Nitheesh NH

EXECUTIVE SUMMARY

Korean beauty brands have seen strong growth in sales volume, as well as a growing influence in the global beauty market in recent years. This has led to market-share gains in the global beauty and personal care market. Innovation is one of the strengths possessed by Korean beauty brands, and this is endorsed by its consumers. A study by Nielsen in 2015 showed that 6 out of 10 Korean beauty brand shoppers from Greater China and Singapore consider Korean products innovative. This perception is the strongest among mainland Chinese shoppers – 68% of them believe Korean beauty products are innovative. The innovative image that Korean beauty brands have is not purely a perception. We can find innovation in all facets, from the product, process and technology innovations, to the packaging.- Innovation in product development is driven in part by the heavy investment in R&D, and also by the expectations of the sophisticated customers in the local Korean market. This creates an ideal platform for beauty brands to create and test their innovations, including formulas, ingredients, manufacturing processes and packaging.

- The shorter product development cycle compared with the international players helps Korean beauty brands respond more quickly to evolving consumer demands, and remain relevant with customers.

- Korean beauty brands have been leveraging the growing influence of digital media to engage with customers while capturing the opportunities brought forward from the Korean wave.

- Korean beauty brands were also fast to adopt in-store technologies, some of which are on par with other technology developed by international beauty brands, but others are ahead of the international market.

- A number of Korean beauty startups have emerged that have brought Korean beauty products overseas with e-commerce, or created innovative beauty products with the latest technologies.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

THE SUCCESS OF KOREAN BEAUTY BRANDS

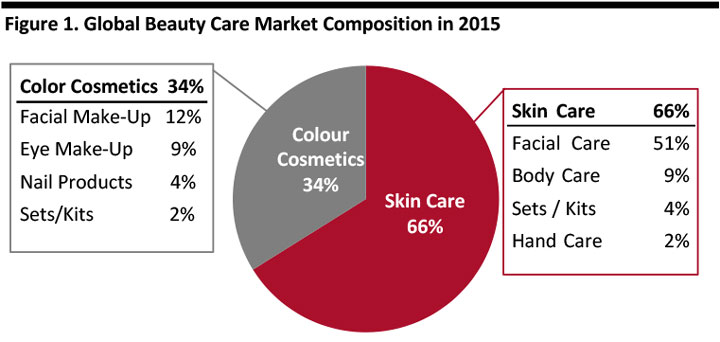

The global beauty care market was valued at US$167 billion in 2015. Skin care products comprised 66% of the total sales, while color cosmetics accounted for the remaining 34%. The total market size is expected to grow to US$198 billion by 2020, according to Euromonitor International. [caption id="attachment_86400" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

The Korean beauty industry has been growing rapidly, exports of Korean cosmetics have been increasing by an average of 36.9% every year since 2011, and reaching US$2.45 billion in 2015, according to the Korean Customs Service. Last year, South Korea overtook the US and Japan to become the second-largest cosmetics exporter to China after France, with a total export value of US$1.1 billion, according to the Ministry of Food and Drug Safety of Korea.

