DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

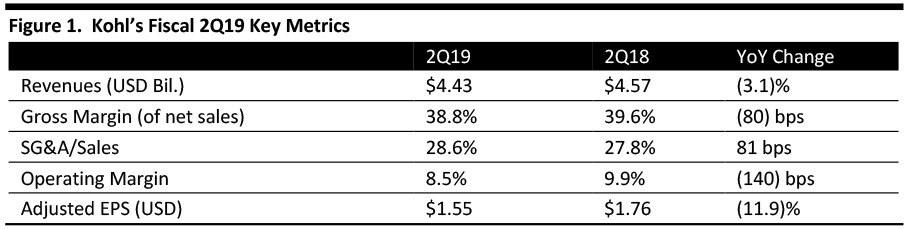

Kohl’s reported 2Q19 revenues of $4.43 billion, down 3.1% year over year and beating the consensus estimate of $4.31 billion. The company reported 2Q19 EPS of $1.55, down 11.9% from the year ago period and higher than the consensus estimate of $1.53.

Comparable sales decreased 2.9% for the quarter, compared to the consensus estimate of down 2.4%. Management said negative sales growth was attributable to weather, with unseasonably cool weather into the spring, which suppressed demand for spring goods. Management said its Home category also underperformed the company average in the second quarter but improved sequentially each month as the company implemented pricing and promotional strategies using aggressive marketing throughout the quarter. Management stated its overall business improved during the quarter, resulting in positive comps during the last six weeks, with 1% growth. The company reported the positive trend has continued into August, driven by a successful start to the back-to-school season.

Regarding tariffs, the company reported that it has been executing a sourcing diversification strategy and Kohl’s is working with vendors to prepare for potential tariff escalations.

From a line of business perspective, accessories, children's and men's outperformed the company while footwear, home and women's performed below the company average. Specific highlights include:

- Accessories had positive growth led by fashion and beauty accessories.

- Children's outperformed the company average driven by growth in active, licensed characters, Carter's and toys (driven by LEGO).

- Active apparel had mid-single-digit growth during the quarter driven by Nike, Under Armour and Adidas.

- Men’s brand highlights during the quarter included IZOD, Columbia, Hager and Kohl’s private brand SONOMA.

The women’s business started off slowly but strengthened as the quarter progressed, driven by active, swim, and national brands, including Levi’s, Lee, Madden for Bali and private brands SONOMA, Apartment 9 and SO.

Inventory dollars increased 2%, due to higher seasonal goods from weaker sales and the build-up of anticipated back-to-school sales traffic. Kohl’s expects to end the year with approximately flat inventory dollars. The back-to-school season is Kohl’s second largest selling season and the store promotes itself as a family destination for denim, active, footwear, and backpacks.

The company updated completed the national rollout of the Amazon Returns program on July 8. Management reported that store traffic is meeting expectations and skewing toward off-peak times. The company is seeing a mixture of existing customers and new, younger customers using the service. Management said it expects the program to have a positive contribution to operating income in 2019.

Kohl’s is launching a platform called “Curated by Kohl's,” in conjunction with Facebook, which will identify and showcase emerging, digitally native brands. It will start in approximately 50 Kohl's stores and online beginning October. Kohl’s will begin by offering six brands and then rotate brands to create continued newness for customers.

The company reported beauty represents a significant long-term growth opportunity since approximately 70% of its customers are female. The company will pilot new beauty brands this fall, including Duncombe Fragrance and clean beauty brands. Kohl’s will introduce a new beauty concept in which the company will showcase 20 beauty products in 200 stores and online.

Kohl’s ended the quarter with 1,155 stores and plans to open four small-format stores later in the quarter.

Outlook

For fiscal FY19, the company affirmed its annual earnings per share guidance of $5.15-5.45, compared to the consensus estimate of $5.23. The company expects comparable sales of flat to slightly down for the year.