pickup, delivery and shipping—were available to 92% of Kroger customer households. Cosset said that in 2019, the coverage will be 100%. He also said that Kroger aims to be easily accessible across all platforms, including computers, mobile devices and voice devices. Finally, Cosset discussed how the digital experience is moving from personalization to curation. Kroger expects an annual digital sales run rate just over $5 billion by year-end 2018 and of $9 billion by year-end 2019.

Stuart Aitken, Group VP, referenced the success of Kroger’s Plus Card loyalty program. He said that email addresses submitted to the program are valid 47% of the time and that, of those, 94% of the submitters want to receive promotions. Shoppers are volunteering their personal information, and Kroger can leverage these data in its alternative profit streams, including its media growth plan. Aitken said that Kroger’s media plan includes live bidding for companies promoting products online based on keyword searches and electronic displays in stores.

Stores Benefit from New Technologies and Improved Associate Experiences

Mary Ellen Adcock, Group VP, Retail Operations, spoke about Kroger’s continued improvement of the checkout experience through technologies such as the Scan, Bag, Go app and self-checkout stations. These technologies also cut down on labor costs and translate into improvements in shrink within stores. According to Adcock, one basis point of shrink improvement translates into $10 million (pretax) that can be invested.

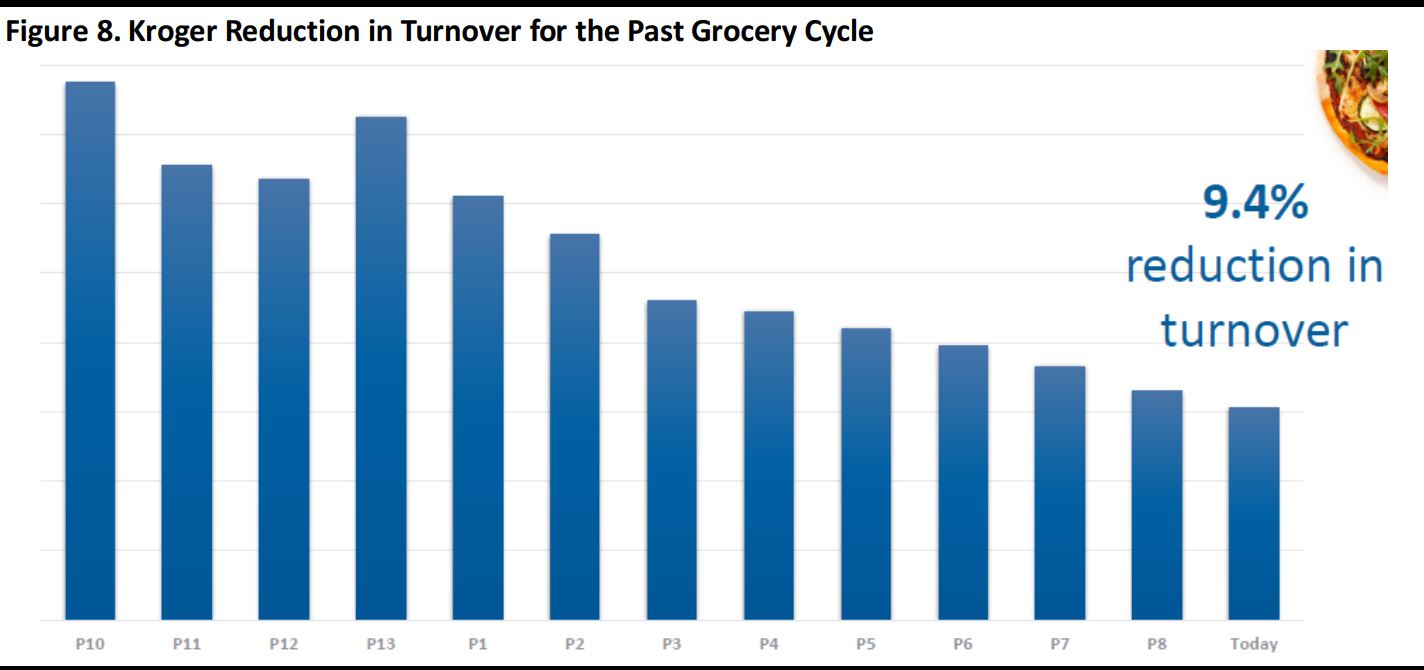

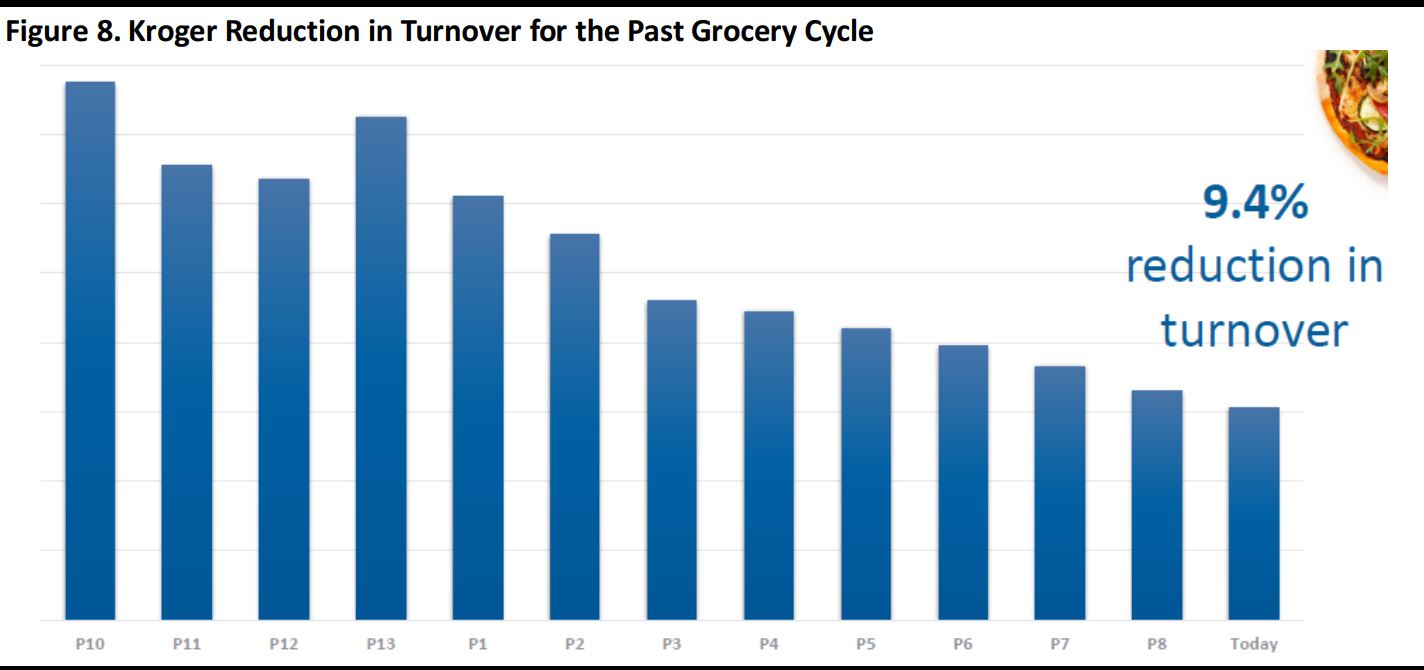

Kroger prides itself on treating its employees well. Tim Massa, Group VP, Human Resources and Labor Relations, discussed how Kroger’s investment in its associates has led to a 9.4% reduction in employee turnover year-over-year. Lower turnover results in improved customer experiences and lower costs. The graph below shows the decrease in employee turnover for the past grocery cycle.

Source: Kroger

Source: Kroger

Massa highlighted Kroger’s Feed Your Future program, which provides tuition reimbursement and scholarships for associates at all levels. He also mentioned the Kroger Leadership Academy. Kroger has accelerated its plan to invest $500 million in wages to retain talent, and the company expects to implement 56% of this target in 2018, 33% in 2019 and 11% in 2020. It also hopes to leverage associate insights to improve business results. The company is actively upskilling its workforce by training leaders to teach, making employees digitally enabled, and providing certifications and performance-based incentives. Kroger is also making its workforce more flexible by providing on-demand scheduling, simplifying job classifications and creating more third-party relationships.