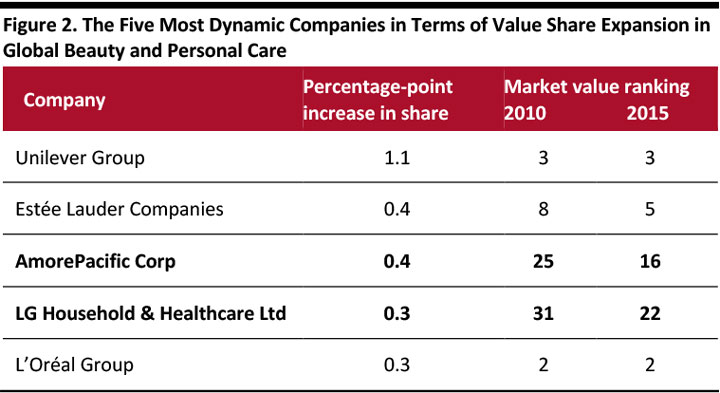

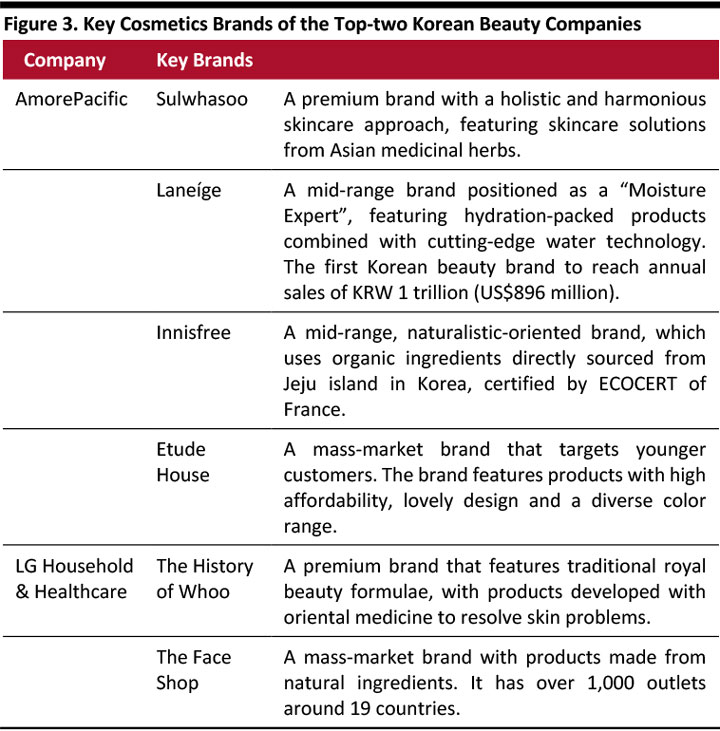

According to Euromonitor International, both AmorePacific Corp and LG Household and Health Care Ltd are ranked amongst the five most dynamic companies in terms of value share expansion in global beauty and personal care, purely through organic growth.

[caption id="attachment_86401" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

The Korean beauty industry has been growing rapidly, exports of Korean cosmetics have been increasing by an average of 36.9% every year since 2011, and reaching US$2.45 billion in 2015, according to the Korean Customs Service. Last year, South Korea overtook the US and Japan to become the second-largest cosmetics exporter to China after France, with a total export value of US$1.1 billion, according to the Ministry of Food and Drug Safety of Korea.

According to Euromonitor International, both AmorePacific Corp and LG Household and Health Care Ltd are ranked amongst the five most dynamic companies in terms of value share expansion in global beauty and personal care, purely through organic growth.

[caption id="attachment_86401" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

[caption id="attachment_86402" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

[caption id="attachment_86402" align="aligncenter" width="720"] Source: AmorePacific/LG Household & Healthcare/Essential Beauty[/caption]

Source: AmorePacific/LG Household & Healthcare/Essential Beauty[/caption]

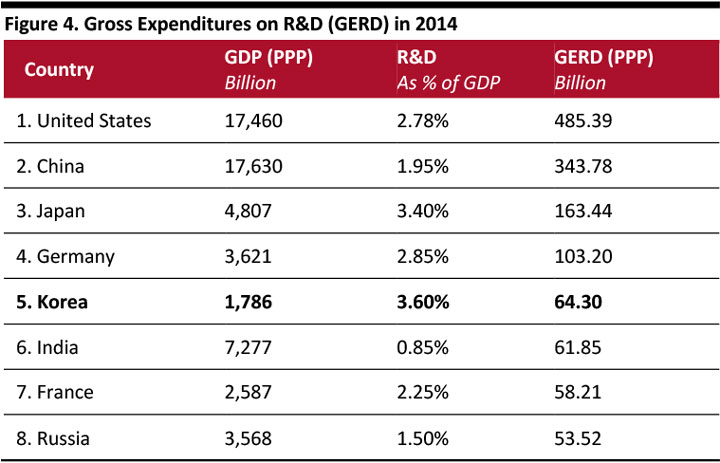

INNOVATION IN PRODUCT DEVELOPMENT

Korean beauty products are renowned for being at the forefront of innovation. Mary Schook, an acclaimed New York-based licensed aesthetician, makeup artist and owner of MS Apothecary, estimates Korean beauty products are 12-14 years ahead of those of the US. This is in part driven by the heavy investment in R&D, and also by the expectations of the sophisticated customers in the local Korean market. Heavy Investment in R&D Korea is the fifth-largest country investing in R&D in the industry, with US$64.3 billion spent in 2014, according to the Industrial Research Institute. The country has recently rolled out a strategic plan to become a global powerhouse in the bio-health industry, and cosmetics is one of the areas in which more R&D investment will be made. Under the plan, the Korean Ministry of Health and Welfare will support expanding R&D investment in anti-ageing products and other cosmetics products. By 2020, the Korean government expects the top-two Korean beauty companies to enter the top 10 companies in the beauty industry in terms of revenue. [caption id="attachment_86403" align="aligncenter" width="720"] Source: Industrial Research Institute[/caption]

The efforts at innovation by the Korean beauty companies are recognized in Forbes list of the world’s most innovative companies. In 2016, AmorePacific and LG Household & Healthcare Ltd found themselves on the list, ranked 21 and 19, respectively. Other companies on the list include Tesla Motors, Under Armour and Amazon. Unilever Indonesia is the only beauty and personal care product company that ranks higher than the two Korean beauty companies.

Adapting the Fast-Fashion Product Development Cycle

Korean beauty brands have a shorter product development cycle than traditional beauty brands, similar to the “Fast Fashion” approach. According to Lim Dae-gyu, a director at Cosmax Inc, a Korean cosmetics company, Korean mass-market brands take just 4-6 months from planning to launch, whereas global brands take over a year to go through the whole process.

This shorter development cycle helps Korean beauty brands respond more quickly to evolving consumer demands, and remain relevant with customers.

