Nitheesh NH

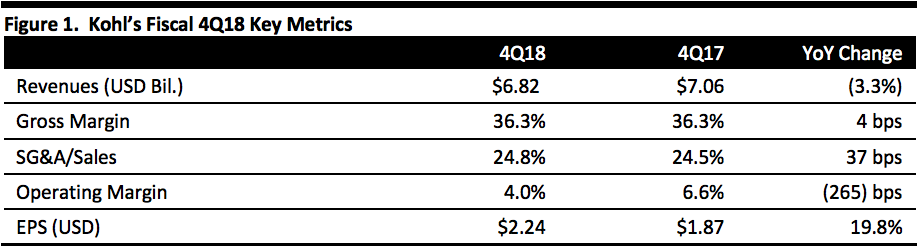

[caption id="attachment_79435" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kohl’s reported fiscal 4Q18 revenues of $6.82 billion, down 3.3% year over year. The company reported 4Q18 EPS of $2.24, up 19.8% from the year ago period.

Comparable sales on a shifted basis increased 1% for the quarter and 1.7% for the year. Management said this is the sixth consecutive quarter of positive growth.

The company reported that its sales performance was driven by a double-digit increase in digital sales and from a line of business perspective, strength in the children's and men's categories. Specifically, the men's business reported its fifth consecutive year of positive sales and has been a top performer for Kohl’s. The company reported its children’s business was supported by the introduction of LEGO and FAO Schwartz products along with the introduction of enhanced in-store and digital toy experiences.

Management stated that its women’s business, which excludes juniors, was flat, driven by modern, casual, and active categories. During the holidays, the company reported that modern apparel, active, intimates and sleep outperformed juniors and women's classics.

Management stated that its active category is a growth driver, and Kohl’s saw mid-single-digit growth in its active category in Q4 and high single-digit growth for the year. In Q4, the company reported strength in its apparel and footwear national brands: Nike, Under Armour and Adidas all reported positive growth. Due to the success in active, the company will extend its in-store activewear expansion strategy to approximately 160 of its highest-performing active stores in 2019.

The company reported that the Midwest was its strongest region, while the Northeast was relatively weaker. Management commented that 4Q18 results were positively impacted by competitor store closures, most notably in the Midwest, where the company noted it had a significant overlap with Bon-Ton’s stores and customer base. Management said the competitor closures will remain an opportunity to capture market share.

In apparel, the company reported strength in sales of national brands, such as Carter’s and its own proprietary Jumping Beans brand.

The footwear category experienced positive comps, driven active brands, Dash and Boots, and casual national brands, such as Vans, Koolaburra by UGG and Clarks. The home category had positive comps for the quarter with holiday items in electronics, kitchen electrics, such as the instant pot, and in bedding and luggage.

Accessories were flat for the quarter, with beauty and fashion accessories outperforming handbags and jewelry.

Kohl’s ended the year with 1,159 stores in its portfolio.

The company is piloting the next-generation of its loyalty program, Kohl's Rewards. The rewards program is in the test phase now, with modified offerings to optimize the reward offerings to create the greatest impacts for customers. Kohl’s plans a full chain rollout of its revamped loyalty program in 2020.

Outlook

For FY19, the company expects earnings per diluted share of $5.80-6.15, higher than the consensus estimate of $5.75. The guidance excludes approximately $50 million to $55 million, or $0.23-$0.25 per share, in nonrecurring charges the company expects to incur in the first half of the year related to store closures. Management projects comparable sales to be flat to up 2.0% for the year, compared to the consensus estimate of a 0.9% increase.

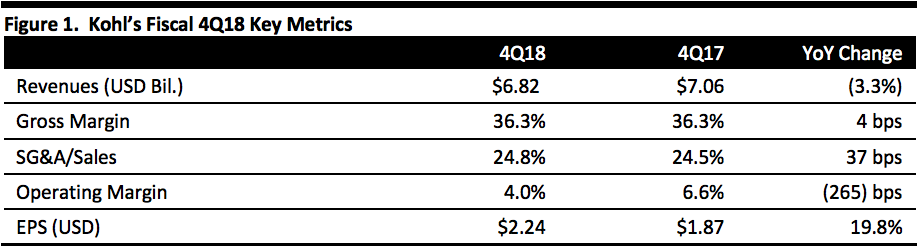

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kohl’s reported fiscal 4Q18 revenues of $6.82 billion, down 3.3% year over year. The company reported 4Q18 EPS of $2.24, up 19.8% from the year ago period.