Kroger’s Brands Are Thriving and the Company Is Growing Strategic Partnerships

Kroger is seeing success with its private-label brands. It has strong national brand partners and indirect sourcing that allow it to keep product costs low while keeping quality high. The company has seen strong sales growth due in large part to its fastest-growing brand, Simple Truth; increases in customer purchases; and new item innovation, which represents more than $500 million in additional sales for the last four quarters. These trends led to an increase of 74 basis points in dollar share in the second quarter. Kroger’s own brand portfolio is six times larger than the leading brand portfolio, and its private-label items generate more revenue in its stores than any other brand’s items.

Source: Kroger

Source: Kroger

In stores, Kroger offers a variety of types of foods beyond regular grocery items. It has stations for fresh food, including pizza and deli food; flash-frozen food that can be purchased for a flat rate and instantly reheated at home; and, in some locations, stores within stores, such as Starbucks. At the location our team visited in the Cincinnati area, there was a station to try items from Eli’s BBQ, a local barbeque restaurant.

Kroger has also made public a number of strategic partnerships designed to help it build its ecosystem and support its “Anything. Anytime. Anywhere.” proposition. Its partnerships with Walgreens and Ocado help Kroger grow its Pickup in-store business, while the Ocado agreement also helps Kroger better serve customers who want specific items shipped to their homes, whether those are unique spices or basic home necessities. To enhance its delivery services, Kroger has partnered with Instacart, Nuro, Walgreens and Home Chef, which help the grocer provide customers with fast delivery of items ranging from ready-to-make meals to medicines.

Source: Kroger

Source: Kroger

Kroger Continues to Support Charitable Efforts

At the heart of Kroger’s national philosophy is its commitment to charitable efforts. Jessica Adelman, Group VP, Corporate Affairs, described Kroger’s continuing Zero Hunger, Zero Waste effort and said that the company believes that its commitment to charitable acts and bettering the world differentiate it from many competitors, allowing it to build stronger loyalty with customers and investors alike while doing good in the world.

Source: Kroger

Source: Kroger

Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger

Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger Source: Kroger

Source: Kroger