Innovation in Products, Formulas and Ingredients

Korean women are dedicated to looking good, and this leads to a higher demand and standard for skin care. According to a BBC report in 2015, Korean women spend twice as much of their income on beauty products and make-up as their American counterparts. Korean beauty consumers are also curious to discover the latest and newest products in the market, and are willing to diversify their skincare portfolio, says Esther Dong, Senior Vice President at AmorePacific. This sophisticated consumer base creates an ideal platform for beauty brands to create and test their innovations.

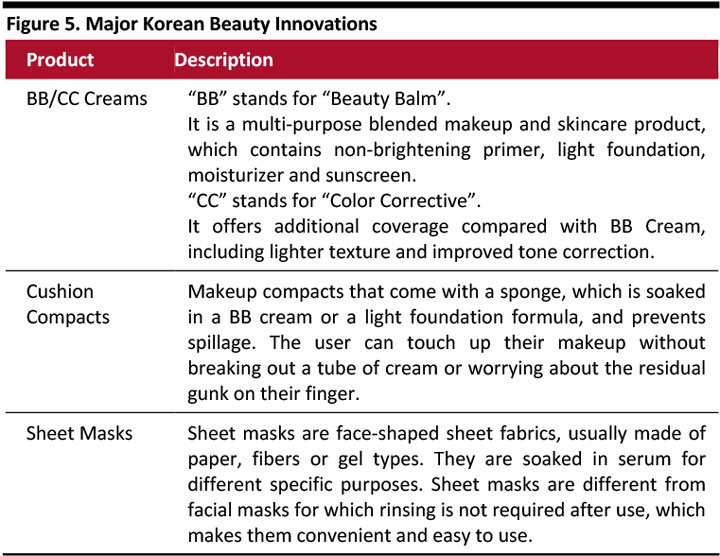

The growing popularity of Korean beauty product started with the BB Cream, which had already been sold in Korea for over 20 years. It first became available in the US in 2011, and major cosmetics brands such as Chanel, Estée Lauder, L'Oréal and Shiseido have also launched their own BB Cream products.

[caption id="attachment_86404" align="aligncenter" width="720"]

Source: Industrial Research Institute[/caption]

The efforts at innovation by the Korean beauty companies are recognized in Forbes list of the world’s most innovative companies. In 2016, AmorePacific and LG Household & Healthcare Ltd found themselves on the list, ranked 21 and 19, respectively. Other companies on the list include Tesla Motors, Under Armour and Amazon. Unilever Indonesia is the only beauty and personal care product company that ranks higher than the two Korean beauty companies.

Adapting the Fast-Fashion Product Development Cycle

Korean beauty brands have a shorter product development cycle than traditional beauty brands, similar to the “Fast Fashion” approach. According to Lim Dae-gyu, a director at Cosmax Inc, a Korean cosmetics company, Korean mass-market brands take just 4-6 months from planning to launch, whereas global brands take over a year to go through the whole process.

This shorter development cycle helps Korean beauty brands respond more quickly to evolving consumer demands, and remain relevant with customers.

Innovation in Products, Formulas and Ingredients

Korean women are dedicated to looking good, and this leads to a higher demand and standard for skin care. According to a BBC report in 2015, Korean women spend twice as much of their income on beauty products and make-up as their American counterparts. Korean beauty consumers are also curious to discover the latest and newest products in the market, and are willing to diversify their skincare portfolio, says Esther Dong, Senior Vice President at AmorePacific. This sophisticated consumer base creates an ideal platform for beauty brands to create and test their innovations.

The growing popularity of Korean beauty product started with the BB Cream, which had already been sold in Korea for over 20 years. It first became available in the US in 2011, and major cosmetics brands such as Chanel, Estée Lauder, L'Oréal and Shiseido have also launched their own BB Cream products.

[caption id="attachment_86404" align="aligncenter" width="720"] Source: Luxury Daily/Korea Times/SytleCaster[/caption]

Korean beauty brands have a reputation for using natural, herbal and sometimes unusual ingredients in their products, which is a very different approach compared with traditional beauty brands.

Sulwhasoo, AmorePacific’s premium skincare brand, specializes in using Asian herbs in its skincare solutions. One of the key ingredients, Ginseng, is the main functional ingredient in its anti-aging and whitening products.

[caption id="attachment_86405" align="aligncenter" width="720"]

Source: Luxury Daily/Korea Times/SytleCaster[/caption]

Korean beauty brands have a reputation for using natural, herbal and sometimes unusual ingredients in their products, which is a very different approach compared with traditional beauty brands.

Sulwhasoo, AmorePacific’s premium skincare brand, specializes in using Asian herbs in its skincare solutions. One of the key ingredients, Ginseng, is the main functional ingredient in its anti-aging and whitening products.

[caption id="attachment_86405" align="aligncenter" width="720"] Source: Shutterstock[/caption]

Korean beauty brands have explored every possibility in terms of ingredients, well beyond one’s imagination. One of the most prominent examples is snail slime, which helps to tighten and smooth the skin. The ingredient is found in a number of products ranging from sheet masks to creams. Other unusual ingredients include bee venom, camel milk and starfish extract.