Comparable sales on a shifted basis increased 1% for the quarter and 1.7% for the year. Management said this is the sixth consecutive quarter of positive growth.

The company reported that its sales performance was driven by a double-digit increase in digital sales and from a line of business perspective, strength in the children's and men's categories. Specifically, the men's business reported its fifth consecutive year of positive sales and has been a top performer for Kohl’s. The company reported its children’s business was supported by the introduction of LEGO and FAO Schwartz products along with the introduction of enhanced in-store and digital toy experiences.

Management stated that its women’s business, which excludes juniors, was flat, driven by modern, casual, and active categories. During the holidays, the company reported that modern apparel, active, intimates and sleep outperformed juniors and women's classics.

Management stated that its active category is a growth driver, and Kohl’s saw mid-single-digit growth in its active category in Q4 and high single-digit growth for the year. In Q4, the company reported strength in its apparel and footwear national brands: Nike, Under Armour and Adidas all reported positive growth. Due to the success in active, the company will extend its in-store activewear expansion strategy to approximately 160 of its highest-performing active stores in 2019.

The company reported that the Midwest was its strongest region, while the Northeast was relatively weaker. Management commented that 4Q18 results were positively impacted by competitor store closures, most notably in the Midwest, where the company noted it had a significant overlap with Bon-Ton’s stores and customer base. Management said the competitor closures will remain an opportunity to capture market share.

In apparel, the company reported strength in sales of national brands, such as Carter’s and its own proprietary Jumping Beans brand.

The footwear category experienced positive comps, driven active brands, Dash and Boots, and casual national brands, such as Vans, Koolaburra by UGG and Clarks. The home category had positive comps for the quarter with holiday items in electronics, kitchen electrics, such as the instant pot, and in bedding and luggage.

Accessories were flat for the quarter, with beauty and fashion accessories outperforming handbags and jewelry.

Kohl’s ended the year with 1,159 stores in its portfolio.

The company is piloting the next-generation of its loyalty program, Kohl's Rewards. The rewards program is in the test phase now, with modified offerings to optimize the reward offerings to create the greatest impacts for customers. Kohl’s plans a full chain rollout of its revamped loyalty program in 2020.

Outlook

For FY19, the company expects earnings per diluted share of $5.80-6.15, higher than the consensus estimate of $5.75. The guidance excludes approximately $50 million to $55 million, or $0.23-$0.25 per share, in nonrecurring charges the company expects to incur in the first half of the year related to store closures. Management projects comparable sales to be flat to up 2.0% for the year, compared to the consensus estimate of a 0.9% increase.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kohl’s reported fiscal 4Q18 revenues of $6.82 billion, down 3.3% year over year. The company reported 4Q18 EPS of $2.24, up 19.8% from the year ago period.

Comparable sales on a shifted basis increased 1% for the quarter and 1.7% for the year. Management said this is the sixth consecutive quarter of positive growth.

The company reported that its sales performance was driven by a double-digit increase in digital sales and from a line of business perspective, strength in the children's and men's categories. Specifically, the men's business reported its fifth consecutive year of positive sales and has been a top performer for Kohl’s. The company reported its children’s business was supported by the introduction of LEGO and FAO Schwartz products along with the introduction of enhanced in-store and digital toy experiences.

Management stated that its women’s business, which excludes juniors, was flat, driven by modern, casual, and active categories. During the holidays, the company reported that modern apparel, active, intimates and sleep outperformed juniors and women's classics.

Management stated that its active category is a growth driver, and Kohl’s saw mid-single-digit growth in its active category in Q4 and high single-digit growth for the year. In Q4, the company reported strength in its apparel and footwear national brands: Nike, Under Armour and Adidas all reported positive growth. Due to the success in active, the company will extend its in-store activewear expansion strategy to approximately 160 of its highest-performing active stores in 2019.

