albert Chan

Koninklijke Ahold Delhaize N.V.

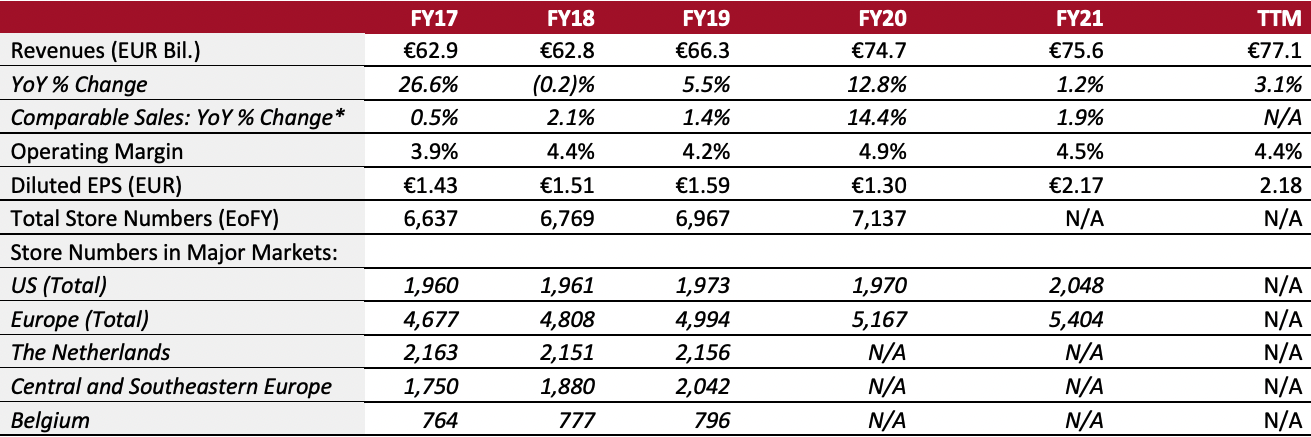

Sector: Food, drug and mass retailers Countries of operation: Belgium, Czech Republic, Greece, Indonesia, Luxembourg, Portugal, Romania, Serbia, the Netherlands, and the US Key product categories: Food and beverage, fuel, general merchandise, health and beauty, and pharmaceuticals Annual Metrics [caption id="attachment_151342" align="aligncenter" width="700"] Fiscal year ends on December 31