Innovation in Processing Technology

Korean beauty brands have innovated in ways to process ingredients, one of which is fermentation, which is a metabolic process that converts sugar to acids and enzymes by using yeast or bacteria, similar to the process to produce the traditional Korean food Kimchi.

By applying this technique in skincare products, fermentation helps break down the active ingredients so that the nutrients and antioxidants are more readily absorbed by the skin. It helps to boost the effectiveness of ingredients, especially in the areas of hydrating skin, refining pores, brightening skin and anti-aging.

Whamisa is an organic skincare brand launched by ENS Beauty Group in 2010, it features naturally fermented ingredients including flowers, fruits and seeds, and offers a full range of products, including skincare, make-up care, body care, hair care and baby care. The brand is one of the first cosmetic brands to use fermentation in skincare, and has successfully differentiated itself from the highly competitive beauty market in Korea.

[caption id="attachment_86406" align="aligncenter" width="720"]

Source: Shutterstock[/caption]

Korean beauty brands have explored every possibility in terms of ingredients, well beyond one’s imagination. One of the most prominent examples is snail slime, which helps to tighten and smooth the skin. The ingredient is found in a number of products ranging from sheet masks to creams. Other unusual ingredients include bee venom, camel milk and starfish extract.

Innovation in Processing Technology

Korean beauty brands have innovated in ways to process ingredients, one of which is fermentation, which is a metabolic process that converts sugar to acids and enzymes by using yeast or bacteria, similar to the process to produce the traditional Korean food Kimchi.

By applying this technique in skincare products, fermentation helps break down the active ingredients so that the nutrients and antioxidants are more readily absorbed by the skin. It helps to boost the effectiveness of ingredients, especially in the areas of hydrating skin, refining pores, brightening skin and anti-aging.

Whamisa is an organic skincare brand launched by ENS Beauty Group in 2010, it features naturally fermented ingredients including flowers, fruits and seeds, and offers a full range of products, including skincare, make-up care, body care, hair care and baby care. The brand is one of the first cosmetic brands to use fermentation in skincare, and has successfully differentiated itself from the highly competitive beauty market in Korea.

[caption id="attachment_86406" align="aligncenter" width="720"] Source: Whamisa[/caption]

Beauty giant AmorePacific is also an early adopter of the fermentation process in its skincare products. The company first released “Hyosiah” in 2010, which comprises fermented soybeans that contain a rare isoflavone marketed as CureBEAN; this antioxidating ingredient helps to remove toxins and normalize skin regeneration effectively.

Innovation in Packaging

Korean beauty brands are also innovative when it comes to product packaging. In an interview with Beauty Packaging Magazine in 2016, Michelle Joo, vice president of Elcos America, a skincare packaging company, pointed out three Korean trends in beauty product packaging, namely “Ki-dult” cosmetics, customizable product packaging and packaging that emphasizes formulation contents.

“Ki-dult” cosmetics carry the images of cute and well-known characters, however, the target market is not children, but rather adults. For instance, The Face Shop has launched products with characters from messaging app LINE, as well as cushion compact products featuring Disney characters. The initial 130,000 Disney products were sold out in just two days, and the company expects to launch about 600 new products in a similar fashion this year.

Customizable product packaging responds to the needs of specific needs of consumers. For instance, it is difficult to get a BB cream that matches the exact skin tone of the user. Lalavesi’s LeoPop has created a refillable “Dual Pact”, and with the push of a button, BB and CC creams, revealed beneath the palette, can be easily mixed to match any skin tone.

On the other hand, Korean beauty brands are creating product packaging that better grab customers’ attention, as well as emphasizes formulation contents. Some highlights are the peach hand cream by TonyMoly, where the packaging in the shape of a peach; a similar approach is used by Nature Republic for its Aloe Vera’s hand cream.

[caption id="attachment_86407" align="aligncenter" width="720"]

Source: Whamisa[/caption]

Beauty giant AmorePacific is also an early adopter of the fermentation process in its skincare products. The company first released “Hyosiah” in 2010, which comprises fermented soybeans that contain a rare isoflavone marketed as CureBEAN; this antioxidating ingredient helps to remove toxins and normalize skin regeneration effectively.

Innovation in Packaging

Korean beauty brands are also innovative when it comes to product packaging. In an interview with Beauty Packaging Magazine in 2016, Michelle Joo, vice president of Elcos America, a skincare packaging company, pointed out three Korean trends in beauty product packaging, namely “Ki-dult” cosmetics, customizable product packaging and packaging that emphasizes formulation contents.

“Ki-dult” cosmetics carry the images of cute and well-known characters, however, the target market is not children, but rather adults. For instance, The Face Shop has launched products with characters from messaging app LINE, as well as cushion compact products featuring Disney characters. The initial 130,000 Disney products were sold out in just two days, and the company expects to launch about 600 new products in a similar fashion this year.

Customizable product packaging responds to the needs of specific needs of consumers. For instance, it is difficult to get a BB cream that matches the exact skin tone of the user. Lalavesi’s LeoPop has created a refillable “Dual Pact”, and with the push of a button, BB and CC creams, revealed beneath the palette, can be easily mixed to match any skin tone.