The company reported that the Midwest was its strongest region, while the Northeast was relatively weaker. Management commented that 4Q18 results were positively impacted by competitor store closures, most notably in the Midwest, where the company noted it had a significant overlap with Bon-Ton’s stores and customer base. Management said the competitor closures will remain an opportunity to capture market share.

In apparel, the company reported strength in sales of national brands, such as Carter’s and its own proprietary Jumping Beans brand.

The footwear category experienced positive comps, driven active brands, Dash and Boots, and casual national brands, such as Vans, Koolaburra by UGG and Clarks. The home category had positive comps for the quarter with holiday items in electronics, kitchen electrics, such as the instant pot, and in bedding and luggage.

Accessories were flat for the quarter, with beauty and fashion accessories outperforming handbags and jewelry.

Kohl’s ended the year with 1,159 stores in its portfolio.

The company is piloting the next-generation of its loyalty program, Kohl's Rewards. The rewards program is in the test phase now, with modified offerings to optimize the reward offerings to create the greatest impacts for customers. Kohl’s plans a full chain rollout of its revamped loyalty program in 2020.

Outlook

For FY19, the company expects earnings per diluted share of $5.80-6.15, higher than the consensus estimate of $5.75. The guidance excludes approximately $50 million to $55 million, or $0.23-$0.25 per share, in nonrecurring charges the company expects to incur in the first half of the year related to store closures. Management projects comparable sales to be flat to up 2.0% for the year, compared to the consensus estimate of a 0.9% increase.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kohl’s reported fiscal 4Q18 revenues of $6.82 billion, down 3.3% year over year. The company reported 4Q18 EPS of $2.24, up 19.8% from the year ago period.

Comparable sales on a shifted basis increased 1% for the quarter and 1.7% for the year. Management said this is the sixth consecutive quarter of positive growth.

The company reported that its sales performance was driven by a double-digit increase in digital sales and from a line of business perspective, strength in the children's and men's categories. Specifically, the men's business reported its fifth consecutive year of positive sales and has been a top performer for Kohl’s. The company reported its children’s business was supported by the introduction of LEGO and FAO Schwartz products along with the introduction of enhanced in-store and digital toy experiences.

Management stated that its women’s business, which excludes juniors, was flat, driven by modern, casual, and active categories. During the holidays, the company reported that modern apparel, active, intimates and sleep outperformed juniors and women's classics.

Management stated that its active category is a growth driver, and Kohl’s saw mid-single-digit growth in its active category in Q4 and high single-digit growth for the year. In Q4, the company reported strength in its apparel and footwear national brands: Nike, Under Armour and Adidas all reported positive growth. Due to the success in active, the company will extend its in-store activewear expansion strategy to approximately 160 of its highest-performing active stores in 2019.

The company reported that the Midwest was its strongest region, while the Northeast was relatively weaker. Management commented that 4Q18 results were positively impacted by competitor store closures, most notably in the Midwest, where the company noted it had a significant overlap with Bon-Ton’s stores and customer base. Management said the competitor closures will remain an opportunity to capture market share.

In apparel, the company reported strength in sales of national brands, such as Carter’s and its own proprietary Jumping Beans brand.

The footwear category experienced positive comps, driven active brands, Dash and Boots, and casual national brands, such as Vans, Koolaburra by UGG and Clarks. The home category had positive comps for the quarter with holiday items in electronics, kitchen electrics, such as the instant pot, and in bedding and luggage.

Accessories were flat for the quarter, with beauty and fashion accessories outperforming handbags and jewelry.

Kohl’s ended the year with 1,159 stores in its portfolio.

The company is piloting the next-generation of its loyalty program, Kohl's Rewards. The rewards program is in the test phase now, with modified offerings to optimize the reward offerings to create the greatest impacts for customers. Kohl’s plans a full chain rollout of its revamped loyalty program in 2020.

Outlook

For FY19, the company expects earnings per diluted share of $5.80-6.15, higher than the consensus estimate of $5.75. The guidance excludes approximately $50 million to $55 million, or $0.23-$0.25 per share, in nonrecurring charges the company expects to incur in the first half of the year related to store closures. Management projects comparable sales to be flat to up 2.0% for the year, compared to the consensus estimate of a 0.9% increase.