Fiscal year ends on December 31*For the US, excluding gasoline

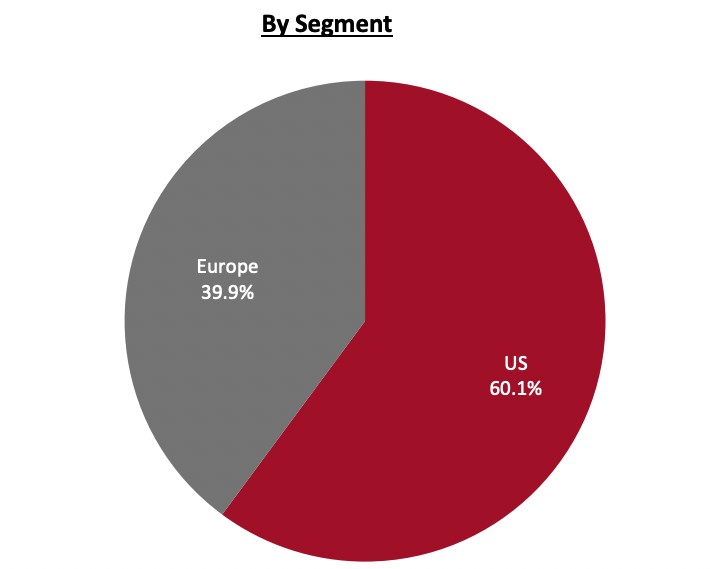

**Trailing 12 months ended April 3, 2022[/caption] Summary Koninklijke Ahold Delhaize NV, known as Ahold Delhaize, is a food and general merchandise retailer based in Zaandam, the Netherlands. It operates stores primarily in the US and Europe. The company was formed in a July 2016 merger between Ahold and Delhaize Group. The company’s banners include Albert Heijn, Alfa-Beta, Bol.com, Delhaize, ENA, Etos, Food Lion, Giant Food, Giant Martin’s, Hannaford, Peapod, Stop & Shop and Tempo. Ahold Delhaize also has two joint ventures: Pingo Doce in Portugal and Super Indo in Indonesia. The company’s store formats include convenience stores, drugstores, hypermarkets, liquor stores, and supermarkets. Its e-commerce businesses include Bol.com in Europe and Peapod and FreshDirect in the US. As of January 2, 2022, the company operates 2,048 stores in the US and 5,404 stores in Europe, including franchises and affiliates. Company Analysis Coresight Research insight: Ahold Delhaize has a strong focus on the US market (mostly along the East Coast) through local banners such as Food Lion, Giant, Hannaford and Stop & Shop. Early investments in the online space (including in Peapod in 2001), its acquisition of FreshDirect in 2020 and the expansion of its e-commerce offerings across its US brands gives the company a strong competitive edge against digitally-enabled brick and mortar grocers (such as Walmart and Kroger) as well as Amazon. The company has a large presence on the East Coast; this leaves it vulnerable to price pressures due to the significant expansion of hard discounters in the region and the subsequent lowering of prices by large national players. Ahold Delhaize does not manufacture its own private-label products, choosing instead to grow through strategic partnerships, which gives the company less direct control over product quality (in contrast to Kroger and Albertsons, which manufacture much of their own brands.)

| Tailwinds | Headwinds |

|

|

- Grow its e-commerce and increase profitability.

- Drive seamless omnichannel engagement.

- Optimize its brick-and-mortar footprint.

- Drive assortment, price and value.

- Improve supply-chain capacity to fulfil pandemic-induced demand.

- Enhance store operations through technologies such as electronic shelf labelling and contactless self-checkouts.

- Strengthen internal operations across all functions.

- Enable customers to make healthier choices.

- Provide greater product transparency.

- Eliminate food and plastic waste.

- Reduce climate impact.

- Create customer-centric operating models and strategic workplans to support the company’s omnichannel and digital ambitions.

- Maximize staff potential by nurturing a mindset of continuous growth and lifelong learning.

- Upskill the workforce for the company’s future needs.

Company Developments

Company Developments

| Date | Development |

| February 7, 2022 | The Giant Company announces the launch of two new home delivery options, Ship2Me by Giant and Ship2Me by Martin’s, giving customers access to an expanded assortment beyond traditional grocery. |

| December 21, 2021 | Ahold Delhaize announces that Bol.com has acquired a majority stake in Dutch last-mile delivery company Cycloon. |

| October 27, 2021 | Albert Heijn launches online grocery subscription service My Albert Heijn Premium in the Netherlands. |

| September 13, 2021 | Ahold Delhaize announces that its Netherlands subsidiary Albert Heijn will acquire supermarket chain DEEN’s 38 stores and convert them to the Albert Heijn banner. |

| May 5, 2021 | Ahold Delhaize announces that David McInerney, co-founder and CEO of FreshDirect will step down, effective immediately. He will be replaced by Ahold Delhaize’s Chief Digital Officer, Farhan Siddiqi, as interim CEO of FreshDirect. |

| February 17, 2021 | Ahold Delhaize’s digital and commercial platform Peapod Digital Labs announces that it will pilot micro-fulfilment technology with the Giant Foods supermarket chain in Philadelphia. |

| November 18, 2020 | Ahold Delhaize and Centerbridge Partners jointly announce that they have entered into a definitive agreement to acquire New York City-based online grocer FreshDirect. |

| October 16, 2020 | Ahold Delhaize Belgium announces the launch of Superplus Card that offers savings of 5–15% on more than 5,000 products |

| October 8, 2020 | Giant Food announces that it has partnered with the Ocean Disclosure Project, a global platform where retailers voluntarily share information about their sourcing methods to the public. |

| October 1, 2020 | Ahold Delhaize Coffee Company opens a new roasting facility at Zaandam, the Netherlands. |

| August 31, 2020 | Ahold Delhaize’s online general merchandise subsidiary Bol.com expands its operations to Brussels and Wallonia, Belgium. |

| June 23, 2020 | Ahold Delhaize announces a collaboration with management consulting firm Oliver Wyman, to leverage its Retail Element tool suite to strengthen merchandising capabilities of its European brands in the areas of assortment, optimization, pricing and promotions. |

| June 10, 2020 | Delhaize Serbia appoints Jan-Willem Dockheer as its new Brand President. |

| June 10, 2020 | Stop & Shop and King Kullen jointly announce that they have terminated their merger agreement because of significant, unforeseen circumstances. |

| June 3, 2020 | Food Lion announces that it has agreed to purchase 62 BI-LO and Harvey Supermarkets from supermarket chain Southeastern Grocers. |

- Frans Muller—President and CEO

- Natalie Knight—CFO

- Kevin Holt—CEO, Ahold Delhaize USA

- Wouter Kolk—CEO, Ahold Delhaize Europe and Indonesia

Source: Company reports