On the other hand, Korean beauty brands are creating product packaging that better grab customers’ attention, as well as emphasizes formulation contents. Some highlights are the peach hand cream by TonyMoly, where the packaging in the shape of a peach; a similar approach is used by Nature Republic for its Aloe Vera’s hand cream.

[caption id="attachment_86407" align="aligncenter" width="720"] Source: Lalavesi/TonyMoly[/caption]

Source: Lalavesi/TonyMoly[/caption]

INNOVATION IN MARKETING STRATEGIES

The unparalleled growth of the Korean beauty brands can also be attributed to their innovation in terms of marketing strategies – they are embracing the digital transformation age and riding on the Korean wave. Embracing the Digital Transformation Age Korean beauty brands have been leveraging the growing influence of digital media to engage with customers. In some markets the online channel has surpassed traditional media when consumers look for beauty information. A Nielsen study in 2015 revealed that for mainland Chinese consumers, recommendations from friends, brands’ websites and fashion/beauty websites are the top-3 information channels for skin-care, surpassing traditional channels such as television and magazines. [caption id="attachment_86408" align="aligncenter" width="720"] Source: Laneíge[/caption]

For instance, Laneíge has launched its online platform to educate consumers. The beauty brand debuted the “School of K-Beauty” on its website, which includes video content and a step-by-step guide to provide consumers with the latest trends on k-beauty and techniques on how to use the beauty products. For example, the beauty products and makeup procedures for Song Hye Kyo in the popular TV drama, Descendants of the Sun, was unveiled in the online video.

Riding on the Korean Wave

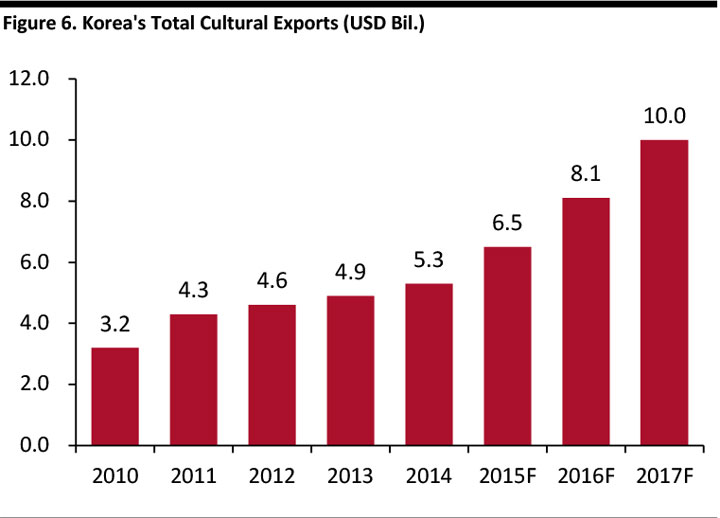

The popularity of Korean culture has been increasing both in Asia and around the world. According to Korea Creative Content Agency, Korea’s total cultural exports reached US$5.3 billion in 2014, growing at a CAGR of 13.4% from 2010, and is expected to reach US$10.0 billion by 2017, at a CAGR of 23.6%.

[caption id="attachment_86409" align="aligncenter" width="720"]

Source: Laneíge[/caption]

For instance, Laneíge has launched its online platform to educate consumers. The beauty brand debuted the “School of K-Beauty” on its website, which includes video content and a step-by-step guide to provide consumers with the latest trends on k-beauty and techniques on how to use the beauty products. For example, the beauty products and makeup procedures for Song Hye Kyo in the popular TV drama, Descendants of the Sun, was unveiled in the online video.

Riding on the Korean Wave

The popularity of Korean culture has been increasing both in Asia and around the world. According to Korea Creative Content Agency, Korea’s total cultural exports reached US$5.3 billion in 2014, growing at a CAGR of 13.4% from 2010, and is expected to reach US$10.0 billion by 2017, at a CAGR of 23.6%.

[caption id="attachment_86409" align="aligncenter" width="720"] Source: Korea Creative Content Agency[/caption]

The term, Korean wave or, Hallyu was coined to depict the cultural influence of Korean dramas, movies, songs and even fashion, food and beauty in Asian countries, especially China, and this has spread to other parts of the world in recent years. A recent Korean TV drama titled, Descendants of the Sun, has been viewed more than 2 billion times on China’s online streaming site iQiyi. This growing cultural influence is evident in the subtlety of a food combination of fried chicken and beer, known as chimek, which became popular in China and Southeast Asia after the preeminent Korean drama My Love from the Star. Consumers appeal to the lifestyle depicted in the drama, which they believe is accessible by purchasing the products such as food, clothing and beauty products.

Korean beauty brands have been pioneers in capturing the opportunities brought forward from the Korean wave. A common marketing strategy is to enlist the protagonists of popular Korean dramas or Korean Pop stars as spokespersons for the brands. For example, Laneíge has Song Hye Kyo, the leading actor in Descendants of the Sun, as the brand ambassador. Yoona, who debuted as a member of the popular k-pop group Girls’ Generation, is the brand ambassador for Innisfree.

[caption id="attachment_86411" align="aligncenter" width="720"]

Source: Korea Creative Content Agency[/caption]

The term, Korean wave or, Hallyu was coined to depict the cultural influence of Korean dramas, movies, songs and even fashion, food and beauty in Asian countries, especially China, and this has spread to other parts of the world in recent years. A recent Korean TV drama titled, Descendants of the Sun, has been viewed more than 2 billion times on China’s online streaming site iQiyi. This growing cultural influence is evident in the subtlety of a food combination of fried chicken and beer, known as chimek, which became popular in China and Southeast Asia after the preeminent Korean drama My Love from the Star. Consumers appeal to the lifestyle depicted in the drama, which they believe is accessible by purchasing the products such as food, clothing and beauty products.

Korean beauty brands have been pioneers in capturing the opportunities brought forward from the Korean wave. A common marketing strategy is to enlist the protagonists of popular Korean dramas or Korean Pop stars as spokespersons for the brands. For example, Laneíge has Song Hye Kyo, the leading actor in Descendants of the Sun, as the brand ambassador. Yoona, who debuted as a member of the popular k-pop group Girls’ Generation, is the brand ambassador for Innisfree.

[caption id="attachment_86411" align="aligncenter" width="720"] Source: AmorePacific/Holika/LG Household & Healthcare/Nature Republic [/caption]

Another marketing tactic is to embed a product in the drama and integrate the advertisement into TV commercials. For example, Song Hye Kyo has modeled for an advertisement for the Laneíge lipstick, Two Tone Lip Bar. The same product has been used in a scene in Descendants of the Sun wbefore she meets the leading male character. Sales of the lipstick soared 400% thanks to this successful marketing tactic.

[caption id="attachment_86412" align="aligncenter" width="720"]

Source: AmorePacific/Holika/LG Household & Healthcare/Nature Republic [/caption]

Another marketing tactic is to embed a product in the drama and integrate the advertisement into TV commercials. For example, Song Hye Kyo has modeled for an advertisement for the Laneíge lipstick, Two Tone Lip Bar. The same product has been used in a scene in Descendants of the Sun wbefore she meets the leading male character. Sales of the lipstick soared 400% thanks to this successful marketing tactic.

[caption id="attachment_86412" align="aligncenter" width="720"] Source: AmorePacific PR Center[/caption]

Korean beauty brands have also leveraged the popularity of beauty-centric shows in Korea and across some parts of Asia, where consumers find tips and product recommendations from them. The most famous one is the weekly show, “Get it Beauty”, which has aired for nine seasons since 2006. It features a “Blind Test” session, where beauty insiders and experts are invited to select the best product in respective categories. Responding to the show’s high influence and popularity, retailers such as Lotte Duty Free and Olive Young have recently set up a “Get it Beauty” campaign, featuring products from the show.

[caption id="attachment_86413" align="aligncenter" width="720"]

Source: AmorePacific PR Center[/caption]

Korean beauty brands have also leveraged the popularity of beauty-centric shows in Korea and across some parts of Asia, where consumers find tips and product recommendations from them. The most famous one is the weekly show, “Get it Beauty”, which has aired for nine seasons since 2006. It features a “Blind Test” session, where beauty insiders and experts are invited to select the best product in respective categories. Responding to the show’s high influence and popularity, retailers such as Lotte Duty Free and Olive Young have recently set up a “Get it Beauty” campaign, featuring products from the show.

[caption id="attachment_86413" align="aligncenter" width="720"] Source: Naver Blog[/caption]

Source: Naver Blog[/caption]

DEPLOYMENT OF IN-STORE TECHNOLOGY

Korean beauty brands are on par with international beauty brands in introducing in-store beauty technology. In some cases, such as with mobile apps, they have lagged the global players in introducing technology elements to the consumer experience; however, with other technologies such as the VDL device introduced by LG’s beauty division, they have shown to be more tech-forward than their western competitors. Beauty Mirror Laneíge released its “Beauty Mirror” app in August 2015, which enables customers to try on makeup and skin-care products using Augmented Reality on their smartphone. Laneíge has also installed large tablets running the “Beauty Mirror” app at its stores. This app is similar to the “Make Up Genius” app launched by L’Oréal one year earlier than Laneíge, which has similar functions. [caption id="attachment_86414" align="aligncenter" width="720"] Laneíge’s “Beauty Mirror” app running on tablet, deployed in one of its stores.

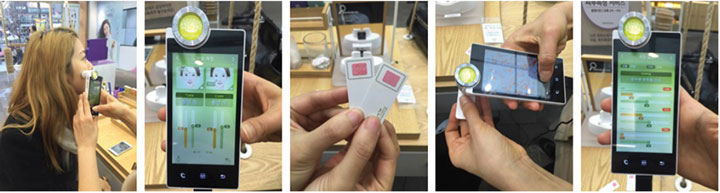

Laneíge’s “Beauty Mirror” app running on tablet, deployed in one of its stores. Source: ModiFace [/caption] We have also identified some digital tools and technology deployed in-store by Korean brands that are ahead of what international beauty brands are currently offering, and which help deliver a more differentiated and personalized service to their customers. “Beauty Talk” station Innisfree, with a relatively young and digital-savvy customer base, has launched a dedicated “Beauty Talk” station, which measures the customer’s skin condition such as moisture level, wrinkle depth and clarity. This information is synced with the Innisfree member’s app, and a beauty advisor can then recommend products based on the results. [caption id="attachment_86415" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Violet Dream Luminous

LG Household & Healthcare’s VDL (Violet Dream Luminous) introduced the VDL + Pantone Color Intel service in its stores. A device is used to analyze the pantone color of the customer’s skin and then recommends products that match the customer’s skin color.

[caption id="attachment_86417" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Violet Dream Luminous

LG Household & Healthcare’s VDL (Violet Dream Luminous) introduced the VDL + Pantone Color Intel service in its stores. A device is used to analyze the pantone color of the customer’s skin and then recommends products that match the customer’s skin color.

[caption id="attachment_86417" align="aligncenter" width="720"] Source: Violet Dream Luminous[/caption]

Source: Violet Dream Luminous[/caption]

KOREAN BEAUTY STARTUPS

Online Beauty Retail Startups A number of Korean online retail startups have emerged in recent years, and they have contributed to the growing influence of the Korean brands by introducing them to overseas markets. Apart from selling products from smaller Korean beauty brands, these online retail startups have dedicated blogs with rich content ranging from product reviews and the latest Korean beauty trends, to tips on using the products. This helps overseas consumers to learn more about the Korean beauty regime. Memebox and Peach & Lily are some of the successful online retail startups. Memebox: The startup first began with an online subscription service in 2012, whereby it sends subscribers a box of selected samples of makeup.The company has quickly developed into an online retailer of beauty products. [caption id="attachment_86419" align="aligncenter" width="720"] Source: Memebox[/caption]

Memebox’s success is largely attributed to the influence of social media, which helps to attract customers with rich online content from skincare guides to product reviews. It now has over 4 million followers globally, and received 70 million video views on its Facebook.

The startup has achieved 280% year-over-year growth, and has recently raised US$66 million to expand its business.

Peach & Lily: This is the first online Korean beauty startup that transformed into a multi-channel retailer, with two brick-and-mortar locations opening in Macy’s New York and Santa Anita stores this year. It has helped the online retail startup to expand its customer base, as 80% of Memebox’s online customers are non-Asian, while it is estimated that up to 90% of the customers at Macy’s New York store are of Chinese descent.

[caption id="attachment_86420" align="aligncenter" width="720"]

Source: Memebox[/caption]

Memebox’s success is largely attributed to the influence of social media, which helps to attract customers with rich online content from skincare guides to product reviews. It now has over 4 million followers globally, and received 70 million video views on its Facebook.

The startup has achieved 280% year-over-year growth, and has recently raised US$66 million to expand its business.

Peach & Lily: This is the first online Korean beauty startup that transformed into a multi-channel retailer, with two brick-and-mortar locations opening in Macy’s New York and Santa Anita stores this year. It has helped the online retail startup to expand its customer base, as 80% of Memebox’s online customers are non-Asian, while it is estimated that up to 90% of the customers at Macy’s New York store are of Chinese descent.

[caption id="attachment_86420" align="aligncenter" width="720"] Source: Peach & Lily[/caption]

Emerging Beauty Brands

New Korean beauty brands, such as Neogen and Cosrx, have emerged in recent years, which have differentiated themselves with innovative technologies and concepts. They have reached overseas customers with the help of online retail startups.

Neogen was founded in 2009, this emerging beauty brand is dubbed as a rising star by Oliver Young, one of the largest beauty retailers in Korea. The company uses advanced natural science and biotechnology to develop its products, one of which is the six-core bio-technology, which helps to maximize the benefits of natural ingredients.

The company has also registered several patents for its technology, covering areas such as natural whitening materials, anti-inflammatory and detoxification natural medicinal herbs, as well as anti-aging research of natural materials by supercritical extraction.

[caption id="attachment_86421" align="aligncenter" width="720"]

Source: Peach & Lily[/caption]

Emerging Beauty Brands

New Korean beauty brands, such as Neogen and Cosrx, have emerged in recent years, which have differentiated themselves with innovative technologies and concepts. They have reached overseas customers with the help of online retail startups.

Neogen was founded in 2009, this emerging beauty brand is dubbed as a rising star by Oliver Young, one of the largest beauty retailers in Korea. The company uses advanced natural science and biotechnology to develop its products, one of which is the six-core bio-technology, which helps to maximize the benefits of natural ingredients.

The company has also registered several patents for its technology, covering areas such as natural whitening materials, anti-inflammatory and detoxification natural medicinal herbs, as well as anti-aging research of natural materials by supercritical extraction.

[caption id="attachment_86421" align="aligncenter" width="720"] Source: Rich & Young Co.,Ltd[/caption]

COSRX was founded in 2014, with the philosophy of making ingredient-oriented and high-performance cosmetics. The company takes a minimalistic approach to skincare by removing all unnecessary ingredients in its products. This helps to lower the chance of an allergic reaction for consumers with sensitive skin, as according to COSRX's Marketing Team Assistant Manager, Lee Hye-Young, it would be hard to tell which ingredient caused the trouble if there were too many ingredients.

The two-year-old company currently sells online only to minimize costs. But according to Lee, plans to open brick-and-mortar stores by the end of the year, due to customer demand.

[caption id="attachment_86422" align="aligncenter" width="720"]

Source: Rich & Young Co.,Ltd[/caption]

COSRX was founded in 2014, with the philosophy of making ingredient-oriented and high-performance cosmetics. The company takes a minimalistic approach to skincare by removing all unnecessary ingredients in its products. This helps to lower the chance of an allergic reaction for consumers with sensitive skin, as according to COSRX's Marketing Team Assistant Manager, Lee Hye-Young, it would be hard to tell which ingredient caused the trouble if there were too many ingredients.

The two-year-old company currently sells online only to minimize costs. But according to Lee, plans to open brick-and-mortar stores by the end of the year, due to customer demand.

[caption id="attachment_86422" align="aligncenter" width="720"] Source: COSRX [/caption]

Beauty Technology Startups

WayWearable is a “beauty-appliance” startup that developed “Way”, a palm-sized IoT device that measures the user’s skin condition and external environment, and offers personalized skincare tips accordingly via smartphone. The more data the device collects about the user’s skin condition and environment, the better it can provide product recommendations.

The startup was founded in 2014, and received crowd-funding totaling US$127,642 for pre-orders on the US site Indiegogo. It has also received US$2.78 million in three rounds of funding from eight investors, including beauty giant AmorePacific.

[caption id="attachment_86423" align="aligncenter" width="720"]

Source: COSRX [/caption]

Beauty Technology Startups

WayWearable is a “beauty-appliance” startup that developed “Way”, a palm-sized IoT device that measures the user’s skin condition and external environment, and offers personalized skincare tips accordingly via smartphone. The more data the device collects about the user’s skin condition and environment, the better it can provide product recommendations.

The startup was founded in 2014, and received crowd-funding totaling US$127,642 for pre-orders on the US site Indiegogo. It has also received US$2.78 million in three rounds of funding from eight investors, including beauty giant AmorePacific.

[caption id="attachment_86423" align="aligncenter" width="720"] Source: WayWearable[/caption]

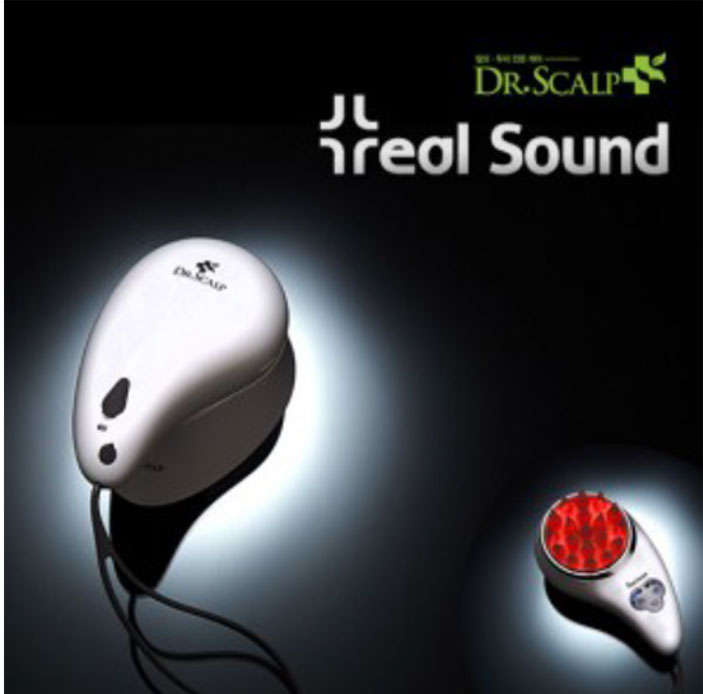

Evosonics has developed “Dr Spa”, a sound rhythmic massager for scalp and hair scaling. According to the startup, the massager has 10 times the cleansing effect of shampooing compared with using bare hands.

The startup was founded in 2013, and also develops acoustic resonance products for healthcare, medical and sports uses. It is currently eyeing the China market and pitched its product at the demo day hosted by Venture Port and Neoply China in Shanghai last year.

[caption id="attachment_86424" align="aligncenter" width="703"]

Source: WayWearable[/caption]

Evosonics has developed “Dr Spa”, a sound rhythmic massager for scalp and hair scaling. According to the startup, the massager has 10 times the cleansing effect of shampooing compared with using bare hands.

The startup was founded in 2013, and also develops acoustic resonance products for healthcare, medical and sports uses. It is currently eyeing the China market and pitched its product at the demo day hosted by Venture Port and Neoply China in Shanghai last year.

[caption id="attachment_86424" align="aligncenter" width="703"] Source: TechNode[/caption]

Source: TechNode[/caption]